Key Takeaways:

- Category II AIFs dominate 75% of India's AIF market, occupying the profitable middle ground between social impact and aggressive speculation strategies.

- SEBI's leverage restrictions force disciplined risk management while providing access to high-growth private markets that mutual funds cannot legally access.

- Lock-in periods enable fund managers to pursue long-term value creation without redemption pressure, often delivering superior returns for patient investors.

- Professional due diligence teams evaluate unlisted deals and structured opportunities, giving investors access to institutional-grade research and exclusive deal flow.

India’s wealth management space is moving fast, but traditional investment routes often feel limiting when growth is the real priority. That’s why Alternative Investment Funds (AIFs), especially Category II, have drawn significant attention.

By December 2024, commitments to AIFs touched ₹13,00,000 crore (about US$149.25 billion), showing a 5% quarter-on-quarter rise as per SEBI. The surge reflects how investors are looking beyond conventional options for structured yet flexible strategies.

This article unpacks what Category II AIFs offer, why they matter, and how they could add depth to your portfolio decisions.

What Are Category II Alternative Investment Funds?

Alternative Investment Funds (AIFs) are pooled investment vehicles regulated by the Securities and Exchange Board of India (SEBI). They gather capital from investors and allocate it to non-traditional assets beyond listed stocks and bonds. SEBI divides AIFs into three categories, each shaped by investment strategy and regulatory framework.

As of June 30, 2025, Category II AIFs account for commitments worth ₹10,78,208 crore, compared to ₹90,571 crore in Category I and ₹2,49,182 crore in Category III. This makes them the dominant segment, representing over 75% of the total AIF market.

Their appeal lies in structured investment strategies that balance growth potential with regulated oversight.

At S45 Club, we see this momentum in Category II AIFs as aligned with how we support MSME founders, with capital, expertise, and a focus on sustainable growth. We walk beside entrepreneurs, helping them scale with purpose while building lasting legacies.

Types of Funds Under Category II AIFs

Category II AIFs are not a single structure but a collection of fund strategies grouped under one regulatory umbrella.

Each type serves a different purpose, offering investors varied ways to participate in businesses and assets that lie outside conventional markets. The most common ones include private equity, debt, and real estate funds, along with a few hybrid approaches.

1. Private Equity Funds

These funds invest in unlisted companies that have strong growth potential. They often provide capital to startups or mid-sized businesses looking to expand operations, launch new products, or enter fresh markets.

Investors in private equity funds typically commit money for a longer period, since returns depend on the company’s growth and eventual exit through an IPO, acquisition, or buyback.

2. Debt Funds

Debt-focused Category II AIFs provide structured financing to businesses. Unlike traditional bank loans, they can design flexible repayment terms and sometimes link returns to company performance.

These funds usually secure their investments with collateral, lowering the risk of default. They are particularly useful for companies that may not get easy access to large loans from conventional lenders.

Also read: Understanding Subordinated Debt: Key Features and Risks

3. Real Estate Funds

These funds pool capital to invest in real estate projects such as residential townships, commercial spaces, or mixed-use developments. They may back projects at different stages, from land acquisition to construction and completion.

For investors, real estate funds offer exposure to property markets without the hassle of directly buying and managing assets.

4. Other Hybrid Structures

Some Category II AIFs combine equity and debt elements to build tailored strategies. These hybrid funds may, for example, provide debt financing with an option to convert into equity at a later stage.

Others may split their portfolio across growth equity and structured debt, giving investors exposure to both potential upside and stable cash flows. While less common than pure private equity or debt funds, hybrids add flexibility for fund managers and investors seeking a balanced approach.

Regulatory Oversight by SEBI That You Should Know

Category II AIFs operate under a clear regulatory framework laid down by the Securities and Exchange Board of India (SEBI). This structure is designed to safeguard investor interests while ensuring that funds follow disciplined investment practices.

For entrepreneurs and investors alike, this regulatory clarity is what makes these funds trustworthy compared to informal or unregulated capital sources.

Key regulatory requirements include:

- Registration and Disclosure: Every Category II AIF must register with SEBI and provide detailed disclosures about its investment strategy, fund size, and governance. This ensures transparency before investors commit capital.

- Restrictions on Leverage: These funds cannot freely borrow or use leverage. Borrowing is only allowed temporarily, for operational needs such as bridging short-term liquidity. This restriction reduces excessive risk-taking.

- Reporting Standards: Category II AIFs must submit regular reports to SEBI, covering details of their portfolio, fund performance, and investor commitments. This enables continuous monitoring and protects investor confidence.

- Investor Safeguards: Rules around minimum investment size, manager accountability, and governance structures ensure that investors are well-informed and funds are managed responsibly.

Feeling confused about how to approach structured capital and long-term growth?

At S45 Club, we guide founders by pairing funding with real-world expertise. We connect you with mentors who’ve walked the same path and give you access to our proven playbook designed for scaling MSMEs with clarity and purpose.

This combination helps you move forward with confidence, make stronger business choices, and focus on building a legacy that lasts.

Connect with us today to explore how we can support your journey.

Knowing the size and structure of Category II AIFs only explains what they are. The real question is why investors commit such significant capital to them despite higher entry barriers.

The draw comes from a set of advantages that combine growth opportunities with professional oversight, making them distinct from both traditional products and other AIF categories.

Key Benefits of Category II AIFs That Is Important

Category II AIFs have become the preferred choice for many investors, not just because they are large in scale but because they offer a distinctive set of advantages.

These funds bring together diversification, disciplined risk-taking, and professional oversight in a way that traditional investment products rarely match.

Each benefit adds a layer of strength, explaining why commitments to this category continue to rise quarter after quarter.

1. Diversification Opportunities

Category II AIFs spread investments across different sectors and asset classes. This allows investors to reduce reliance on a single market cycle and gain exposure to a variety of businesses, from infrastructure and manufacturing to technology and real estate.

2. Potential for Higher Returns

Unlike conventional instruments that may offer predictable but modest yields, these funds focus on long-term value creation. Backing private equity deals or structured debt arrangements means investors can benefit from growth that is not directly tied to stock market swings.

3. Professional Fund Management

Each fund is run by experienced managers who carry out detailed due diligence before investing. Their expertise ensures that opportunities are evaluated carefully, reducing the chances of rash decisions that can harm portfolios.

4. Structured Risk Approach

Category II AIFs are designed to take measured risks. Unlike Category III funds that employ speculative strategies such as short selling, these funds focus on stability and consistent growth. This makes them appealing for those who want exposure to alternative assets without extreme volatility.

Of course, every investment option comes with trade-offs. While the benefits are strong, it’s just as important to weigh the risks before making a decision.

Risks and Limitations You Should Consider

Category II AIFs can be rewarding, but they are not without challenges. Understanding these risks helps set realistic expectations and ensures better decision-making.

- Illiquidity: Investments are typically locked in for several years. This means investors cannot easily withdraw funds, making them suitable only for those comfortable with long-term commitments.

- Higher Ticket Size: The minimum investment requirement is significantly higher than that of mutual funds, restricting access mostly to high-net-worth individuals and institutions.

- Performance Variability: Returns depend heavily on the skill and strategy of the fund manager. A strong manager can add value, but weak decisions can affect performance.

- Regulatory Restrictions: While SEBI oversight ensures discipline, it also limits flexibility. Category II AIFs cannot freely borrow or engage in aggressive strategies, which sometimes caps potential upside compared to riskier funds.

With both strengths and limitations in mind, the logical next step is to see how Category II AIFs stack up against other investment choices.

Comparing Category II AIFs With Other Investment Options

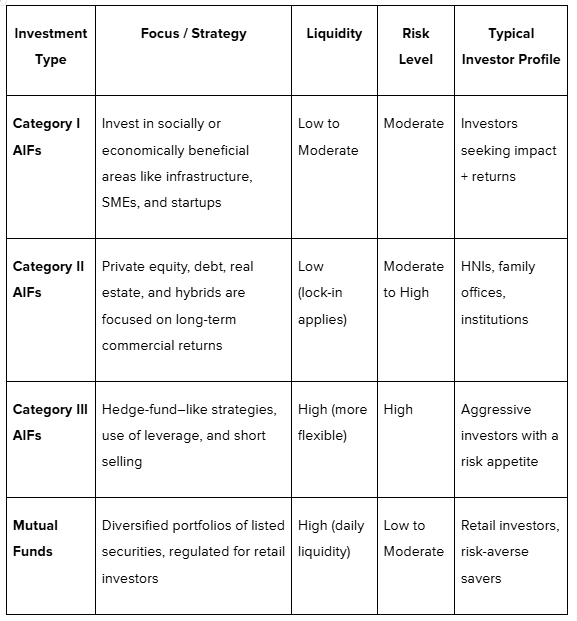

With both benefits and risks on the table, it helps to see where Category II AIFs stand against other popular choices. Comparing them with mutual funds, Category I AIFs, and Category III AIFs highlights how each serves a different purpose and appeals to different investor profiles.

How S45 Can Help You Make the Right Investment Choice

Category II AIFs create opportunities that traditional investments often don’t provide, but deciding if they fit your journey can be challenging. That’s where we step in. At S45 Club, we work with founders and business leaders to bring clarity and direction to these choices.

Our focus is on helping you align investment decisions with long-term growth instead of short-term wins.

Here’s how we support you:

- Practical Guidance on Structured Capital: We explain how options like Category II AIFs can fit into your overall business strategy, allowing you to make more informed decisions.

- Access to Mentors Who’ve Done It Before: Our network of experienced founders and leaders shares insights that help sharpen both financial and strategic calls.

- A Playbook Designed for Growth: We provide a tested framework tailored for MSMEs, giving you clear steps to scale with stability and confidence.

- Focus on Purposeful Legacy-Building: We combine innovation with continuity, helping you shape a business that is resilient and built to last.

With the right guidance, choosing between different investment paths becomes less confusing and far more strategic.

Know more about us to find out how we can walk beside you in building purposeful growth.

Final Thoughts

Category II AIFs have emerged as a powerful investment route in India, combining diversification, long-term growth focus, and professional management under SEBI’s watch.

They stand out as structured vehicles that balance opportunity with discipline, attracting investors who want more depth than conventional options. The benefits are strong, but as with any investment, risks such as illiquidity and manager performance need to be considered before committing.

At S45 Club, we believe the right investment choice should always serve your bigger vision for growth. We guide founders with capital, connect them with mentors, and share our playbook for scaling businesses with purpose. Our focus is on walking beside entrepreneurs as they build sustainable enterprises that last.

Join our community today to take the next step toward growth with clarity and confidence.