Key Takeaways

- Alternative investments are non-traditional assets like private equity, real estate, hedge funds, and crypto that diversify portfolios beyond stocks and bonds.

- They tend to have low correlation with traditional markets, offering risk mitigation and return enhancement.

- Liquidity constraints, complexity, higher fees, and long investment horizons are key challenges to consider.

- Emerging trends include technology adoption, ESG integration, and democratized access through digital platforms.

- Understanding these traits helps investors align alternatives with their financial goals and risk tolerance.

Disclaimer: This content is for educational purposes and not financial advice. Investment suitability depends on individual circumstances, and consulting a qualified advisor is recommended before making decisions.

When building a robust investment portfolio, traditional assets like stocks and bonds often get the spotlight. But the world beyond these familiar avenues hold unique opportunities often overlooked. Alternative investments include assets like private equity, real estate, hedge funds, commodities, and cryptocurrencies, offering distinct advantages and challenges.

With growing interest from institutional and high-net-worth investors, understanding the characteristics of alternative investments is crucial for anyone seeking diversified, resilient, and high-performing portfolios. This guide walks you through what makes alternatives unique, types of assets, benefits, risks, and market trends shaping this exciting space.

What Are Alternative Investments?

Alternative investments are financial assets that fall outside traditional categories such as stocks, bonds, and cash. They may include private equity (buying ownership in private companies), hedge funds (specialized investment funds), real estate, commodities like gold and oil, collectibles such as art, and digital assets like cryptocurrencies.

These investments often come with higher complexity, less liquidity, and longer time horizons compared to traditional assets. Typically suited for accredited or institutional investors, alternatives provide potential for unique returns and diversification benefits due to their differing market dynamics.

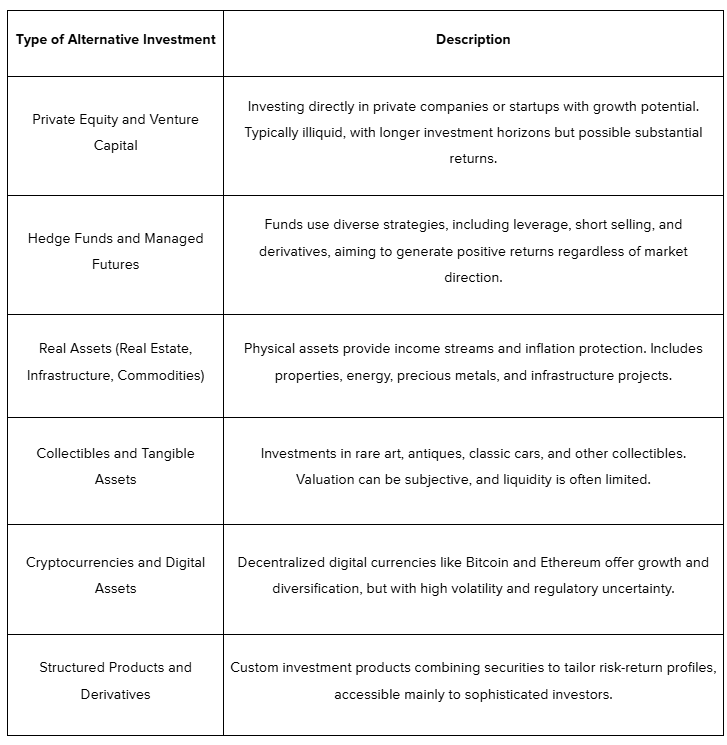

Types of Alternative Investments

Alternative investments encompass a wide range of asset classes, each with distinct traits and risk-return profiles. Here’s a quick overview:

Once you understand the basics of alternative investments, you can explore their key characteristics to build a strong portfolio.

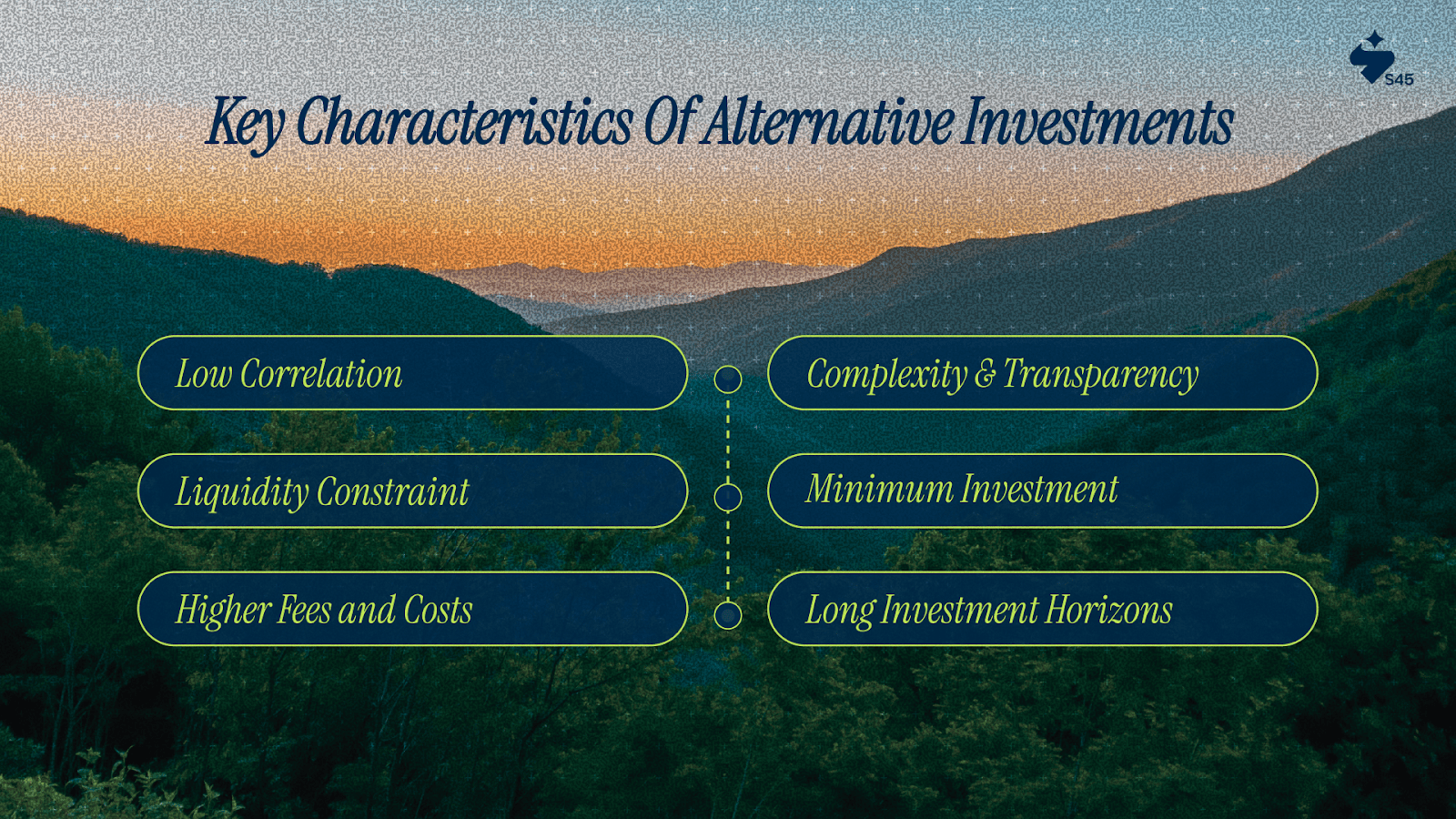

Key Characteristics of Alternative Investments

Alternative investments have distinct features that set them apart from stocks and bonds. Here are the main traits every investor should understand before committing capital.

- Low Correlation to Traditional Markets: Alternative investments often move differently from stocks and bonds, helping reduce overall portfolio risk during market swings.

- Liquidity Constraints: Many alternatives require locking up funds for several years, demanding patience but offering potential for higher returns.

- Higher Fees and Costs: Expect management fees of about 2% plus performance fees near 20%, compensating for active management and due diligence.

- Complexity and Transparency: Valuations aren’t daily and often rely on appraisals or models, making trusted managers and thorough reporting essential.

- Minimum Investment Requirements: High capital and accreditation are often needed, although digital platforms are slowly increasing access.

- Long Investment Horizons: These investments usually require a long-term outlook, with growth and exit timelines spanning several years.

Like any investment, alternatives have pros and cons. Knowing both helps you decide wisely.

Pros and Cons of Alternative Investments

Alternative investments can be powerful portfolio tools but come with specific trade-offs. Understanding both sides helps investors make informed, strategic choices.

Here are the Pros:

- Diversification: Alternatives often move differently from stocks and bonds, reducing overall portfolio risk and smoothing returns.

- Higher Return Potential: Assets like private equity and venture capital can yield above-market returns when managed well.

- Inflation Protection: Real assets like commodities and real estate often appreciate with inflation, preserving purchasing power.

- Access to Unique Opportunities: Alternatives provide exposure to private companies, niche markets, and assets unavailable in public markets.

- Income Generation: Some alternatives, such as real estate, generate steady passive income through rents or dividends.

Here are the Cons:

- Illiquidity: Many alternatives require capital to be locked up for years, limiting access to funds in the short term.

- Higher Fees: Management and performance fees tend to be significantly higher than those for traditional investments.

- Complexity and Transparency: Valuation difficulties and limited disclosure mean investors must rely heavily on fund managers’ integrity and expertise.

- Regulatory Risks: Alternatives are often less regulated, which can increase risk and reduce investor protections.

- High Minimum Investment Requirements: Access often demands substantial capital and accredited investor status, limiting availability for many.

Risks Associated with Alternative Investments

Understanding risks helps investors build lasting portfolios that can navigate uncertainty and create legacy value. Here are the key risks unique to alternatives, with practical examples.

1. Market, Liquidity, and Valuation Risks

Alternative assets often lack frequent market pricing, relying on infrequent appraisals or internal models that may not capture real-time shifts. Illiquidity means capital can be locked up for years without a straightforward exit. Market downturns intensify these risks, delaying returns or forcing unfavorable sales.

Example: A private equity fund holding a portfolio company during a recession may see valuations drop sharply, but actual exit opportunities might be limited until the market recovers.

2. Operational and Manager Risks

The success of alternatives depends heavily on fund managers’ skill and ethical standards. Mistakes, poor oversight, or lack of transparency can erode value quickly. Investors must conduct rigorous due diligence and maintain ongoing oversight.

Example: A hedge fund manager engaging in risky, undisclosed trades can jeopardize capital, as seen in past cases like the collapse of Long-Term Capital Management.

3. Regulatory Uncertainties and Illiquidity

Alternatives often operate with fewer regulatory safeguards, varying by jurisdiction and asset class, increasing compliance risk. Illiquidity compounds this by restricting portfolio flexibility when regulatory changes or market shifts occur.

Example: Changes in real estate regulations or tax laws can affect fund returns, but locked-in investors cannot reposition quickly to mitigate impacts.

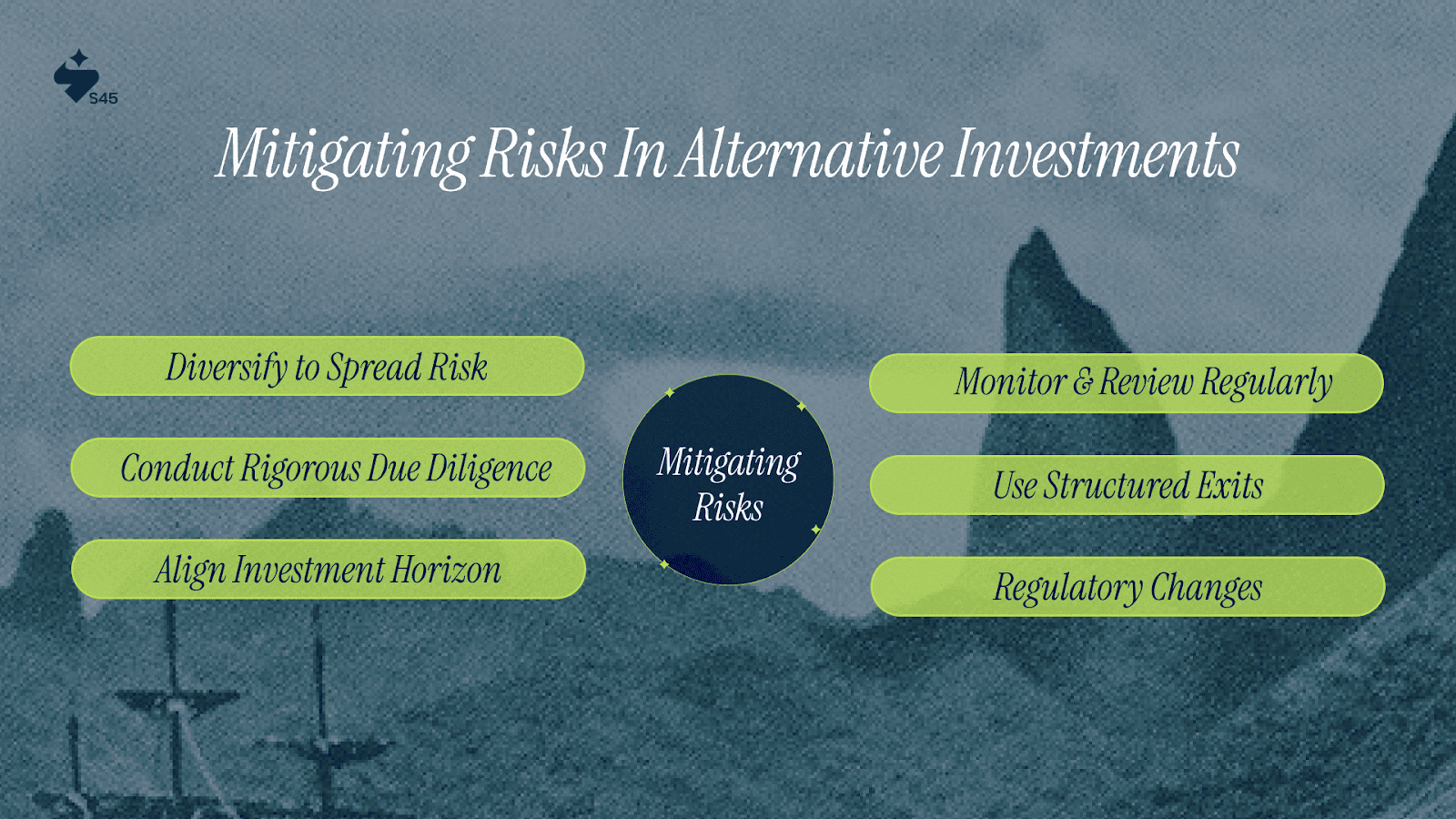

Mitigating Risks in Alternative Investments

Risks are inherent in alternatives, but disciplined strategies make them manageable. Here’s how investors and founders can stay ahead and protect their portfolios.

1. Diversify to Spread Risk

Risk concentration amplifies potential losses. Aim to diversify across asset types, managers, and geographies to reduce overall risk exposure.

Example: Instead of putting all capital into one private equity fund, spread investments across real estate, hedge funds, and venture capital to balance performance fluctuations.

2. Conduct Rigorous Due Diligence

Thoroughly evaluate fund managers, investment processes, track records, and governance structures before committing capital.

Example: s45 Club helps founders assess investor diligence standards and ensures alignment on investment philosophy and exit strategies.

3. Align Investment Horizon with Liquidity Needs

Match alternatives’ typical long lockup periods with your cash flow expectations to avoid forced sales or liquidity crunches.

Example: Reserve a portion of your portfolio for liquid assets if your startup requires flexible capital for operational needs.

4. Monitor and Review Regularly

Stay engaged with portfolio updates, performance reports, and market conditions. Proactive oversight enables timely course corrections.

Example: S45 provides founders with dashboards and periodic reviews to track capital use and project milestone achievements.

5. Use Structured Exits and Legal Protections

Work with legal advisors to design contracts with clear exit options, transfer restrictions, and dispute resolution mechanisms.

Example: A founder negotiating a secondary sale includes terms allowing partial liquidity without sacrificing company control.

6. Be Prepared for Regulatory Changes

Stay informed about evolving regulations and build flexibility into investment plans to adapt when required.

Example: S45 advises founders to maintain compliance readiness and contingency funds to handle unexpected tax or reporting changes.

Conclusion

Alternative investments offer unique opportunities to diversify and grow wealth beyond traditional stocks and bonds. But the path requires thoughtful risk management, a long-term perspective, and trusted partnerships to navigate complexity and illiquidity.

Understanding characteristics, risks, and mitigation strategies empowers investors to build resilient portfolios that foster sustainable growth and lasting legacies.

For founders and investors looking to deepen their knowledge and connect with like-minded peers, platforms like s45 Club provide expert guidance, strategic insights, and community support to achieve confident, collaborative success in alternative investing.

FAQs

Q. What qualifies as an alternative investment?

A. Alternative investments are assets outside traditional stocks, bonds, and cash, examples include private equity, hedge funds, real estate, commodities, and cryptocurrencies.

Q. Why should I consider alternative investments for my portfolio?

A. They offer diversification benefits, lower correlation with traditional markets, and potential for higher returns, which can help manage risk and enhance growth.

Q. What are the main risks with alternative investments?

A. Key risks include illiquidity, complex valuation, operational risks from fund managers, and regulatory uncertainties that require careful management.

Q. What are the characteristics of an Alternative Investment Fund (AIF)?

A. AIFs invest in assets outside traditional equity and debt; they have high minimum investment requirements, are less liquid, involve active management, and often use complex fee structures, including performance-based fees.

Q. What are the features of alternative investments?

A. Key features include low correlation to traditional markets, illiquidity, higher fees, complexity, minimum investment thresholds, and typically long investment horizons.