If your current investments aren't helping your business grow beyond operations and fixed assets, it might be time to explore other options. Equity funds, for instance, offer a way to build market-linked returns while keeping your working capital free for day-to-day operations. With the latest data showing significant net inflows of ₹94,073 crore into growth and equity-oriented schemes in India during the first quarter of 2025, equity investments can be an effective strategy for enhancing your business's financial growth.

For mid-market manufacturing and trading businesses, understanding what is equity fund and how it works can create new ways to plan growth. Many traditional businesses hold cash reserves or fixed assets but miss the chance to build market-linked returns. Equity funds give owners another route to build wealth while keeping operations stable.

In this guide, you will learn the equity fund meaning, types of equity funds, their advantages and limitations for Indian founders with clarity and purpose.

TL;DR (Key Takeaways)

- Types include large-cap, mid-cap, small-cap, multi-cap, sectoral, ELSS, and international funds.

- They offer high return potential but carry market risks and tax implications.

- Choosing equity vs mutual funds depends on goals, liquidity, and risk comfort.

- Businesses can use equity funds for diversification, liquidity planning, and future expansion goals.

What is an Equity Fund?

An equity fund is a type of mutual fund that invests mainly in company shares. The aim is to grow your money by gaining from market movements over time. When you invest in an equity fund, your money is pooled with other investors. A professional fund manager then buys and manages stocks based on the fund's goals.

Equity funds work by spreading investments across different sectors to reduce risk and improve returns. They can focus on large companies, mid-sized firms, or small businesses, depending on the fund's strategy. For Indian founders, knowing what is equity fund and how it works builds confidence in planning investments.

Equity funds offer various types to match different goals. Let's understand these types and how they support your business wealth plans.

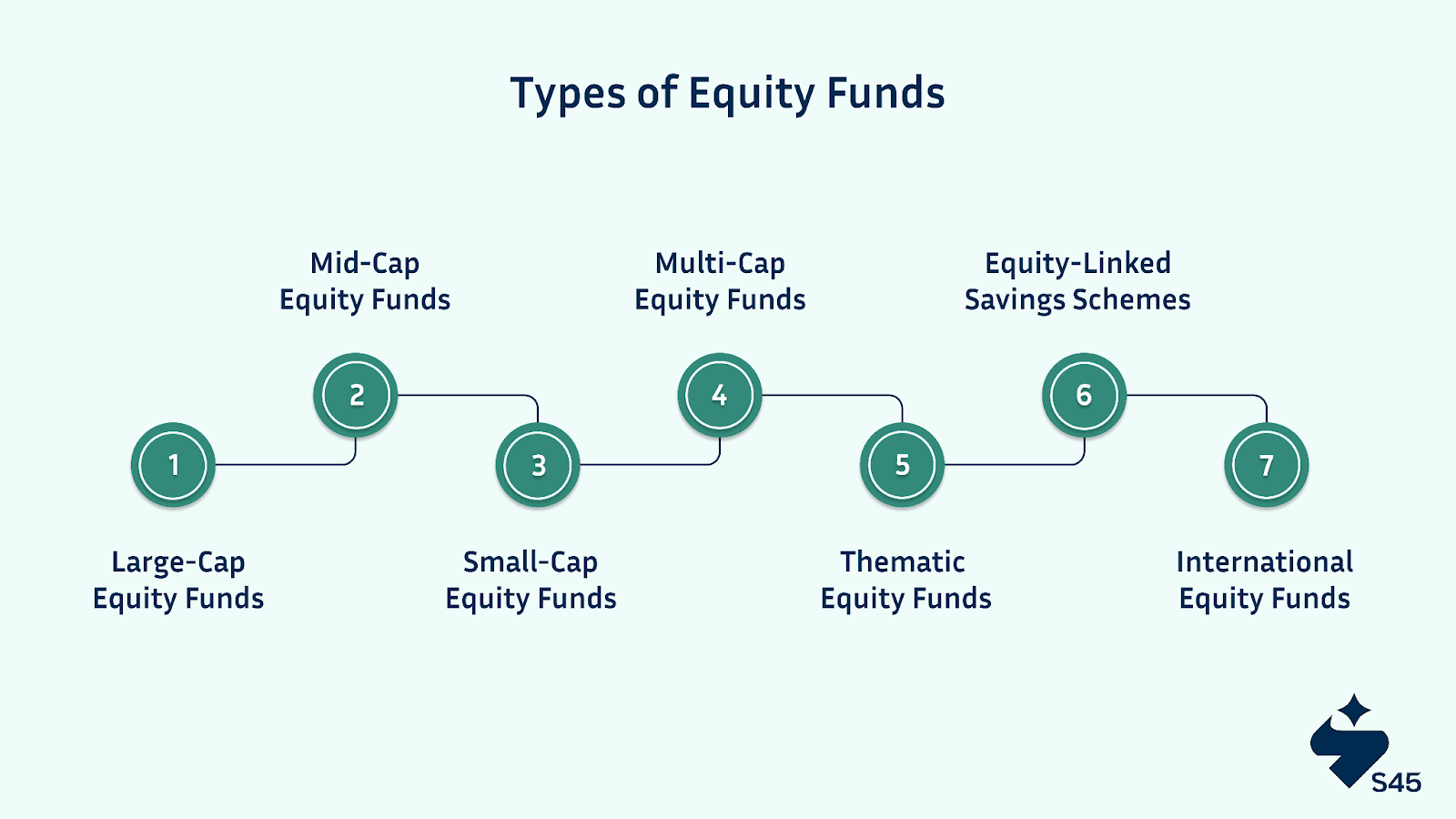

Types of Equity Funds

Equity funds are available in various types, each designed to suit different investment goals, risk appetites, and business strategies. These funds typically focus on specific sectors or categories of companies, offering distinct return profiles.

Here are the major equity fund types explained simply:

1. Large-Cap Equity Funds

Large-cap equity funds focus on investing in well-established, top-listed companies with strong market positions and established reputations. These companies usually have stable earnings and established brands. Examples of companies that a large-cap fund might invest in include Reliance Industries, Infosys, or TCS.

Large-cap funds tend to have lower risk compared to mid-cap or small-cap funds, but their returns are also steadier and lower in magnitude. These funds are ideal for founders who want relatively low-risk exposure with consistent long-term growth.

2. Mid-Cap Equity Funds

Mid-cap equity funds focus on medium-sized companies that have higher growth potential than large-cap stocks. These companies may not be as stable as large-cap companies, but they can offer substantial growth opportunities. Examples include companies like Trent or Crompton Greaves.

While mid-cap funds offer higher return potential, they also come with increased risk due to market volatility. These funds are suitable for founders who have a moderate risk tolerance and are seeking growth opportunities beyond blue-chip stocks.

3. Small-Cap Equity Funds

Small-cap equity funds invest in smaller, emerging companies that are in the early stages of growth. The goal of these funds is to capture high returns as these companies expand and develop into larger industry players. Companies like Aegis Logistics or Deepak Nitrite, during their growth phases, are examples of investments in small-cap funds.

However, small-cap funds come with significant risks, including high market volatility. They are best suited for investors who can afford to wait long-term for growth and can tolerate high risk.

4. Multi-Cap Equity Funds

Multi-cap equity funds invest across a range of companies, including large, mid, and small-cap stocks. The fund manager adjusts the allocation between these categories based on market conditions and opportunities. For example, a multi-cap fund may hold shares in Reliance, Trent, and Deepak Nitrite simultaneously.

The diversified nature of these funds helps balance risk while offering growth potential. Multi-cap equity funds are ideal for founders seeking stability with the growth potential, all within one fund.

5. Sectoral or Thematic Equity Funds

Sectoral or thematic equity funds invest in specific sectors or industries, such as banking, information technology (IT), or renewable energy. A banking sector fund may focus on stocks like HDFC Bank, ICICI Bank, and Kotak Bank.

These funds offer high return potential when the sector is performing well, but they also carry concentrated risk. If the industry underperforms, the fund can face significant losses. Sectoral funds are best suited for investors who have a strong belief in the future growth of a specific sector and are willing to accept the associated risks.

6. Equity-Linked Savings Schemes (ELSS)

Equity-Linked Savings Schemes (ELSS) are tax-saving funds that qualify for deductions under Section 80C of the Income Tax Act, with a three-year lock-in period. ELSS funds primarily invest in equity markets, offering market-linked returns along with the benefit of tax savings.

For example, Axis Long Term Equity Fund is one such fund that provides tax-saving advantages. ELSS funds are suitable for founders or professionals seeking both tax-saving benefits and exposure to equity.

7. International Equity Funds

International equity funds invest in global markets outside India, providing exposure to companies in regions like the US, Europe, or other emerging markets. These funds might invest in international giants like Apple, Google, or Tesla through feeder funds. International equity funds help diversify investments beyond the Indian market and mitigate the risks associated with a single country's economy.

They are ideal for founders seeking global exposure and wanting to hedge against risks that are specific to the Indian market.

Note: The above mentioned funds and their examples are just for information purposes and not investment advice.

These different types of equity funds help build wealth suited to business and personal goals. Choosing the right type requires understanding their risk-return profile and purpose in your investment strategy. Now, let's have a look at the advantages and limitations of equity funds to guide your decisions clearly.

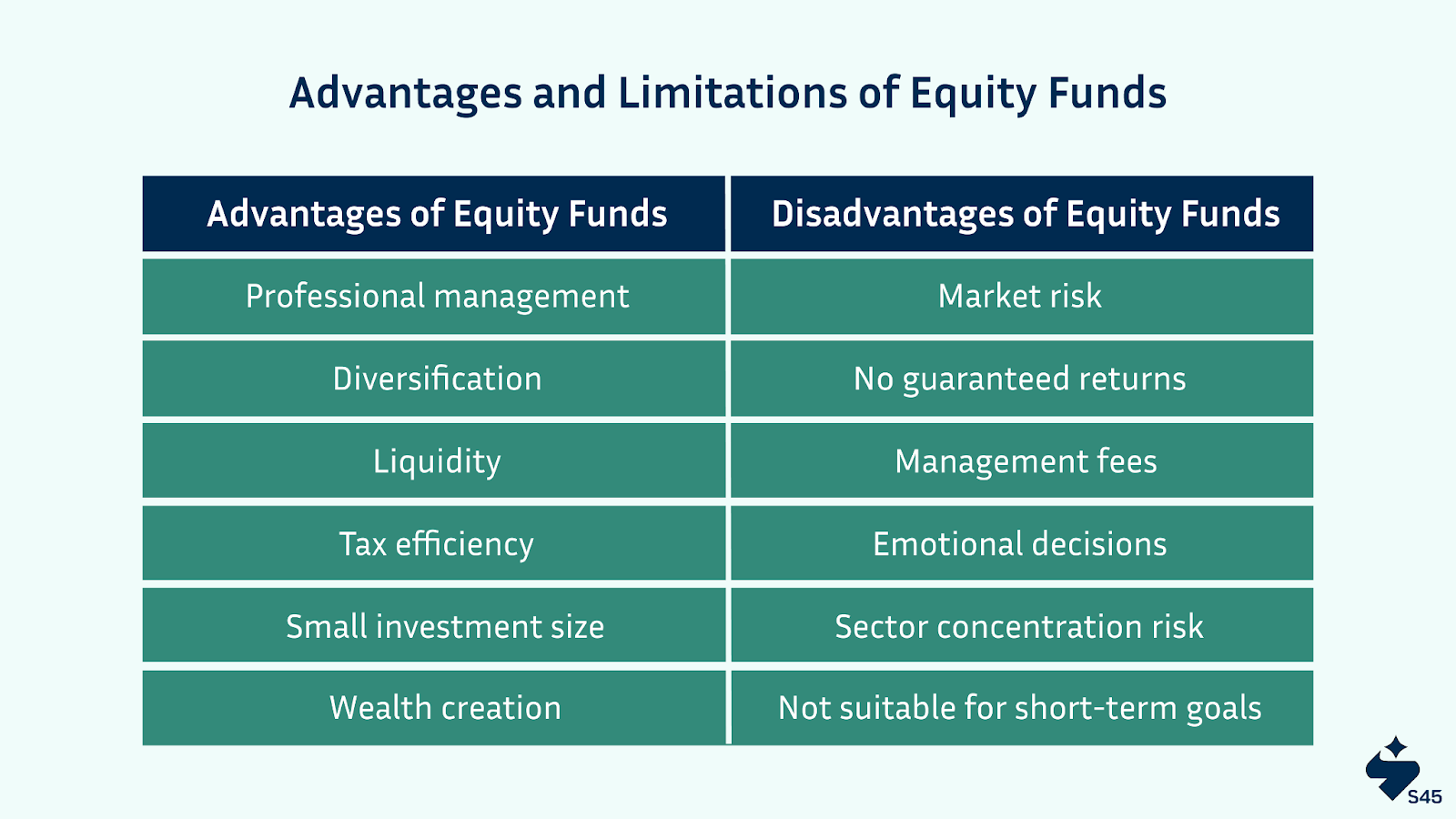

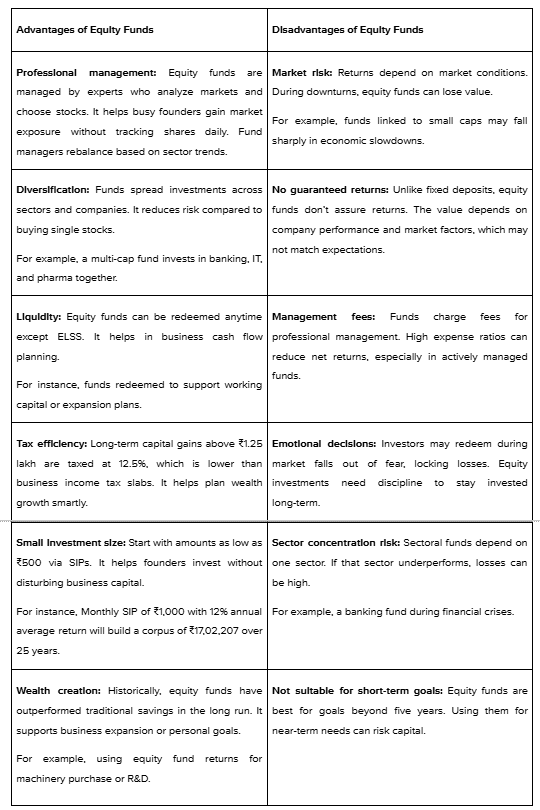

Advantages and Limitations of Equity Funds

Equity funds are popular for building long-term wealth but they carry some risks too. Founders and business owners must understand both sides before adding them to their investment plans. Having a clear understanding of equity funds helps you make clear, confident decisions.

Here is a detailed table explaining both in simple terms.

Equity funds suit founders who want market-linked growth while keeping operations funded. But they are not ideal for short-term or guaranteed needs. Now, let's see how equity funds differ from general mutual funds and when to choose each for your business goals.

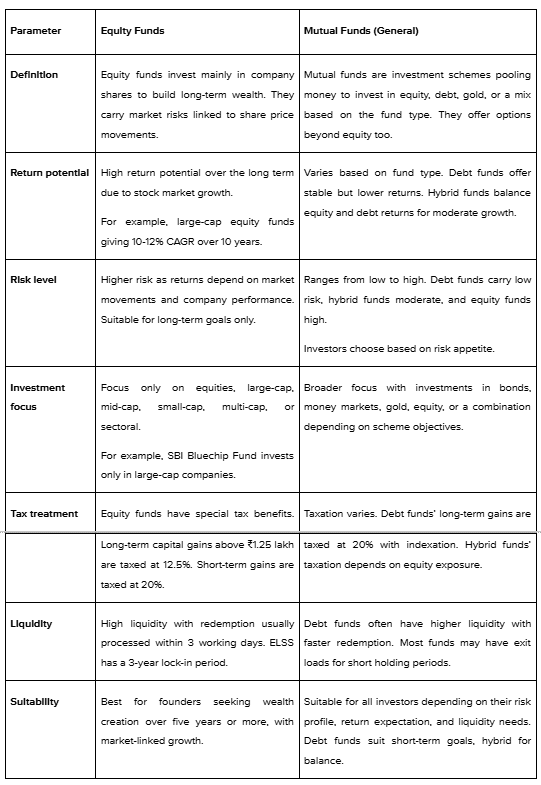

How Are Equity Funds Different from Mutual Funds?

Many founders think equity funds and mutual funds are the same. In reality, equity funds are a type of mutual fund focused on stocks, while mutual funds include other types like debt or hybrid funds.

Here is a table explaining the main differences clearly.

Equity funds bring growth, but timing and goals matter. But, when should founders choose equity funds for their business and personal plans? Let's find out.

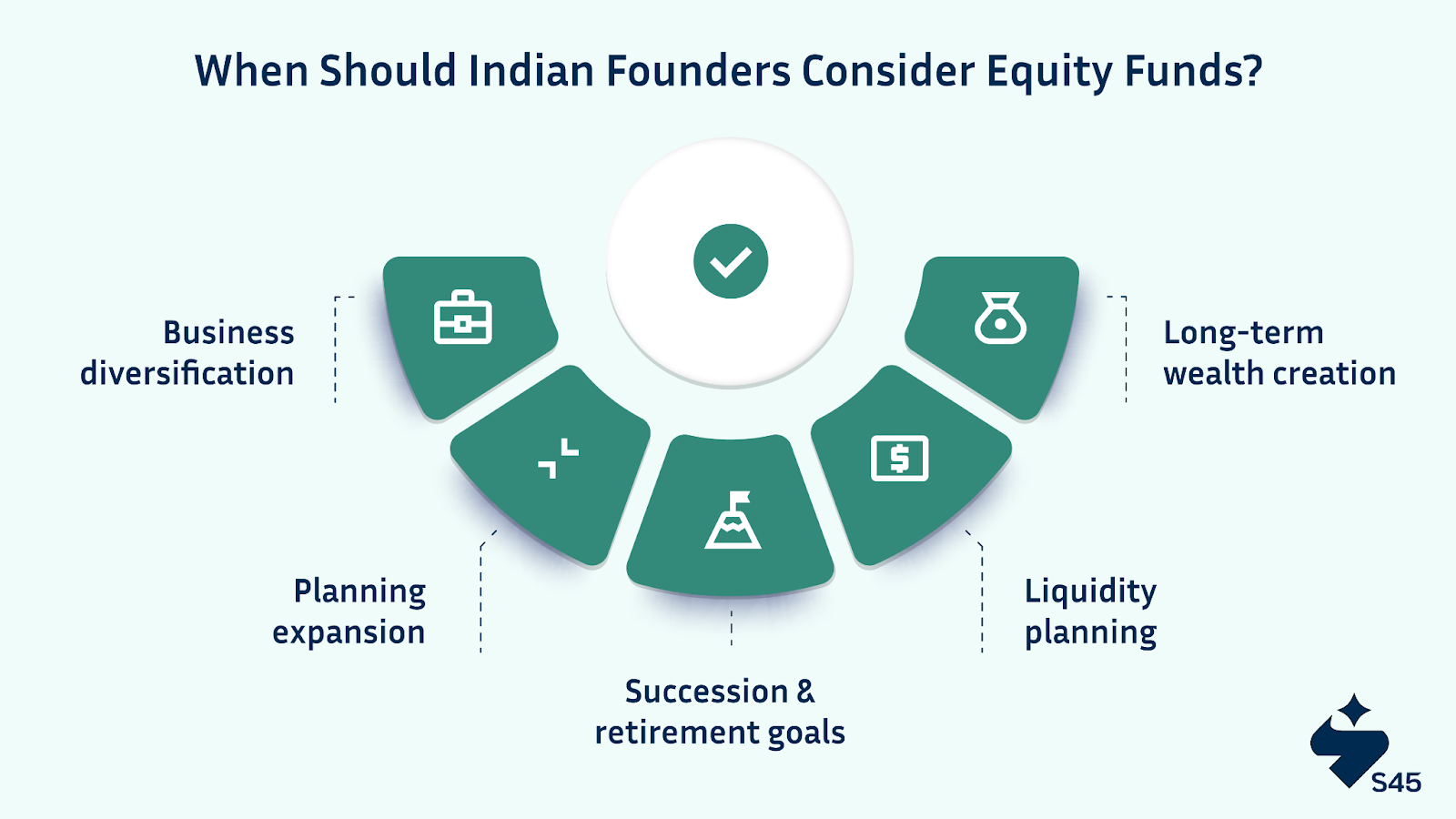

When Should Indian Founders Consider Equity Funds?

Equity funds can be a strong tool in a founder's investment planning. They help balance business risks with personal wealth growth. Here are some situations when founders should consider them:

- Business diversification: When most assets are tied to your business, equity funds offer exposure beyond your sector. It reduces risk if business profits drop. For example, a manufacturing founder invests in multi-cap funds to spread risk.

- Planning expansion or R&D: Returns from equity funds over 5-7 years can support expansion or new projects without taking heavy debt.

- Succession and retirement goals: Family-run businesses can use equity funds to build a retirement corpus or succession funds, ensuring financial stability even if business cycles fluctuate.

- Liquidity planning: Equity funds provide easier redemption options compared to illiquid assets like land or private shares, useful during emergencies.

- Long-term wealth creation: Founders focused only on business profits may miss market-based returns. Equity funds grow wealth for future security.

Equity funds for business owners act as a growth reserve while their ventures continue to operate. Next, let's see how S45 walks beside founders to guide strategic equity investment choices with clarity and purpose.

How S45 Guides You on Equity Fund Decisions?

S45 believes investment choices should build long-term value without losing what founders have built. Our equity fund advisory combines deep sector knowledge with honest guidance, helping founders plan growth without rushing decisions.

We understand equity fund investments are about returns while aligning with your business stability, expansion plans, and family goals. For manufacturing and trading businesses, we suggest equity fund types based on liquidity needs, risk comfort, and future vision.

S45 walks beside you, ensuring equity investment guidance is simple, practical, and purpose-led.

Want clarity on equity funds and your growth plans? Connect with S45 to plan your route safely and confidently.

Conclusion

Equity funds are a practical tool for long-term wealth building. Equity fund types like large-cap, mid-cap, sectoral, and ELSS have their advantages, such as high returns and liquidity. Founders must be aware of specific limitations like market risks and tax impacts.

Choosing between equity funds and general mutual funds depends on your goals. Equity funds suit founders aiming for growth and wealth creation over five years or more. Mutual funds with debt or hybrid focus suit short-term needs or stable income plans. Align these choices with your business cash flows and personal financial goals.

At S45, we walk beside founders to guide such decisions with care and clarity. Scaling businesses while preserving legacies is our core approach. Do you want to plan your investments with purpose and safety? Join Club S45 today and let's build lasting value together.

Frequently Asked Questions

1. What is an equity fund?

An equity fund pools money from many investors to buy shares of companies. It aims for growth by investing mainly in stocks. Fund managers select and manage these shares to build wealth for investors over time, making it a simple way to invest in the stock market.

2. Are equity funds good for long-term investments?

Yes, equity funds suit long-term goals of five years or more. They benefit from market growth, compounding returns, and help beat inflation. However, they carry market risks, so holding them longer reduces the impact of short-term market ups and downs, ensuring better wealth creation over time.

3. Which type of equity fund is best?

There is no single best type. Large-cap funds suit stable growth with lower risk. Mid-cap and small-cap funds offer higher returns with more risk. Multi-cap funds balance all segments. The best choice depends on your goals, risk comfort, and investment horizon. Consult an advisor for clarity.

4. How do equity funds generate returns?

Equity funds generate returns through capital gains and dividends. Capital gains come when the share prices of invested companies rise. Dividends are company profits shared with shareholders. Fund managers reinvest or distribute these gains, growing your investment value over time based on market performance.

5. Can businesses invest in equity funds?

Yes, businesses can invest in equity funds to grow surplus cash reserves. Many firms use them for long-term goals, expansion funding, or succession planning. However, they must assess liquidity needs, market risks, and tax implications before investing to ensure business operations remain unaffected.