Key Takeaway:

Face value and market value are fundamental terms in finance and investing. Knowing their differences informs how business leaders, founders, and investors assess opportunities, structure portfolios, and communicate valuations.

For Indian SMEs and growth-oriented companies, mastering these concepts is vital for making confident, disciplined investment and funding decisions.

What Exactly Is Face Value in Stocks and Bonds?

Face value represents the nominal, stated value of a security at the time of issuance.

- In stocks, it is the value assigned during incorporation, such as ₹10 or ₹100 per share.

- For bonds, face value is the principal amount repaid by the issuer at maturity (often ₹1,000 or equivalent).

Face value is fixed and stays the same through the life of the instrument, unless altered by a corporate action such as a stock split.

It provides a legal and accounting reference point, helping companies meet regulatory requirements for minimum capital and present transparent financial statements.

Determination of Face Value

- Set by company management before public issue or incorporation.

- Reflects regulatory standards and board decisions, not market conditions.

Legal and Accounting Significance

- Used to calculate dividend rates, especially for preference shares.

- Determines the minimum price for new share issues under regulatory frameworks.

- Appears in the capital section of balance sheets for guidance in financial reporting.

Face value anchors the integrity of capital markets by providing consistency and clarity for both investors and business leaders.

What is Market Value?

Market value is the price at which a security trades in the open market, changing constantly based on transaction demand and supply, company performance, broader economic forces, and investor sentiment.

- For stocks, market value is the per-share price on stock exchanges like NSE or BSE.

- Bond market value fluctuates with interest rates, credit ratings, and macroeconomic outlooks.

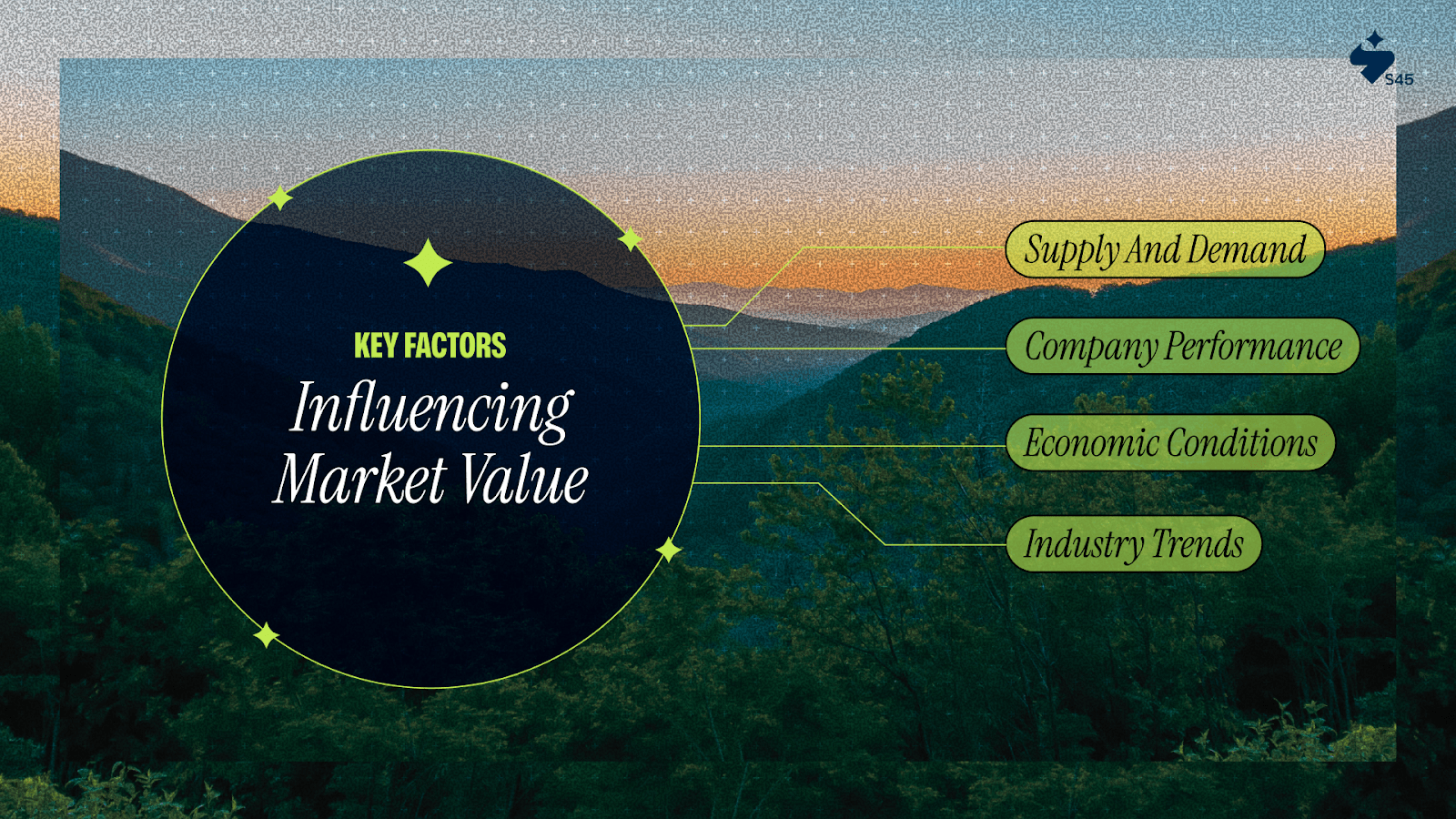

Key Factors Influencing Market Value

- Supply and Demand: More buyers push price up; more sellers push price down.

- Company Performance: Profits, growth, innovation, and solid management increase market value.

- Economic Conditions: Interest rates, inflation, and policy decisions influence investor appetite.

- Industry Trends: Sector booms, competition, and regulatory changes create ripples in valuation.

Volatility and Fluctuations

- Market value can change every minute, moving with news, rumours, or significant company developments.

- Short-term volatility is common—long-term trends emerge from sustained company performance and sector health.

Real-Time Nature

- Market value gives instant insights into what investors are willing to pay, aiding entry/exit timing and risk management.

- For business leaders, market valuation is a dynamic indicator of stakeholder confidence and future growth prospects.

S45 Club supports leaders to understand market valuation dynamics and leverage them for effective business transformation.

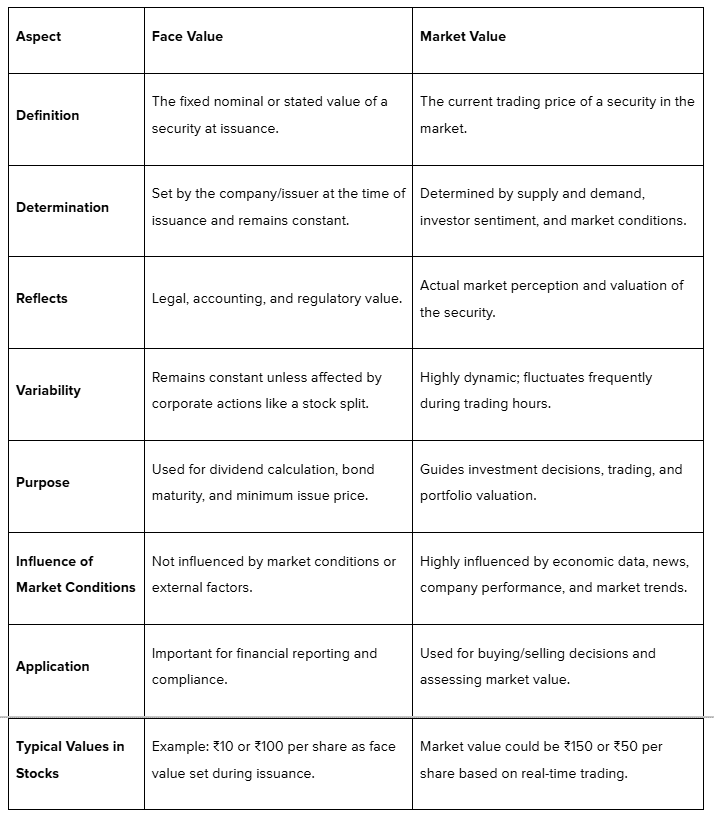

Face Value vs Market Value: Key Differences and Comparison

Face value and market value differ across several levels:

- Stability: Face value is static—set once and rarely changes. Market value is fluid and can spike or drop.

- Determination: Face value reflects internal company decisions and legal conventions. Market value results from external transactions between buyers and sellers.

- Purpose: Face value helps with regulatory compliance, dividend calculation, and financial reporting. Market value is a live reflection of perceived company worth and is used by investors for trading, valuation, and portfolio management.

Fundamental Characteristics Comparison

- Face value is a nominal concept and may not reflect true asset worth. Market value can be higher, lower, or equal, depending on a company’s fortunes and investor perceptions.

- Face value is essential for setting starting points—market value decides actual trading outcomes.

Practical Applications

- Face value is used for calculating dividend per share, bond interest payouts, and actions like stock splits.

- Market value underpins pricing at IPO, guides mergers or acquisitions, and is crucial for everyday trading decisions.

S45 helps founders and investors differentiate, track, and apply these values for scalable, sustainable business growth.

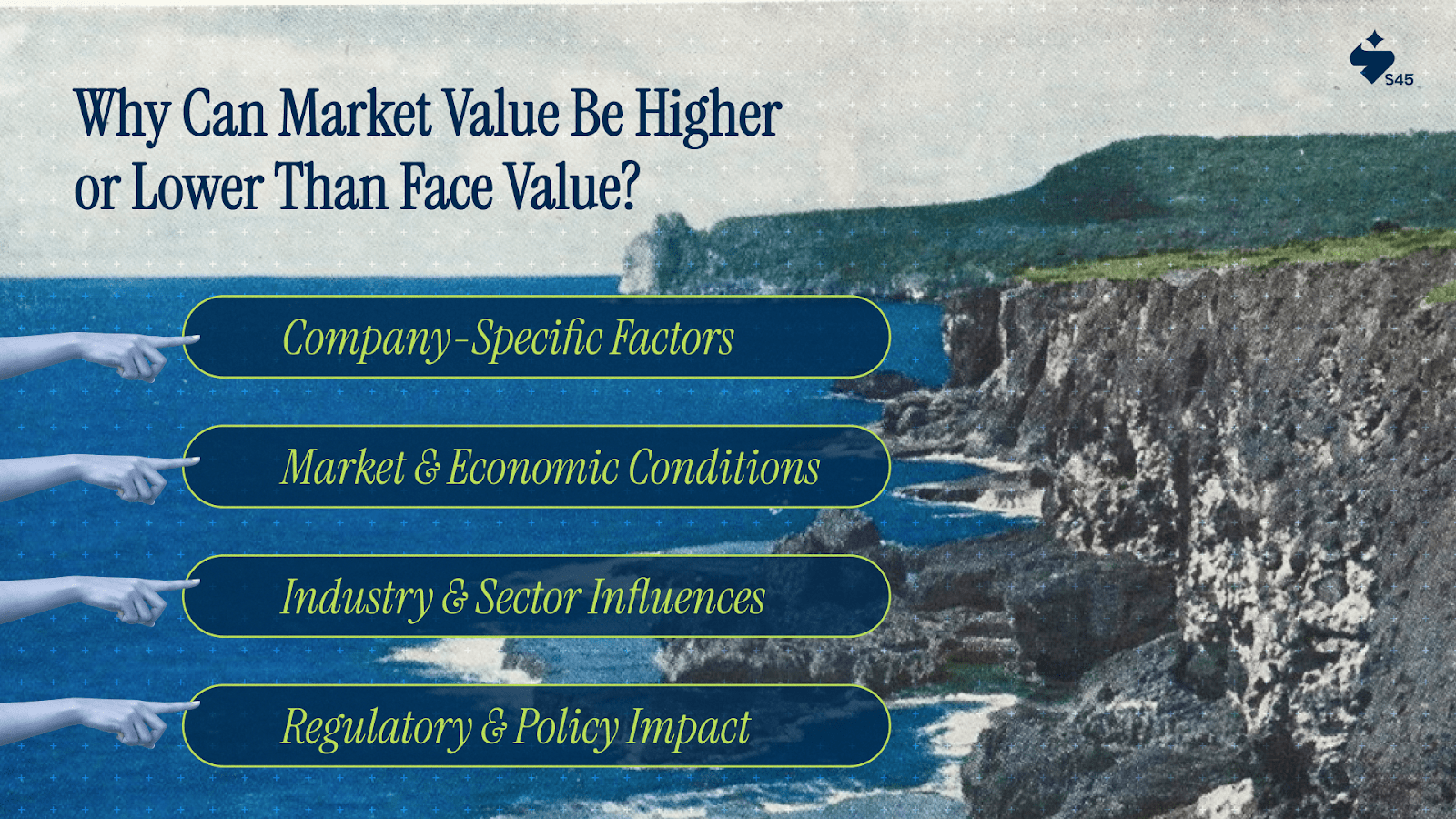

Why Can Market Value Be Higher or Lower Than Face Value?

There are many reasons market value deviates from face value, and understanding these forces helps founders make informed decisions.

Market value reflects both internal and external conditions, making it essential for real-time business and investment strategy.

Company-Specific Factors:

- Financial Performance: Growing profits, efficient operations, and strong revenue growth push market value well above face value.

- Management Quality: Credible leadership and visionary strategy elevate market recognition and investor trust.

- Growth Prospects: Expansion plans and innovation drive up market valuations, often outpacing static face values.

Market and Economic Conditions

- Interest Rates: Lower rates generally boost stock prices and market value, while higher rates do the opposite.

- Economic Cycles: Booms encourage market value surges; recessions can depress values below face value.

- Investor Sentiment: Collective confidence or doubt can swing market values rapidly.

Industry and Sector Influences

- Leaders in booming sectors (e.g., technology, renewable energy) often trade at a premium compared to face value.

- Regulatory reforms can reprice entire market segments quickly.

Regulatory and Policy Impact

- Policy changes around taxes, corporate governance, or industry incentives will influence market perception and valuation.

Tracking, analysing, and responding to these factors keeps SME founders and investors ahead. S45 mentors guide clients through changing environments, ensuring strategic positioning.

How Should Investors Use Face Value and Market Value in Their Decisions?

Both face value and market value play essential roles in portfolio management, investment analysis, and fundraising.

Face Value in Investment Analysis

Used for bond redemption calculations, dividend payouts, and understanding baseline ownership rights.

- In bonds, investors receive the face value at maturity, a key criterion in yield calculations.

- Dividends, especially for preference shares, are declared as a percentage of face value.

Market Value Considerations

Investors assess market value to determine if securities are underpriced (potential good entry) or overpriced (possible exit).

- Entry and exit strategies depend on market price fluctuations.

- Portfolio valuation relies on current market values for real-world tracking of investment performance.

Combining Both Metrics for Decisions

- Smart investors monitor face value for legal and accounting purposes, but rely on market value for actual buy/sell decisions.

- In SME fundraising, aligning market value with face value boosts credibility, while huge gaps may require additional communication with stakeholders.

Risk Assessment

- Market value’s volatility introduces risk; face value provides a reliable baseline for planning and reporting.

Successful founders and investors take a holistic view, leveraging the two concepts for well-informed, tactical decisions. S45’s community resources empower business leaders with practical analysis and decision frameworks.

What Do Indian SMEs Need to Understand About These Two Values?

For Indian SMEs and fast-growth companies, understanding these concepts unlocks better fundraising, valuation, and scaling strategies.

Face Value Considerations for SME Share Issuance

- Setting the right face value during incorporation and new share issuance supports legal compliance and investor trust.

- Too high a face value may deter small investors.

Market Valuation Impact on Funding Rounds

- Funding rounds are usually priced based on the market value established by negotiation and investor assessment.

- Market value signals readiness for larger growth, strategic partnerships, or IPO.

IPO Preparation and Pricing Strategies

- The IPO issue price is typically a premium above face value, reflecting business success and market appetite.

- Founders must ensure clear communication of both values during investor presentations and regulatory filings.

Investor Communication and Valuation Discussions

- Explaining differences between face and market value builds transparency and enhances investor confidence.

- Documents and pitch decks must include both values for clarity with stakeholders.

Indian SMEs benefit from this clarity, allowing smoother capital raising, stronger market reputation, and effective stakeholder engagement.

S45’s advisory network helps founders through these critical growth stages, ensuring robust, compliant, and well-valued business expansion.

What Are the Common Misconceptions About Face Value vs Market Value?

Many business owners and investors mix up face value with market value, leading to misguided decisions.

Face Value Misconceptions

- The belief that a higher face value means a stronger or more valuable company. In reality, market value better reflects actual company strength.

- Assuming face value sets the share price ignores market forces like demand, performance, and sentiment.

- Equating face value with par value can confuse reporting or compliance, as these terms can differ legally.

Market Value Misunderstandings:

- Treating market value as a measure of fundamental worth may be misleading, especially in volatile markets.

- Reading too much into short-term price swings may lead to rash trading or misallocation of assets.

Comparative Analysis Errors

- Failing to account for the role of face value in dividend or bond calculations skews investment analysis.

- Comparing securities solely on face value creates misleading conclusions.

Decision-Making Pitfalls

- Using face value as a primary investment criterion ignores real-time signals of risk or opportunity.

- Neglecting market value during fundraising or IPO preparation may understate business appeal.

By understanding and avoiding these common mistakes, SME leaders and investors can make more confident, credible decisions that build sustainable growth and lasting success.

Conclusion

Face value and market value are essential for informed financial planning, investment analysis, and business expansion. Face value provides legal and accounting stability, while market value reflects real-time investor confidence and opportunity.

Distinguishing between the two enables SME leaders and investors to manage risk, optimise returns, and present their businesses authentically to the market.

S45 Club stands ready to guide entrepreneurs and investors in leveraging these concepts for sustainable growth.

Join the S45 community to elevate your financial strategy, enhance investor communications, and climb towards purposeful, lasting business success.

Embark on your growth expedition with S45, your expert partner for building stronger financial foundations and reaching new heights.

Frequently Asked Questions

1. What is face value in finance?

Face value is the nominal value set by issuers for stocks or bonds, used for legal and accounting purposes.

2. How is market value different from face value?

Market value is the current trading price influenced by demand, company performance, and market sentiment, while face value remains fixed.

3. Does a higher face value mean a stronger company?

No; business strength is better reflected by market value and financial results than by face value alone.

4. Can market value be lower than face value?

Yes; poor performance, negative news, or market downtrends can push market value below face value.

5. Are face value and par value the same?

They are often used interchangeably, but par value can have specific meanings depending on securities and jurisdictions.

6. Why do investors care about both values?

Face value helps with dividend and bond maturity calculations, while market value guides trading, portfolio allocation, and risk assessment.

7. Do face value and market value affect investment decisions?

Yes; understanding both helps in evaluating returns, risks, and fair pricing for new investments or fundraising.