Key Takeaways:

- Par value is the legal and accounting foundation for financial instruments, setting minimum capital requirements and guiding compliance for SMEs.

- It differs from market value, remaining static while market prices fluctuate according to investor sentiment and business performance.

- Par value plays a crucial role in capital structure planning, share issuance, equity accounting, and dividend calculations for growing businesses.

- Indian SMEs must understand par value for regulatory compliance, successful funding rounds, and smooth IPO preparation.

- Partnering with guides like S45 Club empowers entrepreneurs to navigate financial complexities and build stronger, sustainable legacies.

Par value is a foundational term in corporate finance and investing. It defines the stated value of shares and bonds at issuance, shaping legal, accounting, and strategic decisions.

For entrepreneurs and business leaders, understanding par value helps build stronger financial foundations and enables informed capital planning.

What Exactly is Par Value and Why Should You Care?

Par value is the face value assigned to financial instruments like shares and bonds when they’re first issued. This value appears on security certificates and company books, and its primary function is legal and regulatory.

For stocks, par value often acts as a floor price below which shares cannot be issued. For bonds, it represents the principal amount to be repaid at maturity.

Although market prices fluctuate due to investor sentiment and external factors, par value remains constant throughout a security’s life.

Originally, par value helped protect shareholders and creditors by establishing minimum capital requirements. In past decades, par value was significant for pricing shares, calculating tax liabilities, and distributing dividends.

Today, its regulatory importance remains, but market valuations depend more on company performance, investor confidence, and external conditions.

Par value, face value, and nominal value are terms often used interchangeably in finance. Yet, subtle differences exist.

How Does Par Value Differ from Face Value and Nominal Value?

- Face value is the legal value for bonds, forming the basis for coupon or interest calculations.

- Par value is the minimum price at which a company can sell shares, set in its incorporation documents.

- Nominal value is a broader term used in accounting and finance.

Businesses navigating these terms benefit from trusted advisors and networks like S45 to ensure confident financial decisions.

Key Characteristics of Par Value

- It is fixed at the time of security issuance.

- Does not change with market movements.

- Appears in articles of incorporation and on security certificates.

- Guides legal compliance and minimum capital requirements.

In What Ways Does Par Value Impact Stocks, Bonds, and Other Securities?

A clear understanding of par value is essential for anyone working with stocks, bonds, or other securities.

Each type of financial instrument uses par value differently, impacting legal rights, returns, and compliance.

1. Par Value of Stocks

Common stocks typically have a low par value, sometimes even a fraction of a cent. The board of directors sets this value during incorporation.

For example, Apple has assigned a par value of $0.00001 to its common shares. This minimum price, although symbolic, ensures companies never issue shares below a certain threshold.

Preferred stocks are more closely tied to par value. Their dividends are calculated as a percentage of par, aligning shareholder expectations. Some companies now issue no-par value stocks, especially in markets that allow more flexibility.

2. Preferred Stock Considerations

Dividends on preferred stock directly relate to the security’s par value. Investors and founders should know that dividends are fixed as a percentage of par. This impacts both investment analysis and payout strategies for businesses contemplating preferred shares issuance.

3. No-Par Value Stocks

Jurisdictions increasingly permit no-par value shares. These are flexible and help businesses avoid arbitrary capital restrictions. These strategies help scale and evolve business structures as markets and regulations change.

4. Par Value of Bonds

For bonds, par value equals the principal repayment due at maturity. Bonds are usually issued at a standard amount, such as $1,000.

The par value determines coupon payments and is critical for calculating returns. Whether a bond is issued at, below, or above par depends largely on the interest rate environment.

5. Corporate Bonds

Corporate bonds almost always specify a par value to clarify repayment commitments. SMEs issuing bonds should define par value carefully to maintain trust and accountability.

6. Government Bonds

Government bonds use par value for calculating interest payments and final redemptions. Investors rely on these conventions for planning returns and managing risk.

7. Municipal Bonds

Municipal bonds, issued by cities or states, set a par value to guide investors and regulate funding for public projects.

8. Par Value in Other Securities

Debentures, fixed-income instruments, and convertible securities all use par value as a legal and accounting anchor. SMEs managing diverse funding sources can benefit from S45’s playbook approach to secure long-term growth.

9. Debentures and Fixed-Income Instruments

Par value in debentures fixes repayment obligations and coupon rates, which supports investor confidence in the business’s reliability.

10. Convertible Securities

Convertible bonds and shares use par value to set conversion ratios. This supports transparent transitions between debt and equity.

The S45 community is designed to guide businesses as they navigate these complex instruments, ensuring their journey is strategic and sustainable.

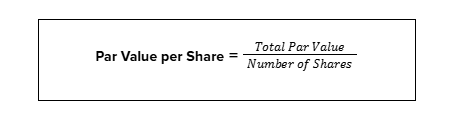

How to Calculate Par Value: Methods and Formulas

Understanding par value calculation is crucial for founders, CFOs, and finance professionals. The basic formula for stock par value is:

For bonds, the par value is simply the amount listed on the certificate, the principal that the issuer promises to pay at maturity. Calculations for preferred stocks involve setting dividend rates as a percentage of par.

Stock Par Value Calculations

- The total share capital method divides stated capital by shares issued.

- Per-share calculation lists par value individually on stock certificates.

Bond Par Value Calculations

- Coupon payment calculations depend on par value and the stated interest rate.

- Maturity value determination simply restates the amount the issuer will pay back.

What’s the Difference Between Par Value and Market Value?

Par value and market value serve different functions in financial markets. Par value is set at issuance, used for legal and accounting purposes.

Market value reflects current trading prices and fluctuates according to demand, profitability, and economic conditions. Comparing the two reveals key insights for investors and business owners.

Fundamental Differences Explained

Par value is a static, regulatory construct. Market value is dynamic, changing daily as investors trade.

- Par value influences legal capital, minimum issue price, and dividend calculations.

- Market value impacts investment returns, asset sales, and portfolio management.

Factors Affecting Market Value vs Par Value

- Market value shifts rapidly with company performance, investor outlook, and macroeconomic trends.

- Par value remains an anchor for regulatory compliance and accounting, even when market prices soar or dip.

When Par Value Matters vs When Market Value Dominates

- Par value matters when issuing new shares, distributing dividends, and meeting regulatory obligations.

- Market value is central in buying, selling, and valuing securities.

For SMEs and founders, knowing when each metric matters is essential for sound financial planning. S45 guides business owners in navigating these complexities for sustainable growth.

Why is Par Value Important for Legal Compliance and Corporate Governance?

Legal requirements for par value vary across countries and states. Most jurisdictions require companies to define par value in their incorporation documents, supporting governance and financial discipline.

Legal Capital Requirements

Par value shapes legal capital, the minimum capital a company must retain to protect creditors and shareholders.

Issuing shares below par value is generally prohibited to sustain capital integrity. This discipline serves both founders and investors, ensuring protection during tough times.

International Standards and Variations

Globally, standards for par value vary. European and Asian markets may use par value more strictly.

Indian regulations require careful adherence to Companies Act standards, as well as SEBI (Securities and Exchange Board of India) guidelines.

Founders and CFOs should maintain robust documentation and follow local regulations. S45 offers practical guidance to help SMEs meet compliance without stifling innovation.

Common Legal Pitfalls

Mistakes such as misreporting par value or issuing shares below par can result in penalties, reputational risk, or litigation. S45’s advisory team stands ready to guide entrepreneurs through these challenges.

Regulatory Violations and Penalties

Non-compliance may lead to financial penalties, revoked licenses, or constraints on future funding. A disciplined approach secures long-term business growth.

Join S45’s community to access resources and mentorship for navigating legal intricacies in your growth expedition.

How Can Smart Businesses Use Par Value to Drive Growth and Funding Success?

Par value is more than a technical requirement; it touches many aspects of business operations for SMEs.

It shapes capital structure, share issuance, accounting, and dividend calculation, making it a key concept for strategic planning.

Capital Structure Planning

Decisions about capital structure often begin with par value settings. Businesses must determine how much equity to issue and at what price. Par value helps set limits and guides these strategic choices.

Share Issuance Strategies

Issuing shares above par value creates additional paid-in capital. This elevates the company’s balance sheet, making it more attractive to growth investors and institutional capital.

Impact on Financial Statements

- Balance sheet representation: Par value appears in the equity section, often alongside paid-in capital and retained earnings.

- Equity accounting: It anchors calculations for share capital, keeping financial statements accurate and transparent.

Dividend Calculations and Par Value

Dividend rates on preferred shares are calculated as a percentage of par. For common shares, par is less influential but remains relevant for legal compliance.

Corporate Governance Implications

Par value supports governance by ensuring companies do not dilute equity indiscriminately. It empowers boards and investors, keeping growth purposeful and sustainable.

SMEs seeking practical, actionable strategies should collaborate with S45’s advisors—partners on the path to peak performance.

Common Misconceptions and Mistakes About Par Value

Despite its importance, par value is often misunderstood by new founders and investors. Misinterpretations can lead to costly errors and missed opportunities.

- Par Value vs Stock Price Confusion: Par value is the stated, unchanging minimum; stock price is the market’s dynamic valuation. Confusing the two may lead to overspending or poor investment decisions.

- Overestimating Par Value Importance in Stock Valuation: In modern finance, par value rarely determines share price. Overemphasising its role can mislead valuations, negotiations, or strategic planning.

- Legal Compliance Oversights: Neglecting local regulations or documentation requirements creates risks. SMEs should partner with experienced mentors—like those within S45’s network—to uphold best practices and compliance at every stage.

Conclusion

Par value is a foundational part of financial literacy in business. For SME founders, investors, and decision-makers, understanding par value supports sound strategies for growth, compliance, and long-term resilience.

Grounded advice, collaborative partnership, and practical resources are essential qualities S45 embodies as a guide on the journey to peak performance.

Join S45’s community to empower your growth expedition, elevate your financial knowledge, and build lasting legacies that transform the future of Indian entrepreneurship.

Embark on your growth expedition today. S45 is here to guide, empower, and navigate every climb with you.

Frequently Asked Questions About Par Value

1. What is par value in stocks?

Par value is the minimum price assigned to a share at issuance, primarily for legal and accounting purposes.

2. Does par value affect stock market price?

No, market prices fluctuate independently, while par value remains constant and serves compliance needs.

3. Why do some shares have no par value?

No-par stocks offer companies flexibility, eliminating arbitrary capital restrictions while maintaining governance standards.

4. How is par value set and calculated?

It’s established during incorporation and calculated by dividing total stated capital by shares issued.

5. Is par value important for bonds?

Yes, it defines the principal amount to be repaid at maturity and is used to determine coupon payments.

6. Can companies issue shares below par value?

No, issuing below par is typically prohibited to protect capital integrity.

7. Is par value relevant for IPO preparation?

Absolutely; clear par value documentation is essential for regulatory approvals and investor communications.