Key Takeaways:

- Subordinated debt financing is a flexible funding tool for high-performing SMEs, positioned between senior debt and equity.

- It offers higher yields to investors but comes with higher risk due to its unsecured nature and lower repayment priority in bankruptcy.

- Key features include fixed dividends, mandatory conversion to equity, and anti-dilution protection for investors.

- The repayment structure often involves long tenors and deferrals, easing the cash flow burden on businesses during growth.

- Risks include potential partial or total loss in default scenarios, with no collateral backing and delayed repayment priority.

What happens when a business needs growth capital but doesn’t want to dilute ownership or pledge assets?

For many high-performing SMEs in India, subordinated debt offers that middle path. With India’s MSME sector contributing nearly 30% of GDP and employing over 110 million people, demand for innovative financing solutions like sub-debt financing is growing.

Positioned between senior loans and equity, subordinated debt offers businesses flexibility while providing attractive yield opportunities for investors, making it a critical instrument for ambitious SME leaders.

This blog breaks down the definition, structure, repayment mechanics, bankruptcy implications, key types, risks, and strategic value of subordinated debt, with a specific focus on the Indian SME context.

What is Subordinated Debt?

Subordinated debt is unsecured financing ranked below senior debt but above equity, offering higher yields to compensate for its subordinate position. Key to structuring growth capital for high-performing Indian SMEs.

For example, a fast-growing Indian tech startup with senior debt can issue subordinated debt for expansion. It can offer higher interest rates to investors in exchange for higher risk, allowing capital access without ownership dilution.

Key Features:

- Unsecured structure: Depends on borrower's credit, not collateral, creating elevated risk.

- Capital stack placement: Repayment occurs only after senior debt, before equity.

- Yield premium: Offers higher interest rates to offset subordinate repayment ranking.

- Fewer restrictions: Typically includes fewer covenants compared to senior debt, granting SMEs operational flexibility.

- Regulatory clarity: Subordination clauses legally embed priority rules in distress scenarios.

Understanding where subordinated debt fits in the capital stack is critical for long-term planning. S45 works with founders and investors to align such financing tools with broader private market growth strategies.

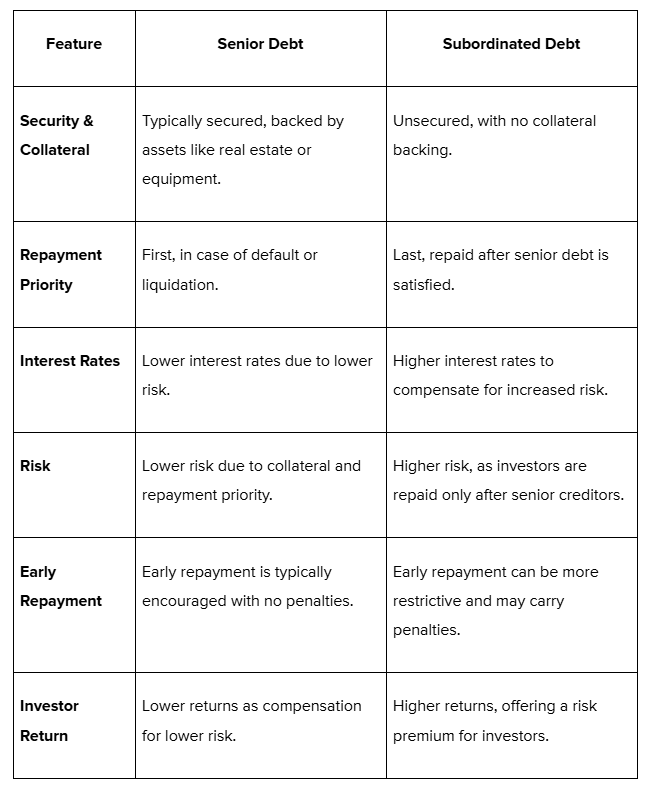

Subordinated Vs. Senior Debt: Key Differences

Understanding the key differences between subordinated and senior debt is crucial for assessing the relative risk and security these financial instruments offer. Each plays a distinct role in capital structure, catering to different investor risk preferences.

Now that we've explored the differences between subordinated and senior debt, it's important to understand how subordinated debt actually works in practice.

How Structural Dynamics & Repayment Mechanics Work for Subordinated Debt

Subordinated instruments in India are structured to provide long-term capital without diluting ownership. They often include features that align repayment obligations with SME cash flows while satisfying regulatory capital norms for lenders.

Repayment Structure within India

Subordinated debt repayment structures offer flexible terms tailored to support SME cash flows and growth, with options like Tier II capital and government-backed schemes.

1. Tier II Capital Qualification

The Reserve Bank of India (RBI) allows banks and non-banking financial companies (NBFCs) to treat subordinated debt as Tier II capital, meaning it can count toward their financial reserves.

Requirements:

- The debt must have a minimum term of 5 years.

- If early repayment is desired, RBI approval is needed.

- After 5 years, the debt loses 20% of its value each year for accounting purposes.

2. Flexible Instruments (PIK and Balloon Repayments)

- Payment-in-Kind (PIK) notes: Instead of paying interest in cash, the interest is added to the principal, helping SMEs preserve their cash for growth.

- Balloon repayment: The company repays the principal amount in larger installments at a later stage, easing the immediate cash flow burden.

3. SIDBI Subordinated Models

The Small Industries Development Bank of India (SIDBI) offers subordinated loans to SME promoters (owners), structured as quasi-equity (a mix of debt and equity).Loan terms:

- The loan is capped at 50% of the promoter’s contribution or ₹75 lakh, whichever is lower.

- The loan term is long (up to 10 years), with repayments starting only after 7 years.

- Repayments are made in 36 equal monthly installments after a grace period.

4. Ministry of MSME – Credit Guarantee Scheme for Subordinate Debt (CGSSD)

- Provides partial credit guarantee cover to banks for loans extended as subordinated debt to stressed MSMEs.

- Maximum guarantee coverage: 90% of the subordinated debt (including interest), subject to a ceiling of ₹7.5 crore per borrower.

- Helps revive stressed but viable SMEs by encouraging banks to extend fresh subordinate loans.

5. Commercial Market Examples

- SBI: Offers subordinated bonds as Tier II instruments, usually 10+ year tenors, callable after 5 years.

- NBFCs and AIFs: Use mezzanine or subordinated structures with 12–18% coupon rates plus equity-linked warrants.

Now, let's take a closer look at the different types of subordinated debt instruments available to Indian SMEs and their unique features.

Types of Subordinated Instruments for Indian SMEs

Indian SMEs have access to various subordinated debt structures, each catering to specific funding needs and investor preferences. These instruments provide flexible capital options without diluting ownership.

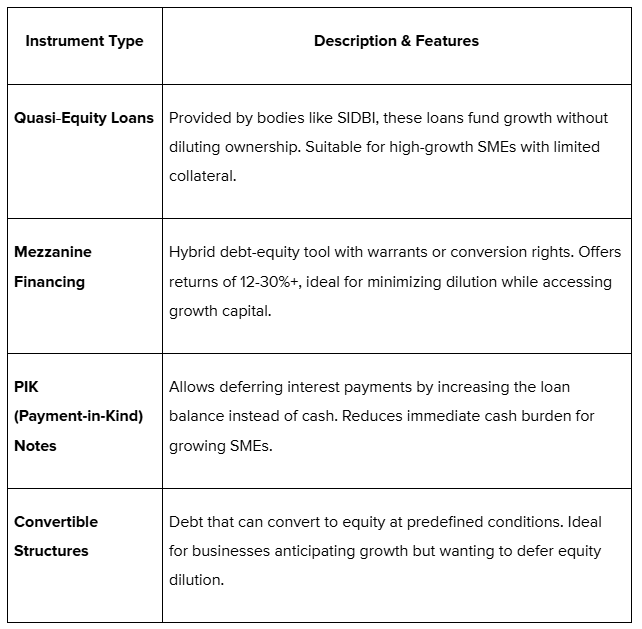

Instrument Types & Features

Choosing the Right Subordinated Debt Instrument

- Quasi‑Equity Loans: Best for SMEs needing growth capital without losing ownership. Ideal for high-growth companies with limited collateral.

- Mezzanine Financing: Suitable for companies looking to raise large amounts of capital with minimal equity dilution.

- PIK Notes: Perfect for businesses with variable cash flows that need flexibility in interest payments.

- Convertible Structures: Best for growth-stage companies willing to offer future equity for current funding.

- Subordinated Debentures: Ideal for asset-light SMEs seeking medium-term unsecured debt.

Furthermore, understanding the risks in case of bankruptcy or default is crucial for both investors and businesses considering subordinated debt.

Bankruptcy & Default Scenarios in India

Subordinated debt in India poses a higher risk in bankruptcy or default scenarios, as it ranks behind senior debt in the repayment hierarchy.

Therefore, careful evaluation of both the issuer's financial stability and the legal framework governing such debt is crucial for investors. Some distress scenario points include:

1. Priority Hierarchy: In the event of liquidation, senior creditors are paid first, leaving subordinated debt holders with only what remains—if any. If the liquidation proceeds fall short of settling senior debts, subordinated creditors may receive limited or no repayment.

2. Unsecured Risk: Most subordinate debt is unsecured, meaning that it does not have any collateral backing it. This places subordinated creditors behind senior secured lenders in terms of repayment priority. In distress situations, this increases the likelihood of a partial or total loss.

3. Government Schemes: Programs like CGSSD (Credit Guarantee Scheme for Subordinate Debt), launched by the Ministry of MSME, help distressed MSMEs by providing a partial guarantee to banks for subordinated loans. This encourages lending to viable but stressed MSMEs by mitigating some of the lender's risk.

4. Regulatory Norms for NBFCs: The RBI classifies subordinated debt as unsecured and non-redeemable, requiring prior approval from the RBI.

Additionally, it must be discounted in the capital adequacy calculations, affecting how these instruments are accounted for in Tier II capital. The inclusion of subordinated debt in regulatory frameworks like these can influence its attractiveness to lenders and investors.

Now that we've covered the various aspects of subordinated debt, it’s important to also consider the potential risks associated with it. Both investors and businesses should carefully assess these risks before proceeding.

What are the Risks of Subordinated Debt?

Subordinated debt can offer high returns, but it comes with significant risks that investors and businesses must consider. The higher yield is directly linked to the increased risk involved.

- Priority of Repayment: Subordinated debt is repaid last in case of liquidation, after senior debt, which means investors may face partial or total loss if the company’s assets are insufficient.

- Interest Rate Risk: Subordinated debt with fixed rates becomes less attractive during rising interest rates, affecting its value and returns.

- Liquidity Risk: These instruments are harder to trade, with limited marketability, especially during economic downturns.

- Extension and Call Risk: Instruments like PIK notes can be extended, locking investors into long-term exposure. Callable debt may be redeemed early, limiting returns.

- Issuer Credit Risk: Investors are highly exposed to the issuer’s financial health. If the issuer faces financial trouble, subordinated debt holders are the most vulnerable.

- Regulatory Risks: Subordinated debt can be affected by regulatory changes, especially in sectors like banking, where Tier II capital requirements might shift.

- Conversion to Equity: Some subordinated debt, such as CoCos, may convert to equity under certain conditions, exposing investors to equity market risks.

Subordinated debt also plays a critical strategic role in corporate finance, particularly for high-growth SMEs.

Subordinated Debt's Strategic Role in Corporate Finance

Subordinated debt plays a key role in corporate finance by providing flexible capital for expansion while maintaining ownership and protecting senior debt.

For SME founders, it helps improve capital structure, manage financial leverage, and enhance financial flexibility. These are a few advantages that you must know:

1. Enhancing Capital Structure:

- Adds a layer of funding that supports senior debt, enabling companies to raise more capital.

- Strengthens the overall financial position, improving creditworthiness.

2. Supporting Senior Debt Financing: Reduces risk for senior lenders, which often results in better terms for senior loans (e.g., lower interest rates).

3. Growth Without Dilution: Raises funds for expansion while allowing founders to retain control, avoiding equity dilution.

4. Tax Efficiency: Interest payments are tax-deductible, improving cash flow and reducing taxable income.

5. Increased Financial Leverage: Provides additional debt capacity, allowing businesses to fund more growth opportunities without compromising financial stability.

6. Attracting Private Equity Investment: Enhances financial stability, making the business more appealing to private equity investors.

7. Flexibility During Distress: Offers repayment flexibility in difficult times, such as deferred payments or extended terms, helping businesses manage short-term challenges.

8. Meeting Regulatory Requirements: For financial institutions, subordinated debt is vital in meeting Tier II capital requirements, ensuring regulatory compliance and capital adequacy.

If you're looking for strategic guidance on navigating funding options, S45 Club can be the right partner to guide your growth journey.

Take the Next Step in Your Financial Journey with S45

S45 is an equity advisory platform for founders and investors focusing on long-term growth strategies rather than short-term raises. We help you make smarter funding decisions with access to capital, pre-IPO opportunities, and startup equity expertise.

Here’s how we assist founders building for the future:

- Timing the Right Capital Raise: We help you assess the best moment to bring in external capital, whether through structured funding, secondary exits, or pre-IPO rounds.

- Investor-Ready Due Diligence: Gain clarity on your company’s valuation drivers, cap table hygiene, and governance so you’re always prepared for the next step.

- Access to Pre-IPO Opportunities: We connect you with exclusive deal flow typically reserved for insider networks, helping you reinvest or diversify as your company scales.

- Risk and Trade-Off Clarity: Understand the implications of dilution, liquidity, and exit options before committing to funding.

- Equity Strategy Beyond the Round: From ESOP liquidity to preparing for institutional capital, S45 Club offers strategic guidance to help you align funding with your long-term goals.

Looking to scale strategically? Start your funding journey with S45 and build towards your next growth milestone.

Conclusion

Subordinated debt offers startups a flexible way to secure capital, but it comes with its share of risks. While it can provide higher returns, its position in the capital stack makes it a riskier option compared to senior debt. Understanding its key features and risks is crucial for any business considering this form of financing.

For founders looking to make informed decisions and learn from others who have successfully raised capital, connecting with a community of experienced entrepreneurs can be incredibly valuable.

Want to learn from those who’ve already raised capital successfully? Join the S45 founder community to exchange insights, share experiences, and stay ahead in your funding journey.

FAQs

Q: Can subordinated debt be used as a tool for regulatory capital in banks or financial institutions?

A: Yes, subordinated debt can be used as Tier II capital by banks and NBFCs (Non-Banking Financial Companies), helping them meet regulatory capital requirements while maintaining operational flexibility.

Q: What are the key differences between subordinated debt and mezzanine financing?

A: Subordinated debt is typically a loan that ranks below senior debt but above equity, while mezzanine financing is a hybrid that includes both debt and equity components, often with the potential for equity conversion.

Q: How does subordinated debt impact a company’s credit rating?

A: The use of subordinated debt can impact a company’s credit rating as it adds to the debt burden, potentially increasing financial risk. However, it can also improve the company's debt-equity ratio, which may positively influence future borrowing terms.

Q: Are there any tax benefits for companies issuing subordinated debt?

A: Yes, interest payments on subordinated debt are often tax-deductible, which can reduce a company’s taxable income and improve cash flow, providing a financial advantage.

Q: How do investors mitigate risks when investing in subordinated debt?

A: Investors mitigate risks through features like anti-dilution protection, higher interest rates, and liquidation preferences. They may also assess the company's financial health and the legal safeguards tied to the debt before investing.