Key Takeaways

- The Debt-to-Asset Ratio measures how much of a company's assets are financed by debt, indicating financial stability and risk.

- A higher ratio (above 1) suggests more debt than assets, signaling higher risk. A lower ratio (below 1) shows less reliance on debt, indicating stability.

- Calculating the ratio involves dividing total debt by total assets and can be expressed as a decimal or percentage.

- Improving the ratio requires debt repayment, refinancing, and increasing assets through equity financing or smarter asset management.

- While useful, the ratio has limitations, including ignoring asset quality and non-financial liabilities, making it important to use it alongside other metrics.

Have you ever wondered how much of your company's assets are funded by debt?

Debt-to-Asset Ratio offers a clear insight into this and reveals the financial risk your company carries. For example, India’s government debt-to-GDP ratio is expected to reach 80.00% by the end of 2025, highlighting the significant reliance on debt at a national level.

Understanding this ratio is crucial for business owners like you, as well as for investors and creditors. By analyzing this metric, you can assess your company's financial stability and risk profile. In this article, you will learn how to calculate and interpret the ratio, why it matters, and how you can use it to make informed business decisions.

What is the Debt-to-Asset Ratio?

The Debt-to-Asset Ratio is a financial metric that shows the proportion of a company's assets that are financed through debt. It is calculated by dividing total debt by total assets, and it provides insight into the company's reliance on debt to fund its operations. A higher ratio indicates higher debt usage, which may suggest more financial risk.

For Example,

For instance, if your company has ₹3,00,000 in total debt and ₹6,00,000 in total assets, the Debt-to-Asset Ratio would be:

Debt-to-Asset Ratio = ₹3,00,000 / ₹6,00,000 = 0.5 (50%).

This means 50% of your company’s assets are financed by debt.

By calculating this ratio, you gain a clearer understanding of your company’s financial structure, which is crucial when assessing its ability to meet debt obligations and its overall risk level.

This understanding is especially important for investors and creditors who rely on this ratio to evaluate the financial stability of a business.

Why Debt-to-Asset Ratio Matters for Investors and Creditors?

The Debt-to-Asset Ratio provides valuable insights into how much of a company's assets are financed by debt, helping stakeholders understand the potential risks involved in lending or investing in the company.

By evaluating this ratio, investors and creditors can make the right decisions based on the company's ability to meet its debt obligations and maintain growth.

Why It Matters:

- Risk Assessment for Creditors: Creditors use the ratio to evaluate the company's ability to repay its debts. A higher ratio indicates that the company relies more on borrowed funds, which may make it riskier to lend to.

- Investment Decision-Making: Investors assess the ratio to determine the level of financial risk in the company. A lower ratio generally suggests a stable company with less reliance on debt, making it an attractive investment.

- Creditworthiness Evaluation: Lenders look at the ratio to gauge the company's ability to manage its debts. A ratio above 1 could indicate that the company's debt exceeds its assets, potentially limiting its future borrowing capacity.

- Predicting Financial Stability: A low Debt-to-Asset Ratio signals strong financial health and a higher likelihood of long-term profitability. Investors and creditors prefer companies with lower ratios, as they tend to be more resilient during market fluctuations.

- Cash Flow Analysis: Creditors and investors assess the Debt-to-Asset Ratio to understand how much debt a company is carrying compared to its assets. This helps predict the company's future cash flow and its ability to pay off liabilities.

For startups looking to optimize their financial health and attract investors or creditors, S45 offers strategic growth support to help businesses scale effectively.

To understand how this ratio is calculated and how it can be improved, let's examine its components in more detail.

Calculation of Debt-to-Asset Ratio

The Debt-to-Asset Ratio is a metric that helps you assess the proportion of a company's assets that are financed through debt. Calculating it is simple, and it requires only two key pieces of financial information: total debt and total assets. This calculation provides a clear picture of your company's reliance on borrowed funds.

Calculation:

To calculate the Debt-to-Asset Ratio, use the formula:

Debt-to-Asset Ratio = Total Debt / Total Assets

For example, if your company has:

- Total Debt: ₹5,00,000

- Total Assets: ₹10,00,000

The Debt-to-Asset Ratio would be:

₹5,00,000 / ₹10,00,000 = 0.5 (50%)

This means that 50% of your company's assets are financed by debt. The result can be expressed as a decimal or percentage, depending on your preference.

This simple calculation helps you determine how much of your business's assets are financed by debt and is a key indicator of your financial health.

Now that you understand how to calculate the ratio, it's important to understand how this ratio is interpreted in different financial contexts.

How to Interpret the Debt-to-Asset Ratio?

Interpreting the Debt-to-Asset Ratio is essential for understanding your company's financial stability and risk level. A higher ratio indicates a greater reliance on debt to finance assets, which could signal higher financial risk. On the other hand, a lower ratio suggests a more stable financial structure with less debt.

Here's how to break it down:

- Ratio > 1 (More Debt than Assets): If your ratio exceeds 1, it means your company has more debt than assets. This could indicate financial distress, as the company is highly dependent on borrowed money. This can be risky, especially in volatile markets.

- Ratio < 1 (More Assets than Debt): A ratio below 1 suggests that your company has more assets than debt, which is a sign of financial stability. It means the company is relying less on debt and has a buffer to absorb financial shocks.

- Ratio = 1 (Debt Equal to Assets): A ratio of exactly 1 means your company's debt equals its assets. While not as risky as a ratio greater than 1, it still suggests the company is equally dependent on debt as it is on its own resources. It may require careful management to avoid higher financial strain.

Understanding the Debt-to-Asset Ratio helps in assessing risk and making informed financial decisions. In addition to the ratio itself, several factors influence its value and how it's interpreted, including industry standards and economic conditions.

The Key Factors Influencing Debt-to-Asset Ratios

Several factors can impact a company's Debt-to-Asset Ratio, making it important to consider more than just the raw numbers. These factors include industry norms, economic conditions, and the stage of the company's lifecycle.

Here are the influencing factors:

- Industry Norms: Different industries have varying debt requirements. For example, capital-intensive industries like manufacturing or utilities may have higher debt ratios compared to service-based industries.

- Economic Conditions: In times of economic uncertainty or high interest rates, companies may take on more debt, which can increase the ratio.

- Company Lifecycle: Startups often rely on debt for funding, leading to a higher ratio, whereas mature companies may have a lower ratio due to accumulated assets and retained earnings.

- Business Strategy: Companies that prioritize aggressive expansion or large-scale projects may incur more debt, leading to a higher ratio, while those focusing on organic growth might maintain a lower ratio.

- Regulatory Changes: Updates in regulations, such as tax laws or financial reporting standards, can impact how companies structure their debt, affecting their Debt-to-Asset Ratio.

Understanding these factors is essential in evaluating the true financial health of a business. With this context in mind, it's important to consider how these factors influence strategies for improving the Debt-to-Asset Ratio.

How to Improve Your Debt-to-Asset Ratio?

If your Debt-to-Asset Ratio is higher than desired, there are several strategies you can implement to improve it. Lowering the ratio is not only about paying down debt, but also involves strategic decisions to increase assets and optimize financial management.

Here’s a Checklist for Improving Your Debt-to-Asset Ratio

- Debt Repayment:

- Focus on paying off high-interest or short-term debts first.

- Refinance long-term debt to lower interest rates, reducing the total debt burden over time.

- Increase Asset Value:

- Invest in appreciating assets, such as property or intellectual property, to increase total asset value.

- Reevaluate underperforming assets and consider selling or redeploying them for better returns.

- Equity Financing:

- Consider issuing new equity to raise capital, thereby reducing reliance on debt.

- Bring in strategic investors to inject capital into the business without increasing debt levels.

- Improved Cash Flow Management:

- Improve your business's cash flow by optimizing receivables and managing inventories more efficiently.

- Monitor and reduce unnecessary operational expenses to ensure more funds are available for debt repayment.

- Cost Cutting and Efficiency:

- Review operational processes to eliminate waste and reduce costs.

- Implement cost-saving technologies or systems to increase efficiency and profitability, increasing asset value.

While improving your Debt-to-Asset Ratio is beneficial, it’s crucial to consider its limitations in providing a full financial picture.

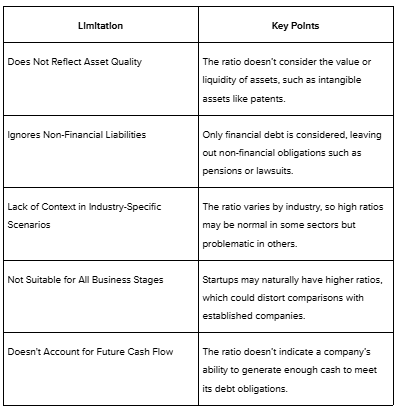

What are the Limitations of Debt-to-Asset Ratio?

While the Debt-to-Asset Ratio is a valuable tool for assessing financial risk, it has its limitations. It doesn't account for the quality or type of assets a company holds, nor does it reflect other important financial obligations. For a complete financial picture, this ratio should be used alongside other metrics and analysis.

Here are the limitations of the Debt-to-Asset Ratio:

While the Debt-to-Asset Ratio is important, it’s essential to consider broader strategies for growth. S45 offers personalized solutions to help Indian startups manage financial challenges and scale effectively.

What Can S45 Do for Indian Startups?

S45 offers strategic support to Indian startups, helping them scale effectively and achieve sustainable growth. With access to exclusive investment opportunities, expert advisory, and financial guidance, S45 assists startups in managing challenges and accelerating their business journey.

What S45 Offers:

- Capital and Expertise: Helping businesses through financial support and expert advice, enabling growth with a solid foundation.

- Sustainable Growth Focus: Encouraging gradual, consistent growth, rather than pursuing short-term wins, to ensure lasting success.

- Innovation and Legacy: Helping bridge the past with future innovations, creating businesses that stand the test of time.

- Walk Beside, Never Above: S45 partners with businesses, prioritizing collaboration and shared success over a mere investor role.

- Trust as Currency: Building transparent, trustworthy relationships that promote long-term business growth.

- Community of Climbers: Connecting founders for collaboration and collective growth within the MSME ecosystem

Get in touch today to explore how S45 can help your startup grow and scale efficiently.

Conclusion

The Debt-to-Asset Ratio is a crucial metric for understanding how much of your company's assets are financed by debt. It helps assess financial stability and risk, with a higher ratio indicating more reliance on debt. Monitoring assets financed by debt allows business owners to make the right decisions about managing debt and financial health.

S45 supports startups by offering both capital and expertise for sustainable growth. With a focus on innovation and legacy building, S45 helps founders overcome challenges and scale effectively. Contact S45 today to learn how they can help your business succeed.

FAQs

Q. What does the Debt-to-Asset Ratio indicate about a company's financial health?

A. The Debt-to-Asset Ratio shows how much of a company's assets are financed through debt. A higher ratio indicates more financial risk, while a lower ratio signals stability and less reliance on debt.

Q. How can I improve my company's Debt-to-Asset Ratio?

A. To improve your ratio, focus on reducing debt through repayments, consider refinancing to lower interest rates, or raise capital through equity financing to reduce reliance on debt.

Q. How does S45 help MSME founders scale their businesses?

A. S45 supports MSME founders by providing capital and expertise for sustainable growth. It helps entrepreneurs manage challenges, drive innovation, and build lasting businesses through personalized advisory and strategic investment opportunities.

Q. What kind of businesses does S45 focus on?

A. S45 primarily targets Indian MSME founders who are focused on long-term legacy building, sustainable growth, and innovation, helping them scale effectively through both financial support and expert guidance.

Q. How can investors and creditors use the Debt-to-Asset Ratio?

A. Investors and creditors use the Debt-to-Asset Ratio to assess the financial risk of a company. A high ratio signals potential risk, while a low ratio indicates financial stability, helping them make informed decisions about lending or investing.