Key Takeaways

- Private Equity Overview: Involves direct investment in companies to drive growth, transformation, or turnaround for a profitable exit.

- India's Expanding PE Market: Rapid growth, attracting diverse investors and capital sources amid evolving policies and economic shifts.

- Key Investment Sectors: Technology, healthcare, financial services, and renewable energy lead private equity investments.

- Importance of ESG and Governance: ESG factors, governance, and operational improvements are vital for portfolio success.

- Market Trends: Valuation corrections and increased private credit options are reshaping deal activity and funding structures.

What is Private Equity?

Private equity (PE) refers to investments made directly into private companies or public companies that are taken private, aiming to enhance their value over a medium to long-term horizon. It primarily involves buyouts, growth equity (capital for expansion), and venture capital (early-stage investments). Unlike public equity traded on stock exchanges, private equity investments are illiquid and not publicly traded.

Key Drivers of Private Equity Growth in India

India’s private equity market is expanding rapidly due to several fundamental factors:

1. Large and Growing Consumer Market

With over 1.4 billion people and rising disposable incomes, India offers a vast market for consumer-centric sectors like retail, healthcare, and e-commerce. Changing consumption patterns and increasing urbanization drive steady demand, attracting sustained PE investment.

2. Strong Digital and Tech Ecosystem

India’s fast-growing digital economy fuels PE activity, especially in SaaS, fintech, healthtech, and edtech. Leading global PE firms actively back technology startups, enabling innovation and creating multiple unicorns. Government initiatives and improved digital infrastructure further accelerate this growth.

3. Supportive Government Policies

Reforms such as "Make in India," streamlined business regulations, and sector-specific incentives create a stable, investor-friendly environment. These measures encourage infrastructure development and manufacturing growth, making India an attractive PE destination.

Why Invest in Private Equity in India?

India’s private equity market is evolving rapidly, emerging as a prime destination for investors worldwide. Key reasons include:

1. Access to Promising Companies

Private equity provides entry into high-potential businesses that are typically unavailable in public markets. Investors can back innovative startups and growing mid-sized companies, gaining access to unique growth opportunities.

2. Wide Range of Investment Options

With over 360 active PE firms operating across sectors, investors find a diverse array of opportunities. Late-stage startups are especially attractive—they combine the promise of rapid growth with more established business models, lowering investment risk compared to early-stage ventures.

3. Increasing Deal Volume and Larger Transactions

PE deal activity in India is rising, marked by a 40% increase in funding in October 2024. The market is witnessing a surge in large deals, typically exceeding $100 million, reflecting strong investor confidence in India’s continuing economic expansion.

Understanding market movement is crucial; so here’s what’s happening with valuations and deal types this year.

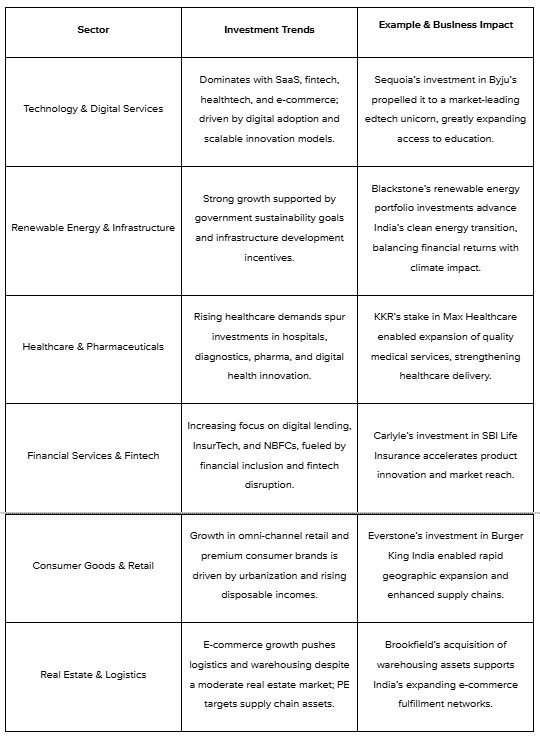

India’s Private Equity: Key Sector Trends and Investment Prospects

Here’s a clear view of the key sectors transforming India, along with illustrative examples demonstrating impactful PE-backed growth.

Valuation Dynamics & Deal Activity in India’s Private Equity

India’s private equity market reflects a more mature, balanced phase marked by valuation adjustments and evolving deal structures. Key points for investors and founders:

1. Valuation Corrections and Their Impact

Valuations, notably in mid and small-cap companies, have corrected due to global uncertainties, inflation, and slower consumer demand. This recalibration narrows the gap between buyer and seller expectations, enabling deals at rational prices. While this may dampen some short-term enthusiasm, it signals an opportunity for prudent investors to acquire quality assets.

2. Negotiation Balance

Sellers have shown greater flexibility, often accepting structured deals or earn-outs to bridge valuation differences. Buyers are focusing on governance rights and operational milestones to mitigate risk and drive portfolio value.

3. Popular Deal Types

Growth capital rounds with active partnership, buyouts, and structured equity deals (preferred shares, convertible instruments) dominate. Private credit is increasingly used to supplement equity, particularly for mid-market companies seeking bespoke financing.

4. Macroeconomic Influence on Capital Costs

Rising inflation and global interest rates have increased capital costs. Consequently, PE firms prioritize portfolio companies demonstrating strong cash flow and operational resilience to ensure sustainable returns.

Looking to overcome challenges in your private equity journey and get lasting growth? S45 connects you with founders and experts who have faced similar obstacles and successfully transformed their businesses for sustainable success.

While opportunities abound, it’s essential to recognize and tackle the current challenges in the market.

Challenges in the Indian Private Equity Market and How to Overcome Them

India’s private equity market faces multiple hurdles, from valuation volatility and rising capital costs to governance gaps and regulatory complexity. Tackling these challenges requires disciplined deal-making, stronger compliance, and proactive collaboration with portfolio companies.

1. Valuation Volatility

Challenge: Fluctuating valuations, especially in mid and small-cap companies, create uncertainty and complicate deal negotiations.

Solution: Adopt disciplined valuation frameworks focused on fundamental business performance and earnings growth instead of short-term multiples. Focus on deep due diligence to identify resilient companies with sustainable competitive advantages. Walk away from overstretched deals to preserve capital discipline.

2. Slumping Consumption Growth

Challenge: Temporary slowdown in domestic consumption impacts revenue growth and investor confidence, particularly in consumer-driven sectors.

Solution: Pivot investments to sectors less directly tied to consumption cycles, such as technology, healthcare, and infrastructure. Collaborate closely with portfolio companies to optimize operations and diversify revenue streams.

3. Complex and Fragmented Regulatory Environment

Challenge: Multiple overlapping regulations and inconsistent foreign investment policies delay deal execution and add compliance risks.

Solution: Build strong in-house or external legal and compliance expertise focused on navigating India’s regulatory environment. Proactively engage with regulators and industry bodies to anticipate changes and streamline approvals.

4. Governance and Transparency Hurdles

Challenge: Many investee companies are family-owned with centralized decision-making and limited formal governance, leading to opacity and risk.

Solution: Work with promoters to implement professional governance structures early, including independent boards and transparent reporting systems. Position governance enhancement as a value driver that ensures long-term stability and access to capital.

5. Talent and Professional Management Gaps

Challenge: Limited access to experienced management teams hinders scale-up and professionalization required by institutional investors.

Solution: Invest in leadership development programs for portfolio companies, bring in professional managers selectively, and foster a culture of accountability and performance measurement.

6. Rising Cost of Capital

Challenge: Global inflation and interest rate hikes increase borrowing costs, pressuring cash flow and returns.

Solution: Prioritize investments in cash-flow positive businesses and operational efficiency improvements. Explore alternative financing channels like private credit to optimize capital structure and reduce funding costs.

7. Geopolitical and Macroeconomic Uncertainty

Challenge: Tensions in trade and politics create unpredictability affecting portfolio risk and investor sentiment.

Solution: Diversify the portfolio across sectors and regions to mitigate exposure. Adopt robust risk management frameworks and maintain close market monitoring to adapt strategy quickly.

8. Fundraising Pressures

Challenge: General partners face difficulties raising new capital amid risk aversion and market volatility.

Solution: Demonstrate clear value creation track records and differentiated investment approaches. Strengthen limited partner relationships through transparent reporting and alignment on long-term objectives.

Final Thoughts

India’s private equity market offers great opportunity amid evolving sectors, valuation shifts, and regulatory changes. Success depends on combining strategic discipline with operational rigor and clear market insight.

Founders and investors who focus on transparency, strong governance, and long-term value creation will overcome volatility and challenges. Learning from experienced peers and tapping into networks like S45 can accelerate this growth journey.

Building a legacy business means turning obstacles into growth milestones, grounded in disciplined investment and adaptive leadership.

Whether you’re an SME leader optimizing capital or an investor managing portfolios, these insights help you navigate complexity with confidence. Connect with India’s next wave of visionary entrepreneurs and fuel your path to lasting success.

FAQs

Q. What is the future of private equity in India?

A. India’s private equity market is set for strong growth, driven by economic strength, sector shifts towards technology and healthcare, and more realistic valuations rewarding long-term value creation.

Q. What is the 80-20 rule in private equity?

A. The 80-20 rule means about 80% of returns come from 20% of investments, highlighting the importance of focusing on high-potential portfolio companies.

Q. Who are the big 4 PE firms?

A. Globally, the Big 4 private equity firms are Blackstone, KKR, Carlyle Group, and TPG Capital, all active investors in India’s market.

Q. Is 2025 a good year for private equity?

A. Yes, 2025 remains positive for private equity in India due to robust economic growth and active deal flow, despite global uncertainties and valuation corrections.