Key Takeaways

- RBF is flexible funding where repayments are tied to revenue, not fixed EMIs.

- Founders keep control since RBF is non-dilutive and requires no equity.

- Repayment stops at a cap (typically 1.5x–3x the borrowed amount).

- Best suited for SaaS, D2C, and e-commerce businesses with steady, recurring revenue.

- Faster approval cycles make it attractive compared to bank loans or equity funding.

- RBF isn’t a one-size-fits-all solution; it works best alongside strategy and governance.

- S45club enhances RBF’s value by adding capital markets guidance and scaling expertise.

What do you do when a bank demands collateral you don’t have, and investors want equity you’re not ready to give up? For many founders, this choice feels like picking the lesser of two burdens: fixed repayments on one side, loss of ownership on the other.

Revenue-Based Financing (RBF) offers a third option. You receive capital upfront and repay it as a small percentage of your monthly revenue until a pre-agreed cap is reached. No board seats handed over, no rigid EMIs, just repayments that move with your sales.

The startup funding scene raised $4.8 billion in H1 2025, but that figure was still down 25% compared to the year before. At the same time, the global revenue-based financing market stood at USD 2.99 billion in 2024 and is projected to grow at a CAGR of 61.8% through 2031, fuelled by demand from SaaS, e-commerce, and D2C ventures seeking flexible capital.

This blog unpacks how RBF works, why it’s gaining traction, who it serves best, and where it fits alongside loans and equity, so you can weigh if it belongs in your growth story.

What Is Revenue Based Financing?

Revenue Based Financing, or RBF, is a way for businesses to raise capital without the weight of fixed monthly instalments or the cost of giving up equity. In this model, you receive an upfront sum and agree to repay it through a fixed percentage of your revenue. The repayments are flexible by design; if sales dip, the repayment shrinks; if sales grow, the repayment rises.

Unlike equity funding, RBF is non-dilutive. You don’t surrender shares or decision-making power, which means the business remains firmly in your hands. The financier’s return is secured through a cap, typically 1.5 to 3 times the amount advanced. Once you hit that cap, the obligation ends, no matter how long it takes.

Think of it as a partnership tied to your business’s rhythm. Both sides are aligned: your growth fuels faster repayment, and your slow months aren’t punished with rigid instalments.

How Revenue-Based Financing Works

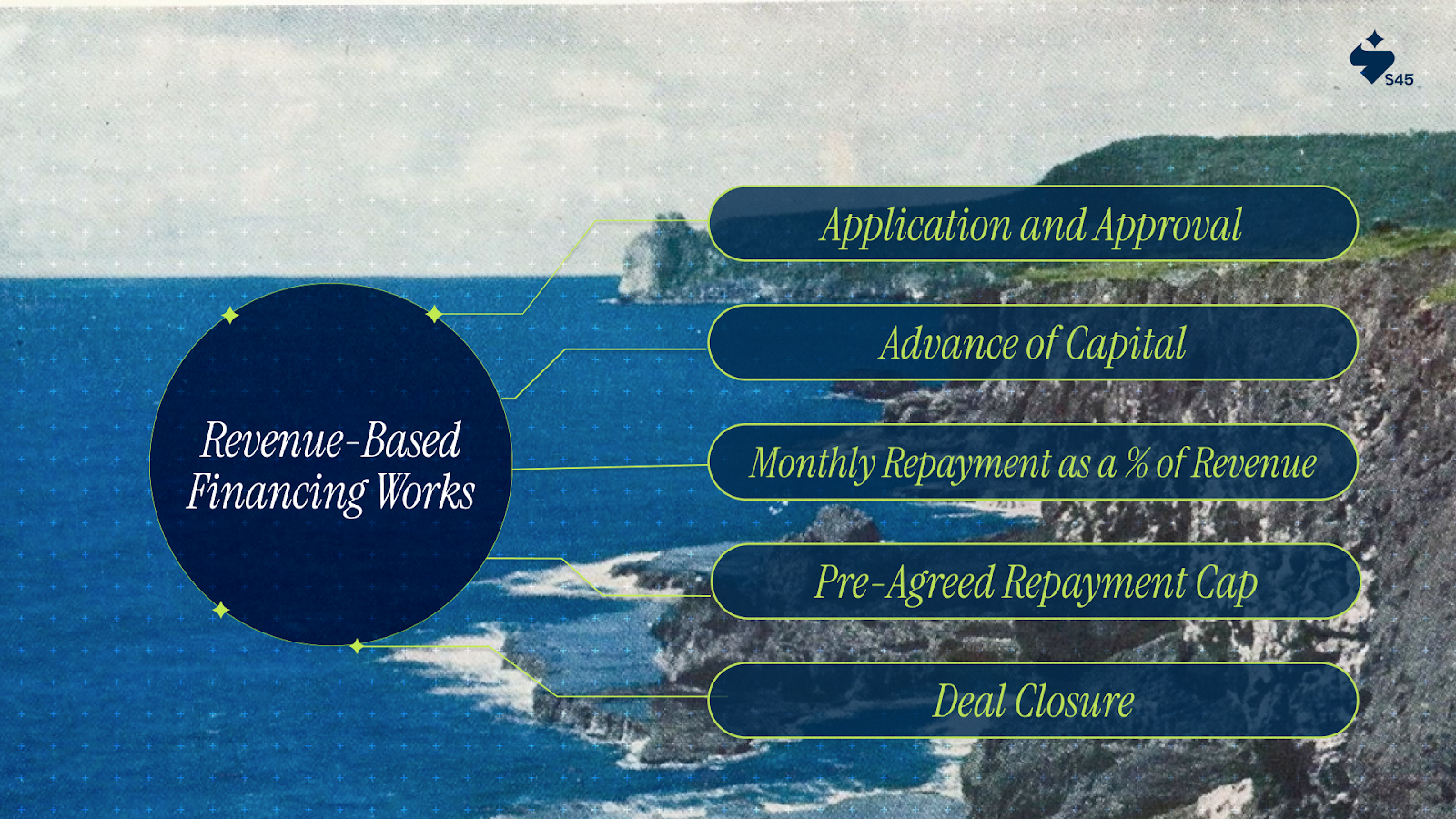

Revenue-Based Financing (RBF) is designed to be straightforward, but it has layers worth understanding. Here’s how the model typically plays out:

1. Application and Approval

The first step is a financial health check. Unlike traditional banks, RBF providers focus less on collateral and more on revenue quality. They assess:

- Average Monthly Revenue (AMR): Consistency matters more than one-off spikes.

- Customer Stickiness: Metrics like churn and repeat purchases signal long-term stability.

- Profit Margins: A business with razor-thin margins might struggle, even with steady revenue.

- Growth Potential: Strong sales trends make repayment faster, lowering investor risk.

Platforms such as S45club streamline this process, combining swift capital access with strategic market insights.

2. Advance of Capital

Once approved, businesses receive an upfront amount sized to match their revenue capacity. Funding usually ranges between 3–6 months of average revenue, which ensures repayment is realistic.

- Example: A SaaS startup generating ₹40 lakh a month could secure ₹1.2–₹2.4 crore.

This capital is typically used for growth-related needs: marketing campaigns, hiring talent, or scaling operations, activities expected to drive future revenue.

3. Monthly Repayment as a % of Revenue

Here lies the defining feature of RBF: repayments flex with business performance.

- Typical range: 3%–15% of monthly revenue.

- Upside: No pressure to meet fixed EMIs during slow months.

- Investor incentive: The faster your revenue grows, the sooner they recover their investment.

This creates an alignment of interests; founders want growth, and so do financiers.

4. Pre-Agreed Repayment Cap

Instead of compounding interest, repayments are capped. The cap is generally 1.5x–3x of the amount advanced.

- Borrow ₹1 crore with a 2x cap → repay ₹2 crore in total.

- If growth is rapid, the cap is reached faster, lowering the effective cost of capital.

- If growth is slow, repayment takes longer, but there’s no penalty for delays.

This transparency appeals to founders, who know exactly what they owe from the start.

5. Deal Closure

Once the repayment cap is met, the agreement ends. There are:

- No lingering debt.

- No claims on ownership.

- No strings attached to future earnings.

This clean exit structure makes RBF less burdensome compared to both debt and equity.

Additional Considerations

- Timeframe: Most RBF deals last between 12 to 48 months, depending on revenue growth.

- Investor Risk: If the business underperforms, investors wait longer, making it riskier for them compared to fixed-income loans.

- Best Use Cases: RBF works best for companies with predictable, recurring revenue streams, like SaaS, subscription businesses, and e-commerce brands with steady sales.

- Not Ideal For: Businesses in very early stages with unpredictable revenue or heavy reliance on one-off contracts.

Example Scenario

Take a digital-first fashion brand earning ₹60 lakh per month. It secures ₹1 crore in RBF under these terms:

- Revenue share: 10%

- Repayment cap: 2x (₹2 crore)

- Month 1: Revenue = ₹60 lakh → Repayment = ₹6 lakh

- Month 2: Revenue = ₹75 lakh → Repayment = ₹7.5 lakh

- Month 3: Revenue dips to ₹50 lakh → Repayment = ₹5 lakh

If the brand grows steadily, the ₹2 crore cap could be reached in under 30 months. If growth slows, repayment stretches longer, but without suffocating the company’s cash flow.

Why Businesses Choose RBF

Revenue-Based Financing has been gaining traction because it addresses pain points that traditional funding models leave unsolved. Here’s why many founders are leaning toward it:

No Collateral, No Dilution

- No collateral: Banks often demand property, assets, or personal guarantees, barriers that early-stage companies can’t always provide. RBF sidesteps this entirely.

- No dilution: Unlike venture capital, you don’t give up equity or board seats. Founders keep ownership, control, and the ability to chart their company’s direction without external pressure for exits.

This combination makes RBF particularly attractive to entrepreneurs who want growth capital while protecting their long-term stake.

Flexible Repayment Aligned with Performance

Traditional loans demand fixed instalments, regardless of whether sales are strong or weak. RBF, on the other hand, adjusts repayment to business performance.

- Good months mean faster repayment.

- Lean months ease the burden with smaller payouts.

This breathing room helps businesses preserve working capital for essentials like payroll, marketing, or reinvestment, instead of draining cash flow to service debt.

Faster Approval Cycles

Getting a bank loan can take weeks or even months, with heavy paperwork and slow-moving approvals. Equity deals may take longer, with negotiations over valuation and investor terms. RBF providers, however, typically focus on revenue data and growth history, making approvals much faster. In many cases, businesses can access funds within days, crucial for seizing time-sensitive opportunities like seasonal campaigns or product launches.

Alignment of Investor and Founder Goals

In RBF, both parties want the same thing: growth. The financier earns back their return only when the company generates revenue. That alignment creates a healthier relationship compared to traditional lenders, who expect payment regardless of performance, or equity investors, who may pressure founders for rapid exits.

This “shared risk, shared reward” dynamic encourages investors to support sustainable growth rather than short-term gains.

Who Should Consider RBF?

Revenue-Based Financing isn’t for everyone, but it can be a powerful tool for businesses with steady, measurable revenue streams. Here are the types of companies that benefit most:

SaaS Companies with Recurring Revenue

Software-as-a-Service (SaaS) firms are among the best fits for RBF. Their monthly recurring revenue (MRR) makes it easy for financiers to predict repayment capacity.

- Consistent subscription income smooths out cash flow.

- Growth funds can be directed toward customer acquisition or product scaling.

- Since these companies often reinvest heavily in growth, RBF helps without forcing them to dilute equity.

E-Commerce Brands with Predictable Sales

Online retail and direct-to-consumer (D2C) brands often see steady or seasonal sales patterns. RBF works well here because:

- Repayments match seasonal peaks and troughs.

- Funds can be used to boost marketing, inventory, or logistics before festive or sales periods.

- The flexible structure ensures the business doesn’t get cash-strapped during off-seasons.

SMEs Scaling Quickly but Avoiding Equity Dilution

Small and medium enterprises often hit a growth stage where they need significant capital to expand operations, enter new markets, or increase production. Yet:

- Bank loans may be inaccessible due to a lack of collateral.

- Equity deals mean giving up control at an early stage.

For such companies, RBF offers a middle ground, growth capital without losing ownership or flexibility.

Businesses with Strong Revenue but Limited Assets

Some companies have healthy revenues but don’t own many physical assets. This makes it hard to qualify for asset-backed loans. RBF focuses on revenue performance rather than asset value, unlocking capital for businesses that would otherwise be overlooked by traditional lenders.

Advantages and Limitations of RBF

Revenue-Based Financing is attractive for many founders, but like any funding model, it has trade-offs.

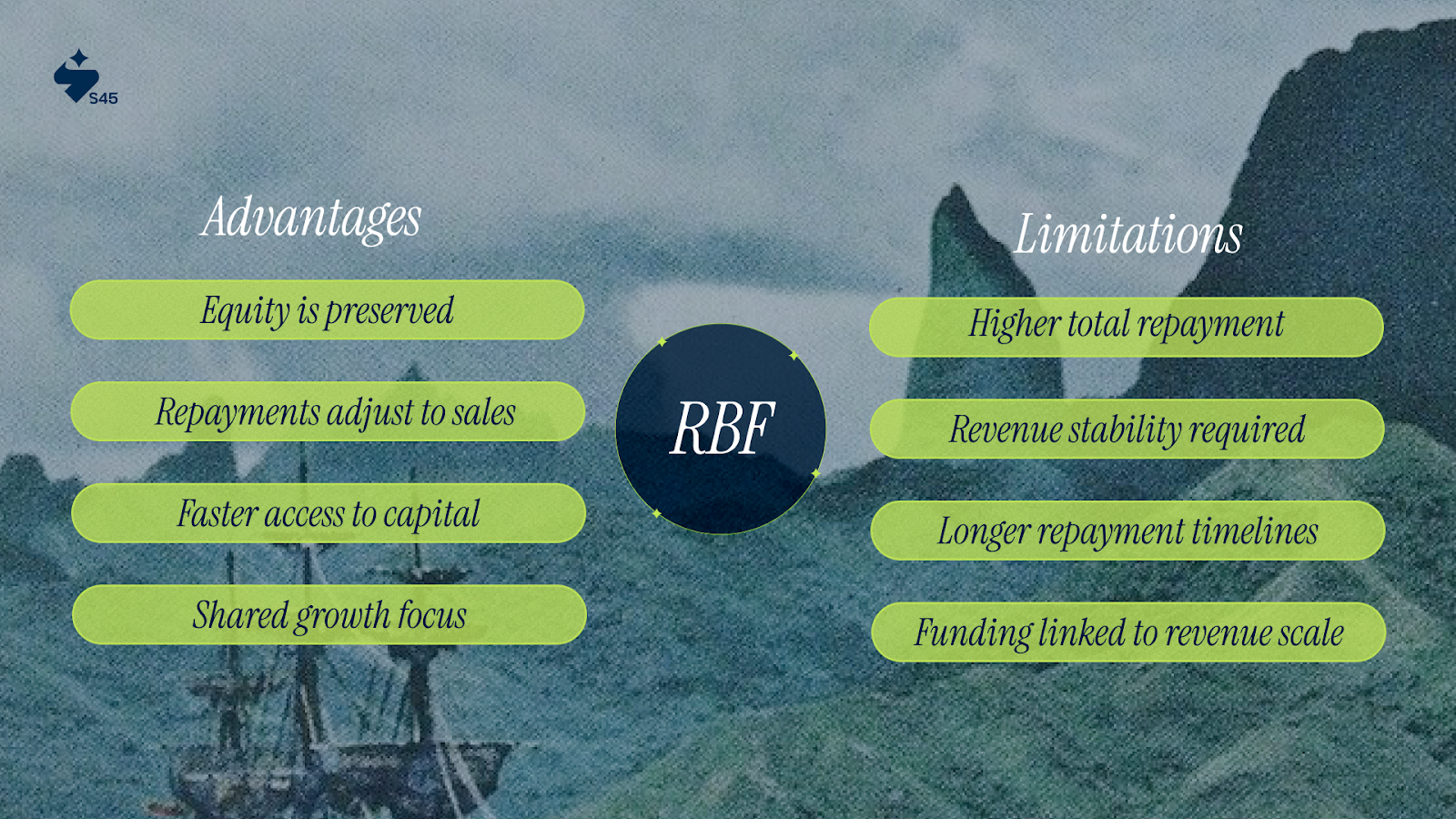

Advantages

- Equity is preserved: Unlike venture capital, RBF doesn’t dilute ownership, so founders retain decision-making power and control over long-term strategy.

- Repayments adjust to sales: Payments are tied to revenue performance, protecting cash flow during lean months while accelerating repayment during growth periods.

- Faster access to capital: Approvals are based on revenue data rather than collateral, making the process quicker and less paperwork-heavy than traditional bank loans.

- Shared growth focus: Since investors are repaid only when the business earns revenue, their returns depend on the company’s success, aligning both parties’ incentives.

With partners like S45club, this alignment is heightened through strategic governance and market access support.

Limitations

- Higher total repayment: With repayment caps typically between 1.5x and 3x, the cost of capital is often greater than that of secured bank loans.

- Revenue stability required: RBF suits businesses with predictable recurring income, meaning companies with volatile or project-based revenue may not qualify.

- Longer repayment timelines: If revenue growth slows, repayment can stretch over several years, tying up obligations longer than expected.

Funding linked to revenue scale: The advance is proportional to current revenue levels, limiting how much capital early-stage or low-revenue firms can access.

RBF vs. Other Funding Options

Equity funding is powerful for startups chasing rapid scale, but it comes at a price.

- Dilution of ownership: Founders part with shares, which dilutes control and long-term wealth.

- Investor oversight: Equity investors often seek influence over strategy, hiring, and even exit timelines.

- Time-consuming: Negotiating valuations and terms can take months, delaying access to funds.

RBF avoids these pain points. Founders keep their equity, retain full control of decision-making, and can access growth capital far more quickly.

RBF vs. Merchant Cash Advances (MCA)

Merchant Cash Advances are sometimes confused with RBF because repayments are linked to sales, but they differ dramatically in practice.

- High costs: MCAs often carry exorbitant fees, making the effective interest rate extremely high.

- Opaque terms: Daily or weekly repayments can choke cash flow and leave little room for flexibility.

- Short-term trap: Many businesses roll one advance into another, creating a cycle of dependency.

RBF is structured with transparency and sustainability in mind. Repayments are monthly, capped at a clear multiple (1.5x–3x of the advance), and designed to support long-term growth rather than quick fixes.

Case Study

GetVantage (India): D2C brands, SaaS firms, and consumer-facing SMEs were struggling to raise capital. Banks insisted on collateral and fixed EMIs, while venture capital demanded equity and control; neither option suited founders who wanted to grow without giving up ownership.

The Solution:

GetVantage stepped in with a revenue-based financing platform that advanced capital ranging from ₹2 lakh to ₹5 crore. Repayments were tied to a share of monthly revenue until a pre-agreed cap was reached, no equity, no collateral, no hidden strings.

The Outcome:

By FY2024, GetVantage had funded over 750 businesses, helping them collectively generate $900 million in GMV across sectors like D2C, SaaS, healthtech, and edtech. For founders, this meant access to fast, flexible growth capital without losing control of their companies.

How S45club Takes It Further

While GetVantage shows how RBF can unlock capital for ambitious businesses, funding is only the first step. Scaling into a resilient, market-leading enterprise requires strategy, governance, and market access. This is where S45club comes in.

- Capital with Direction: Beyond helping founders secure funding, S45 guides them on how to deploy it strategically for sustainable scale.

- Governance Backbone: With deep experience across banking, private equity, and fintech, S45 equips SMEs with governance frameworks and board-level discipline that investors value.

- Future-Ready Growth: For founders with aspirations to go public or raise institutional rounds, S45 provides the playbook for capital market readiness and long-term scale.

Ready to Build Beyond Capital?

RBF can get you started, but scaling into a ₹100–200 crore business requires more than money; it needs partners who understand your growth journey. S45club blends funding with strategy, governance, and market expertise to help you grow stronger, smarter, and founder-led.

If you’re ready to take the next step, log in with S45club today and explore how they can support your business journey.

Conclusion

Revenue-Based Financing has emerged as a powerful middle path for businesses that want growth capital without the burden of fixed EMIs or the cost of equity dilution. It offers flexibility, transparency, and founder control, qualities that resonate strongly in today’s funding environment. Still, RBF is not a one-size-fits-all solution. For companies with steady, recurring revenue, it can be a growth enabler; for others, it works best when paired with strategic guidance and governance.

With the right partner, founders can turn RBF into more than just capital; it can become the fuel for building resilient, market-ready enterprises.

Take the next step with S45club, where capital meets strategy, and growth is built to last. out today to explore how S45 can support your journey from growth to greatness.

FAQs

1. How does RBF differ from traditional debt, like bank loans?

Unlike fixed EMIs and collateral-heavy loans, RBF repayments flex with revenue, and there are typically no covenants or facility fees.

2. Is RBF considered a loan or equity?

RBF isn’t structured as traditional debt or equity. It doesn’t come with board seats, valuation hurdles, or ownership dilution.

3. What’s the typical repayment model?

Businesses repay by paying 1–3% (or more) of monthly revenues until they’ve met a predetermined return cap, usually 1.5x to 3x the original capital.

4. How fast can businesses access RBF funds?

RBF is designed to be fast; some providers can approve and disburse in as little as 1–3 days.

5. What kinds of businesses can qualify?

Businesses with predictable, recurring revenue, like SaaS, D2C, or subscription models, are prime candidates; however, pre-revenue startups usually do not qualify.