Key Takeaways

- Private equity invests in unlisted companies for higher returns, longer horizons, and limited liquidity.

- Public equity offers easy access, liquidity, and steadier returns but with stricter regulations.

- Private equity investors have direct control; public equity investors rely on voting rights.

- Private equity requires a 7-10 year commitment; public equity allows instant buying and selling.

- Private equity targets startups and growth; public equity focuses on stable, mature companies.

Equity investing can broadly take two paths: private equity, where capital flows into unlisted companies, and public equity, where shares of listed firms are traded on exchanges like NSE and BSE.

Both channels fuel business growth but differ in who can invest, how liquid the investments are, and the degree of control investors hold.

India’s capital markets illustrate this contrast well. On one side, private equity and venture capital investments rebounded to USD 43 billion in 2024 across 1,600 deals after two years of muted activity.

On the other hand, IPOs and follow-on offers continue to draw retail and institutional investors, with companies like Swiggy preparing for listings.

In this blog, we explore the structures, accessibility, liquidity, fundraising models, regulatory frameworks, growth stages, and risk-return profiles of private vs public equity

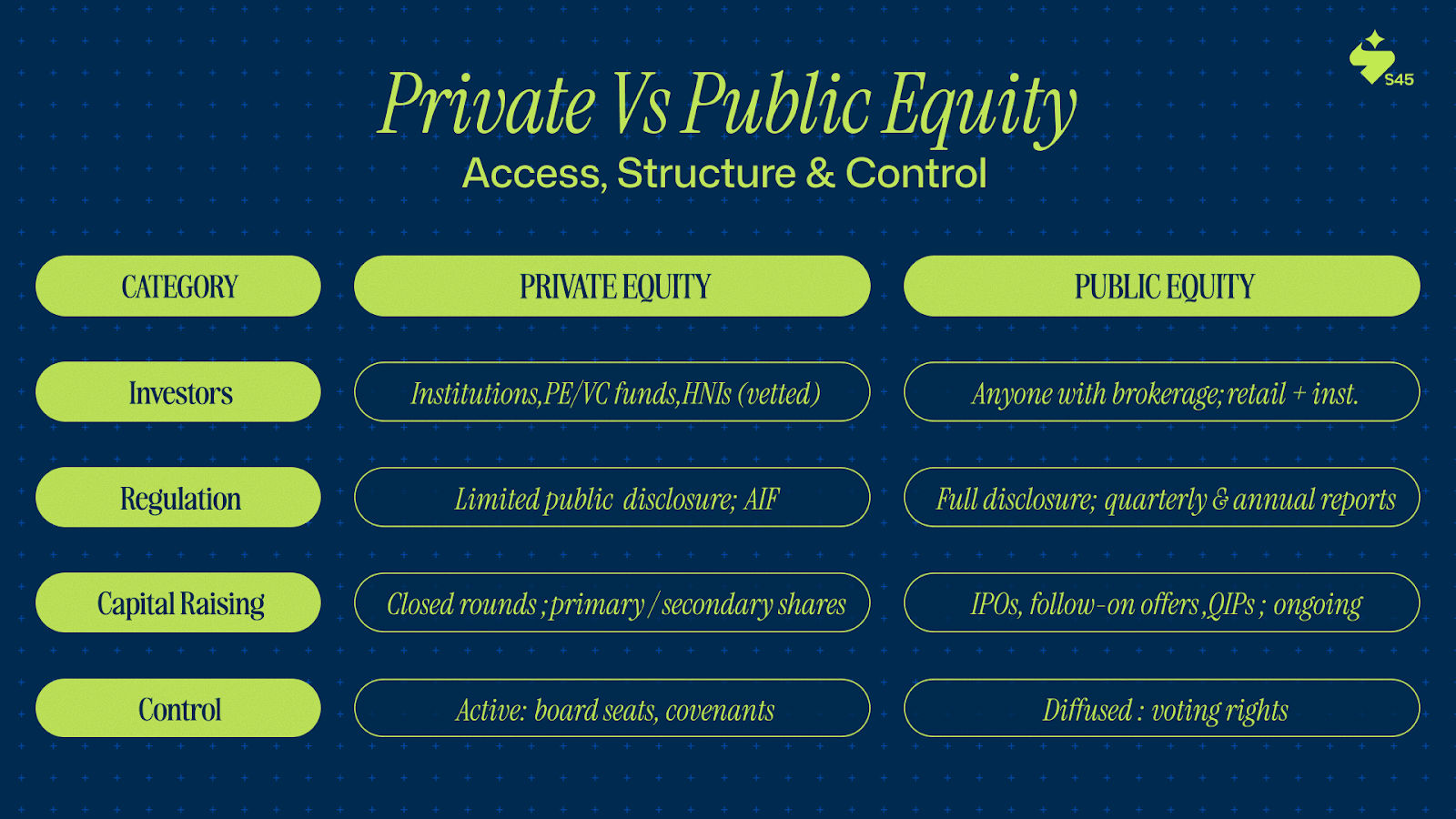

Access, Structure, and Control: How Private and Public Equity Differ at the Core

The most fundamental gap between private and public equity lies in who can participate and under what rules. Public equity is designed for mass participation, where anyone with a trading account can buy shares.

In contrast, private equity is restricted to a narrower pool of accredited investors, institutions, and funds. The points below highlight the structural contrasts between the two:

1. Who Can Invest

The investor base differs sharply between private and public equity.

- Private Equity: Typically limited to institutional investors, PE/VC funds, and high-net-worth individuals. Entry requires accreditation or vetting.

- Public Equity: Open to anyone with a brokerage account—retail investors, individuals, or institutions—with far lower entry barriers.

2. Regulation and Oversight

Regulatory obligations and disclosure norms shape how each operates.

- Private Equity: Governed under the Companies Act, SEBI AIF rules, and sectoral regulators. Disclosure to the public is limited and less frequent.

- Public Equity: Full disclosure required under SEBI norms, including quarterly and annual reporting, shareholder rights, and market scrutiny.

3. Capital Raising Process

The way capital is mobilized differs by market access and structure.

- Private Equity: Funds raised through structured rounds—primary or secondary share purchases in closed markets.

- Public Equity: Companies raise capital through IPOs, follow-on offers, or QIPs, with continuous access to markets. QIPs streamline fundraising for listed firms.

4. Governance and Control

Investor influence varies based on how equity is held and exercised.

- Private Equity: Investors often take board seats, negotiate covenants, and influence company strategy directly.

- Public Equity: Control is more diffuse. Shareholders exercise rights through voting but have limited influence over daily operations.

Case in Point – Zepto’s Pre-IPO Shift

As of October 2023, domestic shareholding in Zepto was 22%. By November 2024, after securing a $350 million funding round, this rose to 35%, with a goal of 50% before IPO. This restructuring does three things:

- Strengthens alignment with Indian institutional investors ahead of listing.

- Provides liquidity to early investors and employees through secondary sales.

- Maintains valuation consistency at just over $5 billion, creating confidence in IPO pricing.

This illustrates how private equity structures and governance choices directly shape readiness for public equity markets.

For MSMEs and mid-growth firms, structuring ownership and governance early is critical. S45 helps founders assess investor readiness, clean up equity structures, and prepare for either private rounds or eventual listings with fewer roadblocks.

Liquidity and the potential for exits are some of the starkest differences between private and public equity. Let’s break down how these factors play out for investors in each category.

Liquidity, Exit Options & Holding Period

One of the sharpest contrasts between private and public equity lies in how quickly investors can enter or exit. Private equity locks in capital for years, with exits tied to company performance and broader deal cycles.

In contrast, public equity offers daily liquidity, with transparent pricing and open access to exchanges like BSE and NSE. These structural differences shape investor behavior, risk tolerance, and portfolio construction.

1. Private Equity

Private equity requires long-term commitment, with capital tied up until a planned exit event.

Holding Period: Typically 7–10 years. Investors commit capital for the full fund life, with limited scope for early withdrawals.

Exit Routes:

- IPOs refer to the process by which portfolio companies list on exchanges.

- Trade sales to strategic buyers.

- Secondary sales involve selling stakes to other PE funds or investors.

Constraints: Secondary exits often involve discounts to net asset value, especially if market conditions are weak.

In 2024, global PE secondary deals were forecast at $58 billion, about 14% of all PE exits, up from just 5% in 2021. This reflects growing reliance on continuation funds and discounted sales when IPO markets are muted.

Example: PE investors in Piramal Enterprises and Byju’s have turned to partial secondary exits as IPO timelines stretched.

2. Public Equity

Public equity offers immediate liquidity, with shares freely traded on regulated stock exchanges.

- Liquidity: Shares of listed companies can be bought or sold daily on BSE and NSE, with transparent pricing and minimal transaction costs.

- Flexibility: Investors can rebalance portfolios instantly, hedge risk, or exit positions without negotiation.

Understanding the right stage for each type of equity investment is crucial. Let’s examine the growth phases that private and public equity cater to and how they align with different business models.

Stages of Growth and Market Targets in Private vs Public Equity

The stage of a company’s growth often dictates whether it turns to private or public equity. Investors must understand these distinctions, as returns, risks, and levels of influence vary widely depending on when capital is deployed.

Private equity spans early startups to mature buyouts, while public equity largely caters to established firms that prioritize stability and compliance.

1. Public Equity – Mature Companies

Public equity primarily serves large, established businesses that prioritize stability and compliance.

- Targets: Businesses with proven models, steady revenue, and predictable cash flows.

- Investors: Retail and institutional participants seeking liquidity and moderate returns.

- Example: Infosys and HDFC Bank raise funds through follow-on offerings, supported by broad market participation.

- Focus: Lower risk, compliance with SEBI norms, steady dividends or reinvestment, and transparency in reporting.

2. Private Equity – Multiple Growth Phases

Private equity spans different growth stages, offering capital and guidance where public markets cannot.

- Venture Capital: Early-stage startups with untested models but high growth potential.

- Growth Equity: Companies with product-market fit scaling operations.

- Buyouts: Mature companies restructured through leveraged financing to improve performance..

- Pre-IPO Rounds: Capital infusion before a public listing to strengthen governance and financials.

3. Investor Role

Investor involvement is markedly different across the two equity classes.

- Private Equity: Active involvement through board seats, operational oversight, and restructuring decisions.

- Public Equity: Limited to voting rights, with liquidity as the primary advantage for investors.

For many founders and growth-stage companies, the challenge is knowing when to transition from private funding to the public markets. This is where s45club can help as a partner in timing and strategy.

By helping founders assess business readiness, structure equity cleanly, and align with investor expectations, S45 bridges the gap between private equity growth phases and public market preparation.

Risk, Returns, and Cost Structures in Private vs Public Equity

Investors weigh private and public equity not just by accessibility or liquidity but also by expected returns, risk exposure, and cost of participation. These dimensions differ sharply across the two asset classes and can define long-term portfolio outcomes.

1. Return Potential

Private equity aims for higher returns by creating value through operational improvements, scaling businesses, and restructuring. However, performance varies widely across funds and sectors.

Example: The NAIC Private Equity Index reported a net IRR of 17.23% for top private equity funds vs a benchmark median of 11.58% in its study.

Public equity returns are steadier, influenced by market cycles, dividends, and macro conditions. Upside is often capped for mature firms.

Example: The “25 Years Journey of Nifty 50” report shows that since June 30, 1999, the Nifty 50 Total Return Index has given a 14.2% CAGR.

2. Risk Factors

Private equity carries illiquidity and depends heavily on management execution. Due diligence is more complex, and valuations are less transparent.

Public equity risk stems from volatility and shifts in investor sentiment. Liquidity is high, but this often amplifies short-term price swings.

3. Cost Structures

Private equity involves higher costs: management fees (1–2% of committed capital), carried interest (20% of profits), and additional legal and monitoring expenses.

Public equity costs are lower: brokerage fees, transaction charges, and statutory reporting costs for listed companies.

4. Transparency and Valuation

How prices are determined and reported differ sharply between private and public equity.

- Private Equity: Valuations occur infrequently and are often negotiated between investors and managers.

- Public Equity: Valuations are continuous, set by the market, with quarterly disclosures and audited reports ensuring comparability.

When investing in either private or public equity, regulatory and tax frameworks play a key role. Here’s a breakdown of how these regulations affect both asset classes in India.

Regulatory and Tax Considerations in India

Regulation and taxation shape how investors engage with private and public equity. India’s framework ensures that both asset classes are monitored but with different levels of disclosure, compliance, and tax treatment.

1. Private Equity

Private equity investors in India face a layered regulatory framework and specific tax rules.

- Must comply with SEBI’s AIF Regulations and the Companies Act 2013.

- Subject to FDI norms and sectoral caps, especially in sensitive industries like defense or telecom.

- Pre-IPO shares are usually locked in, affecting liquidity.

- Taxation: Gains are taxed based on holding period and structure, often treated as capital gains.

2. Public Equity

Public equity operates under stricter disclosure rules but offers tax benefits for long-term holdings.

- Governed by SEBI IPO regulations and continuous disclosure norms.

- Qualified Institutional Placement (QIP) allows listed firms to raise capital without a complete public offer.

- Taxation: Listed shares enjoy lower long-term capital gains tax (10% above ₹1 lakh, after one-year holding). Short-term trades attract higher rates.

Why This Matters

For investors, these frameworks affect entry, exit, and net returns. For companies, the choice determines not only access to capital but also the burden of transparency and compliance.

Conclusion

The choice between private and public equity depends on priorities. Private equity lets investors influence decisions and target higher returns, but funds remain locked for years, and exits are limited. Public equity offers easy buying and selling with transparent pricing, though returns are steadier and regulations heavier.

For companies, staying private preserves control, while going public opens access to larger capital. s45club helps founders decide the right stage, structure ownership, and prepare for growth in both markets.

Want to learn from founders who’ve already walked these funding paths? Join the S45 community to share playbooks, exchange insights, and stay prepared for every stage of your capital journey.

Frequently Asked Questions

Q: How can MSMEs transition from private to public equity?

A: MSMEs can transition to public equity by preparing their operations for the regulatory requirements of public markets. This includes improving governance, ensuring transparency, and meeting financial reporting standards. The process usually involves a pre-IPO round to strengthen financials before the listing.

Q: Are private equity investments suitable for all investors?

A: No, private equity is generally restricted to institutional investors, accredited investors, and high-net-worth individuals due to the complexity, risk, and long holding periods involved. It’s not accessible to everyday retail investors without proper vetting.

Q: What role do governance and control play in private equity?

A: Private equity investors often take a hands-on role, including board seats and involvement in strategic decisions. This level of control is essential for driving value creation, operational improvements, and business restructuring to achieve higher returns.

Q: How does the liquidity of public equity affect investor behavior?

A: The high liquidity of public equity allows investors to quickly buy or sell shares based on market conditions. This flexibility makes public equity attractive for those seeking short-term investments or wanting to quickly rebalance portfolios.

Q: Can public equity investments yield high returns like private equity?

A: While public equity can offer steady returns, it typically doesn’t offer the same high upside potential as private equity. Public companies are more stable, while private equity targets higher growth potential in early-stage or distressed businesses, albeit with higher risks.