Key Takeaways

- Securing startup funds is a critical step that goes beyond financing, enabling meaningful growth, market entry, and business transformation.

- Understanding your startup’s stage helps identify the right sources of funds, from personal savings and angel investors to venture capital and institutional funding.

- Preparation is key: Clear milestones, solid financial projections, and a strong, concise pitch deck are essential to communicate your vision and potential effectively.

- Investors look for complementary teams, validated solutions, scalable business models, market opportunity, and traction. Aligning with investors who share your values is crucial.

- Addressing legal and compliance requirements upfront builds trust and smooths the fundraising process, protecting both your startup and its partners.

- Common fundraising challenges like competition for attention, valuation differences, and equity concerns can be overcome with clarity, realistic expectations, and thoughtful negotiation.

Securing startup funds can feel like an uphill battle, but the right approach transforms it into a powerful step toward lasting growth and impact. The process might seem overwhelming at first, but understanding the scenario clearly and preparing well puts the necessary resources within reach.

When approached thoughtfully, raising funds can become a powerful conversation about your startup’s future, its impact, its legacy, and the sustainable path forward. Getting this right means more than just chasing capital; it means aligning with partners who believe in your vision and offering value that goes beyond a cheque.

This guide covers the essentials needed to raise startup funds confidently in India, providing you with clear steps and practical insights to help secure the backing that truly supports your goals.

Startup Funds And Their Importance

Startup funds provide the necessary resources to develop your product or service, build a skilled team, and reach your market effectively. At s45club, we believe that beyond the financial aspect, funding signals confidence in your business idea and opens doors to valuable partnerships and opportunities.

Understanding the role of startup funds helps you approach fundraising with clarity and purpose, aligning resources to your long-term vision. Here’s why it is important:

- Provide the capital needed to develop and refine your product or service.

- Enable timely market entry and expansion to seize growth opportunities.

- Support hiring skilled talent essential for innovation and execution.

- Offer a financial cushion to manage risks and unforeseen challenges.

- Validate your business model, boosting credibility with customers and partners.

- Open access to networks, mentorship, and strategic partnerships.

- Fuel sustainable growth that balances ambition with practical execution.

With the value of startup funds clear, the next step is recognizing how the funding you seek aligns with the unique stages of your business journey.

Stages of Startups and Sources of Funding

Each stage of a startup’s journey requires specific types and amounts of funding to meet the evolving needs of the business. Understanding the connection between these stages and the appropriate sources of startup funds is crucial to effectively planning your fundraising efforts.

As your startup grows, funding moves from supporting initial validation to scaling operations and expanding market reach, aligning financial resources with meaningful milestones. Below are the stages and sources of funding:

1. Pre-Seed Stage

This is the earliest phase where the main goal is to validate your idea and develop a prototype. Funding usually comes from personal savings, friends and family, or early-stage angel investors. The amounts are typically smaller, meant to get your concept off the ground.

2. Seed Stage

At this point, you have a refined business model and early product-market fit. Seed funding sources include angel investors, startup accelerators, and early venture capital funds. The focus is on product development, market research, and building a core team.

3. Series A Stage

Here, the emphasis shifts to optimizing your business model, scaling customer acquisition, and fine-tuning operations. Venture capital firms become the primary source of funds, investing larger sums to fuel growth.

4. Series B Stage

With proven market traction, funds are directed towards expanding market share, growing teams, and entering new markets. Investment sources broaden to include private equity firms along with venture capitalists.

5 . Series C and Beyond

These later stages focus on scaling aggressively, acquiring other companies, or preparing for IPOs. Funding comes from a mix of private equity, hedge funds, and institutional investors.

Understanding these stages sets the stage for a deliberate approach. Here's how you can strategically raise startup funds through each phase.

Steps to Startup Fundraising

Raising startup funds is a journey that requires both strategic planning and thoughtful execution. It’s not just about presenting numbers; it’s about sharing the story of your business’s potential and aligning with partners who see the vision clearly.

Each step builds on the previous one, creating a foundation that supports meaningful growth and lasting impact. Approaching fundraising with clarity and readiness helps you manage the process with confidence and purpose. Here’s what you need to know:

- Define Clear Milestones: Identify what you need to achieve with the funds. Clear milestones shape your ask, helping you explain why the investment is critical and how it will be used to create measurable progress.

- Prepare Your Financials and Growth Model: Back your vision with solid data. Have a clear model of your costs, runway, and revenue projections that illustrates both the current state and future potential.

- Build a Concise Pitch Deck: Your pitch deck is a communication tool that should tell your company’s story in a straightforward, compelling manner. Focus on the problem, your solution, market opportunity, traction, and team.

- Identify the Right Investors: Target investors who understand your industry and are aligned with your business values. Personalize outreach to create meaningful conversations rather than broad appeals.

- Start Conversations Early: Maintain ongoing relationships with potential investors. Early interactions are not just about funding but about building trust and reputation within relevant networks.

- Conduct Meetings with Preparedness: Be ready to answer detailed questions about your business model, market, competition, and growth plans. Listen as much as you speak; investor feedback can strengthen your approach.

- Negotiate Terms Thoughtfully: Understand the investment terms fully, focusing on the long-term impact on your business and its legacy. Ensure the agreement aligns with your growth aspirations responsibly.

- Complete Due Diligence and Close the Round: Prepare for a thorough verification process, keeping all documentation accurate and transparent. Closing marks not just a transaction but a strategic partnership.

Following a clear fundraising process helps, but knowing what investors prioritize will deepen your readiness and engagement.

What Do Investors Look For In Startups?

Investors focus on several core aspects that reveal both immediate potential and long-term viability. Their evaluation goes beyond surface-level metrics, seeking signals of business transformation and sustainable growth.

The priority is to find opportunities where startup funds can be used effectively to drive impact, growth, and legacy. Key factors include:

- Strong, Complementary Team: Investors place significant value on a capable and committed team that can adapt, execute, and navigate challenges effectively.

- Clear Market Opportunity: They look for startups addressing sizeable, growing markets with realistic paths to capture meaningful share.

- Validated Problem and Solution Fit: Evidence that your product or service meets a genuine need, supported by customer feedback and early traction.

- Sustainable Business Model: Viability rests on clear revenue streams, scalable margins, and sound unit economics.

- Competitive Advantage: Defensibility through unique technology, strong brand, or barriers to entry is critical to maintain growth momentum.

- Traction and Metrics: Concrete data on customer acquisition, revenue, and growth trends demonstrate validated progress.

- Alignment with Investor Focus: Fit with the investor’s sector, stage, and investment philosophy ensures a mutually beneficial partnership.

Knowing investor expectations guides you in crafting a pitch deck that speaks directly to their concerns and aspirations.

Ready to take the next step with the right startup funds? Connect with like-minded investors who believe in purposeful growth and lasting impact. Join the s45club today!

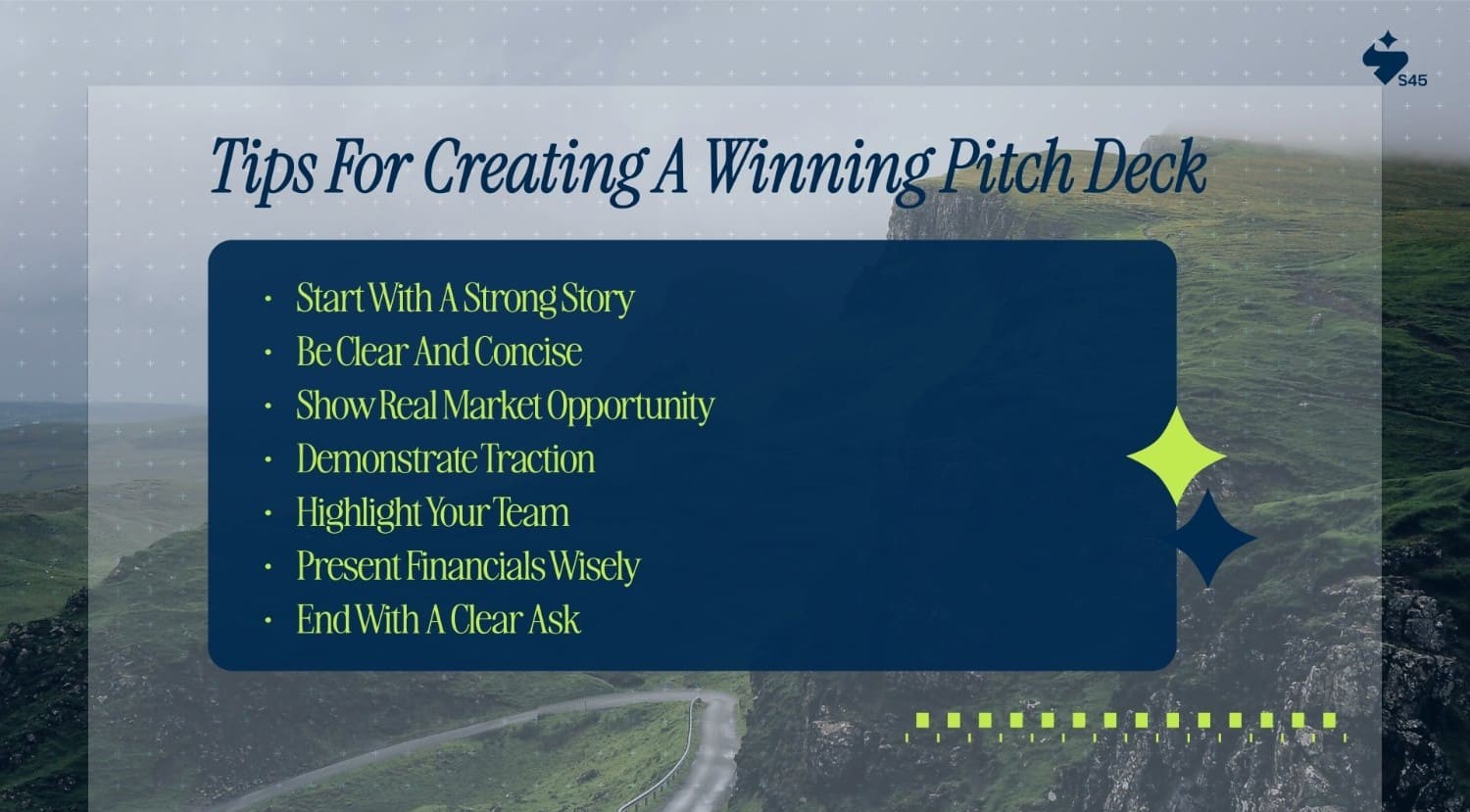

Tips For Creating A Winning Pitch Deck

A pitch deck is your chance to make a clear and compelling case for your startup funds. It’s the story you tell investors about your business’s potential and the impact it can create.

Good pitch decks combine clarity with purpose, showing why your venture matters and how it will grow sustainably. Keep the focus tight, communicate confidently, and make every slide serve a meaningful role.

- Start with a Strong Story: Open with the problem you’re solving and why it matters. Let your solution shine as the clear answer to a pressing need.

- Be Clear and Concise: Use simple language and visuals that highlight key points without overwhelming. Investors appreciate decks that get straight to the point.

- Show Real Market Opportunity: Clearly explain your target market size and how you position yourself to capture value. Avoid overestimating, focus on specific, reachable segments.

- Demonstrate Traction: Share data on early wins, customer validation, or pilot results to prove momentum.

- Highlight Your Team: Showcase the expertise behind your startup that can turn plans into action.

- Present Financials Wisely: Include realistic projections with key metrics that show potential for steady growth and returns.

- End with a Clear Ask: Specify how much funding you need and how it will be used to reach your next milestones.

A compelling pitch opens doors, but grounding your fundraising in legal and compliance frameworks ensures those doors stay open.

Legal And Compliance Considerations In Fundraising

Raising startup funds requires a strong legal foundation to protect your business and build investor trust. Understanding and adhering to the relevant regulations ensures your fundraising process runs smoothly and safeguards your long-term goals.

Complying with legal requirements helps avoid costly disputes and demonstrates your commitment to transparent and responsible business practices. Key legal and compliance points to consider are:

- Business Registration and Structure: Ensure your company is properly registered and structured in accordance with applicable laws, setting a solid framework for growth.

- Securities Regulations: Comply with laws governing the issuance of shares and investments, including private placements and preferential allotments, to avoid penalties.

- Documentation and Agreements: Prepare clear and thorough documents such as term sheets, shareholder agreements, and stock purchase agreements to define rights and responsibilities.

- Tax and Regulatory Filings: Keep up with tax obligations, filings with the Registrar of Companies (RoC), and reporting requirements related to foreign and domestic investments.

- Intellectual Property Protection: Secure your innovations through patents, trademarks, or copyrights to strengthen your competitive position and protect value.

- Anti-Money Laundering (AML) and Investor Verification: Verify investor identities and comply with AML rules to maintain legality and investor confidence.

- Post-Funding Compliance: Continue fulfilling legal requirements after funds are received, including issuing share certificates and updating corporate records.

Even with strong legal foundations, fundraising comes with hurdles. Here’s how to meet common challenges with confidence.

Need clarity on your fundraising journey? Join our community to access expert insights and connect with partners aligned to your vision.

Common Challenges In Startup Fundraising And How To Overcome Them

Raising startup funds comes with its share of challenges that can slow progress or create roadblocks. Recognizing these common hurdles and addressing them directly helps you maintain momentum and strengthen your position.

Each challenge is an opportunity to refine your approach and build resilience, turning fundraising into a purposeful part of your startup’s growth story.

- Standing Out in a Crowded Market: Competition for investor attention is fierce. Focus on clearly communicating your unique value and showing measurable progress to differentiate yourself.

- Lack of Proven Track Record: Without a history of success, building credibility can be hard. Highlight early customer traction, strategic partnerships, and team expertise to build confidence.

- Equity Dilution Concerns: Balancing ownership with the need for capital is challenging. Consider alternative funding methods and negotiate terms that protect your long-term control while fueling growth.

- Valuation Differences: Founders and investors often see value differently. Prepare detailed, realistic financials and understand valuation methods to find common ground and build trust.

- Limited Access to Collateral: Traditional loans may be off the table without assets. Explore non-traditional financing like revenue-based loans or government grants designed for startups.

- Small Internal Team and Time Constraints: Fundraising demands significant time and resources. Plan early, delegate wisely, and use external advisors or consultants to share the workload.

Recognizing and addressing challenges equips you to move forward deliberately, with clarity and purpose, toward securing startup funds and lasting success.

Conclusion

Raising startup funds is a pivotal step that shapes the future of your business. It requires clarity, preparation, and purposeful engagement to connect with the right partners who share your vision for sustainable growth and lasting impact.

Approaching fundraising with a clear understanding of the stages, investor expectations, and legal requirements strengthens your ability to secure the support needed. By addressing challenges strategically and creating focused, compelling communication, you position yourself to attract the right startup funds that align with your goals.

Stay grounded, keep your purpose clear, and move forward with confidence. Your path to lasting business transformation is within reach.

At s45club, we help ambitious founders find the right investors and guidance to support their next major step. Ready to discover what best fits your business? Let’s achieve it together.

FAQs

Q. What are the most common sources of startup funds in India?

Startup funds in India commonly come from personal savings, angel investors, venture capitalists, government schemes like the Startup India Seed Fund Scheme, bank loans, and crowdfunding platforms. Each source aligns with different stages of growth and capital needs.

Q. How much equity should be given away while raising startup funds?

Equity dilution varies depending on the stage and amount of funding raised. It’s important to balance raising sufficient capital while retaining enough ownership to steer the business. Negotiating terms thoughtfully can help preserve control while attracting the right partners.

Q. What legal compliances should be ensured before raising startup funds?

Ensure your business is properly registered, comply with securities regulations for issuing shares, maintain transparent documentation like shareholder agreements, file necessary tax and regulatory reports, and protect intellectual property. Proper compliance builds investor confidence and prevents future disputes.

Q. How can one prepare a compelling pitch deck for raising startup funds?

Focus your pitch deck on clearly defining the problem, presenting your solution, showcasing the market opportunity, demonstrating traction, highlighting your team, and presenting realistic financial projections. End with a specific funding ask and how it will be used to achieve the next milestones.

Q. What are the main challenges in startup fundraising, and how to address them?

Common challenges include standing out among many startups, establishing credibility without a long track record, managing valuation differences with investors, and balancing equity dilution. Overcome these by clear communication of unique value, providing validated traction evidence, preparing realistic financials, and negotiating terms that protect long-term goals.