Key Takeaways

- Advisory shares enable companies to reward strategic advisors with equity, aligning incentives for sustainable business growth.

- RSAs, NSOs, and RSUs offer flexible structures for different advisor roles, each with unique vesting and tax considerations.

- Transparent agreements and proper cap table management are essential to protect both the company's interests and the advisor's equity.

- Indian SMEs must comply with regulatory requirements and plan for tax implications to maximize benefits from advisory share programs.

- Guided implementation, like that offered by S45, helps SMEs build lasting partnerships and leverage top expertise for purposeful scaling.

Advisory shares represent a unique way for businesses to attract experienced advisors and strategic partners without immediate cash costs. These shares recognize and reward individuals whose expertise and networks add real value.

For Indian SME founders, understanding how advisory shares work is crucial for long-term scaling and successful partnerships in a complex and competitive market.

What Are Advisory Shares?

Advisory shares are equity grants given to advisors who support a company's growth or strategy. Unlike employee stock options or regular shares, these grants are for individuals not involved in daily operations but whose mentorship or network provides value.

Key traits include limited allocation (usually under 5%), absence of voting rights, and no profit sharing unless specified.

Core Characteristics of Advisory Shares

- Equity rewards for advisory roles

- No voting rights or dividends by default

- Typically small stake, preserving founder control

Who Receives Advisory Shares

- Entrepreneurs, sector experts, or retired executives with valuable insight

- Individuals offering strategic guidance, connections, or industry knowledge

Purpose and Strategic Value for SMEs

- Attract high-caliber advisors without cash strain

- Fill skill gaps, strengthen growth strategies

Advisory Shares vs Equity Shares: Key Differences

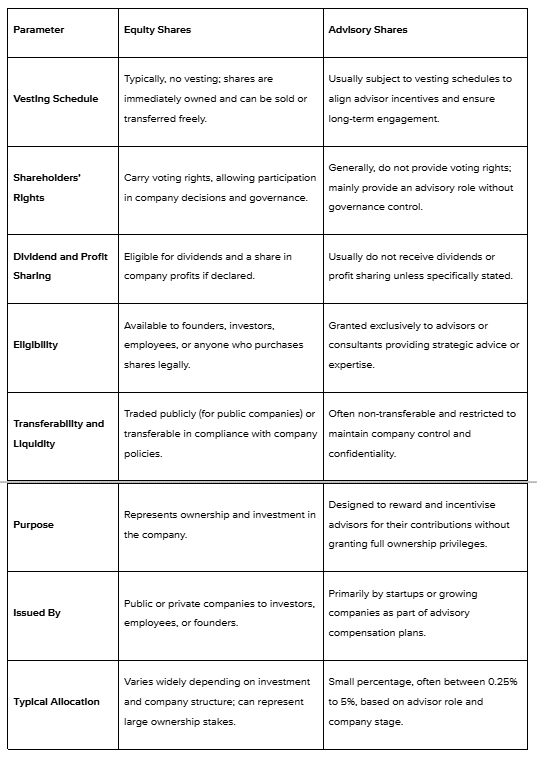

Understanding the differences between advisory shares and regular equity shares is vital for navigating strategy, compliance, and investor communications.

Regular shares confer ownership, voting rights, and, in most cases, profit distribution.

Advisory shares, on the other hand, are designed primarily to align incentives and reward contributions without granting full equity powers.

Types of Advisory Shares and Their Structures

Advisory shares are a versatile tool that allows companies to reward advisors through different equity structures, each tailored to specific roles and objectives.

The main types include Restricted Stock Awards (RSAs), Non-Qualified Stock Options (NSOs), and Restricted Stock Units (RSUs).

Understanding these varieties empowers founders to make the most appropriate choice for their business stage, advisor profile, and long-term strategy.

1. Restricted Stock Awards (RSAs)

RSAs are actual shares granted to advisors. The shares typically come with vesting periods or achievement-based conditions.

- When to Use: RSAs suit advisors providing consistent value over a period, such as ongoing strategy, industry introductions, or board participation.

- Benefits: Immediate equity ownership once vested, clear visibility in the cap table, and straightforward accounting.

- Limitations: Risk of early dilution if not structured carefully; shares may be forfeited if the advisor leaves before meeting conditions.

- Tax impact: Advisors are often taxed upon grant or vesting, which may affect immediate taxable income.

2. Non-Qualified Stock Options (NSOs)

NSOs give advisors the right to purchase shares at a preset exercise price once certain milestones are met or after a vesting period.

- How NSOs Work: Advisors do not receive shares upfront but gain the ability to buy company equity at a locked price, ideally below future market value.

- Exercise Price & Timing: The preset price remains stable regardless of market fluctuations. Timing the exercise correctly is crucial for maximizing benefit and managing taxation.

- Benefits: Allows advisors to participate in future upside, while avoiding premature dilution for the company.

- Limitations: May involve complex accounting; actual gain depends on the company’s future valuation.

- Tax impact: Advisors incur taxes only when they exercise options, often treated as ordinary income or capital gains.

3. Restricted Stock Units (RSUs)

RSUs represent a promise to deliver company shares at a future date, once certain criteria are met, usually through vesting schedules or the achievement of key metrics.

- Usage: Common in larger, more established companies with more intricate compensation plans.

- Benefits: Flexibility for businesses, no initial dilution since shares aren’t issued until vesting. Advisors receive shares only when the minimum conditions are fulfilled.

- Limitations: More complex administration; may require additional regulatory documentation.

- Tax impact: Advisors are generally taxed when RSUs vest and shares are delivered.

Choosing the Right Structure for Your Business

Selecting the best advisory share type depends on:

- The advisor's expected contribution and project duration.

- The company's stage, early-stage startups may favor NSOs to avoid immediate dilution, while mature companies may offer RSAs for transparency.

- Tax considerations for both the business and the advisor.

- Desired level of control and flexibility in managing equity grants.

Key Points for Founders and SMEs:

- Align structure with advisor engagement model, ongoing support vs milestone contribution.

- Consider administrative simplicity, especially as your business grows.

- Work with legal advisors to ensure compliance, proper documentation, and transparent communication with stakeholders.

Companies like S45 help founders navigate these decisions, supplying frameworks and expert support so equity strategies remain aligned with growth, governance, and sustainability.

How Advisory Shares Work: Implementation and Management

Advisory shares are most effective when managed with clear processes, documentation, and ongoing review. This ensures that both advisors and founders remain aligned, equity pools are protected, and advisors stay engaged for sustained impact.

1. The Advisory Share Granting Process

Setting up advisory shares begins by carefully identifying the advisor’s expected contribution. Founders should clarify what expertise, introductions, or strategy the advisor will provide.

- Determine the scope and time commitment needed.

- Assess the advisor’s track record, reputation, and relevance to business goals.

Once the advisor’s value is defined, founders set an appropriate equity allocation. This allocation is formalized through a legal agreement that details:

- The advisor’s role and responsibilities

- Specific deliverables or milestones

- Vesting terms and criteria for share grants

- Confidentiality and non-compete requirements

Drafting such agreements protects both business and advisor, ensuring expectations and rewards are clear from the start.

2. Typical Equity Allocation Percentages

- Individual Advisors: Equity stakes typically range from 0.25% to 5%. The allocation depends on the advisor’s anticipated impact, the company’s stage of growth, and the available equity pool.

- Strategic, high-impact advisors may receive up to 2%–5%.

- Occasional contributors often receive less, sometimes between 0.25% and 1%.

- Advisory Boards: When multiple advisors serve together, total equity is split among members. Advisory boards usually benefit from 1%–2% of company equity, divided based on each member’s participation or specialty.

Setting these percentages balances the need for outside expertise with preserving founder and investor ownership.

3. Role of Advisory Boards in Share Distribution

Advisory boards bring multiple viewpoints and skill sets into a company’s strategy.

- Board members collectively provide broader guidance, industry insights, and help with key decisions.

- Share allocation among board members is guided by each individual’s strategic role, ensuring fairness and clarity.

Collaborative decision-making within advisory boards helps companies address diverse challenges and fosters commitment among advisors.

4. Integration with Cap Table Management

Efficient management of advisory shares requires accurate tracking and transparency.

- Advisory share grants should be maintained separately from employee stock options and founder shares.

- When advisors vest, leave, or change roles, founders must promptly update the cap table.

- Proper recordkeeping protects against equity dilution, supports investor trust, and ensures regulatory compliance for new funding rounds or audits.

Regularly reviewing and updating the cap table as advisors vest their shares strengthens governance and simplifies future transactions.

Vesting Schedules for Advisory Shares

Vesting schedules are crucial in advisory share agreements, ensuring advisors earn equity through sustained contribution or clear achievements.

This approach balances short-term support with long-term value creation, helping founders and advisors remain committed to the company’s goals.

1. Time-Based Vesting

Most advisory shares vest gradually over time.

- Advisors earn equity in regular intervals, monthly, quarterly, or annually, over an agreed period, often one to two years.

- Time-based vesting encourages continued engagement, ensuring advisors remain available for guidance and connections.

- Businesses may opt for monthly vesting for hands-on advisors or quarterly vesting for advisors providing periodic strategic insight.

- This structure allows companies to adjust involvement if needs change before the full vesting period ends.

2. Milestone-Based Vesting

Some companies link vesting to the achievement of specific goals.

- Shares vest after advisors help secure a major partnership, achieve a revenue target, or complete a product launch.

- This method motivates advisors to deliver tangible results and ties their compensation directly to impact.

- Milestone definitions must be clear, measurable, and realistic to avoid confusion or disputes.

3. Hybrid Vesting Approaches

Hybrid schedules combine time-based and milestone-based criteria.

- Advisors may vest a portion of equity over time and earn additional shares by reaching key deliverables.

- Hybrid vesting is ideal for companies seeking accountability and flexibility—rewarding both ongoing effort and standout achievements.

4. Cliff Periods and Their Purpose

Many agreements start with a “cliff” period, such as six months, before any shares vest.

- Cliff periods ensure advisors demonstrate genuine commitment and value before equity transfer begins.

- They help companies avoid giving away shares for short-term or unsuccessful engagements.

5. Termination and Forfeiture Conditions

If an advisor departs early or fails to meet expectations, unvested shares are typically forfeited.

- Agreements should clearly state conditions for termination and forfeiture.

- This protects the company’s equity pool and ensures only impactful advisors earn ownership.

Properly structured vesting schedules align advisor interests with business milestones, sustaining partnership value and maintaining equity discipline as the company grows.

Advisory Shares for Indian SMEs: Regulatory and Strategic Considerations

Offering advisory shares in India requires a careful blend of regulatory compliance and strategic design. This ensures equity grants support business growth while meeting all legal standards and stakeholder expectations.

Indian Regulatory Framework

Indian SMEs are subject to the Companies Act 2013 and Securities and Exchange Board of India (SEBI) regulations.

- Companies must seek board approval and maintain accurate records of equity grants.

- Shares issued to advisors qualify as private placements, separate from public offerings.

- Clear documentation, proper valuation, and adherence to reporting requirements are essential.

Private Placement Process for Advisory Shares

Advisory shares are commonly granted through private placement, which is governed by strict regulatory norms.

- Founders should draft clear agreements ensuring the advisor’s role, compensation, and vesting terms are fully documented.

- Companies must file a return with the Registrar of Companies and disclose details in annual reports.

- This transparency builds trust with existing shareholders and potential investors.

Fair Market Value Determination

Determining the fair market value of advisory shares protects all parties and ensures compliance with tax rules.

- Valuation should consider company performance, growth prospects, and market trends.

- Engaging professional valuers or consulting with experienced networks like S45 facilitates accurate, fair market assessments.

Strategic Benefits for Growing Indian Businesses

Advisory shares help SMEs attract global talent, leverage insider knowledge, and expand market reach without straining budgets.

- By aligning advisor interests with company success, businesses foster sustainable, value-driven partnerships.

- Strategic advisors accelerate innovation, provide access to new resources, and support better decision-making.

In India’s dynamic business landscape, thoughtful implementation of advisory shares can give SMEs a competitive edge.

Regular compliance checks, sound agreements, and strategic advisor selection support long-term scalability and operational excellence.

Guided by communities and experts such as S45, Indian business leaders can unlock meaningful growth and build lasting legacies.

Tax Implications of Advisory Shares

Tax considerations play a significant role in structuring advisory share programs for both companies and advisors. Proper planning ensures compliance with Indian tax laws and avoids unexpected financial consequences.

Tax Implications for Companies

From the company’s perspective, granting advisory shares may qualify as a business expense.

- Expenses related to advisory shares—such as valuation and legal fees—can often be deducted from taxable income if properly documented.

- Accurate accounting treatment is required, reflecting advisory share grants, vesting schedules, and related costs on financial statements.

- Companies must disclose equity issuance to advisors in annual reports and regulatory filings to maintain transparency and meet statutory obligations.

Tax Implications for Advisors

Advisors need to understand when and how they will be taxed on advisory shares.

- For RSAs, taxation typically occurs at the time shares vest and become unrestricted, based on the fair market value at vesting.

- For NSOs and RSUs, tax is levied when options are exercised or units convert to shares, with gains considered as ordinary income or capital gains depending on the holding period.

- If the company value rises between the grant and vesting, advisors could face substantial tax bills on share appreciation.

Compliance and Reporting Requirements

Both businesses and advisors must comply with Indian tax reporting standards.

- Companies should maintain thorough documentation of agreements, share allocations, and vesting events for audits and future funding rounds.

- Advisors should keep detailed records of when shares vest, capitalization events, and any share sales to prepare for income or capital gains tax filings.

- Failing to report appropriately or misvaluing shares can lead to penalties, delayed deals, or regulatory scrutiny.

Consulting with tax professionals or leveraging support from networks such as S45 is recommended to ensure all tax consequences are anticipated and managed wisely.

Proper tax planning keeps equity grants beneficial, secure, and compliant, maximizing their impact for both the company and its advisors.

Pros and Cons of Advisory Shares

Like any equity strategy, advisory shares have advantages and challenges.

Advantages for Companies

- Cost-effective access to expertise.

- Advisors’ incentives are tied to company success.

Potential Drawbacks and Risks

- Dilution of founder and investor ownership.

- Requires careful management and legal oversight.

Risk Mitigation Strategies

- Limit the total advisory pool.

- Review performance regularly.

- Keep agreements and cap tables up-to-date.

Conclusion

Advisory shares enable SMEs and startups to guide, scale, and transform by leveraging external expertise without draining cash reserves.

With careful planning, robust legal frameworks, and disciplined management, advisory share programs create sustainable, mutually beneficial partnerships.

Indian SME leaders can unlock transformative potential and build lasting legacies by integrating advisory shares into their strategic growth journey.

S45 Club stands as a committed partner, ready to guide entrepreneurs on the path to peak performance, providing expert mentorship, and building the summit seekers of tomorrow.

Start your growth expedition with S45 and build the strong foundations that elevate your business to new heights.

Frequently Asked Questions

1. What are advisory shares?

Advisory shares are equity given to company advisors for their expertise, without giving full shareholder rights or dividends.

2. How are advisory shares different from regular shares?

Unlike regular shares, advisory shares rarely provide voting rights or profit sharing and are issued specifically for advisory roles.

3. Who typically receives advisory shares?

Experienced professionals, entrepreneurs, or industry experts supporting the company's strategy and growth often receive these shares.

4. What is a typical advisory share allocation?

Individual advisors usually receive 0.25–5% equity, depending on their role and business stage.

5. How do vesting schedules work for advisory shares?

Shares gradually vest over time or upon achieving milestones, aligning advisor incentives with company success.

6. Are advisory shares taxable?

Yes; tax is generally triggered at vesting or exercise, and advisors must carefully plan for these obligations.

7. Do Indian SMEs need special documentation for advisory shares?

Yes; compliance with the Companies Act 2013, SEBI, and clear legal agreements are crucial for regulatory safety.