Key Takeaways:

- Align with business goals: Fund utilization plans align your spending with business goals while demonstrating accountability to investors and stakeholders.

- Milestone-based tranches: Break funding into milestone-based tranches tied to specific deliverables, such as user growth targets or revenue achievements.

- Maintain backup funds: Allocate 10-15% for backup funds and unexpected opportunities while maintaining detailed budget breakdowns for each expense category.

- Prioritize revenue-generating activities: Focus spending on revenue-generating activities like customer acquisition and product development rather than operational overhead.

- Set up monthly review cycles: Create monthly review cycles to track actual spending against projections and adjust allocations based on actual performance.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

India's startup ecosystem has grown to include 1.59 lakh startups, making it the world's third-largest startup hub. Yet most founders securing their first major funding round face the same challenge: how do you prove that the invested fund will drive meaningful growth?

A fund utilization plan acts as your roadmap for turning capital into sustainable growth while maintaining the trust of everyone who believes in your vision. Without it, even the best ideas can stumble when spending decisions become unclear.

In this guide, we walk you through creating a complete fund utilization plan that satisfies investors, guides your team's decisions, and positions your startup for the next funding stage. Let’s get into it!

What Is a Fund Utilization Plan for a Startup?

A fund utilization plan is a detailed document that outlines how your startup will spend raised capital to achieve specific business objectives. It shows investors exactly where their money goes and how it drives growth.

The plan breaks down your funding into specific categories like product development, marketing, hiring, and operations. Each allocation connects directly to measurable outcomes and timeline commitments.

For example, if you allocate ₹50 lakhs for product development, the plan explains what features you'll build, when they'll launch, and how they'll impact revenue.

Smart founders use fund utilization plans as internal decision-making tools, ensuring every expense moves the business forward rather than just keeping lights on. The document serves as both an external commitment to investors and an internal compass for daily spending decisions.

Defining your plan is the first step. The real question founders face is why investors and successful entrepreneurs prioritize this planning process.

Why Do Startups Need Fund Utilization Plans?

Creating a fund utilization plan serves multiple critical purposes that extend beyond investor requirements. Here's why successful startups prioritize this planning process:

- Clear accountability: Investors see exactly how their capital creates value rather than wondering about spending decisions.

- Risk mitigation: Detailed plans reduce investor concerns about fund mismanagement or unclear priorities.

- Professional credibility: Well-structured plans demonstrate business maturity and strategic thinking capabilities.

- Resource optimization: Prevents scattered spending and ensures focus on high-impact activities.

- Performance measurement: Establishes benchmarks for tracking progress and identifying course corrections.

- Future fundraising: Strong execution against previous plans builds credibility for subsequent funding rounds.

Planning matters, but proper implementation separates successful founders from the rest. S45 helps founders create investor-ready strategies that drive results. Connect with our community of successful entrepreneurs who've scaled businesses from local leaders to global players.

Now, knowing about the benefits is good. But what exactly should you add in your fund utilization plan? Let’s find out!

Components of an Effective Fund Utilization Plan

A comprehensive fund utilization plan includes several essential elements that work together to create a clear roadmap for capital deployment. Each component serves a specific purpose in building investor confidence and guiding operational decisions.

1. Business Alignment and Strategic Goals

Your plan must directly support your startup's core business objectives and growth strategy. Start by clearly stating what you aim to achieve with the funding, whether it's market expansion, product development, or scaling operations.

Connect each spending category to specific business outcomes and revenue targets. For instance, if you're allocating ₹30 lakhs to sales hiring, explain how these new team members will contribute to customer acquisition goals and revenue growth within defined timeframes.

2. Detailed Budget Breakdown

Break your allocation into specific categories with clear justification for each expense type. Product development should include feature builds, technology infrastructure, and research costs with specific deliverables attached to each line item.

Marketing and sales budgets need to specify customer acquisition channels, campaign costs, and expected return on investment. Personnel costs should detail key hires, salary ranges, and the strategic value each role brings to the organization.

3. Milestone-Based Funding Structure

Divide your funding into parts tied to specific achievements that demonstrate business progress. Create measurable milestones that investors can evaluate objectively, such as user growth targets, revenue thresholds, or product launch completions.

For example, release 40% upon product launch and first customer acquisition, 30% after reaching 1000 active users, and 30% when achieving monthly recurring revenue targets. Each milestone should represent meaningful business value creation.

4. Financial Projections and Runway

Include detailed forecasts showing how long the funding will last and what metrics you expect to achieve. Project monthly burn rates, revenue growth trajectories, and key performance indicators that matter to your specific business model.

Build multiple scenarios, such as, optimistic, realistic, and conservative, to demonstrate thoughtful planning and risk awareness. Show how different market conditions or execution speeds might affect your funding timeline and business outcomes.

5. Risk Assessment and Contingency Planning

Address potential challenges and how you'll adapt spending if circumstances change. Include backup plans for different scenarios like slower customer acquisition, delayed product development, or unexpected market shifts.

Allocate 10-15% of funding for emergencies and explain how you'll reallocate resources if priorities change. Show investors that you've thought through potential obstacles and have strategies for maintaining progress despite challenges.

Knowing what goes into your plan helps you prepare. Here's how to actually build one that passes investor review.

How to Create a Fund Utilization Plan?

Building an effective fund utilization plan requires a systematic approach that balances investor expectations with practical business needs. Follow these steps to create a plan that guides your decisions and builds confidence.

- Step 1: Define Clear Objectives and Outcomes: Start by articulating what success looks like at the end of your funding period. Set specific, measurable goals like "achieve ₹2 crore ARR within 18 months" or "expand to 3 new cities with 50+ enterprise clients."

- Step 2: Conduct Thorough Market Research: Research industry benchmarks for spending ratios in your sector. Study successful companies in your space to learn how they allocated funding during similar growth stages. This research helps investors evaluate whether your approach aligns with proven strategies.

- Step 3: Create Detailed Budget Categories: Break down your allocation into specific line items with a clear purpose and expected outcomes. For instance, technology and product expenses should include development costs, infrastructure needs, and third-party integrations with specific feature deliverables.

- Step 4: Establish Milestone Markers: Connect funding releases to specific deliverables that demonstrate business progress. Each milestone should represent meaningful value creation that investors can evaluate objectively.

- Step 5: Build Financial Models: Create spreadsheets showing monthly cash flow projections and key metrics progression. Include optimistic, realistic, and conservative scenarios to demonstrate thoughtful planning and risk awareness.

- Step 6: Include Risk Mitigation Strategies: Address potential challenges like delayed product launches, slower customer acquisition, or market changes. Show how you'll reallocate resources if needed while maintaining progress toward core objectives.

- Step 7: Seek Feedback and Refinement: Share drafts with advisors, mentors, or other founders who've successfully raised funding. Their insights can help identify gaps, unrealistic assumptions, or areas that need stronger justification. Incorporate feedback and refine your plan based on expert input.

Want to build a fund utilization plan that accelerates your growth? S45 connects you with founders who've successfully managed funding challenges and built sustainable businesses.

Knowing about the process is helpful. But let’s also take a look at an actual example of how successful founders structure their decisions.

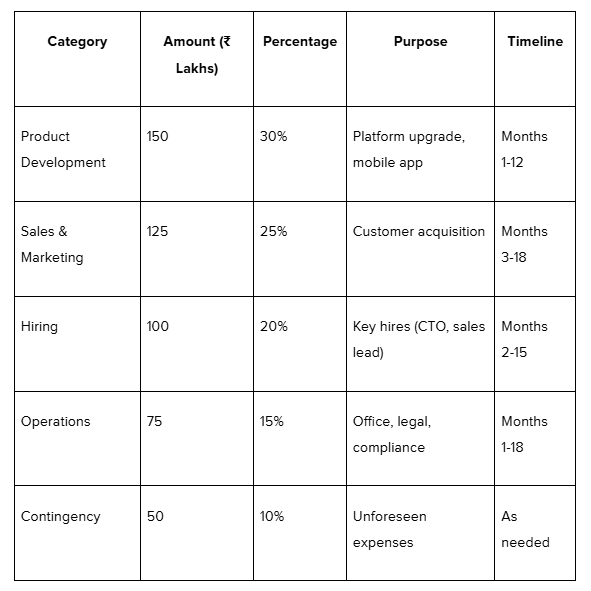

Fund Utilization Plan Example That You Can Consider

Here's an effective framework you can adapt for your startup's specific needs. Use this template as a starting point and customize based on your industry, business model, and growth stage.

Create a milestone schedule that shows specific achievements tied to funding releases. Include target dates and measurable outcomes that demonstrate business progress.

- Month 3: Complete product MVP, hire core team.

- Month 6: Launch beta version, acquire first 50 customers.

- Month 12: Achieve ₹50 lakh ARR, expand to a second city.

- Month 18: Reach ₹2 crore ARR, prepare Series A.

For instance, a B2B SaaS startup might allocate 35% to product development for building enterprise features, 30% to sales and marketing for customer acquisition, and 25% to hiring experienced developers and sales professionals. Each allocation should connect to specific outcomes and timeline commitments.

Templates provide structure, but even experienced founders can make costly mistakes that damage investor relationships and business outcomes.

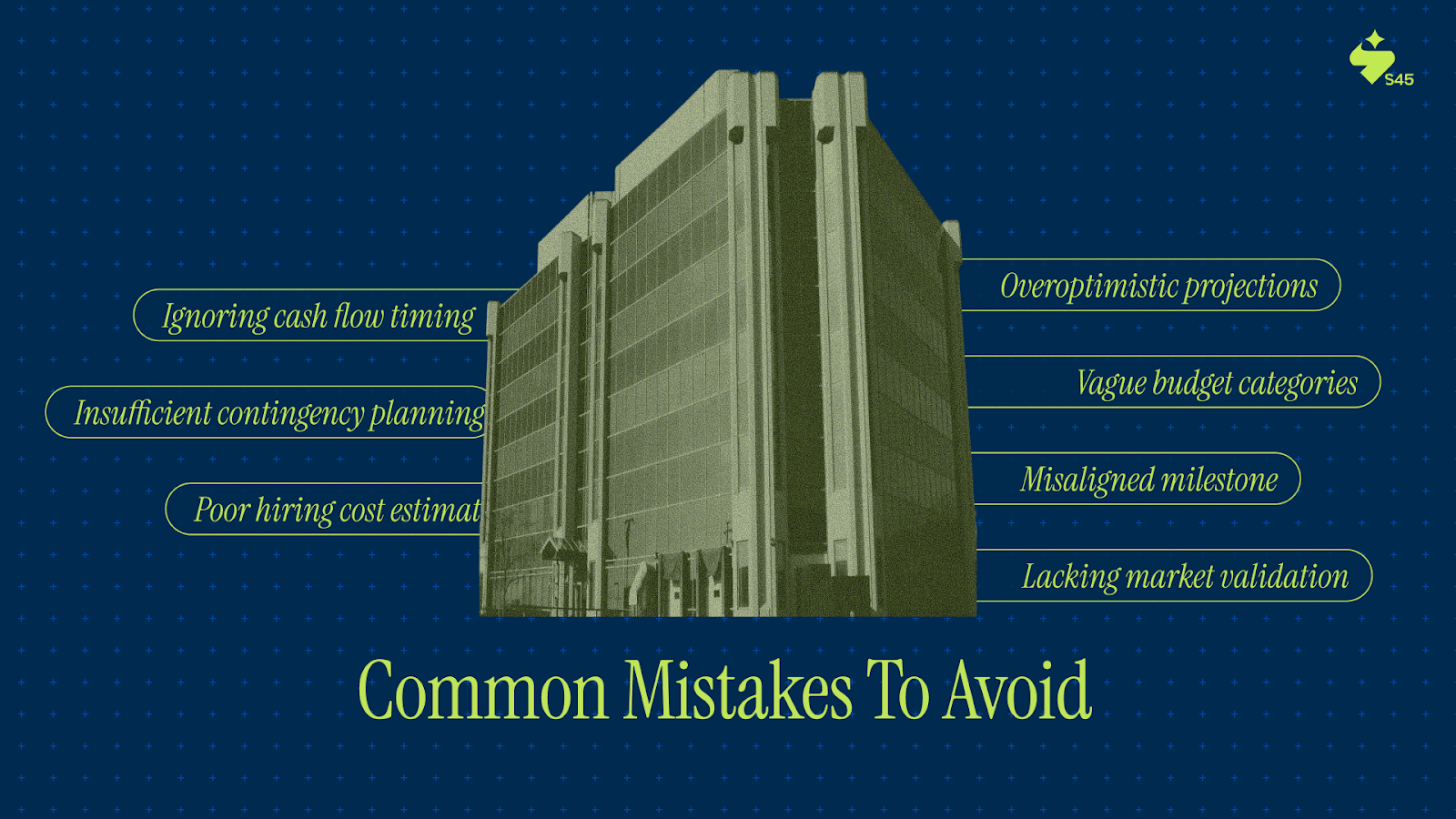

Common Mistakes to Avoid in Fund Utilization Planning

Here are the most frequent mistakes that occur while planning fund utilization and how you can avoid them:

- Overoptimistic projections: Assuming best-case scenarios for customer acquisition costs, conversion rates, or timeline execution leads to unrealistic expectations and disappointed investors. Use proper estimates and include buffer time for unexpected challenges.

- Insufficient contingency planning: Allocating 100% of funds without reserves for market changes or execution delays creates unnecessary risk. Reserve 10-15% for unforeseen circumstances and opportunity investments to maintain flexibility.

- Vague budget categories: General line items like "marketing expenses" without specific allocation or purpose fail to demonstrate strategic thinking. Break down every category into measurable components that show clear intent and expected outcomes.

- Ignoring cash flow timing: Planning spending without considering when revenue actually arrives creates potential cash flow problems. Model monthly cash flow with realistic payment cycles and collection periods to avoid funding gaps.

- Misaligned milestone metrics: Setting milestones that don't directly correlate with business value or investor concerns undermines plan credibility. Choose metrics that demonstrate clear progress toward profitability and scale.

- Poor hiring cost estimates: Calculating only salaries without including recruitment fees, training costs, and productivity ramp-up time leads to budget shortfalls. Include full-loaded costs for new team members, including benefits and onboarding expenses.

- Lacking market validation: Allocating significant resources to unproven strategies or markets increases investment risk. Include customer discovery and market testing phases before committing large amounts to scaling initiatives.

Avoiding pitfalls protects your credibility. But your plan's real value emerges through ongoing tracking and smart adjustments.

Monitoring and Adjusting Your Fund Utilization Plan

Creating your plan marks the beginning of an ongoing process. Successful startups continuously track performance and make strategic adjustments based on real-world results and market feedback.

Here's how to keep your fund utilization plan aligned with business:

- Monthly performance reviews: Compare actual spending against projections and track key metrics like customer acquisition cost, lifetime value, and monthly recurring revenue to identify trends early.

- Real-time dashboards: Create visibility tools that show fund utilization progress, milestone achievement, and budget variance to enable quick decision-making.

- Quarterly investor updates: Send detailed reports showing progress against milestones, explaining any deviations, and outlining corrective actions to maintain trust and transparency.

- Market-based adaptations: Reallocate resources when customer acquisition costs exceed expectations or product development timelines accelerate beyond original projections.

- Strategic pivots: Adjust spending priorities when market feedback indicates better opportunities or changing customer needs require different resource allocation.

- Change documentation: Keep detailed records of all plan modifications, including the business rationale behind each change to demonstrate thoughtful management.

- Stakeholder communication: Proactively inform investors and advisors about significant changes before they impact milestone achievement or funding runway.

Final Thoughts

Fund utilization planning goes beyond satisfying investor requirements. It builds the strategic discipline that separates successful startups from those that burn through capital without creating lasting value.

The best entrepreneurs use fund utilization plans as living documents that guide daily decisions, align team priorities, and create accountability for results. When done right, these plans become the foundation for sustainable growth and successful future fundraising.

Your next funding round depends on how well you execute against current commitments. S45 helps founders build the strategic frameworks and operational discipline needed to scale businesses from local leaders to global players. Connect with entrepreneurs who are building India's next generation of world-class companies.

FAQs

1. How much detail should a fund utilization plan include?

Include enough detail to show serious planning without overwhelming readers. Break major categories into 3-5 subcategories with specific amounts, timelines, and expected outcomes.

2. What percentage should startups allocate to different expense categories?

SaaS startups typically spend 40-50% on sales and marketing, 25-30% on product development, and 20-25% on personnel. Hardware companies often allocate 50-60% to product development and manufacturing.

3. How often should fund utilization plans be updated?

Review monthly and update quarterly or when significant changes occur. Major pivots, faster growth, or market shifts may require immediate plan revisions.

4. What happens if a startup deviates significantly from their fund utilization plan?

Communicate changes proactively to investors with clear explanations and updated projections. Most investors know that plans evolve, but transparency is essential for maintaining trust.

5. Can fund utilization plans be modified after investor approval?

Yes, but significant changes require investor consultation and approval. Minor adjustments within categories are usually acceptable if overall objectives remain achievable.