Confused about which type of investor aligns best with your business goals? In India, founders typically encounter angel investors, venture capitalists, private equity firms, and strategic investors. With so many options, it can be tough to decide who's the best fit for your business.

The investor landscape in India is rapidly evolving, offering new growth opportunities. In the first quarter of 2025, Indian startups raised $3.1 billion across 232 deals, marking a 41% increase from last year. Fintech startups led the charge. It's not just startups attracting investors; even mid-market manufacturers and family-run businesses are now in the spotlight.

The key challenge for founders is choosing between investors who only bring money versus those who offer valuable expertise. This guide will help you explore the different types of investors and make the right choice for your business's long-term growth.

Key Takeaways

- Investor choices shape growth, and suitability varies from angels to private equity.

- Angel investors fund early-stage ideas with personal capital and mentoring.

- Venture capitalists support scaling high-growth businesses needing larger investments.

- Institutional investors like DIIs and FIIs back mature businesses and boost market confidence.

- Choosing the right investor aligns funding terms involvement and long-term business goals.

Why Knowing Investor Types Matters for Business Growth

Choosing the right investor is about more than just raising funds. It plays a key role in shaping your business’s journey and long-term success. Different stages of growth call for different types of investors. Early-stage startups may benefit from angel investors who are more open to risk, while growing companies might turn to venture capital (VC) or private equity (PE), each with distinct expectations.

The wrong investor can create pressure for fast exits or aggressive scaling that doesn’t align with your goals. For example, a family-run business focused on long-term growth may struggle under a VC's short-term return mindset.

Understanding the types of investors helps ensure their goals and expertise align with yours. The right investor brings not just capital, but also experience, networks, and strategic insight. This lays the foundation for sustainable growth.

Let’s explore the different investor types so you can make the best choice for your business.

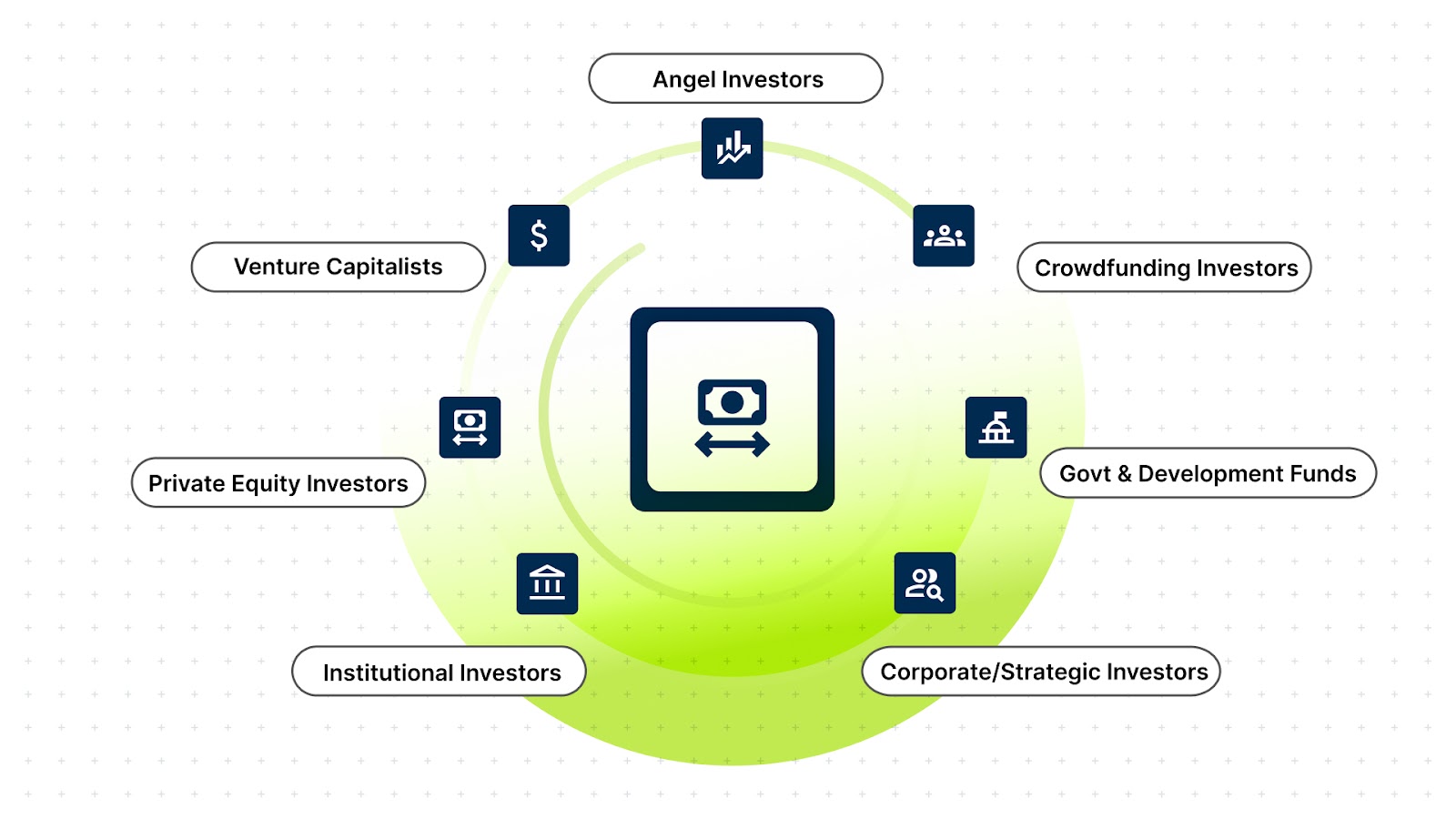

Types of Investors Every Founder Must-Know

Choosing the right investor depends on your business stage, needs, and vision. India offers a wide range of investor types, each with unique funding approaches and expectations. Some focus on early innovation, while others prefer mature, scalable businesses.

Investor participation increased, with 656 investors backing Indian startups in Q1 2025, a 42% rise from the previous year. Knowing these differences helps you prepare and approach them with clarity.

Here is how these investors work and what they offer.

1. Angel Investors

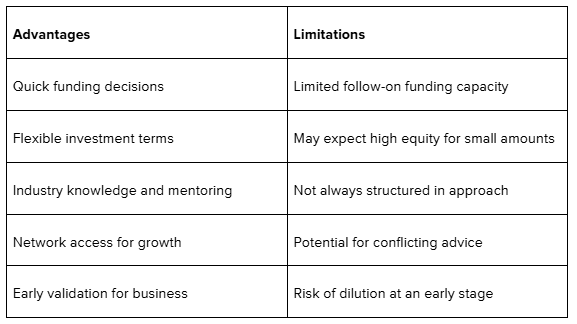

Angel investors are individuals who invest their personal funds into early-stage startups. They usually invest in exchange for equity and take high risks for potential high returns. Typical investments range from ₹10 lakh to ₹2 crore per deal. They often bring industry expertize, networks, and guidance along with funds.

For instance, Ola Cabs raised ₹1 crore seed funding from angel investors like Rehan Yar Khan and Anupam Mittal.

2. Venture Capitalists (VCs)

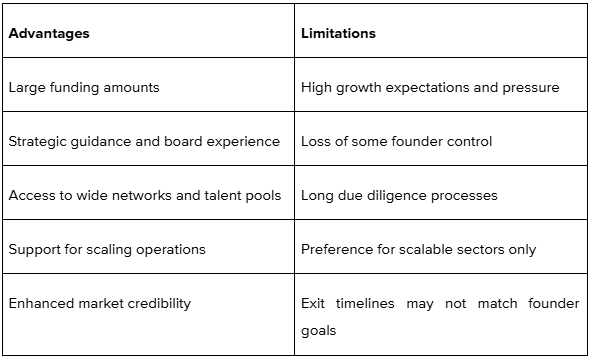

VCs are firms that pool funds from investors to invest in high-growth startups. They enter early growth stages and focus on sectors like fintech, SaaS, and healthtech in India. They earn returns through exits like IPOs or acquisitions.

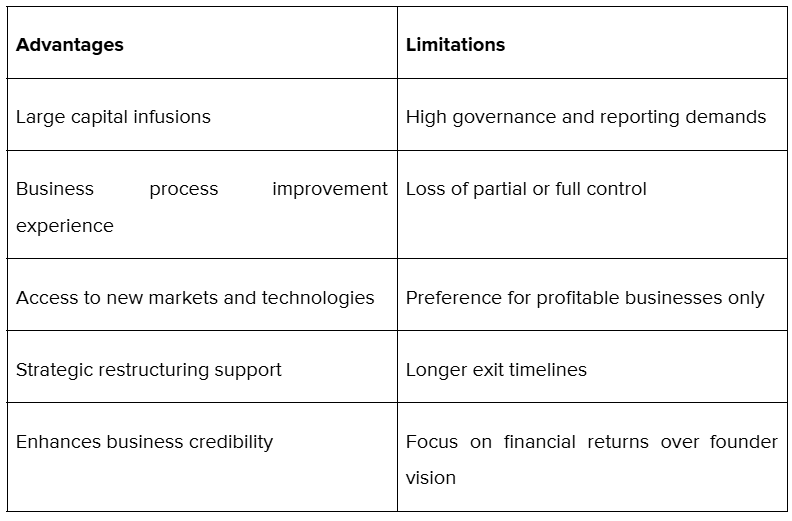

3. Private Equity Investors (PEIs)

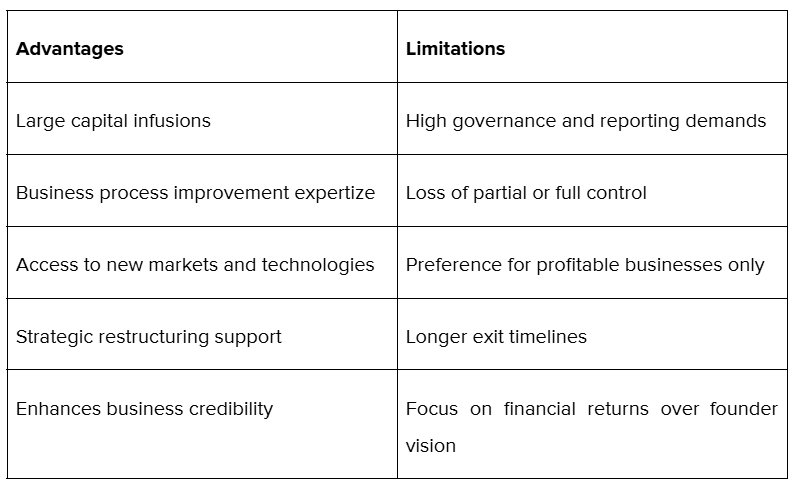

Private equity investors focus on established businesses with strong cash flows. They invest larger amounts for growth, expansion, or restructuring. PEIs often take a significant equity stake and play an active role in management decisions.

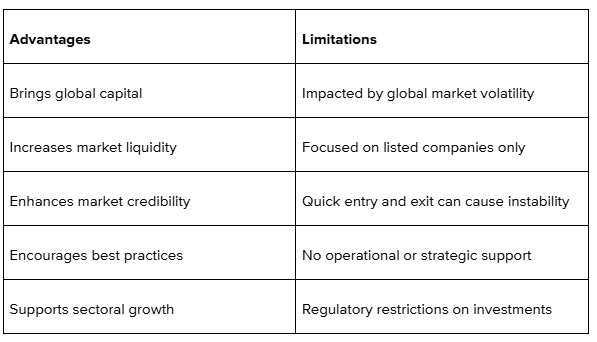

4. Institutional Investors

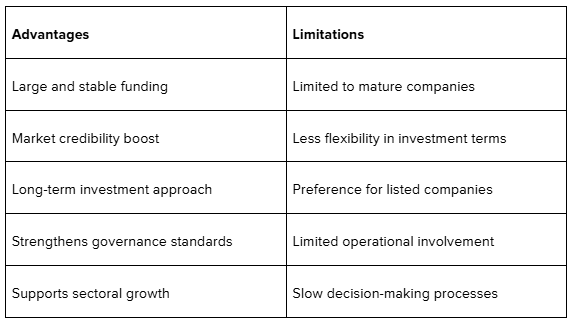

Institutional investors include entities like insurance companies, pension funds, and mutual funds. They invest large amounts, often in listed companies, providing stability and market confidence. Their involvement indicates strong business fundamentals and governance. There are 2 types of institutional investors available, those are:

a)Domestic Institutional Investors (DIIs)

DIIs include LIC, SBI Mutual Fund, and Indian insurance companies. They invest mainly in public markets but also in large private deals, often focusing on stable returns and sector growth.

b)Foreign Institutional Investors (FIIs)

FIIs are overseas funds investing in Indian markets. They bring global confidence, liquidity, and market growth. FIIs invest in public equity and debt instruments, influencing market trends and valuations.

5. Corporate/Strategic Investors

These are companies investing in other businesses to support their strategic goals, like supply chain integration, technology access, or market expansion.

For example, Reliance investing in Dunzo to strengthen its last-mile delivery capabilities.

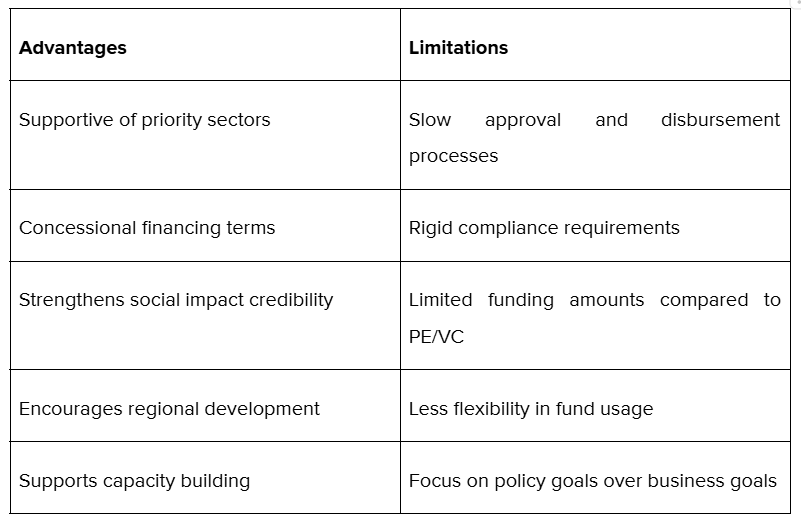

6. Government and Development Financial Institutions (DFIs)

DFIs like SIDBI, NABARD, and IFCI provide funding for sectoral development, MSME growth, and rural financing. They offer debt and equity support under various government schemes.

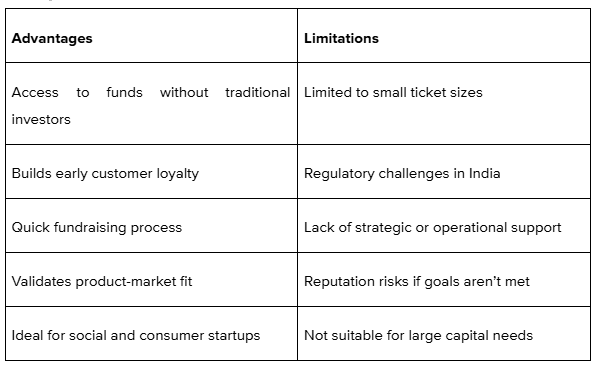

7. Crowdfunding Investors

Crowdfunding involves raising small amounts of capital from a large number of individuals through online platforms. In India, it is gaining traction as a way for startups, creative projects, and social enterprises to secure funding while also building a community of early supporters and customers.

Knowing these investor types builds clarity to choose partners who align with your business goals and stage. It prepares you for strategic funding conversations and sets the base for selecting the right investors ahead.

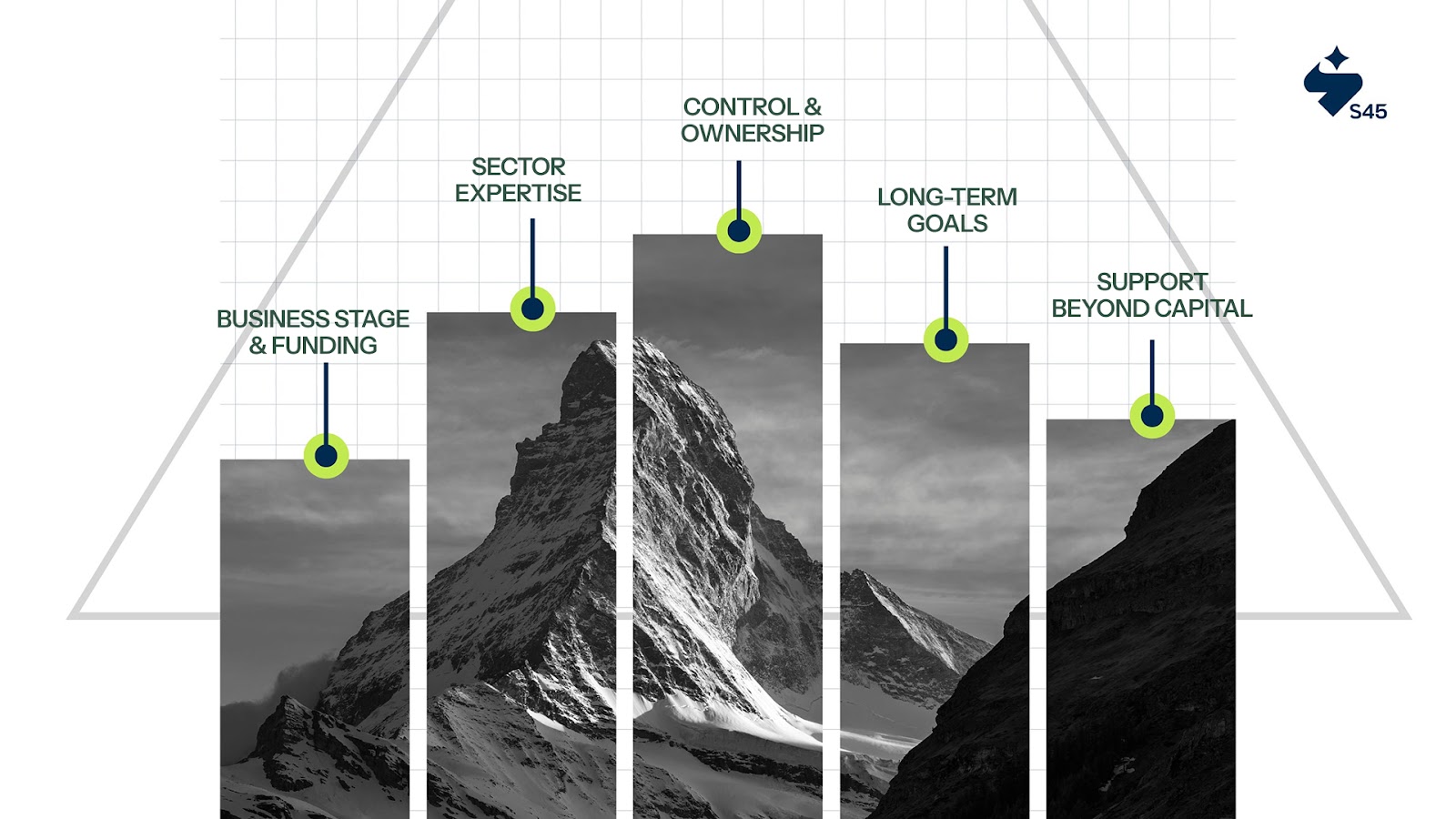

How to Choose the Right Investor for Your Business?

Selecting an investor is not just about money. It shapes your business’s future, influences decision-making, and determines the pace of growth. The right choice supports your vision while protecting your ownership and mission. Think beyond funding and consider long-term alignment, strategic value, and true partnership.

1. Business Stage and Funding Needs

Check if the investor supports your stage. Early-stage startups need angels or seed VCs, while mature businesses benefit from private equity or strategic investors. For example, a scaling manufacturer needs investors ready for operational expansion, not just product development.

2. Sector Expertize

Choose investors who know your industry well. Their guidance, networks, and insights speed up growth. For example, a health-tech founder gains more from a VC focused on healthcare than from a general tech fund.

3. Control and Ownership Expectations

Understand how much stake you must give and the board rights involved. Some investors seek active control, while others prefer advisory roles. Decide what works for your vision and governance style.

4. Long-term Goals Alignment

Ensure the investor shares your growth timeline and exit plans. For example, if you plan to build a legacy business, short-term focused investors may push for early exits that don’t align with your goals.

5. Support Beyond Capital

Check what value they offer apart from money. Sector connections, operational efficiency, and mentoring often matters more than funds alone in sustaining growth and navigating challenges confidently.

Choosing wisely builds strong foundations for lasting growth and value creation. Your decision shapes your next steps and opportunities.

Now, let’s see how S45 supports founders in these strategic funding choices.

How S45 Supports Founders in Investor Selection?

S45 works as an experienced partner for founders, making funding decisions. We guide you in understanding equity structures and choosing the right investor based on your business stage, sector, and growth plans. Our team brings deep knowledge of manufacturing and trading businesses, helping you prepare with clarity.

Instead of imposing decisions, S45 walks beside you, respecting your vision and goals. We assess investor options, negotiate fair terms, and ensure deals align with your purpose. This approach builds confidence and avoids common mistakes that risk ownership or strategic direction.

Through Club S45, you gain access to a network of investors, advisors, and peers who share insights and opportunities. It creates a space to plan growth without feeling isolated or rushed.

If you are planning your next funding round, connect with S45 to build a strategy that supports your long-term goals with confidence and clarity.

Conclusion

The right investor shapes your growth, control, and long-term success. In India, investors span from angels supporting early ideas to venture capitalists funding scale, private equity firms backing mature businesses, and institutional investors building market trust. Each has its advantages, risks, and expectations.

Think about your business stage, funding needs, and vision before approaching investors. Early-stage startups may benefit from angel investors or crowdfunding. Growing mid-market firms often suit venture capital or private equity. Institutional and corporate investors suit businesses with stable revenues seeking strategic backing.

At S45, we offer personalized, hands-on guidance backed by deep market insight. Our experienced team helps founders navigate complex funding choices, ensuring your investment partners align with your growth ambitions and ownership priorities. Would you like to understand which investor type fits your next move? Sign up now for practical, purpose-driven funding guidance.

Frequently Asked Questions

1. How do venture capitalists differ from angel investors?

Venture capitalists are firms that pool funds from investors to back high-growth startups at scaling stages. They invest larger sums, offer deeper involvement, and seek returns through exits like IPOs. Angels invest personal funds earlier in the business lifecycle.

2. Who are institutional investors in India?

Institutional investors include domestic bodies such as LIC, mutual funds, and global funds (FIIs). DIIs invest in public and large private deals, enhancing market confidence. FIIs bring global capital but can create volatility. Both signal strong fundamentals.

3. What do private equity investors look for?

Private equity investors target mature, cash-positive businesses ready to scale or restructure. They provide large capital, governance upgrades, and operational oversight. Their aim is value creation over several years, often seeking board involvement and a structured exit strategy through sales or public listings.

4. Can businesses use crowdfunding to raise capital?

Yes, businesses, especially startups and SMEs, can use equity crowdfunding platforms to raise small amounts from many investors. This method helps validate product-market fit and build early customer support. However, funding size remains limited, and businesses must manage many small investors and regulatory compliance.