Key Takeaways

- Business advisory services provide expert guidance in finance, strategy, operations, compliance, HR, and technology.

- India’s 63 million+ MSMEs face challenges like funding gaps, regulatory complexity, and digital transformation; advisory support helps navigate these.

- Startups and fast-growing SMEs benefit from advisory services by reducing risks, improving profitability, and preparing for long-term sustainability.

- Choosing the right advisory firm ensures customized solutions, industry expertise, and access to growth networks.

- Businesses that invest in advisory services are better positioned to scale smoothly and compete globally.

Have you ever wondered why some businesses scale smoothly while others struggle despite having a great product or strong demand?

The difference often lies in the kind of guidance they receive. This is where business advisory services come in, specialized solutions that help businesses make smarter decisions, manage risks, and plan for sustainable growth.

In India, where over 63 million MSMEs contribute nearly 30% to the GDP and employ more than 110 million people (MSME Ministry), the challenges are immense, ranging from access to capital and regulatory compliance to talent management and digital adoption. For fast-growing companies, these complexities only multiply as they expand across regions and markets.

Businesses that tap into professional advisory support not only avoid costly missteps but also accelerate growth by leveraging expert insights, financial planning, and operational efficiencies. Instead of reacting to problems, they stay ahead with proactive strategies.

Why Business Advisory Services Matter in Today’s Market?

The Indian business landscape is evolving rapidly, and companies can no longer rely on traditional methods alone. From compliance pressures to digital transformation, advisory services play a key role in ensuring businesses stay competitive, resilient, and future-ready.

Navigating Rapid Change

The pace of change in today’s market is relentless. Businesses must adapt quickly to shifting customer demands, digital disruption, and global competition to stay relevant.

- Market dynamics are shifting faster than ever, driven by changing customer expectations and global competition.

- Digital adoption in India has crossed 800 million internet users, pushing businesses to embrace technology at scale.

- Business advisors help organizations analyze industry trends, adopt digital solutions, and stay aligned with emerging opportunities.

Moving Beyond Revenue-Focused Growth

Focusing solely on revenue often creates fragile businesses. Sustainable growth requires balancing profitability, efficiency, and expansion.

- Growth is not just about increasing sales; profitability and sustainability matter more in the long run.

- Businesses often struggle with operational inefficiencies, poor financial controls, or resource mismanagement despite growing revenues.

- Advisory services guide companies in building scalable models that ensure consistent margins while expanding into new markets or product lines.

Managing Risks Proactively

Every business faces risks, but proactive management ensures they don’t derail long-term success. Advisors help identify and address vulnerabilities before they escalate.

- Financial risks such as poor cash flow management or debt structuring.

- Legal and compliance risks due to evolving tax laws, labor reforms, and corporate governance norms.

- Operational risks like supply chain disruptions or inefficiencies in processes.

- Advisors identify these risks early and design mitigation strategies to protect business value.

Building Resilience for the Future

Resilient businesses don’t just respond to crises, they anticipate them. Strategic planning ensures companies remain steady even in uncertain times.

- Global uncertainties such as inflation, policy shifts, or disruptions in trade can directly affect Indian businesses.

- Advisory services prepare companies to withstand shocks through contingency planning, process improvements, and better resource allocation.

- Instead of reacting to crises, businesses are equipped to anticipate and manage challenges effectively.

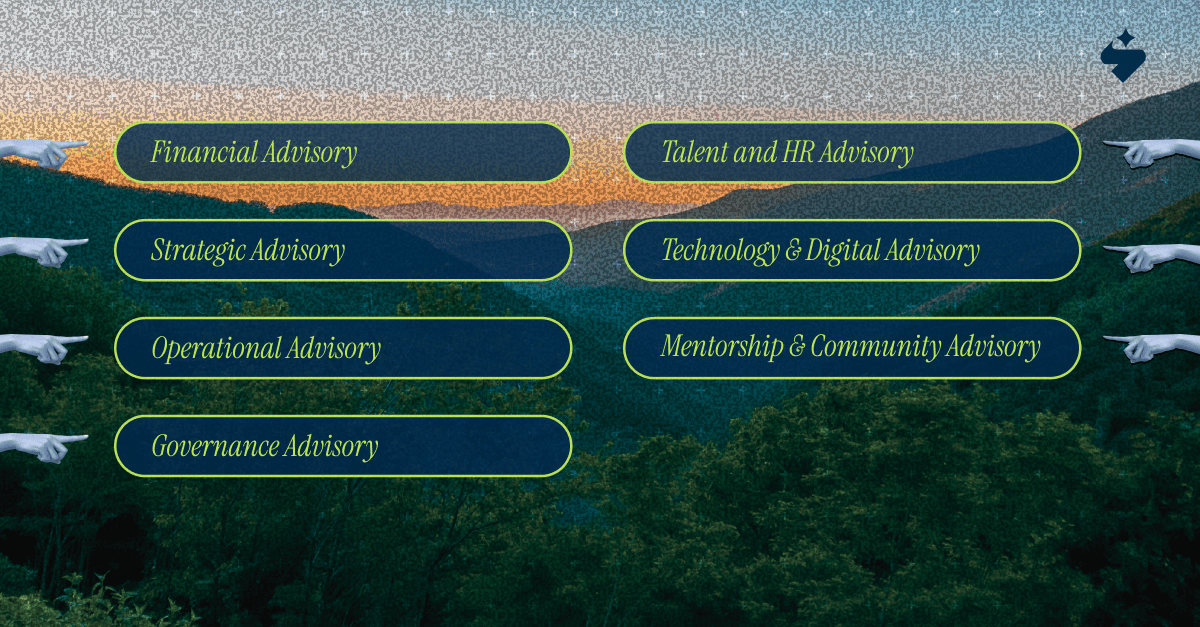

Types of Business Advisory Services

Business advisory services go beyond problem-solving; they empower companies to build stronger foundations, make informed decisions, and scale sustainably. Each service area addresses a critical aspect of business growth.

- Financial Advisory

Advisors help structure debt and equity, raise capital, manage cash flow, and create financial forecasts. In India, where SMEs often struggle with working capital, this support ensures access to affordable financing and long-term stability.

- Strategic Advisory and Growth Planning

From market entry to mergers and acquisitions, strategic advisory shapes a company’s future direction. It helps businesses identify new opportunities, refine business models, and create growth roadmaps that balance ambition with sustainability.

- Operational Advisory

Operational advisors streamline processes, strengthen supply chains, and reduce costs. For growing businesses, efficiency improvements can directly impact profitability, enabling them to scale without unnecessary overhead.

- Regulatory, Tax, and Governance Advisory

With frequent policy changes in India, compliance can be challenging. Advisors ensure businesses meet tax and legal obligations, while also setting up governance frameworks that build trust with investors, partners, and customers.

- Talent and HR Advisory

Advisory in this area strengthens leadership pipelines, succession planning, and employee engagement. By developing people and culture, businesses can retain talent, reduce turnover, and foster innovation.

- Technology and Digital Advisory

Advisors guide digital transformation, IT infrastructure scaling, and cybersecurity. For SMEs embracing automation or e-commerce, this support ensures smoother adoption of technology without exposing the business to unnecessary risks.

- Mentorship and Community Advisory

Beyond technical advice, mentorship connects founders with experienced leaders and peer networks, providing valuable insights and guidance. These communities provide real-world insights, shared experiences, and strategic collaboration opportunities that go beyond traditional consulting.

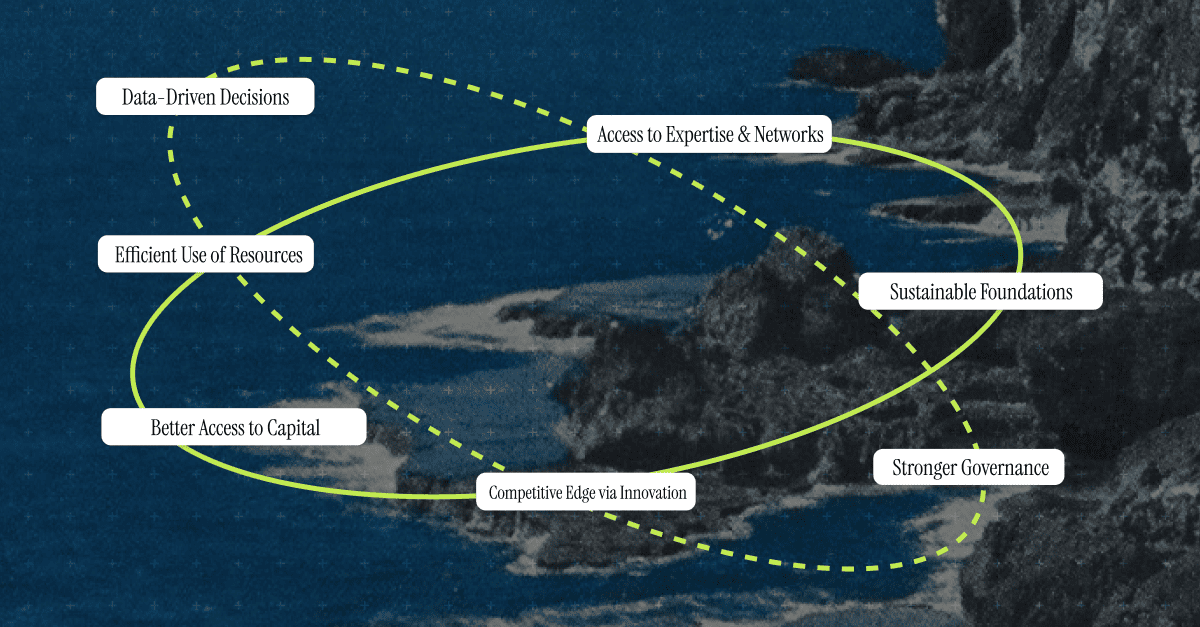

Benefits of Business Advisory Services

Engaging business advisors goes beyond receiving expert guidance; it’s about building long-term resilience and unlocking growth opportunities. Here’s how businesses benefit:

1. Informed & Data-Driven Decisions

Advisors help businesses make smarter decisions backed by financial modeling, industry benchmarks, and market insights.

- Reduces reliance on guesswork.

- Provides clarity in complex scenarios like mergers, expansions, or capital raising.

2. Efficient Use of Resources & Cost Savings

Advisory services streamline processes and optimize operations, ensuring maximum value from every rupee invested.

- Identifying inefficiencies in the supply chain or staffing.

- Leveraging automation and technology to cut costs sustainably.

3. Better Access to Capital & Market Readiness

Advisors prepare businesses for investor scrutiny and lender expectations.

- Structuring debt and equity for balance sheet strength.

- Creating compelling investor pitches and financial forecasts.

- Enhancing credibility through compliance and governance practices.

4. Competitive Edge via Innovation & Speed

Advisors guide businesses in adapting to changing markets and leveraging new business models, digital tools, and partnerships.

- Faster response to market shifts.

- Building innovation roadmaps that align with customer needs.

5. Stronger Governance & Reduced Risk

Risk management is at the heart of sustainable growth. Advisory services improve compliance, reporting, and internal controls.

- Mitigating legal/regulatory challenges.

- Enhancing transparency to build investor and stakeholder trust.

6. Accelerated Growth with Sustainable Foundations

Instead of chasing short-term wins, advisors help build scalable strategies.

- Long-term growth planning with succession and talent strategies.

- Balanced growth between profitability, liquidity, and innovation.

7. Access to Expertise & Networks

Advisors bring deep domain expertise and global/local networks.

- Peer learning and mentorship opportunities.

- Access to investors, industry leaders, and strategic partners.

Who Needs Business Advisory Services?

Many businesses in India operate in rapidly evolving environments marked by policy shifts, intense competition, and scaling challenges. Below are the types of companies that benefit most from advisory services, along with some statistics highlighting the size and importance of these segments.

- Startups aiming to scale — India has over 1,61,150 DPIIT-recognized startups as of January 2025. Many startups struggle with creating scalable models, securing funding, and managing rapid growth without strong financial and operational discipline.

- SMEs looking to professionalize operations — India has around 4.5 crore registered MSMEs, of which 98% are micro enterprises. As these enterprises grow, informal practices become bottlenecks; advisory helps standardize operations, improve efficiency, and reduce waste.

- Businesses preparing for funding or capital markets — To attract investors or meet regulatory requirements, companies need credible reporting, strong governance, and financial preparedness. As many startups and MSMEs enter growth phases, advisory services help with investor readiness, capital structuring, and compliance.

- Founder-led companies seeking legacy and long-term sustainability — Family-owned businesses contribute about 70% of India’s GDP and employ 60% of the workforce. For these companies, advisory input on succession planning, culture preservation, leadership development, and modernization is essential to ensure sustainable growth across generations.

How to Choose the Right Business Advisory Firm

Selecting the right advisory partner can define how effectively your business overcomes challenges and seizes opportunities. Here are the key factors to consider:

- Domain and industry experience – An advisory firm familiar with your sector understands its unique risks, regulations, and opportunities. A healthcare business, for instance, requires different compliance insights compared to a tech startup.

- Breadth of services – A well-rounded firm should cover financial, strategic, operational, and digital needs instead of focusing narrowly on one area. This ensures holistic advice rather than piecemeal solutions.

- Track record and credibility – Case studies, client testimonials, and proven success stories demonstrate whether the firm can deliver tangible results. Evaluating their history with businesses of similar scale adds confidence.

- Alignment of values and philosophy – The right advisory firm should share your long-term vision, be transparent in its approach, and adopt a founder-first perspective. This alignment builds trust and smoother collaboration.

- Financial terms and capital access – Evaluate not only the cost of engagement but also how the firm can help you secure funding, connect with investors, or structure your capital efficiently for future growth.

- Support ecosystem – The best firms provide more than advice; they open doors to mentorship, peer communities, playbooks, and strategic networks that can accelerate business growth.

- Scalability and technology leverage – A strong advisory partner uses data-driven tools, automation, and digital platforms to deliver insights. This ensures their services grow with your business, rather than becoming outdated.

Common Challenges When Advisory Support Is Missing

Without professional advisory guidance, businesses often face hurdles that slow growth and increase risks. Some of the most common challenges include:

- Poor access to capital or expensive capital: Businesses without advisory support often struggle to present credible financials to investors. This leads to higher borrowing costs, limited funding options, or outright rejection from banks and VCs.

- Unstructured growth and inefficiencies: Rapid expansion without a clear strategy creates bottlenecks in operations, supply chains, and staffing. Over time, this results in wasted resources, rising costs, and customer dissatisfaction.

- Regulatory and compliance pitfalls: Many SMEs and startups overlook legal, tax, or regulatory obligations. This exposes them to penalties, disputes, and reputational damage that could have been avoided.

- Leadership and team challenges: Founder-led teams often lack structured succession planning or leadership development. This creates dependency on a few individuals, making it hard to sustain performance as the business scales.

- Being reactive rather than proactive: Without advisory insights, businesses often respond to problems after they occur rather than anticipating them. This reactive approach increases risks, slows innovation, and prevents long-term sustainability.

Why S45 Could Be Your Ideal Investment and Growth Partner

India’s capital markets offer immense opportunities, but making the right moves requires the right platform. S45club gives investors access to curated pre-IPO, listed equity, and alternative investments, enabling confident participation in India’s growth story.

What S45 Brings to the Table?

S45 Club offers a comprehensive suite of features designed to make investing seamless, transparent, and rewarding. Here’s how it supports investors in making informed, confident decisions:

- Exclusive access: Invest in pre-IPO, private, and alternative opportunities usually reserved for institutions.

- Smart technology: Manage, track, and analyze your portfolio in real-time through a seamless dashboard.

- Transparency & governance: Every opportunity is vetted to ensure compliance and investor protection.

- Community insights: Connect with investors, access expert analysis, and make informed decisions.

Why S45 Stands Out?

S45 is more than a marketplace; it’s a partner that supports long-term wealth creation. Its team of professionals brings deep expertise in capital markets and private equity, ensuring research-backed, sustainable strategies.

If you want to diversify your portfolio, access exclusive investments, and make informed, growth-oriented decisions, S45club is built for you. Sign up today to explore curated opportunities and start investing with confidence.

Also Read: How Revenue-Based Financing Works Explained

Conclusion

In today’s fast-changing markets, business advisory is not just a cost; it’s an investment in the long-term health and growth of your business. The right advisory partner provides the foundation for scalable, sustainable operations, helping you navigate risks, seize opportunities, and build a lasting legacy.

Evaluate your business needs carefully, assess advisory options, and with S45club, combine advisory expertise with exclusive access to pre-IPO, listed, and alternative investments. With a strong focus on governance, transparency, and long-term value creation, it positions itself as a trusted partner to help businesses and investors scale strategically in India’s dynamic market.

Join the S45club today and unlock a smarter way to participate in India’s dynamic capital markets.

Frequently Asked Questions (FAQ)

1. Do all businesses need an advisory firm?

While not mandatory, advisory support is especially beneficial for startups, SMEs, founder-led businesses, and companies preparing for funding or expansion. Advisory services help avoid common pitfalls, optimize operations, and scale sustainably.

2. How can business advisory services help with funding?

Advisory firms can prepare businesses for investor scrutiny, structure debt and equity efficiently, and connect companies with lenders or venture capitalists, improving access to capital at favorable terms.

3. How do I choose the right advisory firm?

Key factors include domain expertise, breadth of services, track record, alignment of values, ability to facilitate capital, support ecosystem, and the firm’s use of technology and data to scale services.

4. Can advisory services help reduce business risks?

Yes. Advisors provide frameworks for compliance, governance, financial management, and operational efficiency, helping businesses mitigate legal, financial, and operational risks.

5. How soon can I see results after engaging an advisory firm?

Results vary depending on your business stage and the areas addressed. Financial structuring, operational optimization, or strategic planning can show measurable improvements within months, while long-term growth and scaling benefits emerge over the years.