Steering an SME in India is no small task. You're balancing growth ambitions with constant challenges like limited access to finance, complex compliance requirements, and the pressure to scale without losing your entrepreneurial agility. These hurdles can slow progress and drain focus.

Yet SMEs remain the backbone of India's economy. There are over 63 million of them contributing nearly 30% to the GDP and driving close to half of the country's exports. Under the latest classification, a small enterprise can have investments of up to ₹25 crore and turnover up to ₹100 crore. In comparison, a medium enterprise can have investments of up to ₹125 crore and turnover up to ₹500 crore.

Behind these numbers are entrepreneurs turning ideas into impact every day. And right now, the landscape is shifting in your favor. Government reforms, global supply chain changes, and growing investor interest are opening new doors for SMEs that are ready to adapt.

In this guide, we'll explore the most pressing challenges holding SMEs back and the opportunities driving them forward so you can see exactly where to act and how to turn obstacles into growth.

TL;DR

- Why SMEs matter: With 63 million enterprises contributing nearly 30% to India’s GDP, SMEs are the backbone of India’s growth story. Their agility, innovation, and deep market reach make them central to the nation’s $5 trillion economy ambition.

- The biggest challenges: Many founders are navigating limited access to affordable finance, complex and evolving compliance demands, and the challenge of professionalizing operations without losing their entrepreneurial edge. These roadblocks can slow growth if left unaddressed.

- Opportunities and next steps: Government reforms, global supply chain shifts, and rising investor interest are creating new possibilities. Founders who strengthen financial planning, invest in governance, and explore new market linkages can position their businesses for sustainable, long-term growth.

SME Growth in India: Trends Every Business Leader Should Watch

Small and medium enterprises are not just part of India's economy; they are driving it forward. As the growth of the SME sector in the Indian economy accelerates, understanding what fuels this momentum has never been more critical.

Whether you are scaling operations, seeking new funding avenues, or exploring fresh markets, staying informed about the latest trends helps you make smarter, faster decisions. The following insights highlight where opportunities are emerging and how you can position your business to take advantage of them.

1. Track the right growth indicators

The SME Business Activity Index (SME-BAI) tracks production, sales, and service activity, offering a real-time pulse on sector performance. A reading above 50 signals expansion. In Q4 FY2025, the SME-BAI reached 57.7, reflecting strong demand and healthy operations.

The SME Business Outlook Index (SME-BOI) measures business sentiment and investment intentions. In Q4 FY2025, it stood at 60.3, indicating that SME founders are optimistic about the future and actively preparing for expansion.

2. Watch where growth is happening

Manufacturing remains a strong pillar for SMEs, with sectors like auto components, textiles, food processing, and engineering goods leading production. E-commerce is creating national and global opportunities for smaller enterprises, while technology-driven SMEs in fintech, logistics, and SaaS are scaling rapidly.

3. Learn from thriving clusters

Regional strengths continue to shape SME growth:

- Tamil Nadu leads in auto components and leather exports.

- Gujarat dominates textiles, chemicals, and diamond processing.

- Karnataka drives innovation through tech-focused SMEs.

These clusters show how utilizing local expertise can fuel competitive advantage.

4. Utilize digital tools, exports, and market expansion

Digital transformation is no longer optional. AI-powered supply chain management, cloud-based accounting, and e-invoicing tools are helping SMEs cut costs and operate more efficiently.

Exports remain a key growth driver. MSMEs contributed 45.73% of India’s total exports in 2023–24, with values rising from ₹3.95 lakh crore in 2020–21 to ₹12.39 lakh crore in 2024–25. Additionally, SME stock exchange listings are opening access to capital and improving market visibility.

These trends highlight not just the current strength of SMEs in India but also where the most promising opportunities lie. By focusing on the right areas, business leaders can position their enterprises for faster, more sustainable growth.

Opportunities Driving SME Growth in India

For founders, every challenge hides an opportunity waiting to be seized. In India today, small and medium enterprises can tap into a powerful mix of supportive policies, digital platforms, and strategic partnerships to accelerate growth and build resilience.

These factors are not just helping SMEs succeed; they are shaping India’s economic story. When ideas turn into action, SMEs become the driving force of progress for both their communities and the nation.

Policy & Government Support

- CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) enables collateral-free lending—both fund-based (like term loans) and non-fund-based (such as Letters of Credit and Bank Guarantees)—up to ₹10 crore per borrower, provided loans are based on project viability without requiring collateral.

- MCGS‑MSME (Mutual Credit Guarantee Scheme for MSMEs) was launched on January 29, 2025, offering a 60% guarantee from the National Credit Guarantee Trustee Company (NCGTC) on collateral-free loans up to ₹100 crore for purchasing plant and machinery. Borrowers must have Udyam registration and ensure at least 75% of the project cost is for equipment.

Fintech & Digital Platforms

- While around 90% of MSMEs accept online payments, just 18% use digital lending, highlighting a major growth opportunity in fintech-enabled financing.

- Fintechs like Lendingkart and Kinara Capital rely on AI and alternative data (such as GST filings, UPI flows, and e‑invoices) to underwrite loans, enabling fast, collateral-free access to working capital. Lendingkart alone has disbursed to over 1.3 lakh MSMEs, touching more than ₹1 billion in loans.

These fintech platforms are enabling first-generation entrepreneurs to access formal credit, often for the first time, reducing dependence on informal and costly financing. In fact, around 78% of UGRO Capital’s clients are first-time borrowers who have secured formal loans through fintech channels, helping them move away from informal and high-cost credit sources.

Export & Global Market Potential

- India’s MSME exports have soared from ₹ 3.95 lakh crore in 2020-21 to ₹ 12.39 lakh crore in 2024-25, reflecting their expanding role in both economic growth and global trade.

- Aligning with global demand and participating in PLI-linked export sectors opens significant revenue opportunities and accelerates the growth rate of the SME sector in India.

Sustainability & ESG-Driven Demand

Buyers increasingly expect ethical sourcing and environmentally conscious production. SMEs that embed ESG practices and local procurement can access premium markets and showcase the SME growth potential in India.

Clusters & Accelerators

Industry clusters offer shared infrastructure, mentorship, and business support, enabling SMEs to scale faster. These collaborative ecosystems are fuelling the growth of the SME sector in the Indian economy across different regions and sectors.

Founders who align with government programs, use fintech tools to ease funding, expand into export markets, adopt sustainable practices, and collaborate within industry clusters are better positioned to capture the real SME growth potential in India.

While the opportunities are significant, several challenges continue to hold back the full potential of SME growth in India.

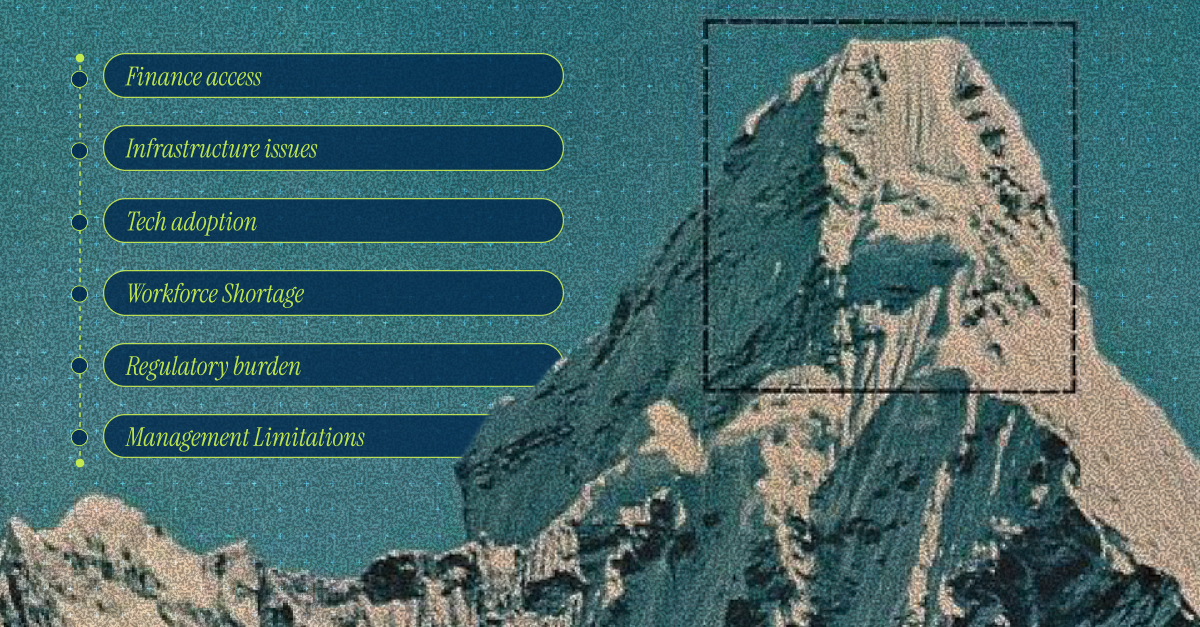

Challenges Hindering SME India Growth

While the SME sector in India has vast potential, several persistent hurdles continue to slow its progress and limit its contribution to the economy. These challenges span finance, infrastructure, skills, technology, and regulatory frameworks.

1. Limited Access to Affordable Finance

Many SMEs still struggle to secure timely and adequate funding from formal channels. Banks and financial institutions often require collateral and lengthy documentation, which smaller businesses may find challenging to provide. As a result, some rely on informal lenders, which raises borrowing costs and financial risk.

2. Inadequate Infrastructure

Insufficient transport networks, unreliable power supply, and limited access to quality warehousing increase operational costs and reduce competitiveness. For export-oriented SMEs, bottlenecks in port and customs processes further constrain market expansion.

3. Slow Technology Adoption

Although digital tools and automation can boost efficiency, many SMEs are hesitant or unable to invest in them. Barriers include high upfront costs, lack of awareness, and insufficient technical expertise, which together slow innovation and productivity growth.

4. Shortage of Skilled Workforce

Finding and retaining trained employees remains a challenge, particularly in manufacturing and specialised service sectors. Skill gaps reduce product quality, affect customer service, and make it harder for SMEs to scale operations effectively.

5. Regulatory and Compliance Pressures

Complex tax procedures, labour laws, and licensing requirements place a heavy administrative burden on SMEs. Smaller firms, which lack dedicated compliance teams, often spend significant time and resources navigating these regulations.

6. Managerial and Marketing Limitations

A large number of SMEs are owner-managed with limited access to professional management skills. This can restrict strategic planning, branding, and market outreach, making it difficult to compete with larger, better-resourced players.

While these hurdles can seem daunting, they can be overcome with the right guidance and resources. S45 partners with SMEs to address these challenges and seize the opportunities that drive sustainable growth.

How S45 Helps SMEs Tackle India’s Growth Challenges & Opportunities

At S45, we don't just work for you, we work with you. We're a community of founders, investors, and advisors who genuinely understand the realities of growing an SME in India. Our mission is simple: to empower businesses like yours with the right capital, playbook, and ecosystem to transform into lasting institutions.

1. Tailored Capital & Strategic Playbook

We offer capital solutions tailored to your business's stage and sector, paired with strategic guidance to strengthen governance, refine growth plans, and safeguard your legacy.

2. Support Through the Complexities of Capital Markets

Consider entering the capital markets or planning an SME IPO. We go beyond capital. S45 offers clear guidance to help you understand compliance frameworks, create effective funding roadmaps, and prepare for investor interactions. What might feel overwhelming becomes a clear, actionable path forward—with our support, you'll feel confident navigating every step.

3. A Founder-First Philosophy

Our founders-first philosophy runs deep. We believe SMEs are the heartbeat of India's economy, contributing around 30% of GDP and generating livelihoods for millions. We understand what it means to scale a business because we've done it ourselves, and we're here to help you scale too.

Through the S45 Club, you plug into a vibrant network of founders, investors, and mentors who've been in your shoes.

Conclusion

India’s SMEs are at a turning point. Global market shifts, supportive policies, and digital innovation are creating opportunities unlike any seen before. At the same time, challenges in funding, infrastructure, skills, and compliance remain, but they are not beyond reach.

The SMEs that will lead the way are those that plan strategically, embrace technology, invest in people, and build resilience into their operations. These businesses will not only grow but also help shape India’s economic story for years to come.

If you’re building an SME in India, you do not have to navigate this journey alone. S45 connects you with founders, mentors, and investors who have faced and overcome similar challenges. Visit the s45 club to tap into insights, networks, and strategies that can help you move from potential to lasting progress.

FAQs

1. What is driving SME India's growth today?

SME India growth is being fueled by government initiatives like CGTMSE and PLI, fintech-driven access to quick credit, digital adoption, and strong export performance. These factors are helping SMEs scale faster and compete globally.

2. What challenges slow down SME sector growth in India?

SMEs face hurdles such as limited access to affordable finance, complex and changing compliance rules, infrastructure gaps, and talent retention issues. Overcoming these is key to accelerating the growth rate of the SME sector in India.

3. How can SMEs benefit from government schemes?

SMEs can use collateral-free loans through CGTMSE, gain incentives under the PLI program, and join state-led cluster initiatives. These schemes directly support the growth of the SME sector in the Indian economy by improving access to capital and markets.

4. Why are exports important for Indian SMEs?

Exports account for nearly 45% of India’s total shipments, showcasing their vital role in scaling businesses. Expanding globally helps SMEs diversify revenue streams and strengthens the SME growth potential in India.

5. How does S45 support SME founders?

S45 provides tailored capital solutions, guidance for IPO readiness, and strategic mentoring. By connecting founders with experienced peers and investors, S45 helps you tap into opportunities in the SME growth market India with clarity and control.