Key Takeaways:

- Raising capital is crucial for scaling, expanding, or acquiring businesses; you need growth, working, or acquisition capital depending on your goals.

- Key options for raising capital include loans, equity from venture capitalists or angel investors, crowdfunding, and bonds.

- Debt and equity financing each have pros and cons; the right choice depends on your business’s financial health, stage, and control preferences.

- Startups go through distinct funding stages, from seed to IPO, each with specific capital needs.

- Established businesses use strategies like bank loans, private equity, and public offerings to fuel growth and expansion.

As a founder, how do you secure the capital needed to take your business to the next level? Capital raising is essential to fuel growth, whether you’re scaling operations, launching new products, or expanding into new markets.

You’ll need growth capital to expand, working capital to keep operations smooth, and acquisition capital for business purchases. Raising this capital can be overwhelming, with options like loans, equity from venture capitalists or angel investors, crowdfunding, or bonds.

The challenge is understanding which type of funding suits your goals and timing to align your strategy with your business needs.

In this blog, we’ll break down the different ways to raise capital, explore the benefits of each method, and provide actionable strategies tailored to both startups and established businesses.

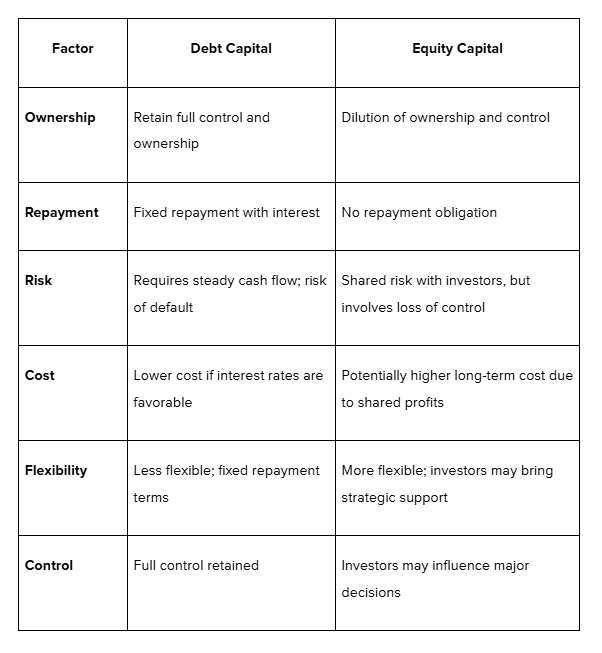

Choosing Between Debt and Equity: Which Option Works Best?

As of March 2025, India's MSMEs collectively held over ₹40.4 lakh crore in loans, reflecting a growing reliance on debt financing. When raising capital, businesses must choose between debt and equity, each offering unique benefits and challenges. The right choice depends on your financial health, growth stage, and long-term goals.

Debt capital involves borrowing money that must be repaid over time, often with interest, while equity capital involves selling ownership stakes in exchange for funding.

The decision comes down to your business’s financial health, growth objectives, and how much control you’re willing to share. Below is a breakdown of the pros and cons of each option:

As you start thinking about raising capital, it’s important to understand the different stages your business will go through. This helps you choose the right funding approach at each point.

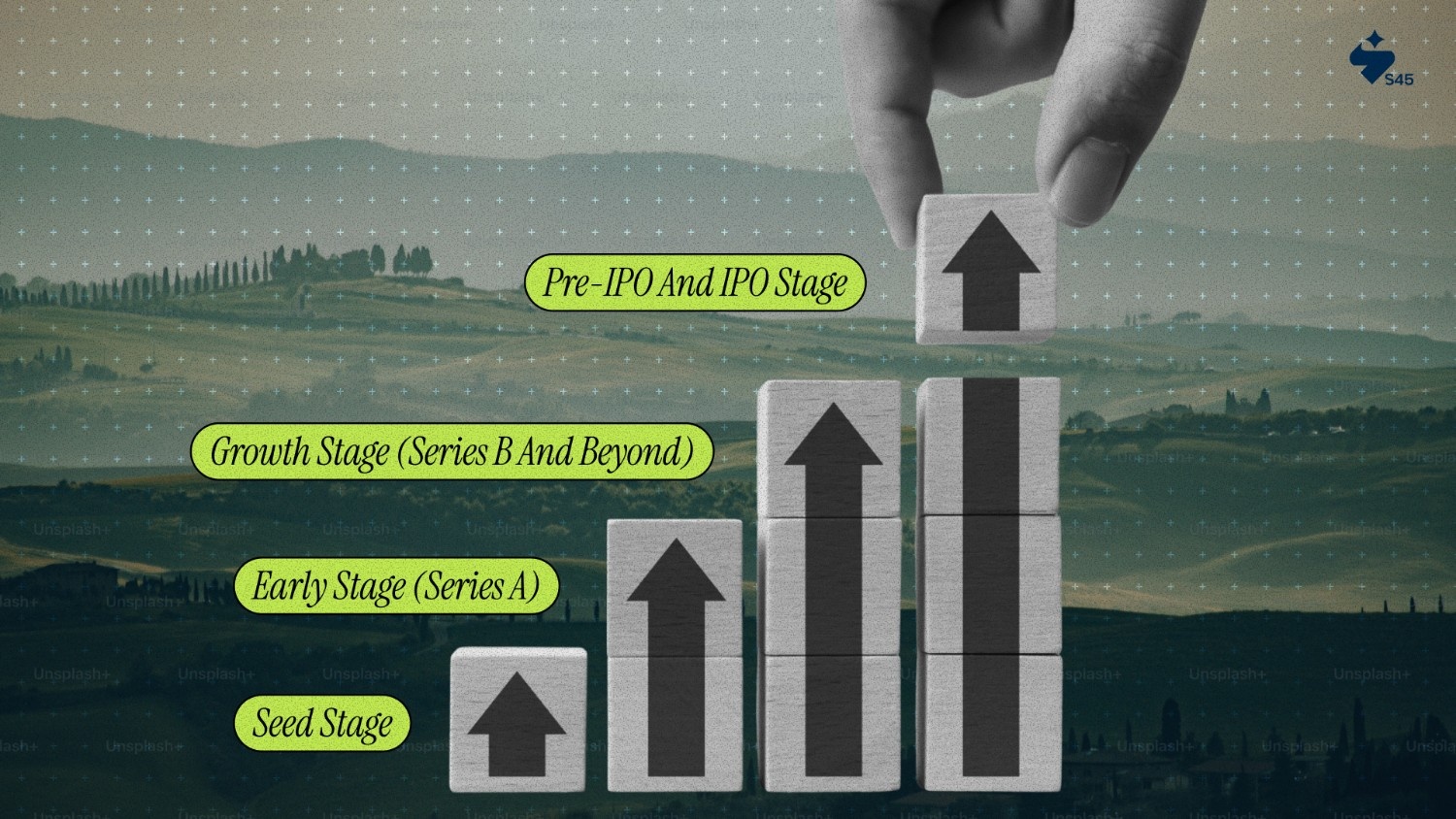

The Capital Raising Journey for Startups: Key Stages

Raising capital is a structured journey that evolves with the growth of your startup. Each stage serves a different purpose, helping the business scale, expand, and eventually reach the public markets. Here’s a concise breakdown of the stages:

1. Seed Stage

At this initial stage, the focus is on product development and market validation. Funding is used for building prototypes, conducting research, and setting up the business.

- Source of Funds: Angel investors, family and friends, crowdfunding.

- Amount Raised: ₹10 lakhs to ₹1 crore.

- Purpose: Product development, team building, and market testing.

2. Early Stage (Series A)

With a working product and market validation, Series A funding helps scale the business. This stage focuses on expanding the customer base and improving operations.

- Source of Funds: Venture capital firms, angel investors.

- Amount Raised: ₹1 crore to ₹10 crore.

- Purpose: Scaling operations and customer acquisition.

3. Growth Stage (Series B and Beyond)

The business has established a strong customer base and proven business model. Funding at this stage is used for rapid expansion and entering new markets.

- Source of Funds: Venture capital, private equity.

- Amount Raised: ₹10 crore to ₹100 crore.

- Purpose: Expanding operations and market reach.

4. Pre-IPO and IPO Stage

At this stage, the startup prepares for an IPO or large-scale exit, focusing on stabilizing operations and ensuring readiness for public markets.

- Source of Funds: Institutional investors, public offerings.

- Amount Raised: Varies significantly, often in the hundreds of crores.

- Purpose: Preparing for IPO and expanding market presence.

At S45, we help SMEs by providing access to capital, mentorship, and growth strategies. Our focus is to guide businesses through the capital raising journey, enabling them to scale and achieve sustained success in the Indian market.

Top Capital Raising Strategies for Startups

In 2024, Indian startups raised approximately ₹1,00,154 crore across 1,321 deals, reflecting a strategic shift towards quality investments over quantity. This trend underscores the importance of selecting the right capital raising strategy.

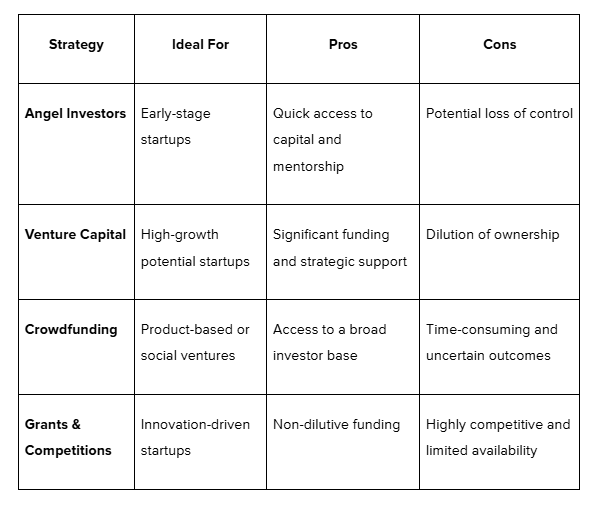

1. Angel Investors

Angel investors provide early-stage funding in exchange for equity, often bringing valuable mentorship and industry connections. They typically invest in startups that are in the ideation or early growth phase and are willing to take higher risks.

These investors offer more than just capital—they often become a trusted resource for guidance and networking.

Key Insights:

- Market Size: India hosts over 125 angel networks and syndicates, with more than 26,000 active angel investors

- Active Networks: Mumbai Angels, one of the most active platforms, has made over 185 investments, with an average ticket size between USD 70k and 272k.

2. Venture Capital (VC)

VC firms invest in startups with high growth potential in exchange for equity, typically during later seed or growth stages. They target companies with proven business models and the potential for rapid scaling.

VC investors bring significant financial resources and expertise, but they also demand a stake in the company’s strategic direction. This type of funding can fuel large-scale growth but at the cost of ownership dilution.

Key Insights:

- Funding Volume: In 2024, Indian startups secured ₹1,19,437 crore (approximately $13.7 billion) in VC funding, marking a 43% increase from the previous year.

- Investor Composition: A significant portion of this funding came from domestic capital, including family offices and small homegrown venture funds.

- Sector Focus: Fintech, enterprise tech, and deeptech sectors attracted substantial investments.

3. Crowdfunding

Crowdfunding platforms allow startups to raise small amounts of capital from a large number of people, typically via online platforms. This method is particularly effective for businesses with a product or idea that can generate public interest.

Key Insights:

- Platform Types: Debt-based crowdfunding currently generates the largest revenue, while equity-based crowdfunding is the fastest-growing segment.

- Usage Trends: Platforms like Milaap and Ketto have been instrumental in funding social causes and early-stage ventures.

4. Grants and Competitions

Government bodies, NGOs, and private organizations offer grants and organize competitions to fund innovation-driven startups without requiring equity. Competitions provide a non-dilutive funding option but can be highly competitive, with limited availability based on specific criteria or project alignment.

Key Insights:

- Government Initiatives: The Maharashtra government launched the 'CM Maha Fund' with a ₹500 crore corpus to distribute loans of ₹5-10 lakh to 25,000 selected entrepreneurs.

- International Support: Under the INDUS-X initiative, the U.S. and Indian governments announced seed funding of USD 1.2 million to ten firms in September 2024.

- Sectoral Focus: These funds often target deep tech, women-led startups, and socially impactful ventures.

Evaluating Capital Raising Options

Choosing the right capital source can make all the difference, here’s a quick comparison to help you decide.

For established businesses, raising capital can look quite different. You might be looking for larger, more structured funding sources to fuel expansion.

Capital Raising Strategies for Established Companies

For established businesses, capital raising is about securing the funds needed to expand, drive innovation, or pursue strategic goals. Here’s how each strategy can be leveraged:

1. Bank Loans and Lines of Credit

Bank loans and lines of credit provide predictable funding for established companies with stable financials. Loans are suitable for large capital needs, while lines of credit help manage short-term working capital.

These options allow businesses to retain full control but require a strong credit history and collateral.

2. Private Equity and Debt Financing

Private equity involves selling equity in exchange for capital and strategic support. Debt financing, on the other hand, lets companies raise capital without giving up ownership, but with repayment obligations.

Both options are ideal for larger funding needs, but private equity comes with the risk of losing some control, while debt requires steady cash flow for repayment.

3. Public Offerings

Public offerings, such as IPOs or secondary offerings, provide significant capital by accessing a wide pool of investors. While IPOs boost market visibility, they come with regulatory and compliance requirements.

Secondary offerings allow already-public companies to raise additional funds but dilute ownership further.

4. Strategic Partnerships

Strategic partnerships enable companies to access capital, resources, and market opportunities through joint ventures or co-investments.

These collaborations offer shared risks and rewards but require careful alignment of business goals and can limit operational independence.

When your business is ready to acquire other companies, the capital raising process shifts. Acquisitions require careful planning and funding strategies. Let’s dive into how to approach this with the right financial backing.

Raising Capital for Acquisitions: What You Need to Know

Acquisitions are a strategic growth approach, and securing the right funding is essential to making them successful. Here’s how you can raise capital for acquiring other businesses:

1. Financing an Acquisition

Raising capital for acquisitions typically involves a mix of debt, equity, and sometimes internal funds.

- Debt Financing: Loans are often used to finance acquisitions, with the acquired company’s assets acting as collateral.

- Equity Financing: Issuing shares to raise funds, though it may lead to dilution of ownership.

- Internal Funds: Using the company’s cash reserves or profits to finance the deal, which avoids additional debt or equity dilution.

2. Leveraged Buyouts (LBOs)

LBOs involve borrowing a significant amount of money to finance an acquisition, with the assets of the acquired company often securing the loan.

- Advantages: LBOs allow companies to make large acquisitions without using their own capital, enabling them to retain control while leveraging external financing.

- Considerations: The acquiring company takes on substantial debt, which can strain cash flow. If the acquired company’s performance falls short, it increases risk.

3. Seller Financing

Seller financing occurs when the company being acquired provides a loan to the buyer, allowing the acquisition to proceed with reduced upfront capital.

- Advantages: This option can speed up negotiations and reduce reliance on third-party financing.

- Considerations: Seller financing typically comes with higher interest rates than traditional loans and relies on the seller’s willingness to finance the deal.

4. Strategic Investors

Strategic investors provide funding either through equity or debt, seeing value in the acquisition's long-term potential.

- Advantages: These investors bring not just capital but valuable market knowledge.

- Considerations: Finding investors who share the same vision for the acquisition can be difficult, and the alignment of interests is crucial for success.

How S45 Supports Founders in Building Lasting Success

Securing capital is just the beginning. True business growth requires a partner who understands your goals and provides the strategic guidance necessary to scale effectively. That’s where S45 steps in.

- Innovation-Driven Legacy: We believe the best legacies are built through innovation, not shortcuts. Our mission is to help you create a business that stands the test of time.

- True Partnership, Not Just Investment: At S45, we don’t simply provide funding; we walk alongside you. We offer both financial support and expert advice to help you navigate the complexities of growth and scaling.

- A Collaborative Community: We connect you with a network of founders, where insights are shared, challenges are tackled together, and wins are celebrated collectively. It’s about growing stronger together.

- Built on Trust: Trust is the cornerstone of everything we do. Our relationships are based on transparency and mutual success, ensuring that our partnership is one that lasts.

- Focus on Sustainable Growth: We focus on long-term, meaningful growth rather than short-term wins. Our goal is to help you build a business with enduring value.

Conclusion

Raising capital is a pivotal step in scaling your business, but it’s only the beginning. Whether you opt for debt, equity, or other funding sources, the key is aligning the right strategy with your business's goals and growth stage. With the right capital and the right guidance, businesses can unlock their full potential and achieve sustainable success.

At S45, we understand that securing capital is just the start of your journey. Beyond funding, we offer the expertise, network, and strategic support needed to help you scale effectively.

By partnering with us, you can confidently navigate the complexities of capital raising and build a business with lasting value.

Frequently Asked Questions

Q: What’s the difference between seed funding and Series A?

A: Seed funding focuses on product development and market testing, while Series A funding is used to scale operations, expand customer acquisition, and refine the business model. Seed funds typically come from angel investors, while Series A usually attracts venture capital.

Q: How do I know when my startup is ready for an IPO?

A: Your startup is ready for an IPO when you have a proven business model, consistent revenue growth, and a large enough market share. You’ll also need strong financials and a management team capable of handling the complexities of being a public company.

Q: Can I raise capital without giving up equity?

A: Yes, through debt financing, such as bank loans or lines of credit, you can raise capital without losing ownership or control. However, this comes with the obligation of repaying the loan with interest.

Q: What are the risks of relying too much on debt financing?

A: Over-relying on debt can strain cash flow, especially if your business faces downturns or revenue fluctuations. Failing to meet repayment obligations can lead to penalties or even bankruptcy, jeopardizing your business assets.

Q: How do strategic partnerships help in capital raising?

A: Strategic partnerships provide access to capital, resources, and expertise from larger companies. These partnerships can also open doors to new markets, but they often require shared decision-making and alignment of business goals.