Key Takeaways:

- Advisory boards provide expert insights and recommendations without the legal responsibilities and voting powers of a board of directors.

- You can structure advisory relationships informally, compensate through equity or fees, and modify the composition as your needs evolve.

- Fill critical knowledge gaps in areas like international markets, technology, or industry-specific challenges through targeted advisor selection.

- Advisory board members often become your best source of introductions to potential customers, partners, investors, and talent through their professional networks.

- Start small with 3-5 advisors and expand based on your specific business challenges and growth stage requirements.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

According to recent data, more than 120,000 startups have been registered across India in the past decade, establishing the country as the world's third-largest startup ecosystem. The most successful of these businesses know how to access the right expertise at the right time.

If you've built your company past the initial startup phase, you know that scaling brings new challenges. The decisions get more complex, the stakes get higher, and suddenly you need knowledge in areas you've never dealt with before. That’s where a business advisory board comes in.

In this guide, we walk you through step-by-step on building a business advisory board that gives you access to senior expertise without losing control of your business. You'll learn how to find the right advisors, structure these relationships properly, and get real value from external guidance while keeping full decision-making power in your hands.

What Is a Business Advisory Board?

A business advisory board is a group of external experts who provide strategic guidance and advice to your company's leadership team. Unlike a board of directors, advisory board members don't have voting rights, legal responsibilities, or financial obligations to your company.

Think of them as your personal expert network. These are seasoned professionals who've gone through similar challenges and can offer insights, connections, and perspective when you need it most. They're there to help you make better decisions, not to make decisions for you.

For example, if you're an Indian manufacturing company planning to expand into European markets, your advisory board might include someone with EU regulatory expertise, a supply chain specialist, and a former executive who's successfully established operations across multiple countries. Each advisor brings specific knowledge that would take you years to develop internally.

The key advantage is flexibility. You can structure these relationships however works best for your business, whether that's quarterly meetings, monthly check-ins, or project-based consultations based on your immediate needs.

Let's take a detailed look at why business advisory boards have become essential for Indian companies ready to scale.

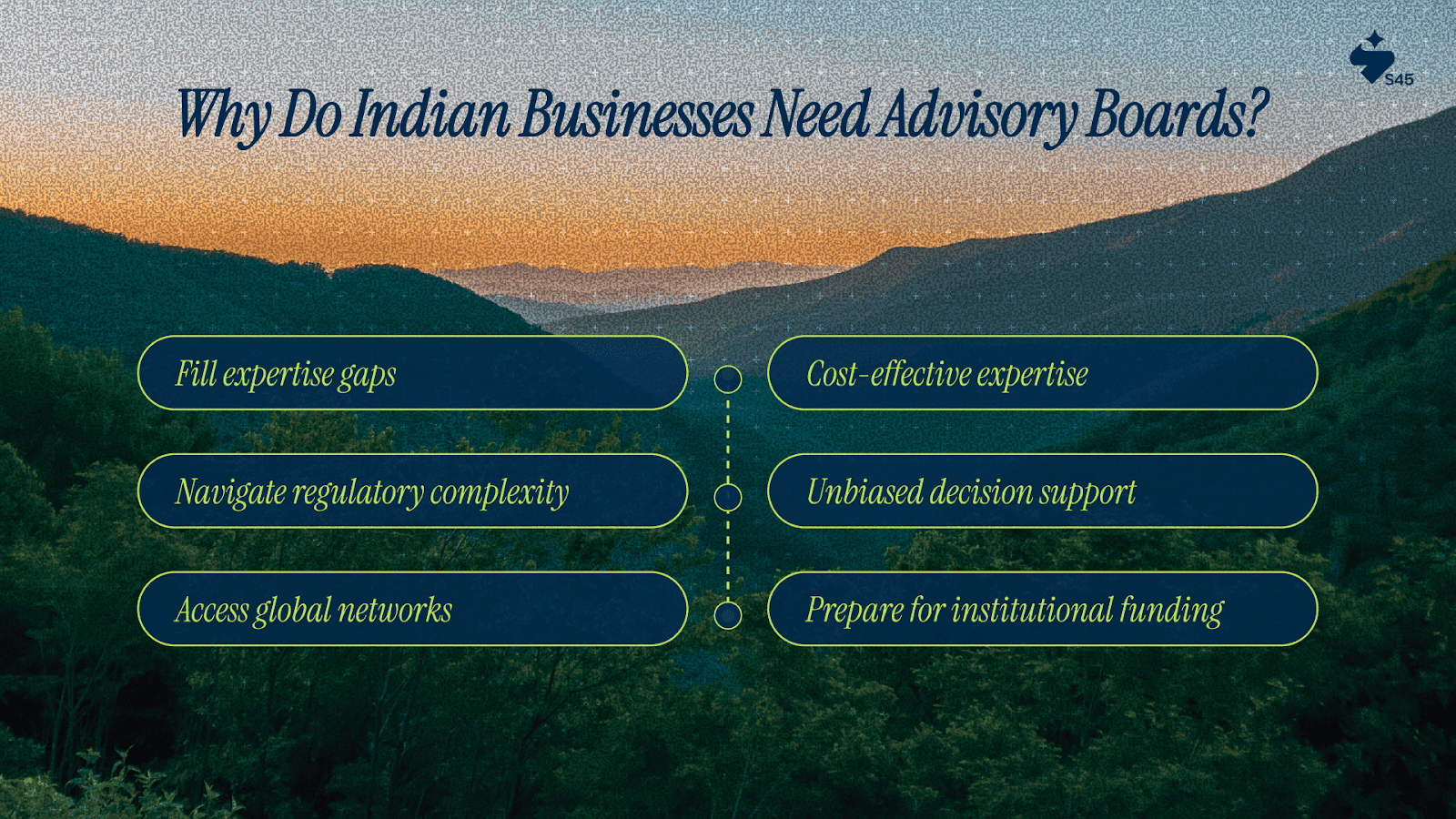

Why Do Indian Businesses Need Advisory Boards?

Growing businesses often need specialized expertise that's expensive to hire full-time but crucial for making smart decisions.

Here's why advisory boards have become essential for scaling Indian companies:

- Fill expertise gaps: Most founders excel in their core domain but need support in areas like digital marketing, international compliance, or modern financial structures.

- Navigate regulatory complexity: India's evolving regulatory landscape requires specialized knowledge, especially for businesses expanding across states or internationally.

- Access global networks: Advisory board members can provide introductions to international markets, customers, and partners that would otherwise take years to develop.

- Cost-effective expertise: Getting C-level guidance through advisors costs a fraction of hiring full-time executives, especially in specialized areas you might only need periodically.

- Unbiased decision support: Family businesses and founder-led companies often benefit from external perspectives that aren't influenced by internal politics or emotional attachments.

- Prepare for institutional funding: Advisory boards help professionalize your business and demonstrate governance maturity to potential investors or partners.

Tip: Manufacturing, technology, and service businesses particularly benefit from advisory boards when they're ready to modernize operations, enter new markets, or adopt new business models that require expertise beyond their current team.

Ready to build your own advisory board but not sure where to start? S45 specializes in helping Indian entrepreneurs handle these exact challenges, providing the strategic guidance and network access you need to scale sustainably.

Now, before you start building an advisory board, it's important to know how they differ from boards of directors.

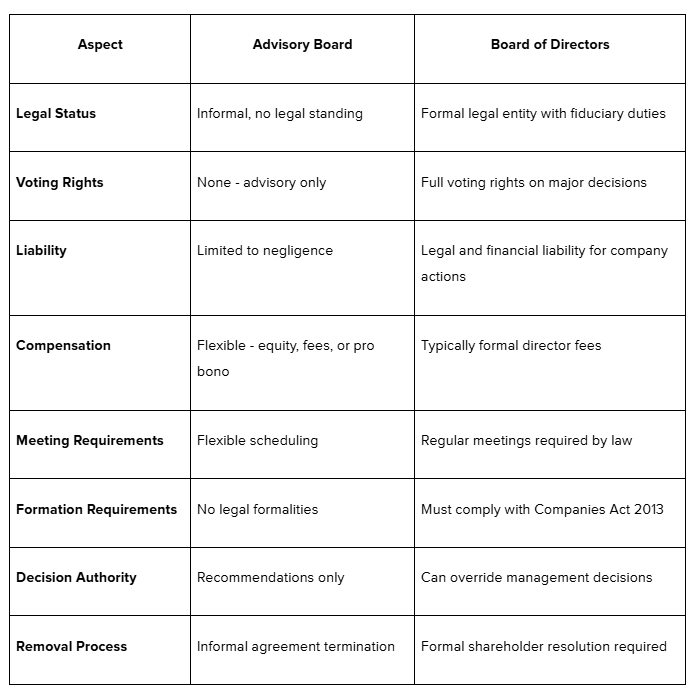

Business Advisory Board vs. Board of Directors

The differences between advisory boards and boards of directors are significant and affect how you structure relationships with external experts:

Here’s how you can decide which option suits you the best:

When To Choose Advisory Boards

You're a growing business that needs expertise and guidance but wants to maintain full control over decisions. Perfect for companies between INR 50-200 crores that aren't ready for formal governance structures.

Advisory boards work well when you need flexible access to senior expertise without the overhead and formality of legal governance structures.

When To Consider A Board Of Directors

You're seeking significant external investment, have complex shareholder structures, or operate in heavily regulated industries where formal oversight is required.

Most successful companies start with advisory boards and transition to formal boards as they mature. This allows you to test relationships, refine your governance needs, and build confidence in external oversight before committing to formal structures.

With these considerations in mind, here's exactly how to build an advisory board that delivers real results for your business.

How to Build an Effective Business Advisory Board?

Creating an effective advisory board requires strategic thinking and careful execution. The best advisory boards focus on specific challenges rather than general business guidance. Here's a step-by-step approach to follow:

1. Define Your Specific Needs

Start by identifying the 2-3 biggest challenges or opportunities facing your business in the next 18-24 months. Most growing companies need help in areas like market expansion, operational scaling, or technology adoption.

Be specific about what you need. Instead of "marketing help," think "digital marketing for B2B manufacturing" or "brand building in international markets." This specificity helps you identify the right advisors and set clear expectations for what you want to achieve.

Map these challenges to the types of expertise you need. For instance, if you're planning international expansion, you might need regulatory expertise, market entry experience, and supply chain knowledge.

2. Identify and Recruit the Right Advisors

The best advisors have successfully navigated challenges similar to yours. They bring both functional expertise and practical experience from relevant contexts.

Look for people in these categories:

- Former executives: People who've held senior roles at companies in your industry or adjacent industries and dealt with similar scaling challenges.

- Successful entrepreneurs: Founders who've scaled businesses through growth stages similar to yours and can share practical insights about common pitfalls and opportunities.

- Functional experts: Specialists in areas like finance, technology, international business, or regulatory compliance who can provide deep domain knowledge.

- Industry veterans: People with extensive networks and market knowledge who can open doors and provide strategic introductions.

Start with your existing network, including customers, suppliers, and professional connections. Industry associations, conferences, and professional platforms can help you identify potential advisors beyond your immediate circle.

When approaching potential advisors, be clear about what you're asking for and what you can offer in return. Most experienced professionals appreciate direct, specific requests rather than vague invitations to help out.

3. Structure Clear Expectations

Create a simple one-page document that outlines the advisory relationship. This doesn't need to be a formal contract, but it should cover key points to avoid misalignment later.

Include these elements:

- Time commitment: Typically 8-12 hours per quarter, including meeting preparation and follow-up conversations.

- Meeting frequency: Most effective advisory boards meet quarterly, with ad-hoc consultations as needed for urgent decisions.

- Specific areas: Define the domains where you're seeking guidance, such as international expansion, technology strategy, or operational efficiency.

- Compensation structure: This might be equity, cash fees, or pro bono depending on the relationship and advisor's preferences.

- Duration: Most advisory relationships work best as 2-3 year commitments, allowing time to build deep knowledge of your business.

Clear expectations help both parties commit appropriately and measure the value of the relationship over time.

4. Keep It Small and Focused

Start with 3-5 advisors maximum to maintain focus and manageable coordination. Too many voices create confusion and make meetings difficult to manage effectively.

Choose advisors whose expertise complements each other rather than overlaps. For example, if you're expanding internationally, you might want one advisor with regulatory expertise, another with market entry experience, and a third with operational scaling knowledge.

You can always add more advisors as your needs evolve, but starting small allows you to refine your approach and build confidence in managing advisory relationships.

5. Run Effective Advisory Meetings

The quality of your advisory meetings determines how much value you get from the relationship. Most founders waste advisory time with lengthy business updates instead of focusing on specific decisions or challenges.

Follow these practices for productive meetings:

- Send materials in advance: Share relevant documents, financial summaries, and specific questions 48-72 hours before meetings so advisors can prepare thoughtfully.

- Focus on specific challenges: Dedicate each meeting to 1-2 major decisions or challenges rather than general business reviews.

- Limit updates: Keep general business updates to 15 minutes maximum, then spend most of the time on substantive discussion.

- End with clear actions: Conclude each meeting with specific next steps, both for you and any follow-up from advisors.

The most effective advisory boards become ongoing strategic partners rather than occasional consultants. Invest in these relationships and they'll help you avoid mistakes while accelerating growth.

However, not all advisors deliver the same value. Here's what makes some advisors truly effective for your business.

What Makes Advisory Board Members Valuable?

The best advisory board members bring specific qualities that multiply your business impact beyond just having impressive resumes or industry connections.

Look for these qualities when selecting advisors:

- Pattern recognition: Advisors who've navigated similar challenges can spot problems early and suggest solutions based on actual experience, not theory.

- Strategic networks: They know the right people and make meaningful introductions to customers, partners, or specialists that would take you months to find.

- Complementary expertise: Choose advisors whose skills fill gaps in your current team rather than duplicating what you already know well.

- Industry credibility: Their reputation enhances your company's credibility with customers, partners, and potential investors through association.

- Objective perspective: They ask uncomfortable questions and challenge assumptions because they're not emotionally attached to past decisions.

- Unique contributions: Each advisor should bring something different to avoid redundancy and maximize the range of perspectives available.

Once you know how to select the right advisory board, learning from common pitfalls also becomes essential.

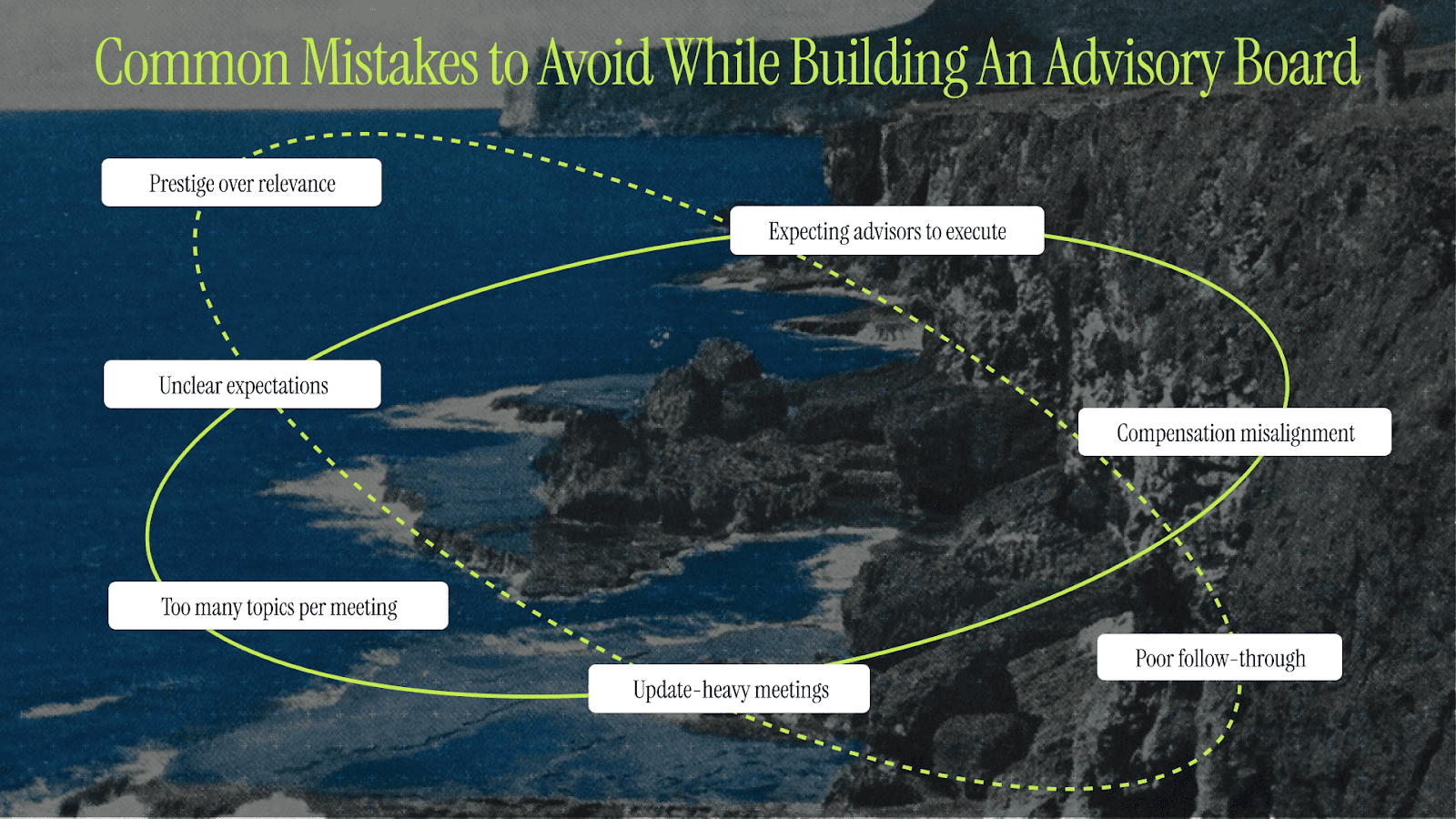

Common Mistakes to Avoid While Building An Advisory Board

Many entrepreneurs make predictable mistakes when building advisory boards that waste time and create frustration for everyone involved. Avoid these common pitfalls:

- Prestige over relevance: Choosing famous names instead of people with specific expertise relevant to your current challenges and growth stage.

- Unclear expectations: Failing to define time commitment, meeting frequency, compensation, and specific areas where you need guidance.

- Too many topics per meeting: Trying to cover everything instead of focusing each meeting on 1-2 specific challenges or decisions.

- Update-heavy meetings: Spending most advisory time on business reports rather than strategic discussion where advisors add unique value.

- Poor follow-through: Not implementing agreed-upon next steps or failing to act on advisor recommendations, which signals you don't value their input.

- Compensation misalignment: Offering inappropriate compensation that either creates unrealistic expectations or suggests you don't value their contribution.

- Expecting advisors to execute: Assuming advisors will solve problems for you rather than provide guidance, connections, and perspective for your decisions.

Advisory boards have become essential tools for growing companies that want to scale systematically while maintaining founder control. The difference between companies that successfully navigate growth challenges and those that plateau often comes down to access to the right expertise at the right time.

Get the Best Advisory Support to Grow Your Business

The most successful Indian entrepreneurs recognize that building a business from INR 50 crores to INR 500+ crores requires different skills, networks, and perspectives than reaching the first milestone. Advisory boards provide that crucial additional capability.

S45 works with Indian entrepreneurs who are serious about building sustainable, scalable businesses. Here are some of the different ways our community can help you:

- Seasoned network access: Connect with advisors who've actually scaled businesses through similar growth stages and challenges.

- Proven growth strategies: Access tested playbooks for international expansion, operational efficiency, and market development that work in the Indian context.

- Strategic partnership guidance: Get introduced to the right investors and partners through relationships built over years of successful business building.

- Business structure development: Build advisory boards and formal structures that prepare you for institutional partnerships while maintaining founder control.

- Legacy-focused scaling: Grow your business sustainably while preserving the values and practices that made you successful in the first place.

Whether you're planning to professionalize operations, enter new markets, or prepare for institutional partnerships, we guide you through building the right support ecosystem for your specific situation and goals.

Ready to take your business to the next level with the right advisory support? S45 connects you with seasoned advisors who've navigated these challenges successfully. Connect with us to start building your advisory board today.

FAQs

1. What's the typical compensation for advisory board members?

Compensation varies widely from 0.1-1% equity for startups to INR 50,000-2,00,000 per quarter for established companies. Many advisors also work for interesting opportunities or strategic relationships that provide other value.

2. How often should advisory boards meet?

Quarterly meetings of 2-3 hours work best for most businesses. This provides regular touchpoints without overwhelming time commitments. Add individual consultations as needed for urgent decisions between formal meetings.

3. Can advisory board members also be customers or suppliers?

Yes, but manage potential conflicts carefully. Customer-advisors can provide valuable market insights, while supplier-advisors bring operational expertise. Ensure transparency and avoid situations where advice might be biased by business relationships.

4. What's the difference between advisors and consultants?

Advisors provide ongoing strategic guidance and relationship-based support, while consultants typically focus on specific projects or problems. Advisors are invested in long-term success; consultants deliver defined outputs within specific timeframes.

5. How long should advisory board relationships last?

Most effective advisory relationships span 2-3 years, allowing time to build deep knowledge of your business and deliver meaningful value. Common shifting points include major business milestones or significant strategy changes.