TL;DR

- Phantom Shares offer businesses an innovative way to reward employees without issuing actual equity.

- Key Benefit for MSMEs: Attract, retain, and motivate top talent while preserving ownership control.

- No Dilution: Phantom shares offer financial benefits similar to stock options, without relinquishing ownership.

- Tailored for Growth: Ideal for MSMEs seeking sustainable scale and team incentives without immediate ownership implications.

- S45’s Support: Learn how S45 helps businesses structure phantom share plans that align with their growth and legacy goals.

As an MSME founder, you know the importance of building a motivated and invested team, but offering equity to employees can be tricky. Phantom shares provide a strategic solution, allowing you to reward employees with a stake in the company’s success without giving up ownership.

However, understanding how phantom shares work, the benefits they offer, and how to implement them effectively can be a challenge for many businesses. Platforms like s45club help businesses scale sustainably, offering guidance on innovative solutions like phantom shares to align your team with long-term growth goals.

In this blog, we’ll explore what phantom shares are, why they matter, and how MSMEs can use them to foster innovation and legacy-building.

What Are Phantom Shares?

Phantom shares are a form of compensation that gives employees the benefits of stock ownership, such as financial payouts, without giving them actual equity or ownership in the company. Phantom shares are also known as "shadow stock" because they mirror the value of actual company stock, typically based on the company’s share price.

Here’s a breakdown of how phantom shares work:

- Cash Payouts: Instead of receiving real shares, employees receive a cash payment equal to the value of a specified number of shares, typically upon meeting certain performance milestones or after a set period.

- Vesting: Just like stock options, phantom shares are subject to a vesting schedule, meaning employees have to stay with the company for a certain period before they can claim the payout.

- No Ownership Transfer: There’s no transfer of actual stock ownership, which means there’s no dilution for the founders or existing shareholders.

In simple terms, phantom shares offer employees the benefit of stock options without impacting the company’s equity structure, making them an ideal option for MSMEs seeking to incentivize employees without relinquishing control.

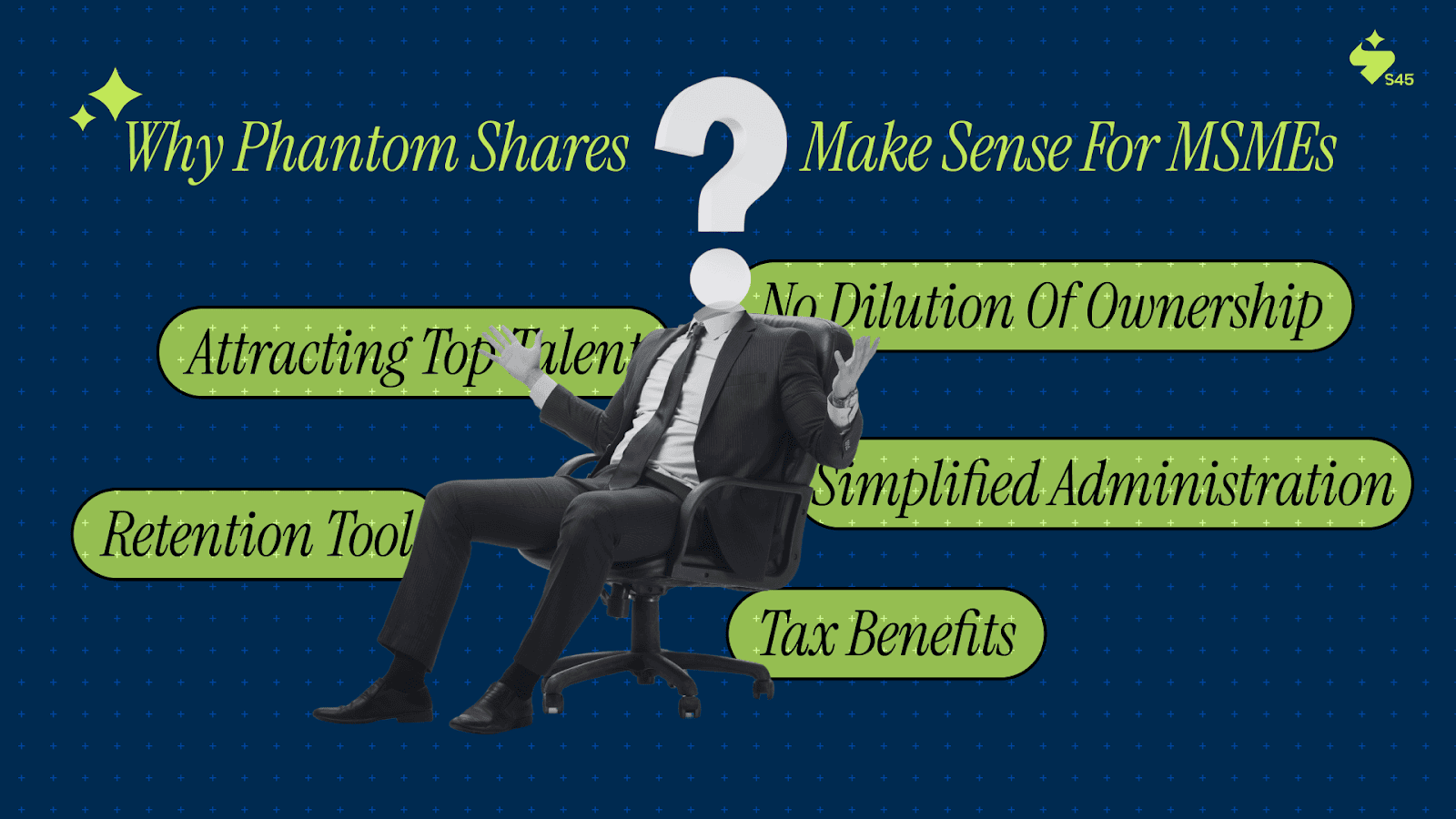

Why Phantom Shares Make Sense for MSMEs

For founders of MSMEs, attracting and retaining top talent is essential for scaling the business. However, offering equity in a small or growing company may not always be feasible or desirable. Here’s why phantom shares are the right fit for your business:

1. No Dilution of Ownership

One of the primary concerns for founders when offering stock options or equity to employees is dilution. By offering phantom shares, you retain full ownership of your company, as there is no transfer of actual equity. This allows you to motivate your employees financially while maintaining control.

2. Attracting Top Talent

As an MSME, you might not be able to offer the same salaries or benefits as larger companies. Phantom shares allow you to offer a competitive long-term incentive that can help attract high-quality talent who are looking for more than just a paycheck.

3. Retention Tool

Phantom shares can be structured with a vesting period, which encourages employee loyalty. Employees will need to remain with the company to realize the full value of their phantom shares, ensuring they stay motivated and aligned with the company's long-term goals.

4. Simplified Administration

Unlike stock options or other equity-based compensation plans, phantom shares do not require the issuance of actual shares, and therefore, do not require a formal share issuance process. This makes them easier to administer, particularly for smaller companies that may not have the resources to manage complex equity plans.

5. Tax Benefits

For employees, phantom shares are typically taxed when the payout is received (at the time of vesting or triggering events), similar to other forms of income. For the company, there are no additional equity issuance-related expenses or tax obligations, making it a cost-effective way to incentivize employees.

Taken together, these advantages show why phantom shares are a key strategy for growth. But to unlock their full value, it’s important to know when and how they fit best into your business model.

When to Use Phantom Shares in Your Business?

Phantom shares are particularly suited to startups or privately held businesses that need to retain talent but cannot afford to give away equity at an early stage. Here are a few scenarios where phantom shares might be the right fit:

- Startup or Private Company: If your company is in its early stages and you don’t want to dilute ownership, phantom shares allow you to keep a motivated team without giving away equity.

- Key Employee Retention: For high-performing employees who are crucial to the business’s success, phantom shares can serve as a powerful retention tool.

- Liquidity Events: Phantom shares are a great way to provide employees with a payout upon a future liquidity event, such as a sale or IPO, without disrupting the company’s existing equity structure.

In these scenarios, phantom shares offer a clear advantage, giving employees skin in the game while protecting the company’s future and ownership integrity.

Tax Implications of Phantom Shares

Like other compensation plans, phantom shares come with their own tax implications that you’ll need to manage carefully. Typically, employees are taxed on the payout they receive when phantom shares are cashed out, either at the time of the liquidity event or when they are paid out.

- For the Company: The company must account for the liability of the phantom shares on its balance sheet until the payout is made.

- For Employees: Employees are generally taxed on the phantom shares as ordinary income when they receive the payout, based on the market value at the time of settlement.

Careful structuring and advice from financial professionals can help minimize any potential tax burdens for both your company and employees, ensuring that the program remains an attractive incentive.

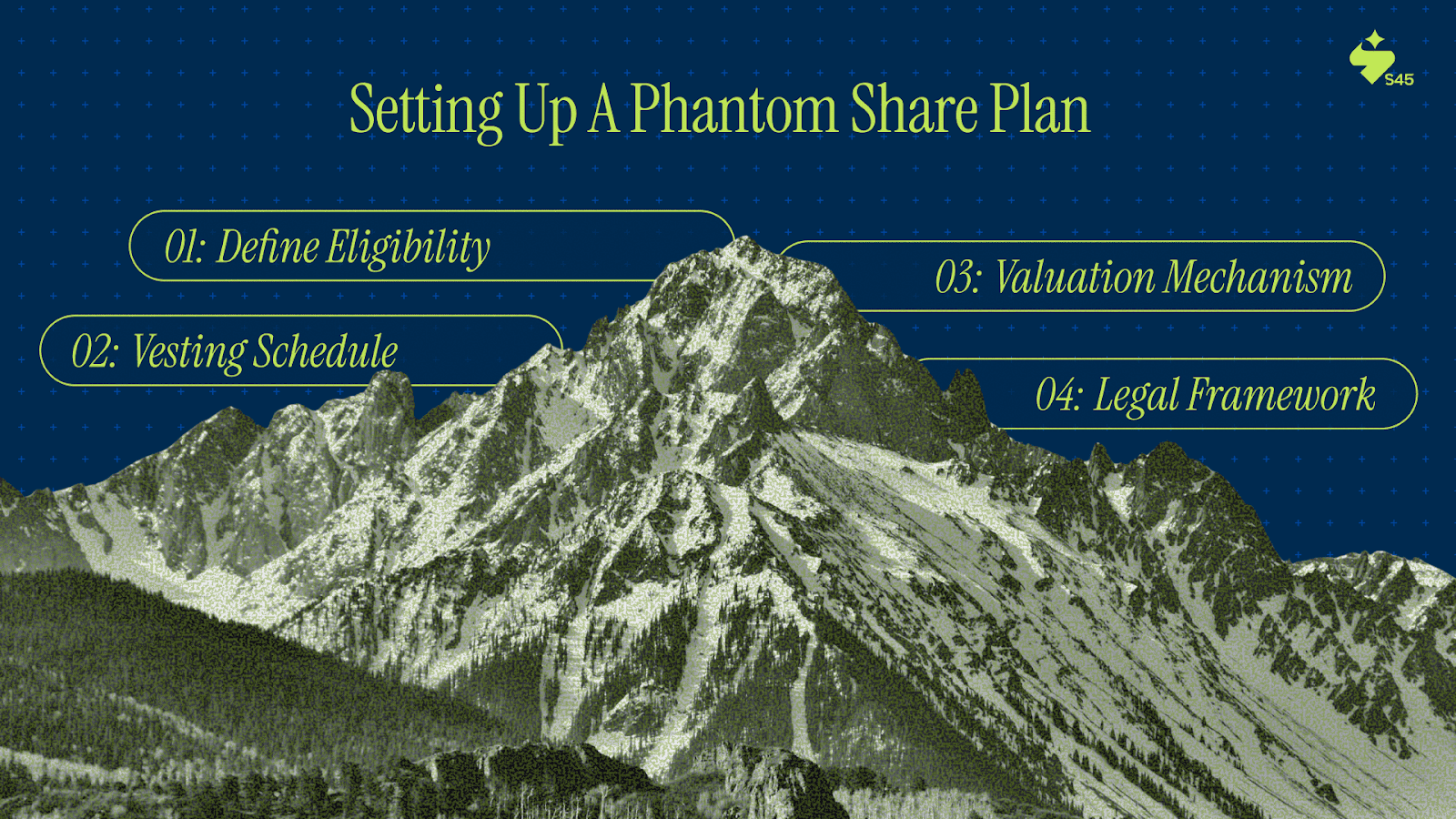

Next Step: Setting Up a Phantom Share Plan

Setting up a phantom share plan requires careful planning and legal structuring. Here are the key steps to consider:

- Define Eligibility: Determine which employees or groups will be eligible for phantom shares.

- Vesting Schedule: Establish a vesting schedule that aligns with your long-term goals.

- Valuation Mechanism: Ensure a clear and transparent valuation mechanism is in place to calculate the payout.

- Legal Framework: Consult with legal and financial advisors to ensure compliance with tax laws and employment regulations.

At s45 Club, we help founders handle these complexities, offering expert guidance on structuring phantom share plans that align with your company’s growth trajectory.

Conclusion

For MSMEs looking to scale sustainably and drive long-term growth, phantom shares offer an innovative way to incentivize employees without sacrificing ownership. By aligning employee interests with company success, phantom shares provide a strategic solution to attract, retain, and motivate top talent. However, it's important to carefully structure these plans to ensure clarity and fairness for both founders and employees.

S45 Club understands MSME founders' specific issues and provides personalized counsel on compensation strategies like phantom shares. Our method combines finance access with the coaching you need to handle challenging growing and retention challenges while maintaining control of your firm.

Ready to learn more about how phantom shares can support your growth strategy? Reach out to S45 Club today to explore how we can help you design the right incentives to drive success and build lasting value.

FAQs

Q: How are phantom shares different from stock options?

A: Phantom shares provide employees with the value of company stock without giving them actual shares. Stock options give employees the right to purchase shares at a predetermined price.

Q: Can phantom shares be offered to all employees?

A: Phantom shares can be offered to any employee or group of employees based on the company’s objectives. Typically, they are granted to key employees or leadership teams.

Q: What happens if the company doesn’t experience a liquidity event?

A: If no liquidity event occurs, phantom shares may remain as a liability on the company’s balance sheet. Some plans provide for payouts based on internal valuations, even if no external liquidity event happens.

Q: Are phantom shares a good option for all types of companies?

A: Phantom shares are ideal for startups and private companies that want to retain employees and incentivize growth without issuing real equity. They can also be beneficial for companies preparing for a future exit.