In today's market, more capital is flowing, but not always toward businesses focused on long-term discipline and operational strength. In 2024, venture capital investments in India rose by 43 percent to $13.7 billion, with much of it directed at SaaS, fintech, and consumer tech startups. For founders building in manufacturing, B2B services, or traditional sectors, this raises a critical question: how do you attract the right kind of funding without compromising control or long-term value?

For growth-stage SMEs, the goal is not just rapid expansion. It is about sustainable growth that strengthens governance, improves margins, expands market reach, and prepares the business for outcomes like capital markets or succession planning, all while maintaining operational focus. Venture capital, when aligned with these priorities, can be a powerful enabler.

This guide explains how venture capital works, what it offers, what it expects in return, and how to evaluate if it is the right path for your business. It also outlines how to prepare structurally and strategically so that growth remains both meaningful and sustainable.

TL;DR (Key Takeaways)

- Venture capital provides large funds and strategic guidance for fast scaling.

- Bootstrapping retains full ownership but limits growth speed.

- Angel investors offer mentorship with smaller funding rounds.

- Bank loans keep ownership intact but add repayment pressure.

- Crowdfunding suits B2C products, while revenue-based financing works for steady sales models.

What is Venture Capital?

Venture capital is a form of private equity financing provided to businesses with strong growth potential. Instead of taking on debt, businesses raise capital from institutional investors or venture capital firms in exchange for a minority equity stake. This capital helps them expand operations, enter new markets, or strengthen their infrastructure without relying solely on retained earnings or bank loans.

Unlike traditional financing, venture capital comes with active involvement. Investors bring more than just money. They offer strategic guidance, governance insight, and access to networks that help scale responsibly. For growth-focused businesses, this partnership can accelerate progress while building long-term enterprise value.

How Venture Capital Process Works?

Venture capital is typically deployed in phases, each tied to a different stage of business maturity. Here's how it generally unfolds:

- Seed Stage: Capital is invested to validate ideas, develop prototypes, or conduct market research. This stage is less common for established SMEs but relevant for new verticals or innovations within a growing business.

- Early Stage: Businesses that have proven demand begin to scale operations, build teams, and enter the market with greater structure and momentum. This is often where high-performing SMEs first engage with venture capitalists.

- Growth Stage: Capital is used to expand nationally or internationally, enhance infrastructure, invest in technology, or prepare for public markets. Governance and strategic alignment become critical at this point.

Each stage represents a different type of venture capital financing. The expectations, investor involvement, and business readiness vary with each phase. Choosing the right time and the right partner is essential to making venture capital work for your business.

Strong funding partnerships build confidence to aim higher. Many Indian founders now wonder if venture capital fits their sector. Understanding the current funding market in India will bring more clarity.

Venture Capital in India: Present Scenario

India's venture capital market will continue to grow in 2025. In the first four months alone, VC funding rose 20% compared to late 2024, with deal volumes up by 19%. It reflects rising investor confidence in the country's growth potential.

Sectors like consumer tech, software, and fintech attract most funds. Three known companies raised strong funding recently:

- Raphe mPhibr secured $100 million for drone manufacturing expansion.

- Simple Energy raised $20 million in Series A to boost electric scooter production.

- Arteria Technologies raised ₹100 crore to strengthen its SaaS-fintech supply chain solutions.

The opportunities are vast. Manufacturing firms in EV components, precision engineering, defence, and advanced materials can attract venture investment. Trading houses can also adopt tech-led platforms to scale efficiently.

India’s venture capital companies look for businesses with proven cash flows, scalable models, and strong teams. Knowing the clear benefits and risks helps you decide if venture capital fits your goals. It ensures you choose funding that supports growth without risking your stability.

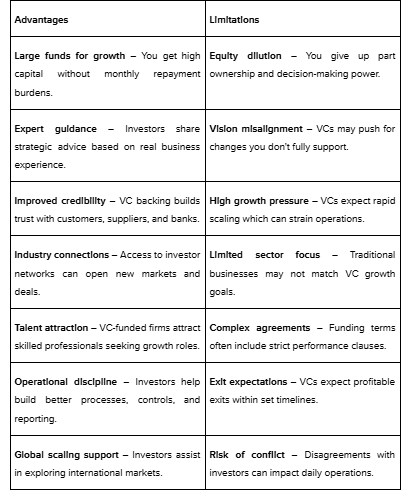

Advantages and Limitations of Venture Capital

Venture capital offers a powerful opportunity for businesses aiming to scale quickly and strategically. However, it also introduces trade-offs in terms of ownership, control, and expectations. Understanding both sides is key to making an informed decision.

Venture capital works best for businesses that are prepared to scale quickly while meeting the expectations of external investors in terms of governance, reporting, and strategic alignment. It can support significant growth, but also requires founders to balance speed with long-term control and operational focus.

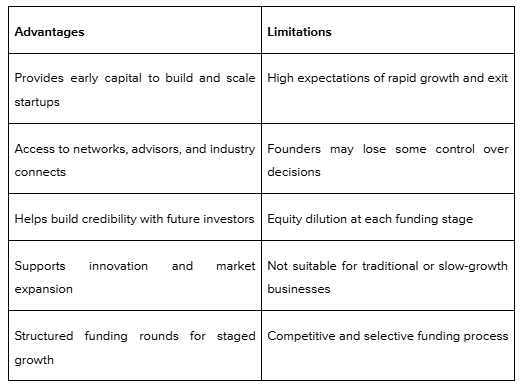

Venture Capital vs Other Funding Options

If you're considering venture capital, it’s worth comparing it with other funding models like initial coin offerings, crowdfunding, or bootstrapping. The right capital partner depends on your growth plans, operational maturity, and appetite for external influence.

Here is a clear comparison:

1.Bootstrapping

This is when you use your own savings or business revenue to fund growth. You stay in control, own 100% of your company, and avoid outside pressure. However, growth may be slower when resources are limited. It works well in the early stages or for businesses with lower capital needs and steady cash flow.

2. Angel Investors

Angels are individuals who invest their own money into promising startups. They typically come in earlier than VCs and may offer mentorship without asking for a board seat. This is a good option if you're looking for guidance and smaller funding rounds, though you might still need larger investors later as you scale.

3. Crowdfunding

If your business has a compelling story or a product that resonates with the public, crowdfunding might be a fit. It's excellent for B2C products and building early visibility, but may not suit businesses with industrial or backend-heavy operations.

4. Bank Loans

Loans let you raise funds without giving up equity. You repay a fixed amount each month and retain full ownership. That said, you'll need strong financials, collateral, and steady income to qualify. Unlike equity investors, banks don't offer guidance or strategic support.

5. Revenue-Based Financing

This model lets you repay a percentage of your revenue instead of fixed installments. When sales dip, payments go down. When sales increase, you repay more. It's flexible and preserves ownership, making it attractive for SaaS and retail companies. However, during high-revenue months, repayment costs can impact your margins.

6. Initial Coin Offerings (ICOs)

Popular among crypto startups, ICOs involve selling digital tokens to raise funds. They don't require giving up equity, but they come with legal uncertainties in India. For most traditional businesses, this model poses more risks than benefits.

7. Grants

Grants are non-repayable funds provided by governments or institutions for specific projects such as sustainability, innovation, or R&D. They're competitive and purpose-bound, meaning they usually can't fund broad business expansion. Still, they can add credibility to your company.

8. Peer-to-Peer (P2P) Lending

With P2P lending, you borrow directly from individual lenders on online platforms. It's typically quicker and has fewer requirements than bank loans. Keep in mind, it's still a loan. You'll need to repay it with interest and won't receive strategic input like you would from investors.Each funding option serves different goals and situations. Understanding when venture capital becomes the right choice can help you plan your growth journey with clarity.

When is Venture Capital the Right Choice?

Choosing venture capital (VC) as a funding option is about more than raising money. It requires alignment with a high-growth business model and a willingness to work closely with external investors. VC is most suitable in the following scenarios:

1. Your Business Is Ready to Scale Rapidly

Venture capital is ideal for companies that have the potential to expand quickly across markets, customer segments, or product lines. If you aim to grow significantly in a short time, this type of funding can support that ambition.

2. Your Model Is Scalable and Defensible

VC firms typically invest in businesses with clear competitive advantages, such as proprietary technology, strong market positioning, or operational efficiency. If your company can grow without a matching rise in cost, you're more likely to attract VC interest.

3. You're Open to Sharing Ownership

Accepting venture capital means giving up a portion of equity in exchange for capital. Investors often expect a say in significant decisions. If you're comfortable with this level of collaboration and oversight, VC could be a strong fit.

4. Strategic Support

VC firms bring more than funding. They offer access to experienced advisors, operational guidance, and professional networks. This can help your team navigate complex growth stages with added clarity and direction.

5. You're Building Towards an Exit

Most VC investments are structured with a clear exit in mind, such as an acquisition or public listing. If your long-term goal is to build and eventually exit your business, venture capital may help accelerate that path.

6. You Can Maintain Financial Transparency

VC investors expect regular reporting, strong governance, and precise financial planning. If your business already practices this level of discipline or is willing to adopt it, VC firms are more likely to see your team as investment-ready.

Choosing funding wisely shapes your path. Preparing your business for venture capital comes next to ensure you attract the right partners for growth.

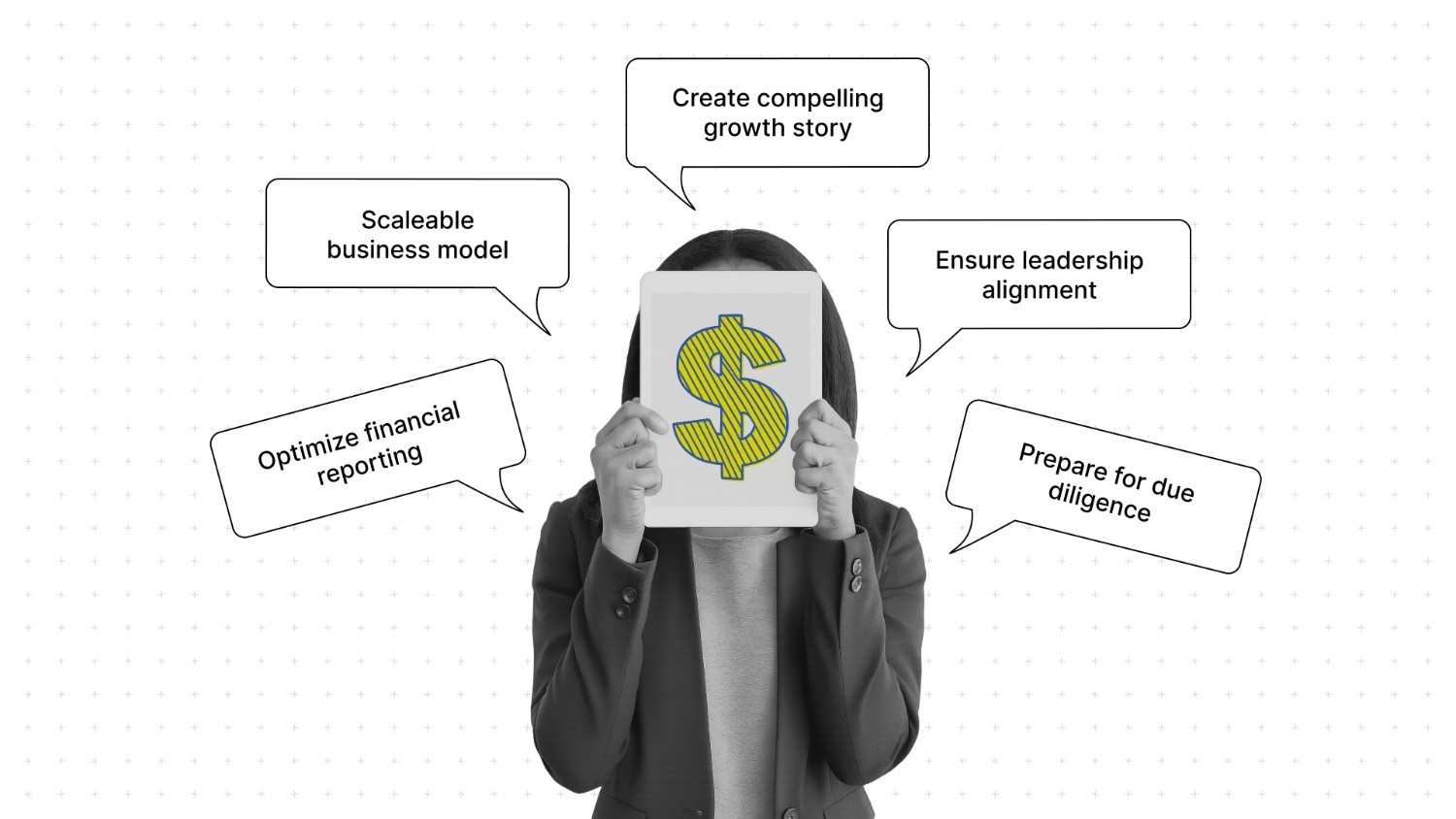

How to Prepare Your Business for Venture Capital Funding?

Securing venture capital is not just about having a great idea. Investors want to see strong foundations, clear growth plans, and disciplined operations. Preparing your business well builds confidence and improves your chances of success.

Here are five steps to make your business venture-ready with clarity and purpose.

1. Strengthen financials and reporting systems

Investors check your numbers closely. Keep clear financial records, audited statements, and data-backed forecasts. Build strong reporting systems that show revenue streams, cost structures, and margins. It builds trust and shows you can manage investor funds responsibly.

2. Build a scalable business model

Venture investors seek businesses that can grow fast. Assess if your operations, supply chain, and teams can handle higher demand. Simplify processes to reduce obstructions. Show potential to expand into new markets or products without heavy cost increases.

3. Create a compelling growth story

Craft a clear vision of where your business is going. Back it with market data, competitor analysis, and customer insights. Show how your product or service solves real problems at scale. A strong growth story helps investors believe in your journey.

4. Align leadership and governance for investor confidence

Build a capable leadership team with clear roles. Investors value strong governance practices. Form an advisory board if needed. Show that decisions are transparent, strategic, and not dependent on one individual. It builds confidence in your business continuity.

5. Prepare for due diligence

Due diligence checks everything from finances to legal documents. Ensure compliance with tax, labour, and regulatory requirements. Sort all agreements, licenses, and contracts. Being ready reduces delays and shows professionalism.

Preparing for venture capital takes time and discipline. When done well, it opens paths to expand responsibly. Now, let's see how S45 walks beside ambitious entrepreneurs in this journey, guiding them towards sustainable and confident growth so that they can be the future global leaders.

How S45 Supports Your Venture Capital Journey?

Scaling your business with venture capital is like climbing a tough summit. S45 acts as your Sherpa, walking beside you, never above. We combine deep expertize with grounded guidance to prepare your business for this climb.

Here’s how we help prepare you for the next phase of your journey:

- Sector expertise: We understand manufacturing and trading businesses at their core. Our team helps refine your model to attract the right venture investors without losing operational stability.

- Capital plus strategic guidance: We support businesses not just with funding but with practical insights, operational improvements, and market strategies that build confidence among investors.

- Legacy-honouring growth routes: We know your business is built on years of hard work. Our growth routes modernise and scale your operations while keeping your legacy and values intact.

- Community of climbers: Through the S45 community, you join a group of entrepreneurs sharing insights, challenges, and solutions. This network makes scaling less lonely and more strategic.

- Preparation for investor readiness: We work with founders to strengthen financials, reporting systems, and governance. It ensures your business is well-prepared and presents a strong case to venture investors.

It’s not just about raising capital. It’s about building companies that are ready for the next decade, not just the next quarter. If you’re scaling with intention, we’re here to walk that path with you.

S45 partners with enterprises that contribute nearly 30% of India’s GDP and employ millions across sectors like manufacturing, trading, and distribution. These aren’t headline-driven startups. They are the engines behind real and sustainable growth.

Conclusion

Venture capital is more than just funding. It supports fast growth, brings market expertize, and builds operational discipline. Each funding option has strengths, and venture capital offers unique value when used wisely.

While venture capital offers growth funds, expertize, and networks, it also means sharing ownership and meeting investor expectations. It suits businesses ready for fast scale-up with a strong growth story. Knowing its advantages and limitations helps decide if it fits your goals for the growth and sustainability of a business.

At S45, we work alongside you as steady partners in growth. If you're building with purpose and looking to expand without losing sight of what makes your business unique, we’re here to support that journey. Reach out to explore how we can grow together with sustainability and long-term impact in mind.

Frequently Asked Questions

1. What is the main difference between venture capital and bank loans?

Venture capital offers funds in exchange for equity, meaning you share ownership and decision-making. Bank loans provide debt funding, requiring fixed repayments with interest but no ownership dilution. VC suits fast-scaling businesses, while loans suit stable businesses needing working capital or asset purchases without giving up control.

2. Is venture capital suitable for every business?

No, VC is not suitable for all businesses. Venture capital suits businesses with scalable models, strong growth potential, and founders open to sharing ownership. Traditional or niche businesses with limited market expansion plans may find bank loans, revenue-based financing, or bootstrapping more aligned with their stability-focused goals rather than rapid expansion.

3. How is angel investing different from venture capital?

Angel investors are individuals investing their own money in early-stage businesses, usually with smaller amounts and more personal mentorship. Venture capital firms invest larger sums, often at later growth stages, with structured due diligence, board participation, and clear exit expectations to achieve targeted financial returns.

4. Can manufacturing businesses use crowdfunding?

Crowdfunding mostly suits B2C products, tech innovations, or creative projects seeking early market validation. Manufacturing businesses can use it when launching consumer-facing products or innovations. For general capacity expansion or B2B operations, crowdfunding lacks relevance compared to venture capital, bank loans, or strategic investors.

5. Why do founders choose revenue-based financing over venture capital?

Revenue-based financing provides funds repaid as a percentage of future sales, avoiding equity dilution and board control. It suits businesses with stable revenues needing flexible, non-equity funding. Venture capital demands ownership dilution and strategic alignment, while revenue-based financing maintains founder control with repayment linked to performance.