TL;DR

- What is Private Equity: It is an investment capital aimed at transforming private companies for sustainable growth and increased value.

- Private Equity as a Growth Partner for Founders: Beyond funding, PE brings operational expertise and strategic guidance, helping founders scale their businesses responsibly.

- How Business Transformation Drives Value in PE: PE investors overhaul people, processes, and technology to improve efficiency, unlock new markets, and boost competitiveness.

- Who Invests and What Founders Gain: By partnering with global institutional investors and high-net-worth individuals, Indian MSMEs access capital and best practices.

- Exit Strategy Is Key to Realizing Business Potential: Every PE investment plans a strategic exit, like IPO or sale, to capture the full value created through transformation.

Private equity is probably something you have considered if you have looked into investments outside of the conventional stock and bond market.

Private Equity (PE) involves investing capital in private companies or public companies transitioning to private ownership. Managed by PE firms or funds, the goal is to improve company performance and generate returns through exits like sales or public offerings. These firms raise money from high-net-worth individuals, pension funds, and institutions, investing in businesses with strong growth potential.

PE can be complex, but understanding its various fund types and features is essential for navigating this space. This blog covers private equity fundamentals from fund structures to types, equity arrangements, and exit strategies. Upon reading, you will get the necessary details to approach private equity situations with confidence.

What is Private Equity?

Private equity is capital invested in private companies or public companies that are taken private. Managed by private equity firms or funds, these investments aim to improve a company’s performance, increase its value, and generate profit through an exit strategy such as a sale or public offering. Typically, private equity firms raise money from high-net-worth individuals, pension funds, and institutional investors, directing this capital toward businesses with strong growth potential.

This investment approach is not just about funding—it is a strategic partnership that supports companies through operational improvements, innovation, and market expansion. For MSME founders, understanding private equity is essential to accessing resources and expertise that drive sustainable growth and long-term business transformation.

Types of Private Equity Funds

Each type targets specific company growth phases and strategies for value creation. Here are the types:

1. Venture Capital (VC) Funds

Venture capital funds invest in early-stage startups with high growth potential but limited revenue history. These investments carry higher risk but offer the chance for substantial returns.

Example: Sequoia Capital is a leading VC firm that has supported early-stage companies like Apple and WhatsApp.

2. Growth Equity Funds

Growth equity targets more mature companies with proven business models needing capital to scale operations, enter new markets, or launch products. It balances risk and reward with a focus on expansion.

Example: Insight Partners specializes in growth-stage investments in technology and software companies.

3. Buyout Funds

Buyout funds acquire controlling stakes in established companies, often seeking to improve operations and profitability before an eventual exit. These funds typically manage companies actively to create value.

Example: Texas Pacific Group’s buyout of Burger King led to a successful turnaround and IPO.

4. Mezzanine Funds

Mezzanine funds provide a hybrid financing option combining debt and equity, suitable for companies needing capital without significant ownership dilution. This type offers higher returns than traditional debt but involves moderately higher risk.

Example: Apollo Global Management used mezzanine financing in Cedar Fair’s $2.4 billion acquisition.

5. Distressed Asset Funds

Distressed asset funds invest in financially troubled or bankrupt companies by buying assets below market value, aiming to restructure and restore profitability. This approach carries a higher risk but also higher potential rewards.

Example: Oaktree Capital Management acquired distressed assets from Lehman Brothers after its 2008 bankruptcy.

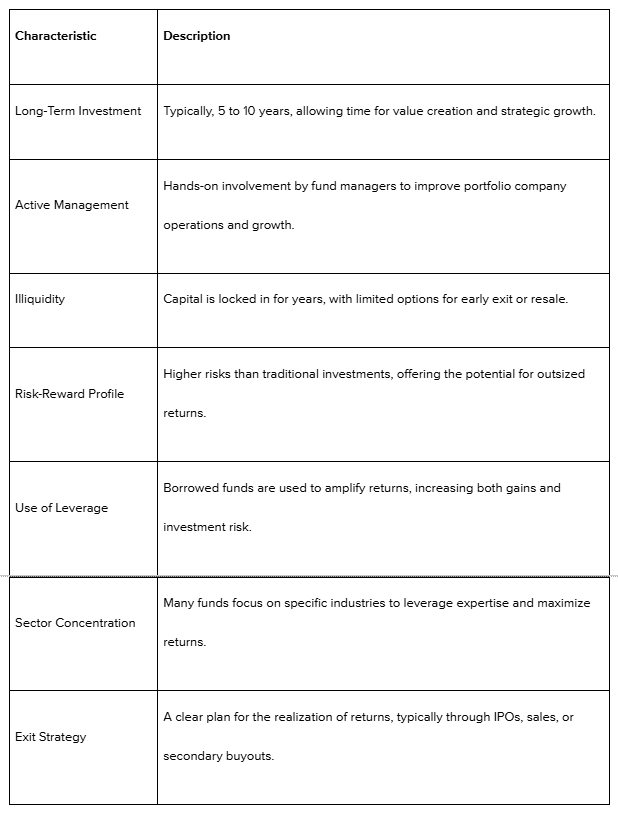

What Makes Private Equity Funds Unique

Establishing the key characteristics of your private equity fund is essential for a clear strategy and investor alignment. These features define how funds operate, manage risk, and pursue returns. Here is an overview of the fundamental characteristics that shape private equity funds:

What are the Common Exit Strategies for Private Equity?

Private equity exit strategies are the methods by which investors realize returns and divest their ownership stakes. The choice of exit depends on company maturity, market conditions, investor goals, and regulatory environment.

Below are the main exit methods, who they target, and how they are implemented:

1. Initial Public Offering (IPO)

An IPO involves listing the portfolio company’s shares on a public stock exchange, enabling the broad market to buy equity. This route targets companies with strong growth potential, solid financials, and operational maturity. It requires extensive regulatory compliance, legal preparation, and market readiness.

PE firms use IPOs to get liquidity and maximize valuation by accessing public market investors.

2. Strategic Sale (Trade Sale)

Here, the company is sold to a strategic buyer, typically another corporation in the same or complementary industry. This exit targets businesses attractive to competitors or industry consolidators who seek synergies or expanded market access.

The process involves negotiations on price, warranties, and transfer of operational control. Strategic sales often provide faster exit options than IPOs.

3. Secondary Sale

In a secondary sale, the PE firm sells all or part of its stake to another private equity firm or institutional investor. This keeps the company private but changes ownership. Secondary sales target investors looking for mid- to late-stage investment opportunities without going public.

This exit allows the original PE firm to realize gains while allowing fresh capital and expertise to continue value creation.

4. Management Buyout (MBO)

An MBO occurs when the current management team purchases the company, often financing the acquisition with debt instruments. This exit suits stable companies with experienced management seeking to take control and maintain strategic continuity.

It can be structured via buyouts and requires thorough planning on financing and implementation.

5. Recapitalization

Recapitalization restructures the portfolio company’s capital, allowing PE investors to receive partial liquidity while retaining some equity. This method balances risk and return by injecting fresh capital or renegotiating debt.

It’s suited for companies needing growth capital without full ownership transfer. Recapitalizations often involve negotiations with lenders and minority shareholders.

6. Liquidation

Liquidation involves selling a company’s assets to pay creditors and close down operations. This usually happens when other exit routes are nonviable or the company is insolvent. Liquidation targets distressed companies and often results in minimal returns for investors. It requires a coordinated process of asset valuation, sale, and legal

Conclusion

The right capital and strategic guidance are essential for founders and MSMEs aiming to scale sustainably and create lasting value. Private equity offers not just funding but operational expertise and strategic alignment to accelerate growth without compromising control. However, capital alone is insufficient; governance, clear valuation, and readiness to engage investors are equally vital.

S45 Club combines tailored capital access with expert equity advisory services designed specifically for India’s MSMEs. Through this platform, founders gain the confidence and clarity to navigate complex funding and scaling challenges effectively.

Looking to connect with like-minded entrepreneurs who have successfully utilized private equity and strategic funding to grow their businesses? Join the s45 Club community to share insights, explore collaboration opportunities, and advance alongside India’s most ambitious founders.

Frequently Asked Questions

1. What is private equity?

Private equity is investment capital focused on buying stakes in private companies to improve performance, drive growth, and increase value before exiting the investment.

2. How do private equity funds differ?

Funds vary by investment stage and strategy, venture capital targets startups, growth equity backs expanding firms, buyouts acquire controlling stakes in mature businesses, and distressed funds focus on troubled companies.

3. Who invests in private equity?

Institutional investors such as pension funds, endowments, and high-net-worth individuals commonly invest in private equity through pooled funds managed by PE firms.

4. What role does private equity play for founders?

Beyond funding, PE firms provide strategic guidance, operational support, and access to networks that help founders scale responsibly and sustainably.

5. What are the characteristics of private equity funds?

Key traits include long-term investment horizons, active management, capital lock-in (illiquidity), risk-return tradeoffs, sector focus, and clear exit plans.

6. What are common private equity exit strategies?

Common exits include IPOs, strategic (trade) sales, secondary sales to other PE firms, management buyouts, recapitalizations, and, as a last resort, liquidation.