Key Takeaways

- India’s capital markets have grown significantly, doubling in size,

- Retail investor participation is on the rise, fueled by online platforms and government financial literacy programs.

- Digital transformation through fintech, AI, and blockchain is modernizing the market and making it more accessible.

- IPO activity and the listing of startups are driving market dynamism, with government reforms simplifying the process.

- Despite challenges like regulatory hurdles and market volatility, opportunities exist in sectors like bonds, green finance, and financial inclusion.

- India’s capital markets are poised for further growth, supported by institutional investments and global interest.

The Indian capital market has undergone a remarkable transformation over the last few decades. From being largely underdeveloped in the post-independence era, it has now emerged as one of the fastest-growing financial markets in the world.

With increasing investor participation, digital innovation, and regulatory reforms, the Indian capital market remains a pivotal driver of economic growth and wealth creation. This blog explores the development of the Indian capital market, highlighting key trends, challenges, and opportunities shaping its future.

The Evolution of the Indian Capital Market

The capital market in India refers to the system where financial instruments like shares, bonds, and debentures are traded between investors. It serves as a crucial mechanism for mobilizing savings and channeling them into productive investments. Historically, India’s capital market was fragmented and less transparent, with limited participation. However, liberalization in the 1990s, the establishment of SEBI (Securities and Exchange Board of India), and the advent of modern technology significantly boosted its growth.

Today, the Indian capital market is a blend of tradition and innovation. It supports small-scale retail investors, large institutional players, and global investors alike. As of 2024, the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) rank among the top exchanges globally by market capitalization, reflecting India’s growing economic clout.

Major Trends Driving the Growth of the Capital Market in India

India's capital markets are experiencing a transformative shift, driven by new investor segments, technological advancements, and the growing importance of startups. Let’s explore the key trends shaping the market and their impact on investors, businesses, and the overall economy.

Rise of Retail Investors

The rise of retail investors in India has been a defining feature of the market’s growth in recent years. With the advent of online trading platforms and mobile apps, individual investors now have unprecedented access to stock markets, which institutional players once dominated. Key drivers include:

- Increased Access through Digital Platforms: Platforms like Zerodha, Upstox, and Groww have lowered the barriers to entry, offering easy-to-use interfaces and reduced brokerage fees.

- Government Support: Initiatives like the National Financial Literacy Mission (NFLM) and various awareness campaigns are educating the public about the benefits of capital market participation.

- Financial Inclusion: As a result, the number of demat accounts in India has grown exponentially, empowering more people, particularly millennials and Gen Z, to invest and build wealth.

The growing retail investor base is creating a more inclusive market, where people from various socio-economic backgrounds are now part of the investment ecosystem.

Digital Transformation in Capital Markets

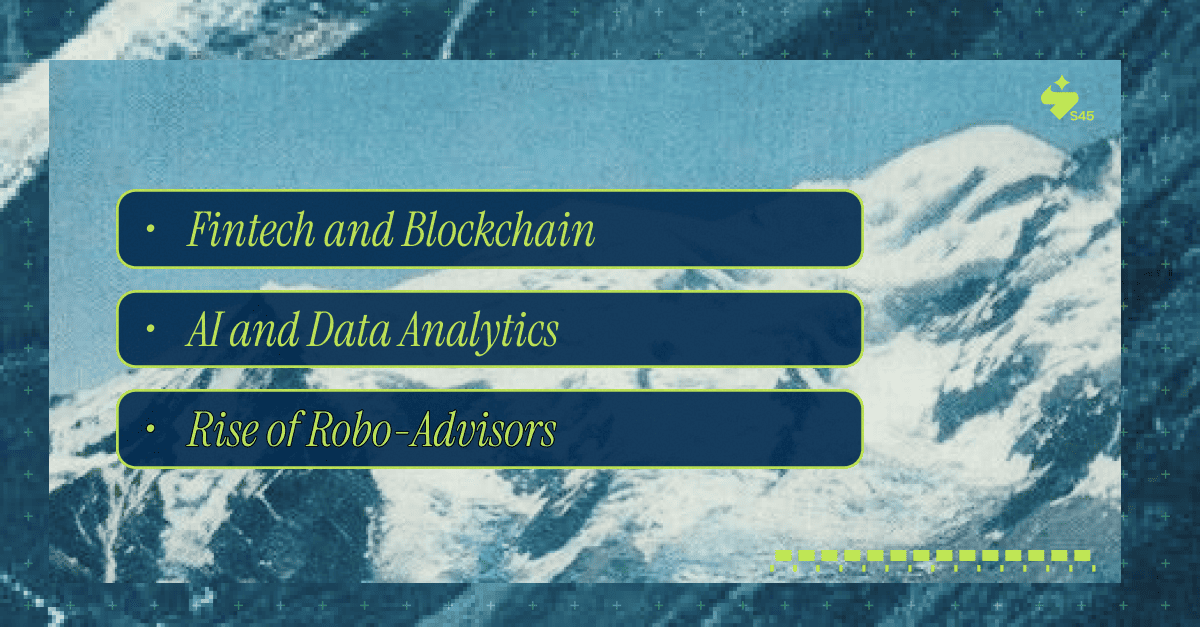

Digital technologies are driving major changes in the capital market landscape. Key innovations in fintech and blockchain are making markets more efficient, transparent, and accessible to investors across India. Key points include:

- Fintech and Blockchain: Blockchain technology is enhancing the security, transparency, and speed of trading processes, especially in clearing and settlement.

- AI and Data Analytics: The adoption of AI and machine learning tools is revolutionizing decision-making, allowing investors to analyze vast amounts of data and predict market trends with greater accuracy.

- Rise of Robo-Advisors: Automated, AI-driven investment management services are making financial advice more affordable and accessible to a wider audience, democratizing wealth management.

This digital transformation is not only improving market efficiency but also lowering costs, making investment opportunities available to a broader group of people.

The Surge in IPOs and Listing of Startups

The Indian IPO market has seen an exciting surge in recent years, with an increasing number of startups going public. This trend is set to continue, driven by various factors that enhance the dynamism of the market:

- Record IPO Activity: 2023 saw a record number of IPOs, signaling increased investor confidence and the growing appetite for high-growth companies.

- Startups Driving Growth: The boom in tech, fintech, and consumer startups, such as Zomato, Paytm, and Nykaa, has brought fresh opportunities for retail investors to access high-growth companies.

- Government Support for Startups: The government is streamlining the listing process for startups, with initiatives to simplify regulations and create a more conducive environment for emerging businesses.

- Venture Capital and PE Growth: The increasing involvement of venture capital and private equity in the startup ecosystem is helping companies scale and position themselves for successful IPOs.

This surge in IPO activity is providing new investment opportunities, particularly in innovative sectors, and further deepening the connection between India’s thriving startup ecosystem and its capital markets.

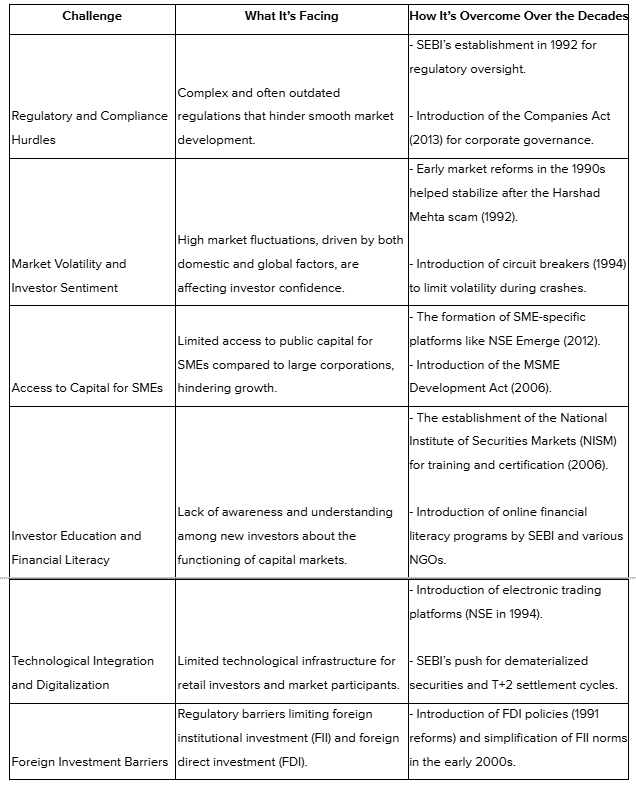

Challenges Facing India’s Capital Market Growth

While India’s capital markets are growing at an impressive pace, several challenges persist that could hinder their long-term potential. Addressing these obstacles is critical for ensuring a sustainable and inclusive growth trajectory. Here, we examine the primary challenges faced by the market.

Regulatory and Compliance Hurdles

One of the biggest challenges facing India’s capital markets is the complex regulatory framework that governs them. While regulations are necessary to protect investors and maintain market integrity, their complexity can act as a barrier to market development.

- Impact on Market Development: Investors, particularly retail investors, often find the regulatory landscape daunting, which can discourage new market participation. For businesses, cumbersome regulations can delay fundraising and public listings, limiting access to capital.

- Need for Streamlining: There is a pressing need to simplify the regulatory process. Inconsistent or outdated rules can create confusion and increase compliance costs for companies and investors.

- Improving Transparency: Transparency in the regulatory process and the timely dissemination of information can help build trust among investors. Streamlined compliance processes would reduce delays in public offerings and foster a more efficient market.

For India to continue its growth as a financial hub, these regulatory hurdles must be addressed by modernizing and simplifying existing structures.

Market Volatility and Investor Sentiment

While volatility presents opportunities, it also poses significant risks for investors and challenges for market stability.

- Balancing Growth with Volatility: India’s capital markets have shown remarkable growth, but this has often been accompanied by periods of high volatility. Rapid market movements can scare off retail investors who may not be equipped to handle such fluctuations.

- Global Economic Influences: Local markets are also influenced by global economic conditions, such as changes in commodity prices, foreign capital flows, and international market trends. For example, the 2020 COVID-19 market crash and the recent geopolitical tensions have shown how sensitive India’s markets are to external shocks.

- Impact on Investor Sentiment: Constant market fluctuations can negatively affect investor confidence, leading to a "wait-and-watch" approach rather than active participation. This sentiment often worsens during periods of economic uncertainty.

Mitigating volatility through better risk management strategies, more investor education, and improved market resilience will be essential for sustainable market growth.

Access to Capital for Small and Medium Enterprises (SMEs)

SMEs form the backbone of India’s economy, yet they often face significant challenges when it comes to accessing capital through the public markets.

- Limited Funding Options: Compared to larger corporations, SMEs have limited access to equity and debt financing. Many are excluded from initial public offerings (IPOs) due to stringent listing requirements or are unable to raise sufficient funds through the bond market.

- Challenges in Securing Financing: SMEs typically rely on traditional banking channels for funding, but high-interest rates and collateral requirements make it difficult for many businesses to grow and scale.

- Reforms to Ease Capital Access: To support these businesses, India’s capital markets need reforms that facilitate easier access to capital for smaller firms. This includes more flexible IPO norms, dedicated SME platforms, and improved financing options through bonds and venture capital.

- Government Initiatives: The government has already taken steps to address these challenges by introducing initiatives like the SME exchange (NSE Emerge), which allows smaller companies to list with less stringent requirements.

For India’s capital market to reach its full potential, these reforms need to be expanded, enabling SMEs to access the necessary funds to fuel innovation and job creation.

How India’s Capital Market is Evolving to Overcome Challenges

Opportunities for Further Growth in Capital Markets

India’s capital markets are poised for further expansion, driven by untapped opportunities in areas like bond markets, sustainable finance, and increasing global access. These areas not only offer growth potential but also attract diverse investor groups, including those focused on fixed-income securities, sustainability, and international investments.

Expanding the Bond Market

The bond market in India holds vast potential, especially with increasing interest from both domestic and international investors. India’s bond market has been growing steadily, but it still lags behind its global counterparts in size and sophistication.

- Growth in Corporate and Government Bonds: The Indian bond market has seen a 6.5% to 9% growth rate over the last few years, but it remains underdeveloped compared to developed economies like the US and Europe. The government is focusing on improving liquidity and transparency to attract more investors.

- Investor Appetite for Fixed-Income Securities: With interest rates expected to stabilize in the coming years, demand for corporate bonds and government securities is expected to rise.

- Government Initiatives: The government’s introduction of "Masala Bonds" (rupee-denominated bonds) and “Sovereign Green Bonds” has added another layer to the bond market, opening up fresh avenues for both domestic and foreign investors.

As the market continues to evolve, there is potential for significant growth, especially in corporate bonds and infrastructure debt, which will attract more institutional and retail investors alike.

Green and Sustainable Finance

The shift towards sustainability is reshaping global capital markets, and India is no exception. With the rise of ESG (Environmental, Social, and Governance) investing, India is positioning itself as a key player in green finance.

- Growth in Green Bonds: India’s green bond market has been expanding rapidly, with over ₹ 1,863,769.13 million ($21 billion) raised in green bonds by 2023. This is expected to grow further as more companies and governments adopt sustainability frameworks.

- ESG Investments on the Rise: In 2022, ESG assets in India grew by 22%, with a significant rise in investments in renewable energy, electric mobility, and sustainable infrastructure projects. The Indian government has also rolled out green finance policies, encouraging private sector involvement.

- Role of Sustainability-Focused Investments: Green bonds and ESG investments are not only attracting institutional investors but are also gaining popularity with retail investors. These investments are seen as long-term value propositions, as sustainability continues to play a key role in global capital flows.

The continued development of green bonds and other ESG investment vehicles will drive this momentum forward.

Financial Inclusion and Access to Global Markets

Financial inclusion is another critical opportunity for India’s capital market, helping bridge the gap for underserved communities and offering access to global markets for Indian investors.

- Driving Financial Inclusion through Technology: The rapid adoption of mobile technology and digital payment systems in India has significantly expanded access to financial services. The government’s Pradhan Mantri Jan Dhan Yojana (PMJDY) has brought over 560 million individuals into the formal banking system, opening the doors to capital market participation.

- Access to Global Markets: The rise of cross-border trading platforms and foreign investor participation is opening up India’s capital market to the global stage. India is increasingly seen as an attractive destination for foreign institutional investors (FIIs). In 2025, FII inflows into Indian stocks hit a record $12.8 billion, marking a growth.

- Technological Advancements in Financial Inclusion: The use of fintech and blockchain in India has enabled easier access to investment products, especially for underserved communities in rural areas. With digital-first platforms, investors can access capital markets directly, overcoming traditional barriers like geographical distance or financial literacy gaps.

India’s capital markets will continue to expand as technology helps democratize access and as the nation gains more international exposure through global investors seeking emerging market opportunities.

Explore Capital Market Insights at S45club

If you’re ready to go beyond generic market tips and back high-potential businesses, you’re in the right place. S45club is built to empower founders and growth-focused SMEs to navigate the capital markets, not just as participants, but as leaders.

We don’t just interpret the market, we co-create the path forward:

- Capital & Access — We help you raise structured capital through IPOs, pre-IPO funding, and tailored equity routes across Main Board, SME, and QIB segments.

- Governance & Strategic Playbook — We embed capital market rigor: governance, financial discipline, and institutional readiness become part of your DNA.

- Founder-First Philosophy — You retain control, legacy, and vision. We partner, not overpower.

- Scaling with Intelligence — We bring sector insights, playbooks, and operational support so your growth is sustainable, not just fast.

Who We Serve

- High-Growth SMEs & Entrepreneurs — You’ve built a strong business. Now scale it through capital markets with the right support.

- Investors & Backers — Discover curated opportunities in exceptional, scalable companies that are ready for the next level.

- Mentors & Network Partners — Join as strategic value creators in our ecosystem of founders, capital, and execution.

At S45, we don’t settle for incremental. We aim for hypergrowth, bridging ambition with execution, and putting India’s next wave of companies on the global map.

Final Thoughts

India’s capital markets are poised for remarkable growth, driven by key trends such as the rise of retail investors, the expansion of the bond market, and the surge in IPO activity. Government reforms and initiatives to promote financial inclusion, green finance, and digital integration are further strengthening the market’s infrastructure. With increased participation from institutional and global investors, India is set to become one of the world’s leading investment hubs in the coming decade.

Ready to dive deeper into the world of capital markets and unlock new investment opportunities? Visit S45Club for expert analysis, market insights, and tailored strategies to help you make informed decisions and grow your wealth. Stay ahead of the curve with S45club’s comprehensive resources and start exploring today!