Key Takeaways:

- CCPS are hybrid instruments that provide fixed returns initially and convert into equity after a set period or milestone.

- They help startups raise capital while deferring equity dilution, making them ideal for high-growth companies.

- Investors receive fixed dividends and later gain equity ownership, benefiting from the company's growth.

- Key features include mandatory conversion, anti-dilution protection, and liquidation preference.

- CCPS can be strategically used in startup funding, joint ventures, and mergers to balance control and growth potential.

Compulsory Convertible Preference Shares (CCPS) combine debt and equity features. They offer fixed returns initially, providing security for investors. After a set period or specific milestones, they convert into equity.

This balance of stability and growth makes CCPS appealing to investors seeking steady returns and equity upside. They also help startups with uncertain valuations by linking conversion to future milestones.

In FY 23, India’s startup ecosystem contributed USD 140 billion, nearly 4% of India’s GDP, with many leveraging tools like CCPS to drive growth.

This blog will cover the key features of CCPS, how they work in practice, their benefits for startups and investors, and how they compare to other investment instruments.

What Are Compulsory Convertible Preference Shares (CCPS) and How Do They Work?

Compulsory Convertible Preference Shares (CCPS) are preference shares that convert into equity after a set period or milestones, like a funding round or IPO. This enables startups to raise capital while deferring equity dilution.

Investors receive fixed dividends, offering stability, and after conversion, gain equity with capital appreciation potential. CCPS helps startups by tying conversion to future events, simplifying the fundraising process. A few key features of CCPS include:

- Fixed Dividend:

CCPS offers predictable returns with higher dividends than ordinary shares, accumulating if unpaid. This ensures investors receive fair returns, even if the company faces financial challenges.

- Mandatory Conversion:

CCPS automatically converts into equity after a set period or when conditions like an IPO or valuation targets are met. This provides clear terms for both investors and startups.

- Anti-Dilution Protection:

Anti-dilution protection keeps investors' stakes secure during future funding rounds. Mechanisms like full ratchet or weighted average adjustments ensure fair value preservation.

- Priority in Liquidation:

In case of liquidation, CCPS holders are paid before ordinary shareholders, but after debt holders. This gives investors significant downside protection.

- Equity Upside:

After conversion, CCPS holders become equity shareholders with voting rights, allowing them to participate in the company’s growth and share in future success.

If you're a startup looking to raise capital strategically, S45 can help you understand funding tools like CCPS, ensuring you secure the right capital without sacrificing control.

How Does CCPS Work?

CCPS converts into equity based on the terms outlined in the issuance agreement. This conversion mechanism is a key feature that aligns the interests of both investors and the company.

Before diving into the specific terms, let's first understand how these agreements are structured to benefit both parties.

1. Holding Period

CCPS are typically issued for 3 to 5 years, during which investors receive fixed dividends. At the end of this period, or earlier if conditions like an IPO are met, the CCPS automatically convert into equity shares.

Milestones, such as mergers or acquisitions, can also trigger early conversion.

2. Conversion and Trading

Upon conversion, CCPS holders receive equity shares based on a conversion ratio tied to the company’s valuation at that time.

Corporate events like an IPO can expedite this process, as seen in Swiggy’s pre-IPO phase, where CCPS converted to equity to simplify the capital structure for the public listing.

3. Accrued Dividends

Any unpaid dividends are compensated either in cash or through additional equity shares during conversion, ensuring investors receive the value owed even if dividends weren’t paid during the holding period.

Now, let’s explore how CCPS creates a win-win situation for both startups and investors, helping raise capital while ensuring secure returns for all parties involved.

How CCPS Benefits Both Startups and Investors

CCPS offers startups a way to raise capital without immediate dilution, while providing investors with stability and future equity upside.

1. For Startups:

CCPS provide startups with flexible and strategic advantages for raising capital and managing ownership:

- Capital Without Immediate Dilution:CCPS enables startups to raise capital while deferring dilution, allowing founders to maintain control during early growth stages.

- Flexibility in Valuation:Startups can avoid complex valuation negotiations by linking CCPS conversion to future milestones, providing flexibility and a clear conversion path.

2. For Investors:

CCPS offers investors a combination of security, stable returns, and potential equity upside:

- Fixed Returns: Investors receive fixed dividends, offering stable returns during the holding period, with upside potential upon conversion.

- Equity Upside: Upon conversion, investors gain equity, benefiting from the company’s growth and capital appreciation.

- Protection and Security: CCPS offers anti-dilution protection, liquidation preferences, and dividend accumulation, ensuring investor protection against dilution and adverse events.

Now, let’s take a closer look at how CCPS compares to other investment instruments, like non-convertible preference shares and equity, to understand better the unique advantages they offer.

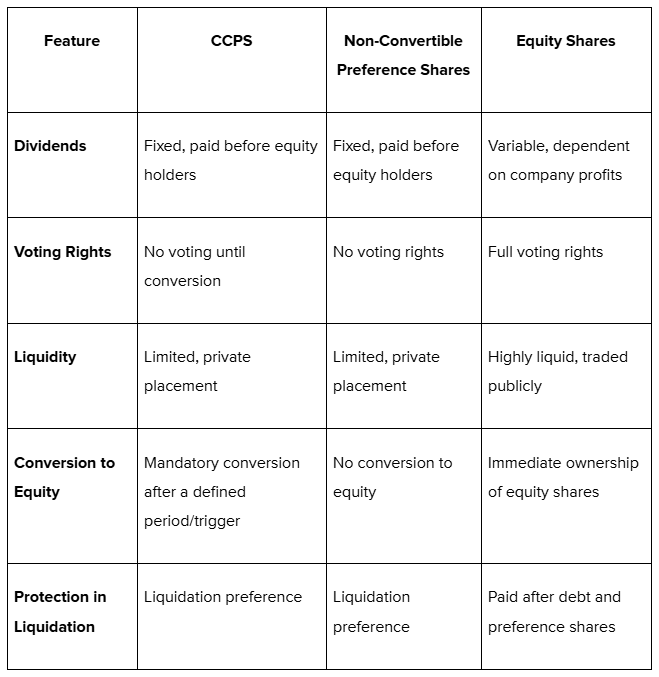

Comparing CCPS with Other Investment Instruments

Compulsory Convertible Preference Shares (CCPS) offer a hybrid structure that blends the benefits of both debt and equity.

Compared to non-convertible preference shares and equity, CCPS offer a unique mix of fixed returns, potential equity upside, and enhanced protection, making them attractive for both startups and investors.

The table below breaks down how CCPS stack up against other investment instruments in terms of key features:

CCPS plays a vital role in the startup ecosystem, offering benefits that help both founders and investors achieve their goals. Here's how they work in practice.

Usage of CCPS in the Startup Ecosystem

Compulsory Convertible Preference Shares (CCPS) have become a key tool in the startup ecosystem, offering startups a way to raise capital without immediate equity dilution. For investors, they combine the security of fixed returns with the potential for future equity upside.

1. Startup Funding

CCPS helps startups raise capital while deferring equity dilution, especially when determining valuation is challenging. The conversion is linked to future milestones, such as a funding round or growth targets.

- For Founders: Retain control during early growth.

- For Investors: Receive fixed dividends with the potential for equity participation as the company grows.

Example: AgroStar, a Pune-based agritech startup, raised $6.7 million from investors like Accel India, Aavishkaar India, and Chiratae Ventures. The company issued 1,45,385 compulsory convertible non-cumulative preference shares (CCPS) at Rs 3,965 per share, enabling them to secure capital while deferring equity dilution.

2. Joint Ventures and Partnerships

CCPS allows companies to bring in partners or investors without altering ownership immediately. The conversion happens later based on performance milestones.

- For Partners: Flexible structure, avoiding upfront dilution.

- For Investors: Fixed returns until equity conversion triggers.

3. Mergers, Acquisitions, and Debt Restructuring

In M&A or restructuring, CCPS provides a flexible way to bring in new stakeholders. These can be linked to specific financial or operational milestones.

- For Startups in Distress: Provides time for restructuring without immediate dilution.

- For Acquirers: Aligns interests by offering a clear path to equity.

4. Managing Valuation Uncertainty

Startups often struggle with early-stage valuations. CCPS avoid this by linking conversion to future events like funding rounds or IPOs, sidestepping the need for a current valuation.

- For Founders: Focus on business growth rather than valuation.

- For Investors: Receive dividends while waiting for conversion based on business performance.

5. Strategic Growth Without Immediate Ownership Dilution

As startups scale, CCPS allow for phased dilution, ensuring founders retain control during critical growth stages while attracting investors who understand that dilution will occur at a later date.

- For Founders: Maintain leadership and control while raising capital.

- For Investors: Secure fixed returns before conversion, reducing risk.

6. SaaS and Technology Startups

CCPS are commonly used in SaaS and tech startups, where growth potential is high but valuation uncertainty remains. Investors convert CCPS into equity once specific milestones, such as revenue targets, are met.

7. Distressed Asset Acquisitions

CCPS also plays a role in distressed asset acquisitions, where companies use them to compensate creditors or management for turning around a struggling business. Conversion terms are tied to turnaround targets.

- For Creditors and Investors: Transition from debt to equity once the company stabilizes and meets targets.

How S45 Can Help Drive Strategic Growth for Your Startup

S45 is an equity advisory platform that helps SME founders and investors achieve long-term growth by understanding complex funding strategies without immediate equity dilution.

How S45 Supports Founders and Investors:

- Smart Capital Access: Connects startups with investors and mentors, offering tailored capital strategies at various growth stages.

- Strategic Funding Guidance: Helps founders navigate funding tools like CCPS, structured funding, and equity advisory to balance growth and control.

- Post-Funding Support: Provides expertise on investor relations, governance, and preparing for future rounds to ensure sustainable scaling.

- Investor Network: Grants access to a network of experienced investors and family offices for capital and mentorship.

By partnering with S45, you gain more than just funding. You also receive a strategic advisor committed to your long-term success.

Conclusion

Compulsory Convertible Preference Shares (CCPS) provide a unique financing tool for startups, offering a blend of fixed returns, equity upside, and investor protection.

Their ability to delay equity dilution while raising capital makes them an attractive option for high-growth companies. With clearly defined conversion terms, CCPS ensure both founders and investors are aligned towards the company’s long-term growth.

For startups looking to leverage funding strategies like CCPS, learning from experienced founders who have successfully navigated the funding landscape can be invaluable.

Ready to explore strategic funding solutions? Join the S45 founder community to gain insights, share experiences, and connect with others who are building for the future.

Frequently Asked Questions

Q: How does CCPS help startups with uncertain valuations?

A: CCPS allows startups to raise capital without needing to settle on a valuation at the time of issuance. The conversion is linked to future performance or funding rounds, which allows the startup to avoid early-stage valuation challenges.

Q: What are the risks for investors when buying CCPS?

A: Investors in CCPS face risks such as the company failing to meet conversion milestones, which can delay or prevent conversion to equity.

Additionally, there’s a risk of partial or total loss if the company goes bankrupt, as CCPS ranks lower than senior debt in the repayment hierarchy.

Q: Can any company issue CCPS, or are there specific regulations?

A: While any company can issue CCPS, there are regulations, particularly for financial institutions and MSMEs.

For example, in India, the Reserve Bank of India (RBI) has specific rules for Tier II capital requirements in banks and NBFCs, where subordinated debt like CCPS can be used.

Q: Can CCPS holders convert their shares to equity before the set conversion period?

A: Early conversion of CCPS typically occurs only under specific conditions, such as a corporate event (like an IPO or acquisition). However, in some agreements, investors may negotiate early conversion rights depending on the terms.

Q: How does CCPS differ from convertible debentures (CDs)?

A: While both CCPS and convertible debentures convert into equity, CCPS are considered preference shares, giving investors a fixed dividend and liquidation preference.

Convertible debentures, on the other hand, are debt instruments, typically providing interest payments and often lacking liquidation preference compared to CCPS.