Key Takeaways

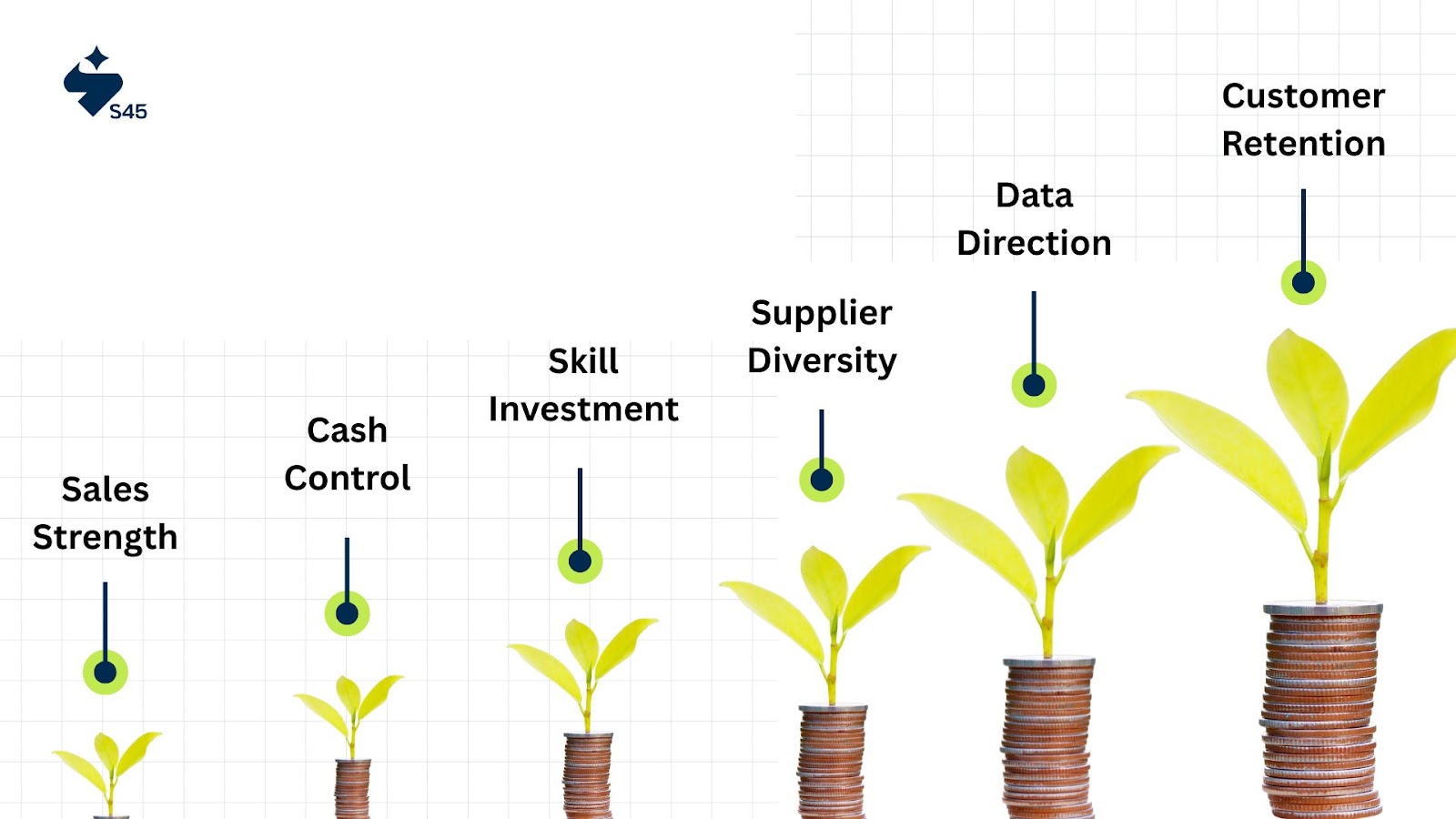

- SMEs contribute over 30% to India’s GDP, but growth requires focused action.

- Key SME growth tips to diversify sales channels to reduce risk.

- Manage daily cash flow; enforce payment terms and maintain lean inventory levels.

- Invest in skill development, not just technology, for better execution.

- Build resilience by diversifying your supplier base and customer base.

- Use data regularly to guide your decisions, rather than relying on intuition.

- Focus on customer retention to protect your lowest-cost revenue stream.

You’re part of a sector that drives over 30% of India’s GDP and powers 46% of the country’s exports. But in today’s fast-moving market, standing still means losing ground. Competitors are moving quickly, customers are changing faster than ever, and opportunities vanish if you’re not ready to act.

You don’t need generic advice like “sell more” or “cut costs.” You need growth strategies that work in your world where demand spikes without warning, costs keep climbing, and customer expectations shift overnight. In this guide, you’ll learn how to take control of the five growth levers: sales, customers, operations, talent, and financial planning, so you can scale without losing focus or stability.

#1 Strengthen Your Sales Engine and Streamline How You Work

Think of your sales pipeline as more than just a way to meet monthly targets; it’s what keeps your business running and growing. In the Indian SME space, many founders still rely heavily on a single lead source, such as word of mouth or a trusted distributor. While this may seem stable, it leaves the business exposed if that source slows down or disappears.

A stronger growth strategy starts with reviewing internal operations. Every step from lead generation to delivery should add value. Delays, repeated work, or unclear handovers are silent profit drains. Streamlining isn’t just about speed; it’s about creating a smoother customer journey that drives both sales and repeat business.

Sales diversification is one of the most practical SME growth tips. For example, some mid-sized manufacturers now pair direct digital outreach like LinkedIn lead generation or targeted industry email campaigns with their dealer networks. This provides steadier order volumes and reduces reliance on seasonal demand.

Execution tip: If you’re tracking prospects in Excel or scattered chats, switch to an entry-level CRM like Zoho or HubSpot. These can send automatic follow-up reminders, improving closure rates by ensuring timely responses.

Pitfall to avoid: Don’t adopt multiple new sales channels at once. Test one, track results for at least a quarter, and scale only what works.

#2 Keep a Tight Grip on Cash Flow

Cash flow gaps sink more SMEs than slow sales. Revenue on paper doesn’t matter if cash isn’t in your account when bills are due. Treat cash tracking as a daily task, not a month-end chore.

Set firm payment terms with both customers and suppliers and enforce them. If early-payment discounts help bring receivables in faster, use them. Cutting your receivables cycle by even a week can free up enough liquidity to cover payroll or seize short-term opportunities.

Running a lean inventory operation is another vital SME growth tip. Stock that sits idle is capital locked away, instead of funding marketing pushes, high-impact hires, or equipment upgrades.

Execution Tip: Deploy real-time tools like Tally or Vyapar to see cash flow as it moves. Act on the data immediately, whether that’s chasing late payments, delaying non-essential purchases, or adjusting stock orders instead of waiting for accounting summaries.

#3 Invest in Skills, Not Just Tools

For growth-stage SMEs, technology is a multiplier, but only in capable hands. A CRM, analytics dashboard, or automation tool will not fix a weak sales pitch, a poor follow-up process, or inconsistent service. The return on technology spend increases exponentially when the team using it has the right skill set.

Prioritise targeted skill development across revenue-driving and customer-facing functions. Sales teams should be trained in objection handling, solution selling, and client relationship management. Operations teams benefit from process optimisation training that reduces waste and improves turnaround time. Even customer service teams need structured guidance on handling complaints, upselling, and client retention.

Cross-functional training is particularly valuable in Indian SME contexts, where lean teams are the norm. A delivery associate who can resolve basic service issues on the spot, or a sales rep who can troubleshoot minor operational delays, reduces friction and prevents revenue leakage. This kind of agility becomes a competitive advantage during peak demand cycles or sudden staff shortages.

Execution Tip: Setting aside a fixed percentage of quarterly profits specifically for capability building is a core strategy for SME growth. Track training ROI the same way you track marketing spend, link it to measurable outcomes such as higher close rates, reduced customer churn, or faster project delivery.

Online micro-courses, live workshops, and role-play sessions can all be deployed cost-effectively without pulling teams away from day-to-day operations for long periods.

#4 Build Resilience Through Supplier and Customer Diversification

Relying too heavily on a single supplier or a dominant client creates a structural weakness that can undo years of progress. In a growth-stage SME, where operating margins are already under pressure, even a small disruption, a shipment delay from your only vendor, or a sudden drop in orders from your largest customer, can trigger a liquidity crunch and derail expansion plans.

A resilient SME supply chain has redundancy built in. For critical raw materials or services, identify and qualify at least two dependable suppliers in different geographies or with different sourcing channels. This not only protects you from operational breakdowns but also strengthens your bargaining position when negotiating pricing, credit terms, or delivery timelines.

On the customer side, dependence on one large account for a disproportionate share of revenue is equally dangerous. If more than 25–30% of your annual turnover comes from a single client, a strategic review is urgent.

Map your customer mix, assess where demand is concentrated, and set specific acquisition targets to balance the portfolio. This might mean entering a new region, targeting a different industry segment, or expanding product lines to appeal to a wider base.

Execution Tip: Creating a quarterly dependency dashboard that tracks supplier concentration (by value and volume) and customer concentration (by revenue percentage) is a foundational tip for SME growth. For any supplier that accounts for more than 40% of inputs or any customer that exceeds the 30% revenue threshold, put a diversification plan into motion within the next 90 days. This proactive discipline keeps you in control rather than reacting under pressure.

#5 Use Data to Guide, Not Guess

In growth-stage SMEs, instincts matter, but they cannot be the sole compass. Data gives you the clarity to move beyond “what feels right” to “what will work.” Even without expensive analytics software, you can turn existing transaction records into actionable insights.

Start with what you already have: daily sales logs, customer order histories, and seasonal peaks. These aren’t just records; they are a map of your demand cycles, product preferences, and revenue drivers. For example, a two-year sales history can tell you whether a dip in February is a one-off or part of a recurring pattern, helping you prepare inventory and adjust campaigns in advance.

The key is to make data part of your operational rhythm. Review trends weekly, not just at quarter-end. Look for movements in average order values, product category shifts, or changes in repeat purchase behaviour. This allows you to refine pricing, promotions, and even product development without wasting capital on trial-and-error campaigns.

Execution Tip: You don’t need enterprise tools from day one. A disciplined, well-structured Excel or Google Sheets tracker with clear categories for SKUs, periods, and customer segments can reveal trends you might overlook in raw numbers. Once the discipline is in place, you can layer in advanced platforms like Zoho Analytics or Power BI for deeper forecasting. This is another essential SME growth tip.

#6 Focus on Retention as Much as Acquisition

For a growth-stage SME, retention isn’t just about keeping customers, it’s about safeguarding your lowest-cost revenue stream. Acquiring a new account often takes 5–7 times the spend and effort compared to retaining an existing one. When you hold on to the customers you’ve already earned, you’re not only preserving cash but also building a compounding asset: a loyal base that spends more over time and refers high-quality leads.

Retention starts with operational reliability. Consistent product quality, accurate delivery timelines, and problem resolution within hours (not days) build the kind of trust that makes customers reluctant to switch. Next, layer in relevance, keep learning from your customers’ evolving needs, and adapt your offer before they ask.

High-touch engagement matters, but it has to be deliberate. Instead of sending generic festival greetings, anchor your outreach in value. Share an insight that helps them cut costs, an idea to boost their sales, or a small upgrade at no charge when you spot an opportunity. This is the difference between being “nice” and being “indispensable.”

Retention also benefits from structured follow-through. Maintain a customer database segmented by revenue contribution, purchase frequency, and risk of churn. Schedule quarterly account reviews, not just renewal calls. Automate reminders for your team to check in at meaningful milestones, first order anniversary, large delivery completion, or a seasonal restock period.

Execution Tip: Assign a retention KPI to your sales or account management team alongside acquisition targets. Track Net Revenue Retention (NRR) monthly, not annually. A steady NRR above 100% means your base is growing even before you add new customers. Use simple CRM tools like Zoho or Freshsales to centralise data, monitor engagement, and flag churn risks early.

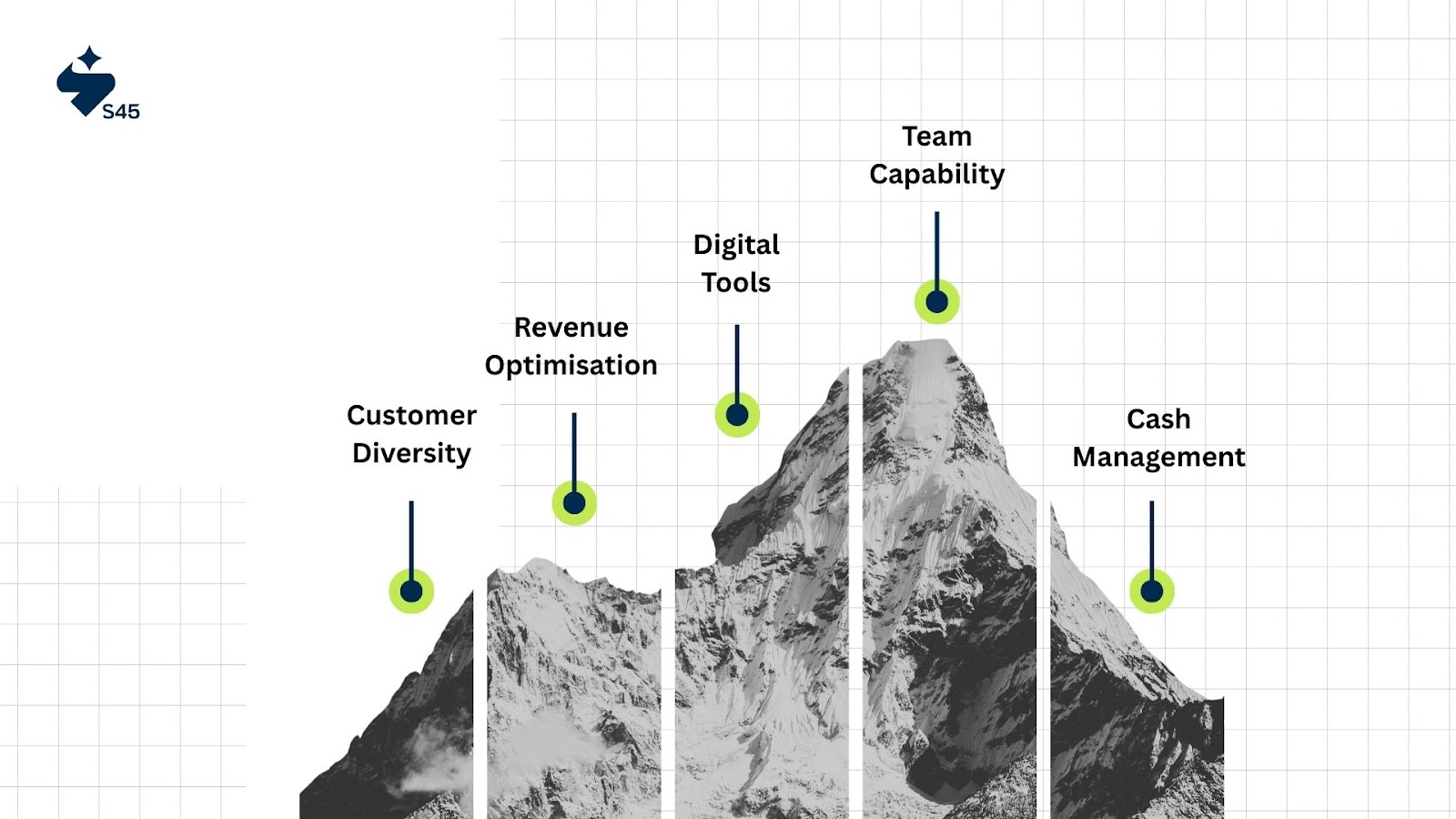

How S45 Club Helps You Put These Growth Tips into Action

Knowing what to do is only half the battle. You face the tougher challenge of turning growth strategies into real, measurable progress in a fast-changing, resource-tight market. S45 Club acts as your growth partner to help close the gap between planning and execution.

Instead of generic playbooks, you get growth roadmaps built on data and tailored to your industry, business stage, and unique challenges. You develop operational and financial systems that deliver consistent, measurable results, allowing you to grow with confidence and control.

- Diversify Your Customer Base: Reduce risks by avoiding over-dependence on a few clients. Identify new market segments, create targeted outreach strategies, and expand your customer portfolio to safeguard revenue and open doors to steady growth.

- Optimise Revenue and Margins: Analyse pricing models, product mix, and market positioning to sharpen margins. Focus on higher-value offerings and plan market expansions aligned with your capacity and goals.

- Implement Digital and Analytics Tools: Select and set up the right digital platforms, whether CRMs, sales dashboards, or financial trackers, that provide real-time visibility into your business. Use accurate, up-to-date data to make informed decisions instead of guessing.

- Build Leadership and Team Capability: Growth increases pressure on your leadership and team. Develop management systems, delegate tasks effectively, and upskill your team to reduce bottlenecks and focus on strategic priorities.

- Strengthen Cash Flow Management: Put robust cash flow monitoring and forecasting in place. Avoid liquidity crunches, optimise working capital, and balance growth investments with financial stability.

With S45 Club, you don’t just gather growth tips; you turn strategies into repeatable, scalable actions that power your business forward. Access practical expertise combined with a founder-first mindset, gaining the tools and support needed to grow smarter and stronger in today’s competitive environment.

Conclusion

SMEs form the foundation of India’s economic progress, but growth doesn’t happen by chance. It demands disciplined focus on key areas like sales, operations, finance, talent, and customer relationships. By applying practical growth strategies, expanding your customer base, managing cash flow tightly, investing in your team’s skills, and making data-driven decisions, you build a business that can grow steadily and stand the test of time.

Sustaining that growth means staying resilient and flexible, ready to adapt when challenges arise and turning them into opportunities to improve. When you consistently focus on these critical levers, you move from uncertainty to control.

Scaling your business is complex, but you don’t have to do it alone. With S45 Club, you have the tools and guidance to build a stronger, more resilient enterprise prepared for India’s changing market.

Frequently Asked Questions

1. What are the most important growth areas SMEs should focus on to scale successfully?

To scale effectively, SMEs need to concentrate on five core areas: sales diversification, operational efficiency, cash flow management, talent development, and customer relationship management. Each plays a critical role in diversifying sales, reducing dependency risks, operational efficiency cuts costs and boosts output, strong cash flow ensures financial stability, skilled teams drive execution, and nurturing customers supports long-term revenue growth.

2. How can SMEs manage cash flow better to avoid liquidity issues?

Managing cash flow starts with treating it as a daily priority, not just a monthly review. Set clear payment terms with customers and suppliers, enforce timely collections, and consider incentives for early payments. Running a lean inventory reduces capital tied up in stock. Using real-time financial tools allows you to track cash inflows and outflows immediately, helping you respond quickly to potential shortages or excesses.

3. Why is customer and supplier diversification critical for SME growth?

Relying heavily on one supplier or customer creates vulnerability. A disruption such as a delayed shipment or a lost contract can severely impact your cash flow and operations. By diversifying suppliers and customers, you spread risk, increase negotiation power, and create multiple revenue streams. This resilience helps your business stay stable and competitive through market fluctuations.

4. How can SMEs use data effectively without investing in expensive software?

Even without advanced tools, SMEs can leverage existing data like sales logs, order histories, and seasonal trends to make informed decisions. Maintaining organized spreadsheets to track key metrics enables you to spot patterns in demand, customer preferences, and product performance. Regularly reviewing this data helps refine pricing, marketing, and inventory without unnecessary spending on trial and error.

5. What role does team skill development play in sustaining SME growth?

Technology can enhance growth only when your team has the right skills. Investing in targeted training such as sales techniques, process optimization, and customer service improves performance and reduces inefficiencies. Cross-training employees to handle multiple roles adds agility, especially in lean teams common in SMEs. Tracking training outcomes ensures you get measurable benefits aligned with your growth goals.