Bank loans rarely work at the speed your business needs. You’ve probably hit that wall too: long paperwork, collateral you don’t have, or a rejection with no clear reason. Meanwhile, others around you are raising funds through revenue-based financing, leasing, or community capital, and scaling without the baggage.

That’s the shift happening in SME alternative financing, and it’s not just buzz. India’s alternative finance market is set to double, while MSMEs stare at a $220 billion credit gap.

If you’re building something and tired of dead ends, this article walks you through real funding models that match your stage, burn, and control goals. You’ll find what works, what doesn’t, and what to watch for.

Key Takeaways:

- SME Alternative financing is not a fallback; it’s a tailored approach to raising capital based on your business model, stage, and control needs.

- Each model offers trade-offs; whether it’s RBF, venture debt, or invoice discounting, you’re choosing between flexibility, cost, and long-term ownership.

- Founders often overlook timing and structure, raising too early or mixing instruments without clarity can complicate future rounds.

- Investor readiness matters, clean financials, a clear use-of-funds plan, and aligned documentation are just as important as traction.

- S45 supports founders who want to go beyond tactical fundraising, helping you think strategically, structure capital smartly, and build toward long-term value.

Why Do Founders Look Beyond Banks? (And Why You Should Too)

Only 11% of Indian MSMEs get formal credit. The rest make do with personal funds, delayed receivables, or informal lenders. If you’ve tried raising through banks, you know the drill: slow approvals, collateral demands, and rigid terms that don’t match your stage.

Here’s what pushes many founders to look elsewhere:

- Working capital delays cost you momentum

Whether you’re planning a key hire, a product launch, or an inventory ramp-up, traditional lenders rarely move at the pace you need. Weeks go by chasing approvals, only to be asked for more documents.

By the time funds come through, if they do, the window of opportunity has often passed.

- Strong revenue doesn’t count if your model is asset-light

If you run a service-based or online-first business, chances are you don’t have property or machinery to pledge. Banks still weigh physical collateral heavily, regardless of how steady your cash flow or how fast your customer base is growing.

- Customer payment cycles don’t align with loan terms

Long receivable cycles are common, especially in B2B. But traditional lenders rarely offer solutions tailored to that gap. You’re expected to manage repayments monthly, even when your own payments are due every 45 to 60 days.

- Government schemes exist, but access is patchy

Schemes like CGTMSE and SIDBI technically support collateral-free lending. But in practice:

- Most private banks hesitate to route loans through these schemes

- The application process is manual and intensive

- Disbursal timelines rarely align with startup urgency

This is where SME alternative financing steps in, not as a fallback, but as a model that’s actually built for how businesses grow today.

How Can You Find Alternative Financing?

Exploring SME alternative financing can feel overwhelming. Different models, different trade-offs, and each comes with its own learning curve. Most founders know what capital they need, but not always which structure fits best at their stage. That’s where guidance matters as much as access.

Platforms like S45club have emerged to help bridge this gap. Instead of just pointing you to money, they help you step back and ask: What kind of capital do I actually need right now, and how does it shape the business I want to build?

Here’s how founders use equity advisory platforms like S45 to avoid costly mistakes:

- Smart Entry Timing: S45 helps assess your company’s growth cycle and maps the right time to bring in external capital, whether through structured funding, secondary exits, or pre-IPO rounds.

- Deeper Due Diligence: You get a clear picture of your own company’s fundamentals from an investor’s lens, valuation drivers, cap table hygiene, and governance gaps, so you’re always pitch-ready.

- Access to Late-Stage Deal Flow: For founders looking to reinvest or diversify, S45 connects you with high-quality pre-IPO opportunities typically reserved for insider networks.

- Risk Clarity, Not Just Return Projections: S45 helps founders evaluate trade-offs like dilution, liquidity timelines, and exit complexity before committing to any funding path.

- Equity Advisory That Looks Beyond the Round: Whether you’re considering ESOP liquidity, partial exits, or preparing for institutional capital, S45 supports you with strategy, not just paperwork.

Instead of chasing capital reactively, you start aligning it with your story, your stage, and your future rounds. That’s the real power of alternative financing for SMEs when it’s done with strategy.

Mapping SME Alternative Financing Models

Not all capital serves the same purpose, and not every funding model fits your stage, cash flow pattern, or growth plan. The key is to stop chasing what’s available and start choosing what’s right. Let’s break down some alternative financing models:

1. Equity-Based Financing

Ideal for growth-oriented SMEs seeking strategic backing through a potential ownership dilution. Works best when you’re chasing scale, not just survival.

- Angel Investors: High-net-worth individuals funding early-stage SMEs. Example: Indian Angel Network funding startups in Tier-2 cities.

- Venture Capital (VC): Professional investors providing large-scale growth capital. Example: Accel’s investment in Indian SaaS SMEs.

- Equity Crowdfunding: Raising small amounts from many investors online. Example: Tyke Invest in India, enabling SME equity crowdfunding.

Equity financing brings not just money, but networks, mentors, and credibility.

2. Debt-Based Financing

Best for SMEs that want to retain ownership but need liquidity for operations, expansion, or short-term working capital.

- Peer-to-Peer (P2P) Lending: Borrow directly from individuals via online platforms. Example: Faircent (India’s leading P2P lending marketplace).

- Business Credit Cards: Flexible credit lines with rewards/benefits. Example: SBI Business Cards tailored for SMEs.

- Working Capital Loans: Short-term loans to manage cash flow gaps. Example: LendingKart SME working capital loans.

- Microloans: Small-ticket loans, often for underserved MSMEs. Example: Grameen Bank–style microfinance in rural India.

- Pension-Backed Loans: Using retirement savings as collateral in some markets (more common in Africa/Latin America).

Debt lets you scale without losing ownership—but repayment discipline is key.

3. Asset/Invoice-Based Financing

If your receivables or inventory are locked up, these financing tools help you unlock working capital without waiting for long credit cycles.

- Invoice Discounting: Sell unpaid invoices to lenders for quick cash. Example: KredX in India.

- Factoring: Lenders purchase receivables and take collection responsibility. For example, SBI Global Factors.

- Invoice Trading: Digital marketplaces where SMEs trade invoices with investors. For example, Invoicemart on RBI’s TReDS platform.

- Supply Chain Financing: Anchor corporates help SMEs get early payments. For example, M1xchange supplies supply chain finance.

- Inventory Financing: Borrow against stock-in-hand. For example, TradeCred's inventory financing partnerships.

- Merchant Cash Advance: Advance based on future card/UPI receivables. For example, Razorpay Capital for merchants.

This category is scaling fast in India as RBI-backed platforms (like TReDS) gain traction in 2025.

4. Government & Institutional Support

For SMEs in priority sectors, government-backed schemes and grants reduce financing costs and encourage formalization.

- Grants: Direct support for innovation or sector-specific growth. For example, the SIDBI innovation grants.

- Subsidized Schemes for SMEs: Interest subventions or collateral-free loans. For example, Mudra Loans under the PMMY scheme.

Government support is evolving to work hand-in-hand with fintechs, not just banks.

5. Fintech-Driven Financing

The fastest-growing segment in 2025, designed for speed, tech-integration, and flexible repayment models.

- Rapid Finance Platforms: Digital-first lenders disbursing within 48 hours. For example, Indifi, NeoGrowth.

- BNPL (Buy Now Pay Later) Solutions for SMEs: Helps SMEs buy raw materials or inventory on credit. For example, Rupifi BNPL for small retailers.

- Embedded Finance Models: Financing built into platforms SMEs already use (ERP, SaaS, marketplaces). For example, Amazon Business credit lines in India.

Each of these financing types comes with its own trade-offs. Choosing the right one depends on whether you value speed, cost, ownership, or risk distribution. The real question is ahead of you.

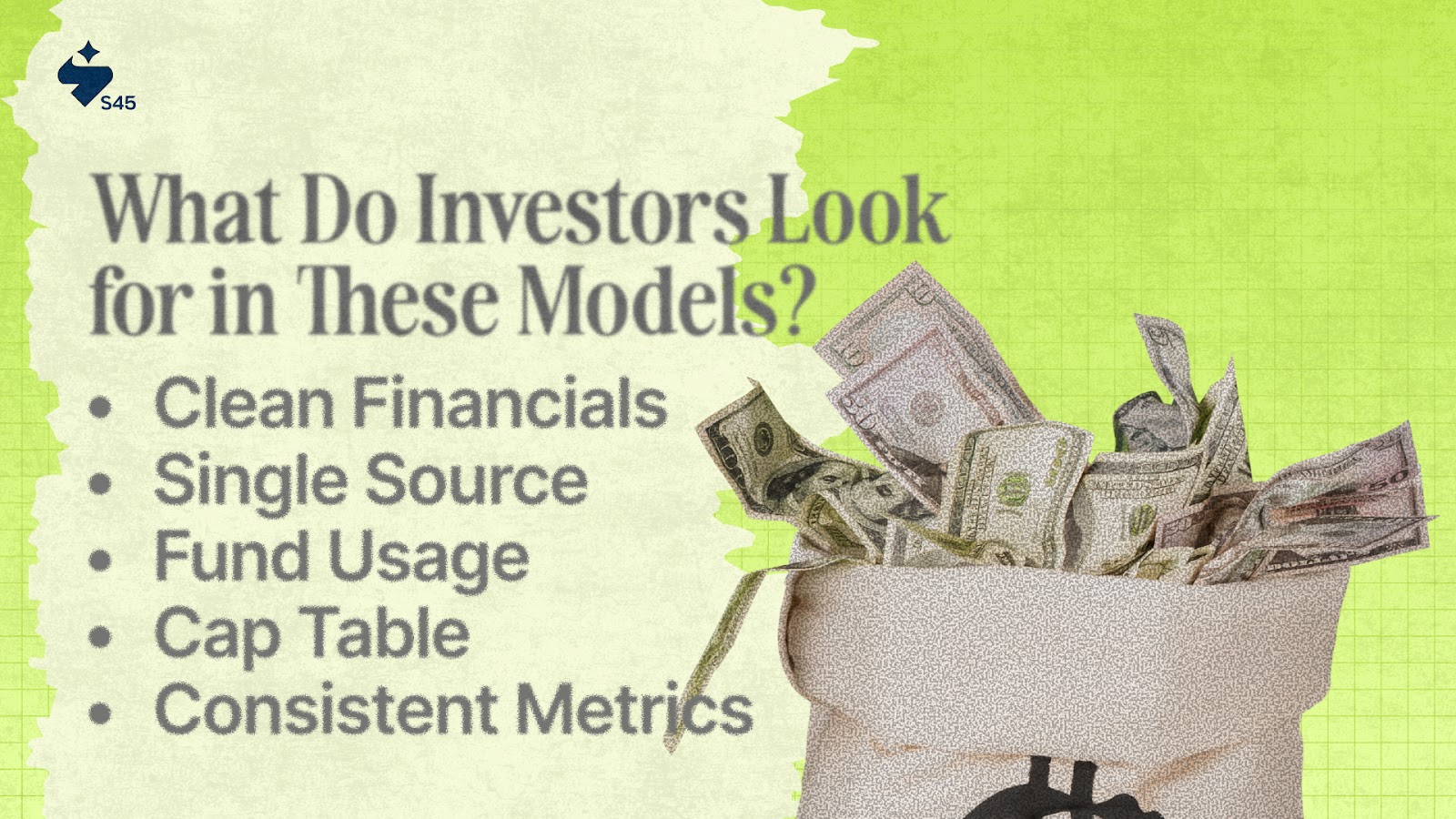

What Do Investors Look for in These Models?

Each model has its own mechanics, but across the board, investors and platforms are scanning for one thing: clarity and consistency. Whether you’re approaching a revenue-based financing platform, a venture debt firm, or applying for a grant, your internal readiness signals how reliable your business is.

Here’s what they watch for beyond the pitch:

- Clean financials: Updated P&L, cash flow statements, and basic compliance docs ready (GST, ROC, income tax returns)

- Single source of truth: One data room. One version of your business story. No scattered spreadsheets.

- Clarity on fund usage: Whether it’s for working capital or scaling ops, be specific, not “general growth.”

- Cap table clarity: Simple structures win. Clean records of past raises, notes, and equity splits.

- Consistent metrics: What you say in the pitch deck should match what’s in your dashboards or ledger.

- Prepared to answer questions like:

- What's your current burn rate and runway?

- How do you handle client or revenue concentration?

- What happens if revenue dips next quarter?

What do founders often overlook?

- Raising before internal systems are audit-ready: Investors, especially in RBF or debt, expect clean financials, reconciled books, and consistent invoicing, not just a traction chart in a deck.

- Forecasting without operational proof: Forward-looking numbers that aren’t tied to marketing strategy, CAC assumptions, or hiring plans raise flags, especially in short-term models like RBF or factoring.

- Pitching every model the same way: Equity stories focus on vision and upside; RBF and debt need evidence of stable revenue and repayment capacity. Founders often blur these lines and lose credibility.

- Overlooking investor experience in spotting disorder: Sloppy metrics, unclear cap tables, or mixed-up funding history signals deeper structural issues, even before due diligence begins.

You’ve seen the models. Now it comes down to choosing the structure that actually fits how your business runs.

Debt, Equity, or Hybrid? Cut Through the Noise

Founders often fixate on the source of the money. But the smarter question is: what kind of money serves your stage, risk appetite, and control preferences best?

Here’s how to think it through.

1. Equity: When Ownership Is Worth Trading

Choose equity (or equity-linked tools like SAFEs or convertible notes) when:

- You’re pre-revenue or pre-product

- There’s no way to repay capital in the near term

- You’re building long-term value and don’t want repayment pressure

- You’re raising from angels or VCs who bring more than just money

Equity is patient, but expensive. You’re not paying it back, but you're giving up a piece of everything you’ll build.

2. Debt: When Revenue Can Carry the Load

Debt-based models like RBF, venture debt, or invoice financing make sense when:

- You have predictable, recurring revenue

- You’re looking to fund growth without giving up ownership

- You can afford repayments without straining operations

- You’ve already raised equity and want to extend your runway without another round

Debt is non-dilutive, but demanding. You keep control, but the repayments start soon, whether or not growth plays out as planned.

3. Hybrid: When You Want Both Breathing Room and Control

A blended approach works well when:

- You’ve raised equity but want to preserve ownership through debt-based top-ups

- Your business has cash flow for partial repayments, but also needs longer-term backing

- You’re in transition, scaling between rounds or de-risking a new initiative

- You’re structuring capital based on use-case: equity for R&D, RBF for marketing, leasing for assets

Hybrid models give you flexibility, but only if you manage complexity. The key is clean documentation, synced timelines, and clear communication with all stakeholders.

Final Thoughts

Exploring models such as revenue-based financing, venture debt, and invoice discounting helps you approach fundraising with greater clarity and intention. While these options open up smarter ways to fund your journey, choosing the wrong model or jumping in without a long-term view can lead to avoidable dilution, repayment strain, or stalled momentum.

If you're planning your next raise with a longer horizon in mind, S45club can help you structure smarter capital decisions, align funding with strategy, and stay in control of what you're building.

Frequently Asked Questions

1. How do I avoid getting stuck with funding that limits my future rounds or exit?

A. Always think a few steps ahead. Some founders accept capital that comes with restrictive terms, like aggressive repayment clauses or investor control rights, which complicate future fundraising. When choosing any model under SME alternative financing, make sure it aligns with your long-term roadmap and doesn’t scare off future VCs or institutional investors.

2. Is it possible to combine multiple financing models in one round?

A. Yes, and many founders do it. For example, a startup might raise part of its capital via revenue-based financing to fund growth campaigns and use a small SAFE note for added runway. Just ensure your documentation is clean, terms are consistent, and future investors aren’t confused or put off by a complex structure. Always loop in legal advisors when mixing instruments.

3. How do I explain my funding model to early team members or advisors who hold equity?

A. Transparency is key. Your team should understand how any funding decision affects dilution, control, and company value. If you’re using SME alternative financing like venture debt or invoice discounting, walk them through how it preserves equity while fueling growth. This helps manage expectations, especially when negotiating ESOPs or performance-linked compensation.

4. Can I access SME alternative financing if I don’t have institutional investors on my cap table?

A. Yes, though options may vary. Some models, like venture debt, often require you to have raised from a known VC. But others, like revenue-based financing, invoice discounting, or crowdfunding, are open to bootstrapped or angel-backed founders. SME alternative financing today is more inclusive than before, as long as your business metrics are healthy and well-documented.

5. How can I use these models without overwhelming my limited bandwidth as a founder?

A. Simplify your stack. Choose one model that fits your most immediate use case, say, RBF for performance marketing, and set up basic reporting templates to stay on top of repayments or investor communication. As your ops grow, you can layer in other tools. The key is to scale your financing model at the same pace as your internal systems.