Key Takeaways:

- The 45-Day MSME Credit Period Rule requires buyers to settle dues within 45 days if a formal agreement exists, or 15 days if there’s no agreement, to improve MSME cash flow.

- The rule applies to Udyam-registered MSMEs, and buyers must verify their registration to avoid compliance issues.

- Tax deductions can only be claimed for payments made within the prescribed timeframes; delays result in disallowed expenses.

- Late payments incur compound interest penalties and can damage a business’s reputation and tax deductions.

- MSMEs benefit from improved cash flow, financial stability, and stronger supplier relationships, enabling them to focus on growth.

The 45-Day MSME Credit Period Rule, introduced under the MSMED Act of 2006 and strengthened in the Finance Act of 2023, addresses the persistent issue of delayed payments for micro, small, and medium enterprises (MSMEs).

Effective from April 1, 2024, the rule mandates buyers to settle dues within 45 days if a formal agreement exists, or within 15 days if there’s no agreement. This regulation aims to improve MSME cash flow, reduce reliance on high-interest loans, and create a culture of timely payments.

In this blog, we’ll explore the rule’s scope, objectives, impact, and strategies for compliance, while discussing the challenges businesses may face in implementation.

What is the 45-Day MSME Credit Period Rule?

The 45-Day MSME Credit Period Rule addresses the longstanding challenge of delayed payments faced by many micro, small, and medium enterprises (MSMEs).

Effective from April 1, 2024, the rule mandates that buyers must settle dues within 45 days from the acceptance of goods or services if there is a formal agreement in place. In the absence of such an agreement, the payment period is reduced to 15 days.

Key Highlights:

- 45-Day Payment Requirement: Payments must be made within 45 days from the acceptance of goods or services if a formal agreement exists between the buyer and seller.

- 15-Day Default Period: If no written agreement exists, the payment period is reduced to 15 days.

- Financial Relief for MSMEs: The rule is designed to improve MSME cash flow, allowing businesses to focus on growth rather than survival.

- Government Support: The government's push for timely payments is part of broader efforts to improve the business environment for MSMEs, as highlighted in the 2023 Union Budget.

This rule directly contributes to a healthier financial ecosystem for MSMEs, ensuring they are paid promptly and can maintain smooth operations.

Understanding the Rule's Scope and Applicability

The 45-Day MSME Credit Period Rule applies to businesses purchasing goods or services from MSMEs registered under the MSMED Act, 2006. MSME registration can be easily verified through the Udyam Registration system.

Key Points:

- Applies to Registered MSMEs: The rule applies to transactions with MSMEs registered under the MSMED Act.

- Tax Deductions: Tax deductions are only allowed on payments made within the 45-day period; delays result in disallowed expenses.

- Legal Compliance: Businesses must verify MSME registration and comply with the payment timelines to avoid legal and financial issues.

Whether you're looking to scale your MSME or explore strategic funding options, S45 provides the equity advisory needed to align your financing decisions with long-term growth, not just short-term goals.

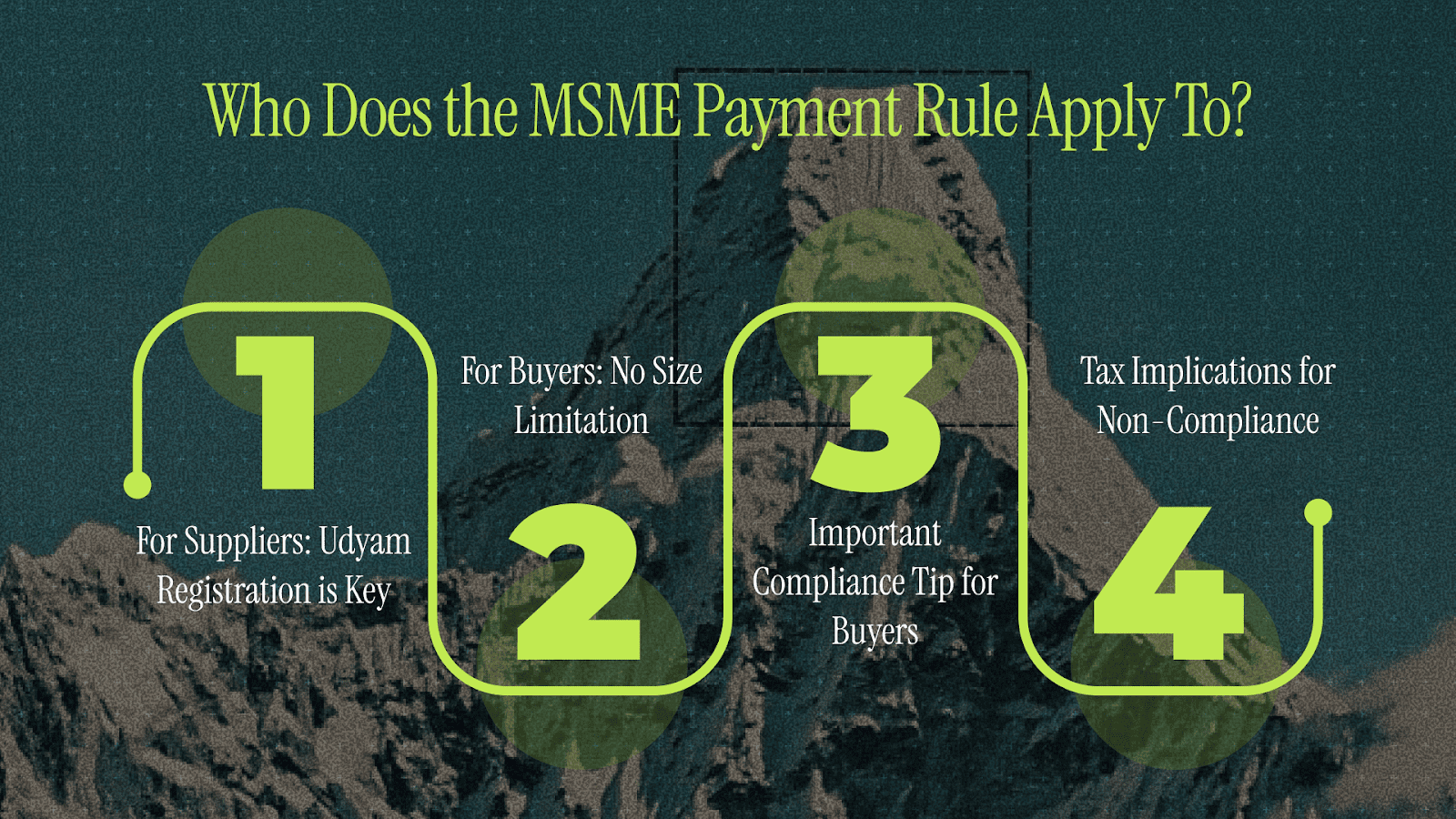

Who Does the MSME Payment Rule Apply To?

The 45-Day MSME Credit Period Rule, as part of the MSMED Act and Section 43B(h) of the Income Tax Act, applies specifically to transactions between buyers and registered MSME suppliers. Here’s a breakdown of who qualifies:

For Suppliers: Udyam Registration is Key

The rule only applies if the supplier is registered on the Udyam Registration Portal. Suppliers who meet the MSME criteria (based on investment and turnover) but are not registered do not benefit from the rule. To qualify, the supplier must be classified as:

- Micro: Investment < ₹1 crore and turnover < ₹5 crore

- Small: Investment < ₹10 crore and turnover < ₹50 crore

- Medium: Investment < ₹50 crore and turnover < ₹250 crore

For Buyers: No Size Limitation

The rule applies to all business entities, regardless of size. Whether the buyer is a private company, public sector unit, partnership, LLP, or sole proprietorship, they are required to make payments within 45 days to avoid penalties under this rule.

Important Compliance Tip for Buyers

Buyers must verify that their suppliers are Udyam-registered before finalizing contracts or making payments. Failure to do so can lead to compliance issues and penalties.

Tax Implications for Non-Compliance

If a buyer fails to make payment within the stipulated 45 days, even by a single day, they risk having their tax deductions disallowed unless the payment is made within the same financial year.

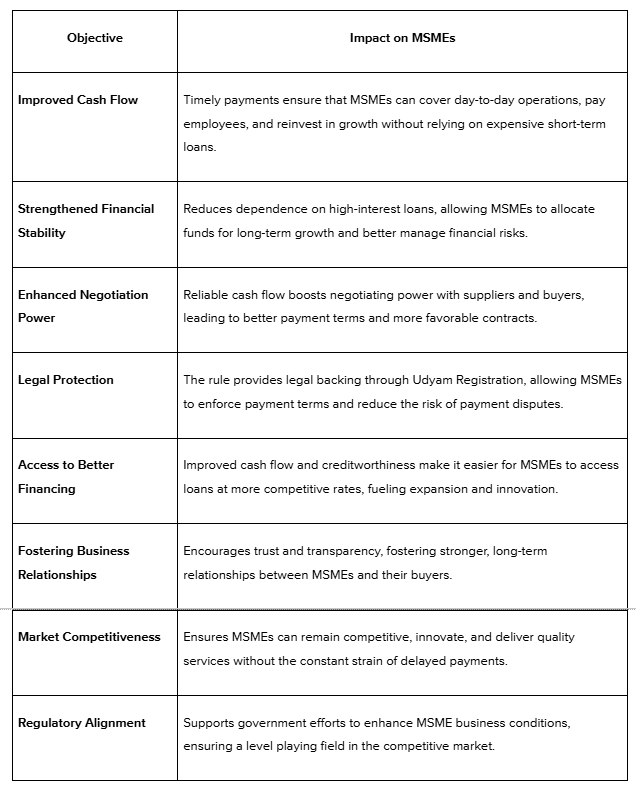

How the 45-Day MSME Credit Period Rule Helps MSMEs

The 45-Day MSME Credit Period Rule offers significant benefits that enhance the financial health and growth potential of MSMEs in India. Below is a table summarizing the key objectives and impacts:

Now that we’ve explored the rule’s impact, let’s dive into the practical steps businesses must take to align with these new changes.

Changes Effective from 1st April 2024: Key Compliance Updates

With the start of the new financial year in April 2024, businesses were required to adapt to significant changes regarding MSME payment terms. These adjustments impacted how businesses manage accounts payable, particularly with MSME suppliers, and had implications for tax deductions and expense claims.

Here’s what businesses need to prioritize to stay compliant:

1. Create a Detailed Vendor List

The first step is to compile a comprehensive vendor list, categorizing suppliers to identify which qualify as MSMEs under the MSMED Act, 2006. This is crucial because the new payment rules apply only to registered MSMEs. To do this:

- Review current vendor contracts and documentation.

- Confirm the MSME status with suppliers.

- Update vendor management systems to flag MSME suppliers.

- Implement regular updates, as a supplier’s MSME status can change.

2. Record All Outstanding Payables

It’s essential to keep track of all payables as of March 31, 2024. This record should include:

- The amount owed to each supplier.

- The invoice date and due date for each payment.

- Whether the supplier is an MSME.

- The age of each payable.

A clear record helps businesses manage cash flow, identify which payables are impacted by the new rules, and prepare for any necessary adjustments.

3. Understanding the Allowance and Disallowance Rules

One of the most important aspects of these changes is understanding how payments made after the 45-day or 15-day deadlines affect tax deductions. Here's a breakdown:

- Same Financial Year Payments: If payments are made within the same financial year, even if they exceed the 45-day or 15-day limit, the expense can still be deducted in that year.

Example: A payment made after the 45-day limit but within the same financial year still qualifies for tax deductions in that year.

- Subsequent Financial Year Payments: Payments made after the deadline and in the next financial year can only be deducted in the year the payment is made.

Example: A payment made after the 45-day deadline in the next financial year will be deducted in the year the payment is made, not the year the invoice was issued.

- Payments Within the Approved Credit Period in the Next Year: If payments are made within the stipulated credit period, but in the following financial year, deductions can still be claimed in the year of accrual.

Example: An invoice received at the end of one year but paid within the next financial year within the 45-day period can still be deducted in the previous financial year.

- Subsequent Year Payments Beyond Credit Period: If payments exceed the credit period in the following year, the deduction will only be allowed in the year the payment is made, not on an accrual basis.

With the 45-day rule in place, businesses must also be aware of the potential consequences of non-compliance and how to avoid them.

Non-Compliance Penalties and Consequences

Failure to comply with the 45-Day MSME Credit Period Rule can have serious financial and reputational repercussions for businesses.

These penalties are designed to encourage timely payments and ensure MSMEs are paid fairly for their goods and services. Here’s what happens if deadlines are missed:

1. Compound Interest

Companies that miss the payment deadline will incur a penalty of compound interest at three times the RBI bank rate on the overdue amount, starting immediately after the payment period expires.

2. Tax Implications

Under Section 43B(h) of the Income Tax Act, businesses can only claim tax deductions for payments made within the required period. Late payments result in the interest being non-deductible, and deductions can only be claimed in the year payments are made, not when they’re due.

3. Reputational Damage

Regular late payments can damage a company’s credibility, making it harder to secure future contracts or partnerships, as buyers will be wary of working with unreliable payers.

4. Legal Actions

MSMEs have legal recourse through the MSME Samadhaan portal and the Micro and Small Enterprise Facilitation Council to file complaints and resolve payment disputes quickly, ensuring fair compensation for delayed payments.

s45club helps MSMEs plan beyond immediate funding needs, offering guidance on funding options that align with long-term growth. From understanding payment regulations to preparing for expansion, we ensure your financial decisions support sustainable success.

Ensuring Compliance: Strategies and Challenges

Successfully complying with the 45-Day MSME Credit Period Rule requires clear processes and attention to detail. Here are some effective strategies to help businesses stay on track:

- Documenting Agreements: It’s essential to have signed contracts that clearly outline payment terms. Make sure all parties agree on deadlines and acceptance criteria upfront to avoid any confusion or disputes down the line.

- Tracking Payments: Using digital invoicing and e-payment systems can simplify the payment tracking process. These tools help businesses stay organized and ensure that payments are made on time, reducing the risk of delays.

- Addressing Compliance Gaps: Some MSMEs, especially in rural areas, may not be fully aware of the rule or lack the resources to comply. To bridge this gap, businesses can invest in outreach and education programs to ensure that all stakeholders understand the rule and its benefits.

Conclusion

The 45-Day MSME Credit Period Rule offers a critical solution to the cash flow challenges faced by small businesses. By ensuring timely payments, MSMEs can maintain financial stability and focus on growth, rather than dealing with payment delays.

This regulation creates a more predictable business environment, fostering stronger relationships with suppliers and improving the overall financial health of MSMEs.

As MSMEs adapt to these changes, strategic funding and expert guidance can further accelerate their growth. S45 helps you align your funding decisions with your long-term business goals.

Join the s45club founder community to learn from other entrepreneurs, share insights, and access the resources needed to secure the right capital for sustainable success.

Frequently Asked Questions

Q: What happens if a buyer doesn’t verify an MSME supplier’s registration?

A: If a buyer doesn’t verify the supplier’s Udyam registration and makes late payments, they risk non-compliance with the 45-Day rule. The supplier must be registered to claim the payment timelines and avoid penalties.

Q: Can MSMEs claim deductions if payments are made after the 45-day period but within the same financial year?

A: Yes, payments made after the 45 days but within the same financial year can still be deducted, provided the payment is made before the financial year ends.

Q: How does the 45-Day MSME rule affect MSMEs in rural areas?

A: MSMEs in rural areas may face challenges with awareness and resources to comply. Businesses need to provide outreach and education to ensure full understanding of the rule and its benefits.

Q: What legal recourse do MSMEs have if payments are delayed beyond 45 days?

A: MSMEs can file complaints through the MSME Samadhaan portal or the Micro and Small Enterprise Facilitation Council to resolve payment disputes and ensure fair compensation.

Q: Are payments made by MSMEs eligible for tax deductions under the same rule?

A: No, the rule applies explicitly to MSME suppliers. Buyers can only claim deductions for payments made within the prescribed timeframe, not MSME payments to their suppliers.