Key Takeaways

- CLCSS helps MSMEs reduce the cost of technology upgrades by offering subsidies on institutional loans.

- Eligibility: Open to all MSMEs with Udyam registration, including SC/ST units for higher subsidies.

- Application: Submit online via the MSME portal with approval from lending institutions and nodal agencies.

- Impact: CLCSS addresses key challenges like productivity, quality, and access to markets while helping MSMEs modernize.

- Delayed Payments: Despite CLCSS, delayed payments remain a significant liquidity challenge for MSMEs, impacting their growth.

Small and medium enterprises form the backbone of India’s economy, contributing nearly 30% to GDP and employing over 110 million people as of 2024. Yet many units face persistent hurdles: outdated machinery limits productivity, compliance gaps restrict market access, and delayed payments from large buyers strain cash flow.

Competing with bigger players or meeting export standards often feels out of reach because the cost of upgrading technology remains prohibitive.

The Credit-Linked Capital Subsidy Scheme (CLCSS) was introduced to close this gap by reducing the financial burden of technology adoption, giving Indian MSMEs a viable pathway to modernization and long-term stability.

This blog explains how CLCSS works, its objectives, eligibility, application process, and how it connects with the persistent challenge of delayed payments faced by MSMEs.

CLCSS: Reducing Technology Costs and Enabling MSME Modernization

The Credit-Linked Capital Subsidy Scheme (CLCSS) is designed to offset the high cost of plant and machinery upgrades, making modernization accessible for micro, small, and medium enterprises.

By subsidizing institutional loans, the scheme reduces entry barriers to technology that directly improves output, compliance, and competitiveness.

- Capital Support: 15% subsidy on institutional loans, capped at ₹15 lakh for general MSMEs.

- Enhanced Support for Inclusivity: 25% subsidy for SC/ST units under the Special CLCSS (SCLCSS), capped at ₹25 lakh.

- Scale of Impact: As of FY 2023-24,344 SC/ST enterprises received subsidies worth ₹322 crore.

- Sector Coverage: More than 750 technologies approved across 51 industries, including food processing, textiles, auto components, pharmaceuticals, khadi, and coir.

Beyond the direct financial support, CLCSS also plays a pivotal role in improving the broader operational landscape of MSMEs. Let's explore these impacts in detail.

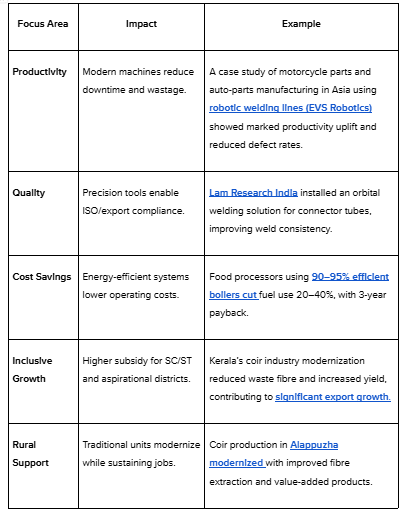

Why CLCSS Matters: Productivity, Quality, and Market Access

CLCSS addresses the three bottlenecks that hold MSMEs back: productivity gaps, inconsistent quality, and limited access to modern markets. Let us further see how:

The government targets raising the MSME sector’s GDP contribution from 29% to 50% over the next decade, and CLCSS is positioned as a key lever in this transition

For founders, adopting schemes like CLCSS is only one part of the growth journey. Scaling a business requires not just capital relief but also guidance on compliance, strategy, and sustainable expansion.

This is where s45club positions itself, walking alongside MSME leaders, combining financial expertise with long-term growth support, and building a community focused on legacy and innovation.

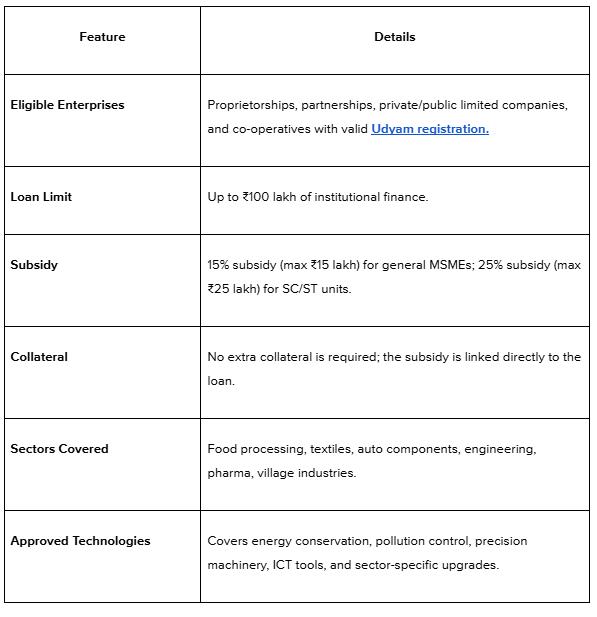

Eligibility, Loan Limits, and Key Scheme Features

The design of CLCSS ensures broad applicability across ownership structures and sectors, while maintaining strict caps on subsidy limits.

Example: An auto-component MSME investing ₹80 lakh in robotic welding lines would qualify for a subsidy of ₹12 lakh under the general scheme, reducing the effective loan burden to ₹68 lakh.

Application Process: Digital Workflow for MSME Access

The CLCSS application is routed through a single digital portal, reducing paperwork and delays. MSMEs apply online, their bank verifies the request, and nodal agencies release the subsidy once approved.

The system ensures transparency and allows applicants to monitor progress in real time.

Steps to Apply:

- Register on the MSME CLCSS portal.

- Complete the form with enterprise details, loan requirements, and machinery quotations.

- Submit through a Primary Lending Institution (commercial bank, cooperative bank, SIDBI, NABARD, or state financial corporation).

- PLI verifies and forwards to the nodal agency.

- Approved subsidy is adjusted against the sanctioned loan.

Processing Time: 6–8 weeks, depending on document accuracy and bank response.Tracking: Status can be checked anytime on the portal.

Tip: Verify machinery against the approved technology list before applying; ineligible equipment is a common reason for rejection.

While CLCSS helps improve operational capacity, it doesn’t address the ongoing challenge of delayed payments. Let’s dive into how delayed payments continue to impact cash flow and sustainability for MSMEs.

Delayed Payments: A Persistent Threat to MSME Liquidity

Upgrading machinery under CLCSS improves output and competitiveness, but these gains are undermined if delayed payments block cash flow.

Even well-equipped enterprises cannot sustain operations without timely receivables, making payment discipline as critical as modernization.

To address this, India has introduced legal safeguards and reporting systems:

1. Legal Framework

India has implemented a robust set of legal safeguards to ensure timely payments to MSMEs. These frameworks are designed to protect MSMEs from delayed payments and ensure financial discipline from buyers:

- MSMED Act, 2006 – Section 15: Buyers must pay MSMEs within 45 days of acceptance.

- Penalty Clause: Delayed payments attract interest at three times the RBI bank rate, compounded monthly.

- Income Tax Act – Section 43B(h): From April 2024, buyers can claim tax deductions only if MSME dues are cleared within statutory limits.

2. Scale of the Problem

Despite the legal frameworks in place, delayed payments remain a significant challenge for MSMEs. The scale of the issue continues to grow, underscoring the need for more effective enforcement and timely payment practices:

- ₹21,108 crore is pending across 90,000 cases on the Samadhaan Portal as of October 2024.

- In FY25, MSMEs filed 47,587 applications on the Samadhaan Portal to recover dues of ₹8,024.9 crore—the highest number of cases since inception. This marked a 94% rise from 24,519 applications in FY20, while total dues grew more modestly at 25.7%.

Now that we’ve established the significance of delayed payments, let’s examine practical strategies MSMEs can adopt to combine the benefits of CLCSS with proactive measures for managing cash flow.

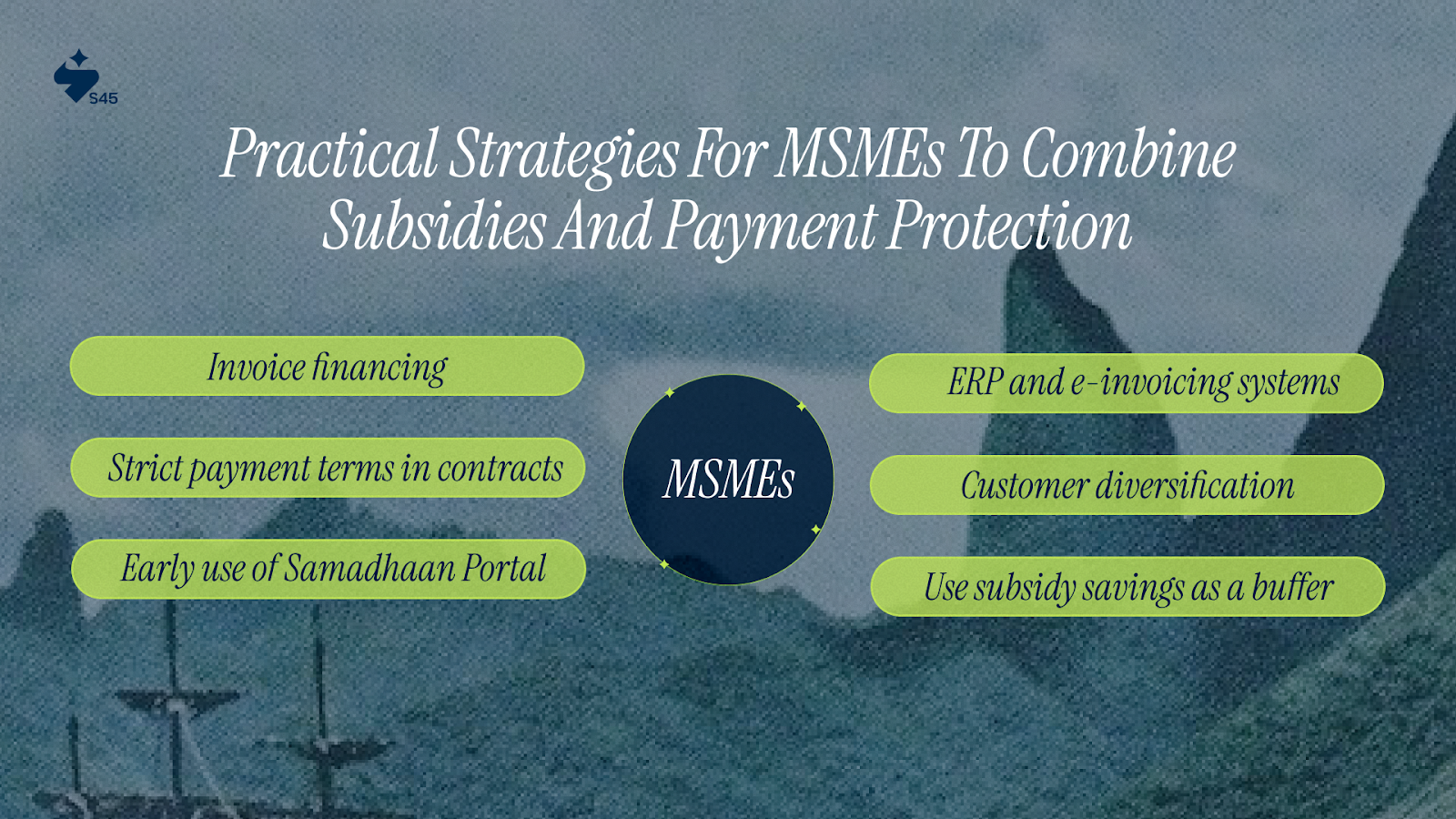

Practical Strategies for MSMEs to Combine Subsidies and Payment Protection

Modernization through CLCSS improves efficiency, but delayed payments can still disrupt cash flow and blunt these gains.

The subsidy reduces upfront financial pressure, giving MSMEs some cushion, yet lasting stability requires a mix of subsidy benefits, financial tools, and legal safeguards.

Combining these approaches helps enterprises keep operations steady even when receivables are delayed.

1. Invoice financing (factoring/TReDS)

Receivables often remain stuck with buyers for 60–90 days or longer. Factoring and platforms like TReDS enable MSMEs to sell approved invoices to banks or NBFCs and receive immediate cash. This helps maintain steady cash flow without waiting for buyers to release payments.

Example: A component supplier on TReDS sells invoices worth ₹25 lakh to a bank and receives funds within 3 days, avoiding a liquidity crunch.

2. Strict payment terms in contracts

Contracts and purchase orders should clearly include the 45-day payment mandate under the MSMED Act. Adding penalty clauses or interest terms discourages buyers from pushing payments indefinitely. Written terms give MSMEs firmer ground if disputes escalate.

3. Early use of Samadhaan Portal

Many businesses wait months before filing claims, which weakens their position. Filing cases as soon as payments cross due dates creates early pressure on buyers and brings the case under the notice of authorities. This can also help track repeat offenders when dealing with government or PSU buyers.

4. ERP and e-invoicing systems

Manual tracking of invoices leads to errors and missed follow-ups. ERP systems integrated with GST e-invoicing provide automated reminders, clear receivable records, and digital proof of dues. This improves internal cash planning and strengthens any legal claim.

Example: A mid-sized food processor integrates ERP with GST e-invoicing and reduces overdue invoices by 30% within one year.

5. Customer diversification

Dependence on a few buyers exposes MSMEs to high risk when payments are delayed. By balancing between large clients, regional buyers, and exports, units reduce the impact of any single delayed payment.

Example: A textile unit in Surat works with both exporters and domestic wholesalers, ensuring steady turnover even when export payments slow down.

6. Use subsidy savings as a buffer

The subsidy from CLCSS reduces the effective loan burden. A portion of this saving can be earmarked as a reserve fund.

This buffer allows enterprises to meet salary, raw material, and utility expenses during payment delays without resorting to costly short-term borrowing.

S45: The Right Partnership Your MSME Needs

For MSME founders, raising capital is rarely the only challenge. The bigger hurdle is knowing when to raise, how much to raise, and what it means for ownership and long-term stability.

s45club was created to guide businesses through these decisions, combining access to capital with deep equity advisory designed for India’s growth-focused enterprises.

How S45 Club Supports MSMEs

- Timing Capital Right: S45 assesses your business cycle and identifies the right stage for structured funding, partial exits, or pre-IPO opportunities.

- Investor Readiness: Clarity on valuation, governance, and cap table hygiene so your business is always pitch-ready.

- Diversification Access: Connects MSME owners with late-stage, high-quality opportunities usually limited to insider networks.

- Risk Transparency: Explains trade-offs around dilution, liquidity, and exit timelines before you commit.

- Beyond a Single Raise: Guidance on ESOP Liquidity, Secondary Sales, and Preparing for Institutional Capital.

Conclusion

The Credit-Linked Capital Subsidy Scheme has given MSMEs a practical way to upgrade technology without taking on unsustainable debt. Better machinery raises productivity, improves compliance, and expands access to markets. Yet modernization alone cannot sustain growth if liquidity remains locked in overdue receivables.

Payment discipline under the MSMED Act and Section 43B(h), combined with financial tools like TReDS and invoice factoring, is just as critical.

Looking to learn from peers who’ve scaled with strategic capital? Join the s45club community to share experiences, compare playbooks, and grow alongside other founders.

Frequently Asked Questions

Q: Can MSMEs apply for CLCSS more than once?

A: No, MSMEs can apply for the CLCSS subsidy once per machinery upgrade. If additional upgrades are needed, they must seek separate funding through other schemes or financial institutions.

Q: How does CLCSS help with energy efficiency?

A: CLCSS supports MSMEs in adopting energy-efficient technologies, such as energy-saving boilers and machinery, which help reduce operating costs. These upgrades are critical for long-term sustainability and cost reduction in operations.

Q: Are there any sector-specific subsidies under CLCSS?

A: Yes, CLCSS covers over 750 approved technologies across 51 sectors, including food processing, textiles, engineering, and rural industries like coir and khadi, ensuring broad applicability for MSMEs in various industries.

Q: Can MSMEs use the subsidy amount for working capital needs?

A: No, the subsidy from CLCSS is strictly for machinery and technology upgrades. It cannot be used directly for working capital. However, the improved productivity from the upgrades can indirectly free up cash flow.

Q: Does CLCSS apply to both small and medium-sized businesses?

A: Yes, the scheme is designed to assist both small and medium-sized enterprises (SMEs) in India, offering the same subsidy rates for both categories, provided they meet the eligibility criteria and loan requirements.