Have you ever thought about how an equity advisor could shape your business decisions? In India, after two years of contraction, private equity and venture capital investments grew by 9% in 2024, reaching $43 billion, showing founders' growing focus on structured growth. Yet many founders enter equity deals without guidance, risking ownership loss or unfair terms.

Growth is not just about revenue; it is about building value that lasts. An equity advisor (EA) helps plan funding routes that keep your vision strong.

In this guide, you will learn the duties of an equity advisor, how they differ from financial advisors, qualifications to check, and when to engage one for your growth plans.

Key Takeaways

- Equity advisors help guide funding, ownership, and deal structuring decisions.

- Their duties include assessing valuations, structuring deals, ensuring compliance, and negotiating with investors.

- Choose an advisor with relevant experience, strong qualifications, and a collaborative approach that aligns with your goals.

- Prepare your business with strong governance, clean compliance, and clear objectives for smoother equity structuring and growth.

Who is an Equity Advisor?

An equity advisor is a trusted expert who helps founders navigate funding, ownership, and equity structuring decisions. Unlike brokers, who execute trades for commission, equity advisors focus solely on equity-related matters. While merchant bankers typically manage large-scale fundraising, IPOs, and compliance, an equity advisor works closely with founders to create fair deals and long-term strategies that align with their vision.

For Indian mid-market and traditional businesses, equity advisors play a crucial role in ensuring that growth plans protect both control and core values. Many family-run businesses lack in-house expertise to assess equity deals effectively. In such cases, an equity advisor helps safeguard ownership while raising the necessary funds for sustainable expansion.

In essence, an equity advisor is a key partner for equity-related decisions, whose role has become even more vital with the growing prevalence of private equity deals in India.

Choosing the right advisor shapes your growth journey. Now, let’s understand the roles and duties they perform to support your business vision.

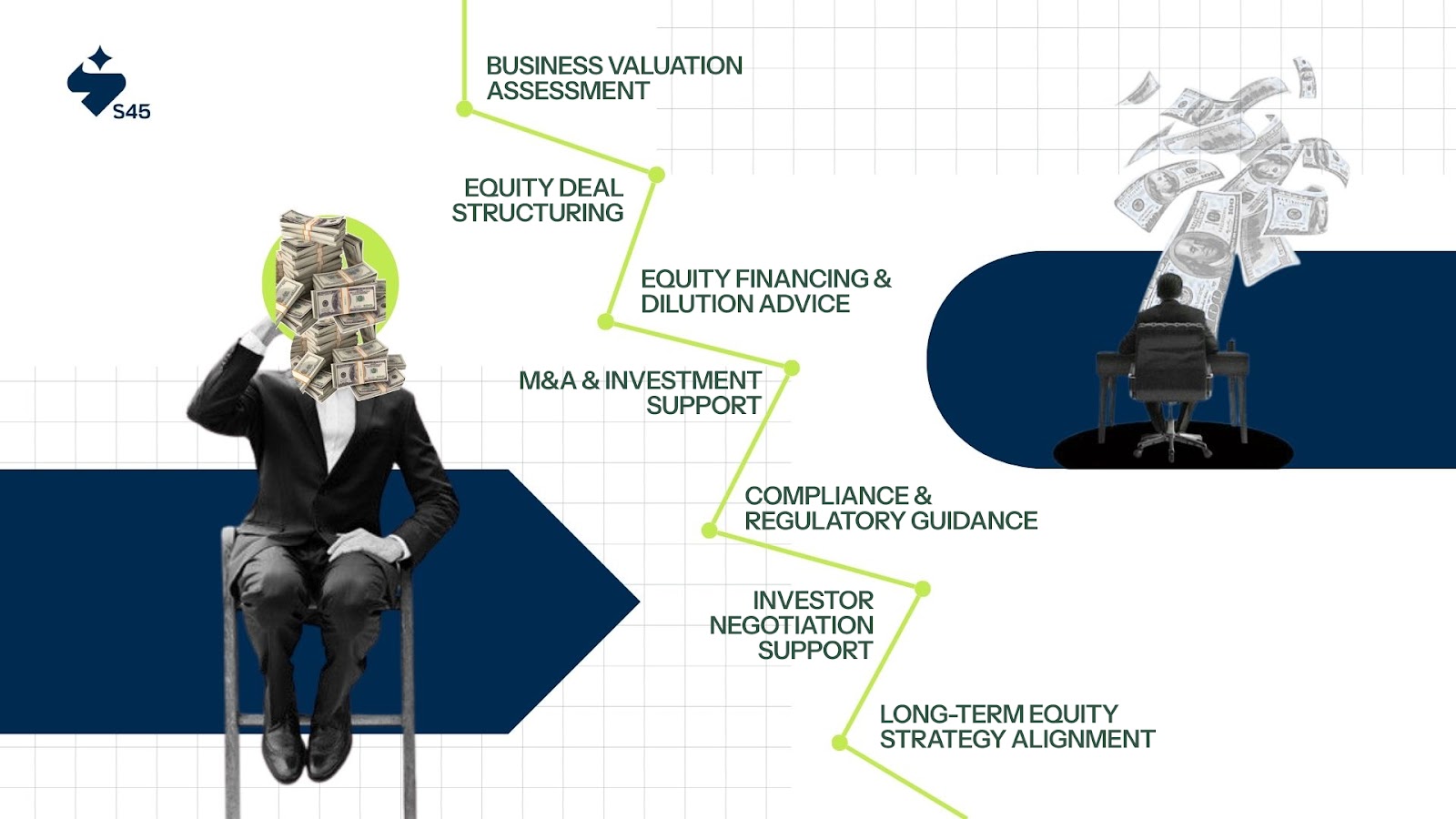

Key Duties of an Equity Advisor

An equity advisor does more than give funding suggestions. They act as your guide on ownership decisions, deal structures, and investor terms. Their duties ensure your growth does not weaken your control or values. Each role they play builds confidence for founders, making long-term decisions.

Here are their major duties explained in simple terms:

1.Assessing Business Valuation

Equity advisors assess what your business is worth before any funding or sale. They use market data, financial statements, and growth potential to set fair valuations.

For example, a mid-market manufacturer planning to raise growth funds would need an advisor to value its supply chain strength, asset quality, and future cash flows.

2. Structuring Equity Deals

They design deal terms that balance investor needs and founder interests. It includes deciding ownership percentages, voting rights, and exit options.

A trading business raising funds for expansion would need deal structures that keep founders in control while giving fair returns to investors.

3. Advising on Equity Financing and Dilution

Equity advisors guide you on how funding rounds impact ownership. They ensure you raise the required funds without giving away too much.

For example, a founder planning a second funding round can plan dilution to retain decision-making power.

4. Supporting M&A and Strategic Investments

EAs help in mergers, acquisitions, or strategic partnerships. It includes valuations, structuring deals, and ensuring smooth integration. If a textile manufacturer acquires a dyeing unit, the advisor ensures fair pricing and clear ownership transfer terms.

5. Guiding Compliance and Regulatory Requirements

Equity advisors check that funding deals meet SEBI, Companies Act, and other legal norms. Non-compliance can risk deals or cause penalties. Their checks keep your business safe during and after funding rounds.

6. Assisting with Investor Negotiations

Equity advisors support you during investor meetings by preparing you with key negotiation points, explaining complex terms, and guiding you through deal structures. They ensure you understand the implications of each term and help you secure agreements that align with your business goals and protect your long-term interests.

For example, if an investor demands board control, an advisor helps you assess impacts and negotiate better structures that protect your vision.

7. Ensuring Long-Term Equity Strategy Aligns with Business Goals

Equity advisors build funding plans that match your goals. If you plan to expand across states within five years, your advisor will map equity needs, stages, and structures to suit that journey.

Equity advisors perform these roles to keep your business strong while growing responsibly. Now, let's discuss why Indian businesses need equity advisors for their next stage.

Why Indian Businesses Need Equity Advisors?

Raising funds is only one part of building a strong business. Founders also need to keep control and create lasting value. Many Indian founders enter equity deals without proper guidance, risking ownership loss or unfair terms. An equity advisor helps avoid these risks and plan growth with confidence.

Here are the key reasons why an equity advisor is needed:

- Complex equity structuring: Many founders do not know how funding rounds dilute ownership. Advisors plan structures that protect control while raising funds.

- Limited valuation expertize: Businesses often undervalue or overvalue themselves. Advisors assess fair value based on assets, market, and future potential to avoid loss or deal rejection.

- Family-run enterprise needs: In family businesses planning external investment or succession, advisors design structures that keep founder influence intact while attracting investors.

- Negotiating fair deals: Advisors guide you through investor discussions. They ensure terms do not weaken your rights or drain profits through harsh clauses.

- Compliance gaps: Advisors ensure deals follow SEBI and Companies Act rules. It prevents penalties, delays, or deal cancellations later.

- Building long-term growth plans: They align funding with goals, whether it's modernizing plants or expanding product lines, for sustained growth.

- Investor confidence: A structured approach builds investor trust, increasing chances of closing deals faster and on better terms.

These benefits show why equity advisors are essential for growth with control. But, how do they differ from financial advisors in supporting your business journey? Let's find out.

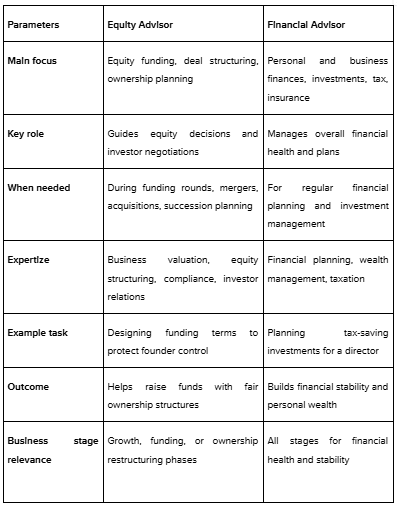

Equity Advisor vs Financial Advisor: What's the Difference?

Many founders think equity advisors and financial advisors do the same work. In reality, they play different roles. An equity advisor focuses only on equity funding, ownership, and deal structuring. A financial advisor covers broader personal and business finances, such as tax planning, investments, and insurance.

For a better understanding, here is a simple table to show their differences:

An equity advisor is best for growth stages needing funding or ownership planning. A financial advisor is needed for ongoing financial management and wealth building.

Knowing this difference helps you choose the right support at each stage. Next, let's see how to choose the right equity advisor for your business goals.

How to Choose the Right Equity Advisor?

Choosing an equity advisor is a serious decision. The right advisor protects your assets, plans fair deals, and supports your growth with confidence. Many founders rush this choice, only to face ownership loss later.

Let's look at what to check before engaging an equity advisor:

1. Key Qualifications and Certifications to Check

Ensure your advisor has formal finance, business, or law qualifications. Certifications like CFA, CA, or an MBA in finance add credibility. They prove knowledge of equity structuring and compliance.

For example, a CFA-certified advisor can better assess fair valuations and investor returns. Always verify these qualifications before hiring.

2. Relevant Industry Experience and Deal History

Check if the advisor has worked with your industry before. Ask about deals they have structured, including funding rounds, mergers, or acquisitions.

For instance, a manufacturing founder should prefer an advisor with past work in industrial businesses rather than pure tech startups. Experience brings practical insights to protect your ownership.

3. Approach to Advising – Transactional vs Partner-Based

Some advisors just close deals without long-term planning. Others act as partners, planning funding routes aligned with your goals. Choose an advisor who listens to your vision and builds equity structures accordingly.

For example, an advisor suggesting quick dilution without a strategy risks your assets and future plans.

4. Compatibility with the Founder's Vision and Values

Your advisor should respect your goals, work style, and ethics. If you plan to build a legacy business, but the advisor focuses only on quick exits, it creates conflicts. Speak with past founder references to check compatibility before signing any agreements.

Choosing the right equity advisor builds confidence in funding and ownership decisions. But, it's also important to prepare your business before working with an equity advisor to get the best outcomes.

How to Prepare Your Business to Work with an Equity Advisor?

Working with an equity advisor needs preparation. It helps them support you better and ensures smooth funding or equity structuring. Founders these days approach advisors without the basics, leading to delays or weak outcomes.

Here are key ways to prepare your business for this process:

1. Strengthening Governance and Reporting Structures

Ensure your business has clear governance systems. It includes updated board structures, roles, and documented processes. Advisors assess these before suggesting deals. Strong reporting builds investor trust.

For example, a company with timely, audited accounts and structured decision logs shows readiness for funding or mergers.

2. Clarity on Business Goals and Valuation Expectations

Know why you need funding and how much. Define your short and long-term goals. Have a fair idea of your business value based on financials, assets, and market position.

This clarity helps advisors design equity deals that align with your plans instead of random structures that risk your control.

3. Ensuring Clean Compliance Records

Check your legal and compliance health. Resolve pending tax filings, statutory dues, or unrecorded liabilities. Advisors and investors review compliance before deals.

For example, a clean GST record, PF compliance, and updated ROC filings build confidence in your business integrity and reduce deal delays.

4. Building an Open, Collaborative Mindset for External Advisory

Be ready to listen to external views. Advisors bring expertize you may not have in-house. Share information transparently, discuss concerns openly, and build trust.

This collaboration ensures that deal structures match your goals while staying fair to investors, building lasting partnerships.

Preparing your business in these ways makes working with an equity advisor smooth and impactful. Now, let's see how S45 supports founders as equity advisors with a grounded, partnership-led approach.

How S45 Supports You as an Equity Advisor?

At S45, equity advisory is more than deal structuring. Our philosophy is to walk beside founders as true partners, not distant advisors. We believe that equity decisions should protect your legacy while building future growth with confidence.

S45 brings deep expertize in manufacturing and trading equity structuring. We understand the unique challenges of mid-market and traditional businesses in India. Whether you seek growth funding, plan succession, or enter strategic partnerships, our team designs equity routes that keep your values and goals intact.

Through Club S45, founders gain access to a trusted community and collective expertize. Here, you can discuss equity strategies, connect with experienced guides, and plan decisions with clarity and purpose.

Join Club S45 today and let our equity advisory expertize guide your business decisions with clarity, fairness, and purpose.

Conclusion

Equity advisors shape funding, ownership, and growth decisions for any business. They assess valuations, structure fair deals, guide compliance, and support negotiations to protect founder interests. EAs differ from financial advisors who focus on personal and corporate finances. Choosing the right advisor ensures your equity decisions match your long-term goals.

It's important to understand your advisor's duties, check qualifications and industry experience, and align their approach with your business values. Preparing with strong governance, clean compliance, and clear goals builds confidence in every equity discussion. These steps protect your control while opening new growth opportunities.

At S45, "Partners in purposeful growth" defines our equity advisory approach. We walk beside founders to plan equity structures that preserve legacies and build future value. How will you shape your equity journey ahead? Join S45 club today and scale new heights with fairness, clarity, and confidence.

Frequently Asked Questions

1. What does an equity advisor do?

An equity advisor guides businesses on funding, ownership structuring, and investor deals. They assess valuations, plan equity dilution, support mergers or acquisitions, and ensure legal compliance. Their main role is to protect founder control while securing fair funding, making them key partners during business growth and ownership planning stages.

2. How is an equity advisor different from a financial advisor?

An equity advisor focuses on funding, ownership, and deal structuring for businesses. A financial advisor manages personal or corporate finances, tax, and investments. Equity advisors plan funding routes and protect control, while financial advisors build wealth stability and manage broader finances for individuals or businesses at any stage.

3. When should a business hire an equity advisor?

Hire an equity advisor when planning to raise funds, dilute ownership, merge, acquire, or restructure equity. They are also needed during succession planning or strategic partnerships to ensure fair valuations and deal terms. Early engagement helps protect founder interests and builds stronger, compliant funding structures for long-term goals.

4. What qualifications should an equity advisor have?

Equity advisors should have finance, law, or business qualifications such as CFA, CA, or an MBA in finance. Certifications prove they understand valuation, deal structuring, and compliance. Experience in your sector is also important to ensure practical, personalized advice for your funding, ownership, and strategic decision needs.

5. Why do Indian founders need equity advisors?

Indian founders need equity advisors to plan funding without losing control, structure fair deals, and comply with complex regulations. Advisors protect founder interests, build investor trust, and align funding with business goals. It is especially important for family businesses, manufacturing units, and trading houses planning growth or succession.