Ever spent weeks preparing loan applications, only to face endless paperwork, repeated rejections, or vague responses from lenders? For many MSME founders, this isn’t an exception; it’s the norm.

In India, where MSMEs contribute nearly 30% of GDP and employ over 110 million people, limited access to credit remains one of the biggest obstacles. The challenges in accessing credit go beyond delays or paperwork. They trigger a domino effect across the business ecosystem.

When payroll is delayed, skilled workers migrate to competitors offering stability. Missed supplier payments result in withheld raw materials, leading to production stoppages that harm client relationships.

Additionally, a single rejected loan application can push founders towards high-cost informal borrowing at 24–36% interest, trapping them in a debt cycle. Worse, a lack of timely credit often means MSMEs cannot bid for large corporate or government contracts that require upfront capital.

The good news is that by understanding where the bottlenecks lie and what solutions are emerging, you can find more innovative ways to secure the financial backing your business needs.

Key Takeaways

- Collateral, paperwork, and eligibility barriers: Traditional banks demand property, extensive documentation, and multi-year financial history that many MSMEs can’t provide.

- Costly and limited credit access: High interest rates, weak or no credit history, and a lack of awareness of government schemes make borrowing expensive.

- Liquidity and informality issues: Delayed buyer payments, poor bookkeeping, and low digital adoption leave many MSMEs cash-strapped and less credible to lenders.

- New-age solutions: Invoice discounting, digital lending, revenue-based financing, and supply chain finance are reshaping MSME credit access.

- Why it matters: Improved financing helps MSMEs scale, create jobs, and sustain their 30% contribution to India’s GDP.

Disclaimer: The information shared here is for general awareness about MSME credit challenges and solutions. It does not constitute financial advice. Please feel free to consult banks, fintech lenders, or certified financial advisors before making borrowing or investment decisions.

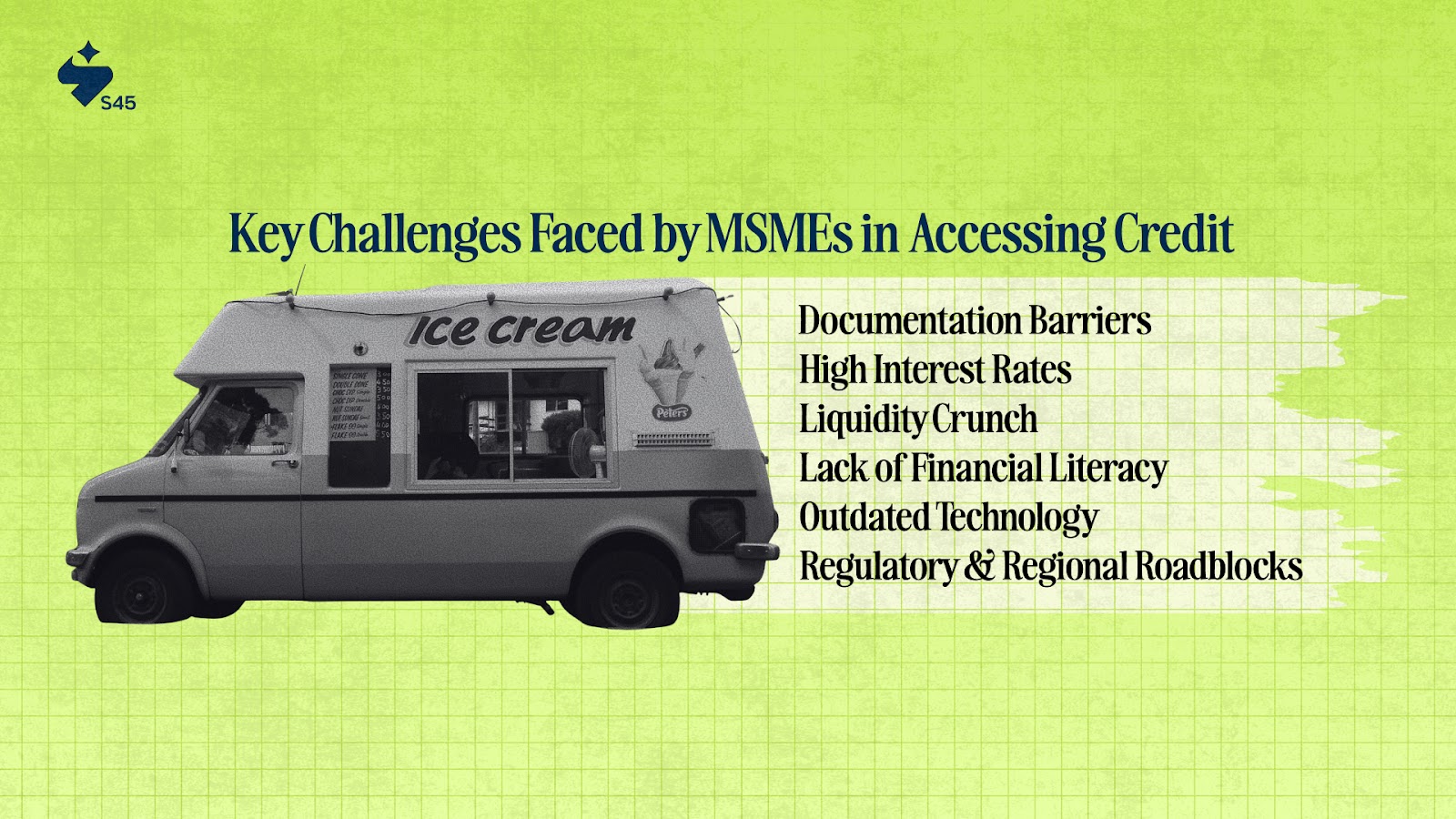

The Biggest Barriers Keeping MSMEs From Getting Credit

For many Indian MSMEs, securing credit feels like climbing a mountain with no clear path. The challenges faced by MSMEs in accessing credit directly impact their survival, expansion, and ability to compete with larger players. Here’s a closer look at what stands in the way.

1. Collateral and Documentation Barriers

Banks typically view MSMEs as high-risk borrowers, demanding collateral and lengthy documentation.

- Collateral requirement: Most small businesses don’t own assets that qualify. Without land or property, loans are often denied. The frustrating reality is that your ₹2 crore annual turnover business gets rejected because you rent your office space instead of owning it. Meanwhile, someone with inherited property but no business experience gets approved instantly.

- Documentation hurdles: Traditional lenders typically require audited financial statements, tax returns, business plans, and compliance certificates. Many MSMEs either lack these records or struggle to prepare them.

- Strict repayment terms: Even when loans are sanctioned, rigid repayment schedules make cash flow management challenging.

Example: A first-generation entrepreneur in Kanpur may run a successful textile unit but fail to secure a loan simply because he cannot pledge property as collateral.

By connecting founders to networks of alternative lenders and fintech platforms, S45 helps bridge the gap when banks hesitate.

2. High Interest Rates and Credit History Challenges

Loans may get approved, but the terms often kill profitability.

- Punishing rates: MSMEs without a strong credit profile often face interest rates of 14–18% or higher. At this cost, even profitable orders can become loss-making once repayment is factored in. For instance, a ₹50 lakh loan at 16% means ₹8 lakh annually just in interest; money that could otherwise fund marketing, a plant upgrade, or additional staff.

- Thin records: Many small businesses operate without audited financials or long credit histories. To banks, this lack of data translates into “high risk,” so they price the loan accordingly.

- Unforgiving systems: Even a small late payment, sometimes just a few days, can significantly damage a founder’s credit score. A single default can shut the door on future borrowing, regardless of the business’s current growth.

Why it matters: A growing order book or solid business idea means little if the cost of credit eats away at margins before growth can take off.

3. Liquidity Crunch from Delayed Payments

Cash flow, not revenue, determines survival.

- Long credit cycles: Large corporates and government buyers often push MSMEs to 60–90 day payment terms. While revenue looks healthy on paper, actual inflows remain stuck for months.

- Survival squeeze: Salaries, rent, raw material suppliers, and utility bills can’t be postponed. Founders are forced to take short-term loans or overdrafts at punishing interest rates just to keep operations running.

- Growth sacrificed: With so much cash locked up in receivables, there’s little left to fund expansion, whether that’s entering new markets, upgrading machinery, or hiring critical talent.

Pro Tip: Consider exploring invoice discounting and receivables exchanges to free up working capital more quickly.

4. Lack of Financial Literacy and Expertise

Many entrepreneurs are masters of their craft but lack financial know-how. These include the following:

- Limited awareness of schemes: Despite initiatives such as Mudra loans, the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), and Stand-Up India, many founders remain unaware of these schemes. The result: they miss out on affordable, government-backed credit.

- Choosing the wrong loan product: Without proper guidance, you may end up with high-cost unsecured loans, overlooking more affordable subsidized credit options. Over time, this increases repayment burden and stifles growth.

This is where platforms like S45 help by curating workshops and peer-sharing forums. Founders learn directly from business owners who’ve navigated the credit maze, making funding decisions more informed and less risky.

Where s45club fits: By curating workshops and peer-sharing forums, S45 enables founders to learn from experienced business owners who’ve navigated the credit maze.

5. Outdated Technology and Informality

Banks favor businesses with strong, digital records. Unfortunately, many MSMEs still operate informally.

- Manual systems: Reliance on paper-based invoices and cash transactions makes tracking difficult. To banks, this lack of a digital trail raises questions about reliability.

- Limited adoption of digital tools: Lack of affordable accounting, ERP systems, or digital payments weakens credibility.

- Informal operations: The lack of GST registration or absence of Udyam registration signals informality, prompting lenders to either reject applications or charge higher rates.

Founder Impact: Informal systems may save costs in the short run, but they become expensive when your business is deemed “unfundable” at scale.

Did you know? As of August 2025, over 4 crore MSMEs are registered on the Udyam portal, a step that improves credit access, yet millions still operate outside the formal system.

6. Regulatory and Regional Roadblocks

Rules and geography decide credit access more than business potential.

- Complex approvals: Obtaining licenses, tax assessments, and insurance is a lengthy process. Each delay drags out loan approval, leaving you juggling urgent business needs with slow-moving bureaucracy.

- Regional gaps: Founders in tier-2 and tier-3 towns often struggle to find nearby institutions offering flexible lending. Local banks may have stricter collateral requirements, while larger lenders may not operate in those areas.

Fintech lenders and NBFCs are beginning to bridge this gap with faster onboarding, digital-first approvals, and products tailored for underbanked regions. But awareness remains low among many MSMEs.

While these roadblocks can be discouraging, the financing landscape for MSMEs is undergoing rapid change. From digital lending to revenue-based financing, new-age solutions are making credit more accessible, and founders now have more options than ever.

Smarter Ways MSMEs Can Overcome These Credit Barriers

The financing landscape in India is changing, and MSMEs no longer need to rely only on traditional banks. Here are some emerging solutions that can ease access to credit:

1. Invoice Discounting

Invoice discounting allows you to unlock cash that is stuck in unpaid receivables.

- How it works: Lenders advance a percentage (often 70–90%) of your invoice value upfront. Once the buyer pays, the financier deducts a fee and releases the rest.

- Why it helps: Solves liquidity crunches caused by 60–90 day payment cycles from large buyers.

- Impact: Ensures payroll, supplier payments, and operations continue without adding fresh debt.

Pro Tip: Use invoice discounting selectively for big-ticket buyers with reliable payment records; it reduces risk and lowers discounting fees.

2. Revenue-Based Financing (RBF)

Revenue-based financing lets you pay as you earn, rather than through fixed EMIs. Instead of rigid monthly repayments, you return a percentage of your revenue, which rises or falls with your sales.

- How it works: You receive upfront funds in exchange for a fixed percentage of future monthly revenue until the principal and fee are repaid.

- Why it helps: Unlike rigid EMIs, repayments fluctuate with sales, reducing pressure during lean months.

- Ideal For: D2C brands, SaaS startups, and seasonal businesses that see peaks during festivals or off-seasons. Capital scales with the business cycle instead of straining cash flow.

3. Peer-to-Peer (P2P) Lending

P2P platforms directly connect lenders and borrowers, reducing the need for banks.

- How it works: Platforms connect MSMEs with individual or institutional lenders.

- Why it helps: Offers quicker approvals, flexible loan terms, and lower interest than informal moneylenders.

- Use Cases: Useful for small-ticket working capital needs (₹5–25 lakh).

Pro Tip: Check platform credibility and repayment terms minutely.

4. Digital Lending Platforms

Digital lending platforms provide paperless credit.

- How it works: Digital lenders use AI and alternative data (GST filings, utility bills, POS transactions, UPI history) to assess creditworthiness.

- Why it helps: MSMEs with thin or no credit history can still access funds, loans are approved in 48–72 hours, often fully paperless.

- Key Takeaway: Particularly useful for MSMEs in tier-2/3 cities with limited access to traditional banks. They help formalize businesses while giving fast credit.

Pro Tip: Use digital lending for speed and short-term liquidity, but pair it with better record-keeping for long-term bank financing access.

5. Supply Chain Finance

This model lets you capitalize on your buyer’s credit strength instead of your own.

- How it works: Unlike invoice discounting, where you sell invoices and remain liable, supply chain finance involves the buyer directly. A financier pays you upfront, and the buyer later settles with the financier.

- Why it helps: Risk shifts from the MSME to the corporate buyer, making financing cheaper and easier to access. Capital becomes available at lower rates compared to discounting.

- What It Means: MSMEs in auto, textiles, and FMCG gain predictable cash flow while also strengthening long-term buyer–supplier relationships.

6. Merchant Cash Advances

Beyond mainstream loans, MSMEs are embracing merchant cash advances. Here’s how it works:

- How it works: You receive upfront funds and repay as a percentage of daily sales. This reduces pressure during slow days.

- Why it helps: Provides fast liquidity for inventory purchases, outlet expansions, or marketing pushes without diluting equity.

- Risk check: Fees and effective interest rates can be higher than traditional loans. Overuse can eat into margins if daily sales remain inconsistent.

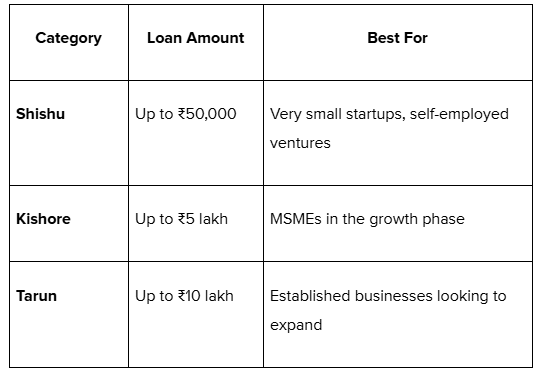

7. Pradhan Mantri Mudra Yojana (PMMY)

PMMY offers collateral-free loans tailored to business size and growth stage:

Impact: These loans serve as a stepping stone into the formal credit system.

Did you know? PMMY loans are designed to promote inclusivity, with special access for women, SC/ST, and OBC entrepreneurs.

With numerous financing options emerging, the real question for founders is not whether credit is available, but which option best suits their business. That’s where the proper guidance makes all the difference.

How S45 Helps You Overcome Credit Challenges

For many MSME founders, access to credit isn’t about a lack of ambition; it’s more about facing collateral demands, high interest rates, and confusing eligibility criteria. This is where S45 steps in as a growth partner, not just as another financing network.

Here’s how S45 supports you in solving credit hurdles:

- Access to Alternative Financing: Connect with fintech lenders, supply chain finance providers, and peer-to-peer platforms that look beyond traditional collateral requirements.

- Tailored Financial Guidance: Collaborate with advisors who understand the unique challenges of manufacturing, trading, and growth-stage businesses in India.

- Credibility Building: Utilize structured decision-support tools to strengthen financial records, create reliable business plans, and improve your credit profile.

- Peer Benchmarking: Through our community, compare your financing strategies with those of peers facing similar challenges, ensuring that your data and real-world examples inform your choices.

- Government Scheme Awareness: Stay updated on schemes like Mudra loans, CGTMSE, and PMMY, and learn how to apply them effectively for your stage of growth.

Conclusion

For MSMEs, credit serves as a bridge to expansion, innovation, and long-term sustainability. Yet many founders remain locked out by outdated processes, collateral demands, and delayed payments.

The rise of fintech lending, supply chain finance, and government-backed schemes means access is improving. However, the real advantage lies in knowing which option fits your stage and strategy.

For too many MSMEs, funding delays mean missed opportunities, but it doesn’t have to be that way. At S45, we help founders overcome credit hurdles, discover more effective financing options, and enhance their credibility with lenders.

Connect with us today to turn credit access into your growth advantage.

FAQs

1. Why are MSME loans essential for India’s economic growth?

MSME loans enable small and medium-sized businesses to expand, adopt new technologies, and access new markets. They create large-scale employment, strengthen rural and urban economies, contribute around 30% to India’s GDP, and promote inclusive, long-term national development.

2. What is the new MSME credit assessment model?

Announced in Budget 2024-25, PSBs will use MSMEs’ digital footprints, including GST returns, utility bills, and online transactions, for in-house credit scoring. This reduces reliance on collateral, enables quicker approvals, lowers evaluation costs, and improves access for businesses with thin credit histories.

3. How can we improve our CIBIL MSME (CMR) Rank?

Pay your EMIs and dues on time, keep your credit utilization below 30%, and avoid making frequent loan applications. Regularly check your credit report for errors, build a mix of secured and unsecured loans, and maintain stable revenue to boost credibility with lenders.

4. What is the Credit Guarantee Fund for Micro Units (CGTMSE)?

The CGTMSE, established by the MSME Ministry and SIDBI, offers collateral-free credit to micro and small enterprises. By guaranteeing loans, it encourages banks to lend confidently, helping MSMEs access institutional credit for growth without needing property or heavy security.

5. How is digital transformation reshaping MSME lending?

AI and machine learning enable faster, more accurate credit assessments, reducing errors and bias. Blockchain boosts transparency, security, and fraud prevention in loan processes. Together, these technologies simplify access, cut delays, and make financing more reliable for MSMEs across India.