Key Takeaways

- A lead investor anchors a funding round, sets valuations, negotiates terms, and helps startups scale.

- They provide more than just capital. They bring credibility, mentorship, and networks.

- Unlike follow investors, leads take on bigger risks and hold decision-making power.

- The right lead investor can shorten fundraising timelines, improve valuation outcomes, and attract other investors.

- Choosing one with experience, financial strength, and alignment with founders is critical to long-term success.

For any startup, raising funds is both exciting and daunting. Founders often face endless pitches, investor rejections, and the overwhelming task of convincing the right people to believe in their vision.

But here’s the thing: fundraising isn’t just about securing money, it’s about securing the right kind of money.

This is where the lead investor comes in. Acting as the anchor of a funding round, a lead investor is more than just a capital provider. They’re a strategic partner, a negotiator, and a credibility builder. In fact, many follow-on investors will only come on board once a strong lead investor has stepped up.

For startups associated with platforms like s45club, connecting with the right lead investor can mean faster growth, stronger market positioning, and smoother fundraising journeys.

So, if fundraising isn’t just about money, what exactly makes a lead investor different from everyone else putting in capital? To understand their impact, let’s first look at who a lead investor really is.

Who is a Lead Investor?

A lead investor is the primary backer in a startup’s fundraising round. They usually contribute the largest share of funding, but their role extends far beyond writing a cheque.

- They negotiate the structure of the deal from equity percentages to governance rights.

- They represent the round, attracting other investors to participate.

- They often take an active role in shaping the company’s strategy.

In short, they’re the ones willing to take the first leap of faith, signaling to others that the startup is worth betting on.

But simply being the biggest backer isn’t enough. What separates a true lead investor from a regular check-writer is the qualities they bring to the table.

Attributes of an Effective Lead Investor

A strong lead investor isn’t just about money; they need the right qualities:

- Experience in venture capital or finance to guide the startup wisely.

- Leadership skills to manage the investment process and rally other investors.

- Financial strength to make meaningful contributions.

- Personal alignment with founders to ensure trust and smooth collaboration.

Startups should look for investors who share their vision and values, not just their financial goals.

These qualities come to life through the responsibilities a lead investor takes on. From due diligence to deal-making, their influence runs through every stage of the funding process.

Responsibilities and Influence of a Lead Investor

A lead investor doesn’t just show up with money; they shape the entire fundraising journey. Their responsibilities are both financial and strategic, and their influence often determines the quality of the round as well as the startup’s long-term trajectory.

Here’s a closer look at what they do:

- Conducting deep due diligence: Before committing, a lead investor thoroughly evaluates the startup’s business model, revenue streams, financial health, market size, and team dynamics. This process goes beyond basic checks. It’s about spotting risks, identifying hidden opportunities, and validating whether the company can scale.

- Structuring and guiding the fundraising process: Once committed, the lead investor typically takes charge of structuring the deal. They set timelines for closing, decide how much equity is on the table, and often draft or negotiate the term sheet, the document that governs how the investment works. This guidance helps startups avoid costly mistakes and keeps the round moving smoothly.

- Setting valuations and investment terms: Perhaps the most influential role of a lead investor is deciding the valuation of the startup. This isn’t just a number; it impacts founder equity, investor returns, and the startup’s attractiveness to follow investors. A strong lead ensures the valuation is fair and realistic, balancing growth potential with investor protection.

- Providing strategic mentorship: Beyond the deal, lead investors often act as advisors. They mentor founders on key business decisions such as market expansion, hiring senior leadership, or refining the product roadmap. Their experience helps startups navigate challenges faster and with fewer missteps.

- Building investor confidence: The lead investor’s conviction often inspires follow-on investors to join the round. Their backing signals that the startup has been vetted and is worth the risk, making it easier for founders to attract additional capital.

And here’s where many founders get it wrong — thinking the lead’s job ends once the term sheet is signed. In reality, the most valuable contributions of a lead investor often happen after the deal is closed.

Contribution Beyond Capital

Raising funds is only one part of the journey. The real value of a lead investor often goes far beyond the check they write. Beyond providing capital, they act as partners, advisors, and connectors, helping startups accelerate growth and avoid costly missteps.

- Industry expertise: With their knowledge, they help startups avoid common pitfalls, refine business models, and adapt to shifting market conditions.

- Strategic guidance: They advise on critical areas such as pricing, go-to-market strategy, and scaling operations, ensuring founders make informed decisions.

- Valuable connections: From future investors to potential customers and industry partners, they expand a startup’s network and open new doors.

- Credibility boost: Their involvement sends a strong signal to the market, making it easier for startups to attract fellow investors, customers, and top talent.

- Operational support: They assist with hiring key executives, strengthening governance, and improving internal processes.

- Long-term partnership: Unlike passive investors, lead investors remain actively engaged, offering mentorship and accountability throughout the startup’s growth journey.

This is why S45 Club’s ecosystem is so impactful by connecting startups with the right investors; it ensures they gain not just funding but the mentorship and networks needed for sustainable growth.

With so many strategic advantages beyond funding, the question isn’t whether lead investors matter — it’s why no serious startup can afford to raise without one.

Why Do Startups Need a Lead Investor?

For many founders, raising capital isn’t just about finding money;it’s about finding direction, credibility, and momentum. That’s exactly where a lead investor steps in. Here’s why startups need one:

- Sets the tone for the round: A lead investor usually decides the valuation, terms, and size of the deal. Once this framework is in place, it becomes easier to bring other investors on board.

- Boosts credibility: Having a well-known lead investor signals confidence to the market. Other investors often follow their lead, making fundraising faster and smoother.

- Provides guidance beyond capital: Lead investors often bring mentorship, strategic advice, and introductions to future investors, customers, and partners.

- Acts as an anchor: Startups can sometimes struggle to close funding rounds without someone taking the first leap. A lead investor anchors the round, reducing uncertainty for others.

- Long-term partnership: Lead investors aren’t just writing a cheque;they’re committing to walk with the founders through multiple stages of growth, offering stability and direction.

But to really understand their importance, it helps to see how lead investors compare to their counterparts, the follow-on investors who come in later.

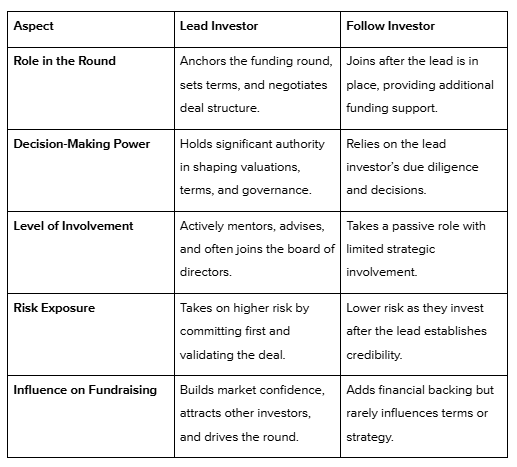

Distinction Between Lead and Follow Investors

While both play important roles in a funding round, the lead investor and follow-on investors operate very differently.

In short, lead investors drive the deal, while follow investors support it. Both are important, but the lead sets the foundation for trust, credibility, and structure.

Example: In India, Sequoia Capital has often stepped in as a lead investor for startups like Zomato and Byju’s, taking the first big bet and structuring the round. Once Sequoia commits, smaller funds and angel investors typically follow, relying on Sequoia’s due diligence and conviction.

This distinction makes it clear why leads hold such an outsized influence. Their presence, or absence, can make the difference between a round that takes off and one that stalls.

Importance of a Lead Investor in Startup Success

The presence of a lead investor often determines whether a startup thrives or stalls. Here’s why they’re so crucial:

- They ensure structured deals with fair valuations.

- Their involvement reduces risks by ensuring thorough vetting.

- Many join the board of directors, directly influencing long-term strategy.

- Their backing can attract media attention and create market buzz.

For startups, this combination of capital, credibility, and guidance can dramatically improve survival and growth rates. Of course, knowing why lead investors are crucial is only half the battle. The bigger challenge for founders is figuring out how to actually secure one.

The Process of Securing a Lead Investor

Finding a lead investor is not about luck. It’s about preparation, relationships, and timing. Startups that plan ahead stand a much better chance of securing a strong partner. Here’s how the process typically unfolds:

1. Build Early Relationships: Founders should start networking with potential investors long before they actually need funding. Attending pitch events, accelerators, and industry meetups helps create familiarity and trust.

2. Demonstrate Traction: Lead investors look for proof that the business is gaining momentum. This could mean steady revenue growth, a growing customer base, or strong user engagement. The more evidence of traction, the easier it is to attract a lead.

3. Craft a Strong Pitch: A compelling pitch isn’t just about the product. It highlights the problem, the market size, the team’s capability, and the potential returns. Lead investors want to see a clear growth story backed by numbers.

4. Align on Vision and Values: Beyond the business model, investors care about founder-investor alignment. If values, goals, or working styles clash, even a great idea can fall apart. Founders must ensure their long-term vision resonates with the investor.

5. Negotiate the Term Sheet: Once interest is secured, the lead investor usually helps draft the term sheet covering valuation, equity, governance, and other conditions. This document sets the foundation for the entire round.

6. Close the Round with Follow Investors: After the lead investor commits, it becomes easier to bring in follow-on investors. Their involvement validates the deal and accelerates fundraising closure.

By following this process, startups not only increase their chances of landing a strong lead investor but also set themselves up for a smoother fundraising journey.

Platforms like S45 Club simplify this process by connecting startups directly with credible lead investors who are actively looking for opportunities. This reduces the guesswork and shortens the time it takes to secure a round.

Conclusion

A lead investor is more than an anchor; they’re a catalyst. From setting terms and valuations to mentoring founders and boosting credibility, their role is critical in a startup’s journey. With the right lead investor, fundraising becomes smoother, growth becomes faster, and credibility within the investment community skyrockets.

For startups ready to scale, platforms like S45 Club can be the bridge to finding the perfect lead investor, one who not only funds but also fuels success.

Still have questions about how lead investors work in practice? Let’s tackle some of the most common ones founders ask.

Frequently Asked Questions

1. Is a lead investor always the one who invests the most money?

Not always, but typically yes. The lead investor usually puts in the largest cheque and takes on the most responsibility in structuring the round.

2. Can a startup have more than one lead investor?

Yes, though it’s less common. In larger rounds, co-lead investors may share responsibilities.

3. Do lead investors always take board seats?

Often they do, but not always. It depends on the deal structure and the level of involvement they want.

4. How does a startup find the right lead investor?

Networking, accelerators, and platforms like S45 Club are excellent starting points to connect with aligned investors.

5. What’s the biggest risk for startups when choosing a lead investor?

Misalignment. If the lead investor’s vision or strategy doesn’t align with the founders, it can create long-term conflicts.