Key Takeaways

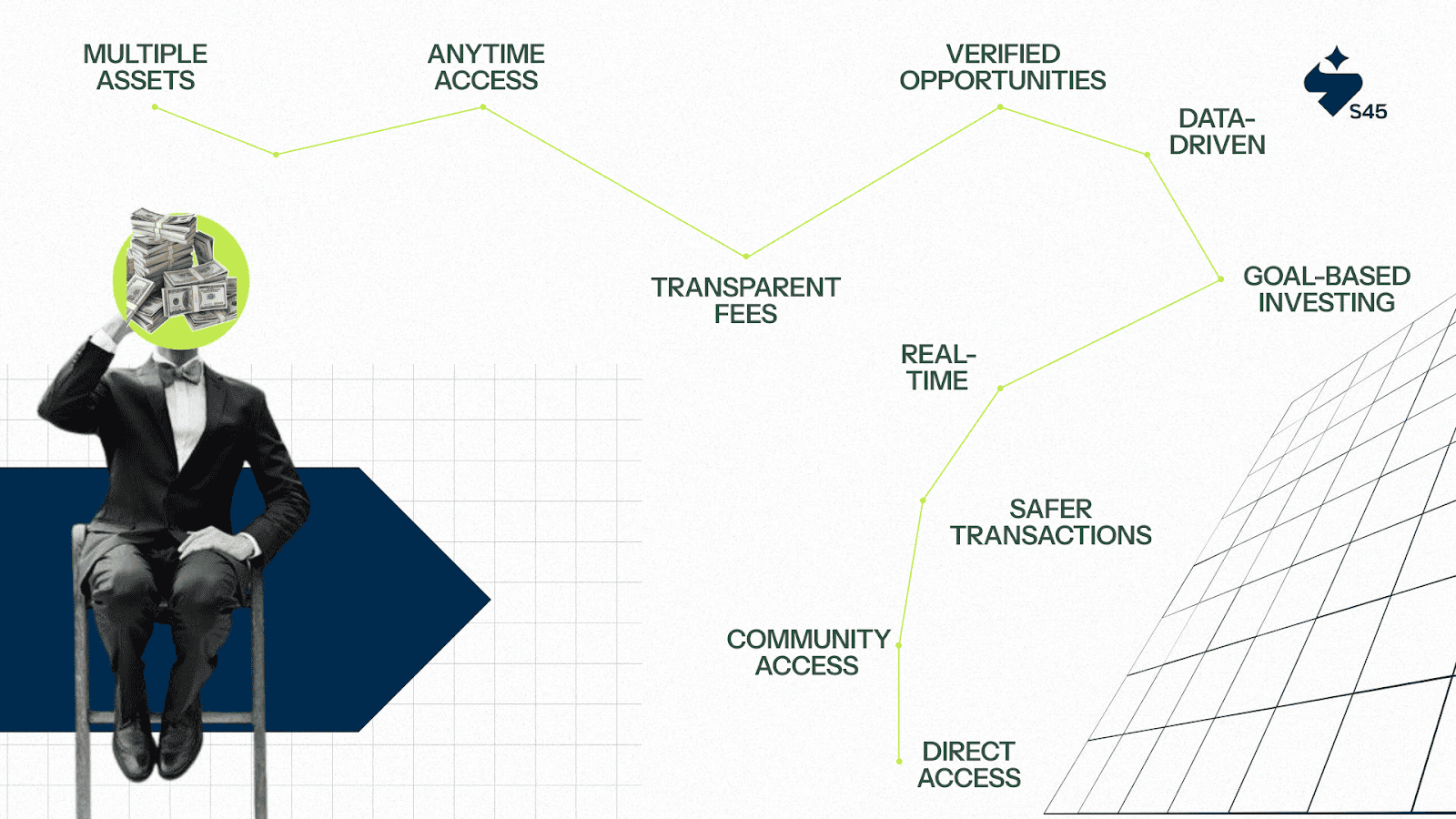

- Digital investment platforms provide access to multiple asset classes, including equities, debt, pre-IPO, and startups.

- They offer convenience, low costs, and real-time tracking through mobile-first, user-friendly interfaces.

- Verified and curated opportunities reduce risk and improve the quality of investments for retail and HNI investors.

- Personalized recommendations, portfolio analytics, and goal-based tools support strategic financial planning.

- Investors should evaluate platform credibility, support, access requirements, and transparency before choosing where to invest.

Are you getting the most from your investments or just using outdated tools?

A digital wave is transforming how people invest, fast, simple, and smarter. Investment platforms are redefining access, cost, and convenience for India’s investors, whether you're a first-time retail user, an HNI, or a startup founder.

According to Grand View Research, India’s online investment platform market, valued at $ 114.7 million in 2022, is projected to grow at a 15.5% CAGR and reach $ 362.2 million by 2030. This surge reflects the growing trust in platforms that combine technology with curated opportunities across asset classes.

With better tools, clear fee structures, and smooth access to pre‑IPOs, mutual funds, equities, and more, investment platforms are not just trends; they're reshaping wealth creation journeys. In this guide, you’ll learn the top 10 benefits of using an investment platform and what matters before choosing one.

Investment Platform for Beginner to Experienced Investors

An investment platform is a digital product or service that helps individuals and institutions access a wide range of investment opportunities. It brings together tools, data, and advice to support smarter decision-making. In India, these platforms are reshaping how investors of all sizes grow their portfolios.

There are different types of platforms, including:

- Self-serve apps: Platforms like Robinhood and Fidelity let you research and manage investments on your own. They’re low-cost, user-friendly, and ideal for hands-on investors.

- Niche platforms: Specialized marketplaces such as Hiive and Indiegogo focus on specialized areas like pre-IPO shares, private equity, or startup funding, appealing to investors looking for less traditional options.

- Others: Banks and wealth managers like Morgan Stanley and Merrill Lynch & Co. provide personalized guidance. They personalize investment strategies to your risk appetite and long-term financial goals.

Investment platforms are used by:

- HNIs seeking diversification

- AIFs exploring private markets

- Family offices managing large portfolios

- Founders planning exits or reinvestments

- Retail investors building long-term wealth

As technology and regulations evolve, platforms offer a faster, more organized approach to investing. Now, let’s discuss the benefits that make investment platforms worth considering.

Why Are Investment Platforms Worth Using?

Investment platforms are becoming the go-to choice for investors across India. Their rise is driven by the need for smarter, faster, and more accessible investment options. Whether you're starting small or managing large portfolios, these platforms help simplify the entire process.

Let’s break down how they add value to your investing experience.

1. Easy Access to Multiple Asset Classes

Investment platforms bring a wide range of asset classes to your fingertips. From equities, bonds, and mutual funds to alternative options like pre-IPO shares, startup equity, and AIFs, these platforms make it easier to build a diversified portfolio.

Traditionally, access to many of these investments required brokers, offline networks, or high capital. Platforms remove those barriers. With a few clicks, users can inspect opportunities that were once reserved for institutions or the ultra-wealthy. It helps more investors spread risk across asset classes.

2. Convenience and Anytime Access

Gone are the days of signing documents, waiting for broker calls, or visiting offices. Investment platforms allow you to research, invest, and manage your portfolio from your phone or laptop. Mobile apps and real-time dashboards offer instant control over your investments, whether you're at home or travelling.

This 24/7 access means you're no longer tied to office hours or middlemen. You can act quickly on market moves or review your portfolio at your convenience.

Platforms like S45, designed for high-performing SMEs, take this a step further by combining advanced tools with simplicity, giving business leaders a clear view of opportunities without added complexity. It’s a smoother investing experience that saves time, reduces hassle, and keeps you in control.

3. Lower Costs and Transparent Fees

Traditional investment models often come with high brokerage charges or hidden commissions. Online platforms work differently. They usually follow a low-fee structure and show exactly what you're paying for. Some charge flat fees, others take a small percentage, but it’s all clearly disclosed.

This cost-efficiency means more of your money stays invested and working for you. The transparency also builds trust, especially when compared to models where costs are buried in fine print. Over time, saving on fees can make a real difference to your returns.

4. Curated and Verified Opportunities

Good investment platforms don’t just offer everything; they offer the right things. Especially in the case of alternative assets like startup equity, pre-IPO shares, or private funds, platforms run due diligence before listing deals.

It helps filter out scams and low-quality opportunities. Investors can evaluate deals that are pre-verified for financial health, promoter history, or future potential. Curated access saves time and improves quality, helping investors focus only on what fits their goals and risk appetite.

5. Data-Driven Decision Making

Top platforms provide tools that go beyond buy/sell functions. You get built-in features for portfolio analysis, risk scoring, performance tracking, and market insights. These tools help you understand where your money is going and what it’s doing.

With access to charts, analytics, and expert commentary, you make more informed decisions. Instead of guessing or relying on tips, you base your strategy on data. This approach builds consistency and confidence over time.

6. Personalization and Goal-Based Investing

Modern platforms ask about your financial goals, timelines, and risk comfort. Based on that, they offer customized investment suggestions. Whether you’re planning for retirement, a house, or a startup exit, the platform aligns its advice with your plans.

It helps build discipline and keeps you on track. You’re not chasing trends; you’re working toward your own outcomes with clarity. This personalization brings structure to investing and reduces emotional decisions.

7. Real-Time Tracking and Reporting

You no longer need to wait for quarterly statements or chase your broker. Platforms provide real-time updates on your holdings, profits, losses, and returns. Some even offer downloadable tax reports and performance summaries.

It improves transparency and helps you stay informed. If something needs rebalancing or review, you see it right away. The result is better engagement with your money and fewer surprises at tax time or exit events.

8. Safer Transactions and Compliance

All trusted platforms follow SEBI regulations and perform KYC checks, documentation, and regulatory filings. It ensures that your investments are legal, traceable, and protected. Unlike informal or unverified investment routes, platforms offer an audit trail.

It matters especially in high-value or long-term investments. With proper digital contracts, dashboards, and support, your money moves securely within a structured system.

9. Community Access and Learning Resources

Many platforms also offer more than just transactions. You get access to learning resources, expert articles, investor webinars, and discussion forums. It helps you grow your knowledge as you grow your money.

For new investors, this support is especially helpful. You’re not alone; you’re part of a learning community where questions are welcome and insights are shared. It makes investing less intimidating and more engaging.

10. Direct Access to Emerging Investment Trends

India’s investment space is evolving fast, from sustainability and green energy to early-stage tech and pre-IPO opportunities. Investment platforms often highlight such trends early. They provide updates, insights, and opportunities to explore these themes with small tickets.

It lets you stay ahead of market shifts and take part in areas that interest you personally or align with your values.

As you can see, investment platforms offer more than just digital convenience. They bring clarity, structure, and access to investing. But choosing the right one requires more than a good app or a few deals on display. Let’s look at what you should keep in mind before making a choice.

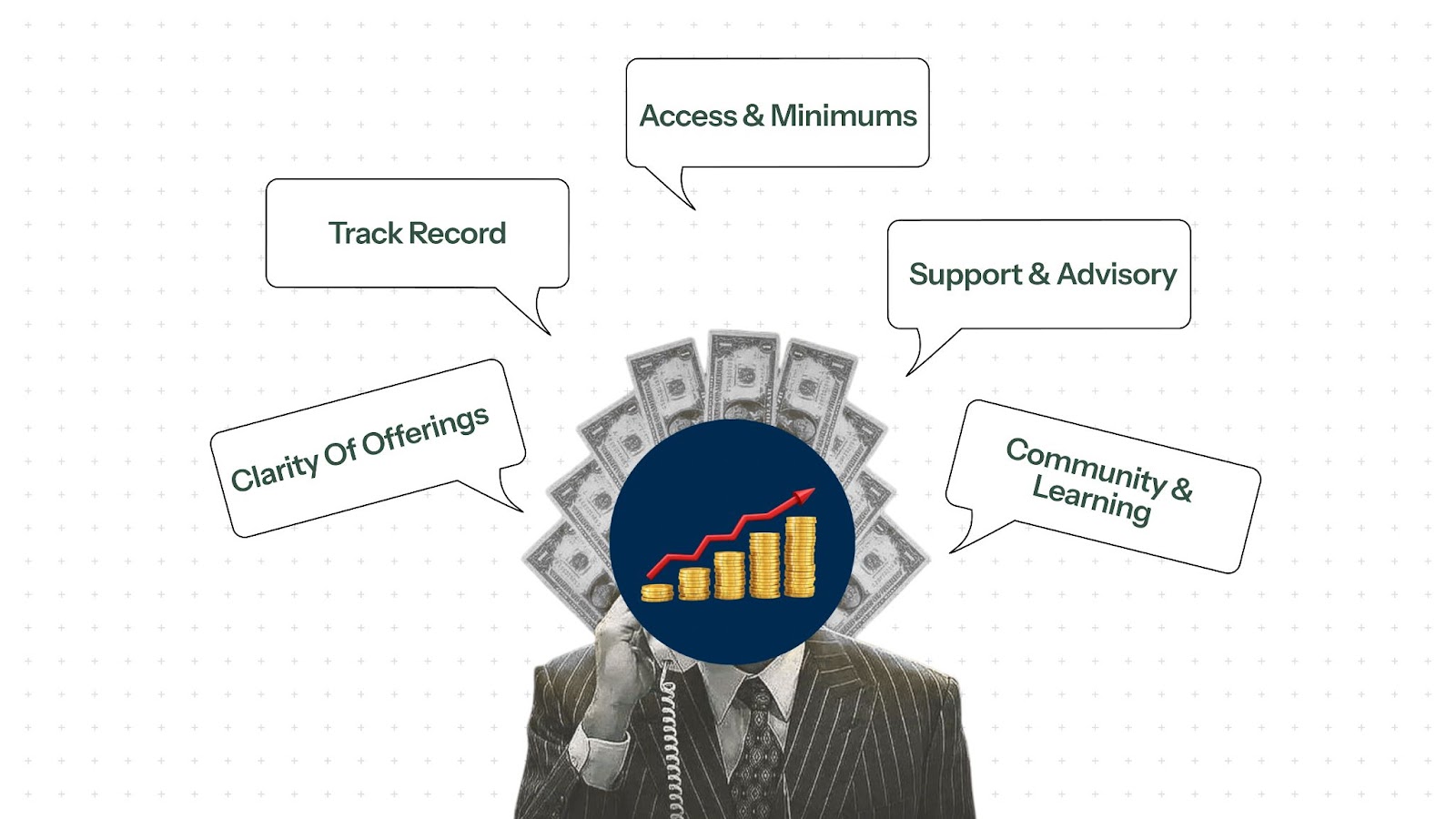

Things to Consider Before Choosing an Investment Platform

Choosing a platform is more than just checking for features or a fancy dashboard. What looks good on the surface may not match your investment needs. Every investor should assess whether the platform fits their risk appetite, asset preference, and support needs.

Here are some points to weigh before you commit:

- Clarity of Offerings

Check what the platform truly offers. Some focus only on public market assets, while others specialize in niche areas like startup equity or pre-IPO investing. Make sure their strengths match your goals. A platform with clarity helps you avoid distractions and stick to your financial plan.

- Track Record & Credibility

Always ask who runs the platform. Look for SEBI-registered advisors, founders with investment backgrounds, or experienced partners. Review past performance, client testimonials, and the quality of deals listed. Credibility builds confidence, especially when you’re investing outside traditional asset classes.

- Access & Minimums

Platforms often serve different investor segments. While some are open to retail investors, others may be designed for HNIs or institutions. Minimum investment amounts can vary widely. Ensure you qualify and understand any commitments before you start. Don’t sign up for a product you can’t access.

- Support & Advisory

Is it a DIY platform or one that offers support and advisory features? Many investors benefit from advisory-led models, especially in newer asset classes. Others prefer full control. Make sure the level of guidance matches your comfort with decision-making and financial knowledge.

- Community & Learning

Go beyond the transaction. The best platforms create a space for investors to learn, ask questions, and connect. Webinars, newsletters, and peer networks add long-term value. For new investors, a strong community can reduce risk and build confidence over time.

A thoughtful choice ensures your investment experience is smooth, transparent, and aligned with your goals. Some platforms like S45 take this further by offering guidance, access, and community in one place.

How S45 Helps You Invest Smarter?

S45 is a platform cum gateway to high-growth, well-governed private market opportunities in India. Designed for founders, early-stage investors, and HNIs, S45 blends technology with deep market expertise. At its core is the mission to support India's most promising SMEs through capital access, strategic advisory, and governance support.

The S45 platform stands out for its focus on quality. Every opportunity is handpicked through rigorous due diligence, focusing on businesses with over ₹100 crore in revenue, ₹10 crore in annual profit, and over 30% YoY growth. It ensures that investors access credible, high-potential deals, not just volume.

Alongside access, S45 offers portfolio tools personalized for startup equity and pre-IPO investments. Whether you're diversifying beyond traditional markets or backing future leaders, the platform helps you invest with insight and discipline.

Book a free demo to explore smarter investing with S45, where access meets accountability.

Conclusion

Digital investment platforms offer more than just convenience; they change how investors access, evaluate, and manage their money. From equity and debt to niche opportunities like pre-IPO and startups, these platforms bring choice and structure under one roof. For many, that means breaking free from traditional broker limitations and exploring more diversified, data-driven options.

The benefits are clear: easy access to many asset classes, real-time dashboards, transparent fees, verified deals, and goal-based planning. These features simplify investing and help improve decisions over time.

For Indian investors, especially those exploring private markets, the right mix matters. Pairing the simplicity of digital platforms with expert-led guidance, like S45’s curated approach, can lead to smarter, more confident investments.

Consider S45 as your strategic partner to stay ahead in the investment game and take charge of your financial future. Join our founder’s community today to meet like-minded, investment-oriented, and value-driven individuals.

Frequently Asked Questions

1. What is the minimum investment required on a digital investment platform?

Minimum investments vary by platform and asset type. Some public market platforms allow amounts as low as ₹500. Private market or pre-IPO platforms may require ₹2–5 lakh or higher. Always confirm minimum ticket sizes before signing up to ensure you align with available deals.

2. Can I switch between platforms easily if I start with one?

Yes, you can switch platforms, but you may face delays or transfer restrictions. Some funds and pre-IPO shares come with lock-ins or transfer requirements. Always review exit policies and platform terms before moving your holdings to a new service.

3. Are investments made through digital platforms protected under regulation?

Trusted platforms registered with SEBI or backed by financial advisors follow strict KYC and compliance rules. Your money is safeguarded by regulations applicable to mutual funds or AIFs. Always verify the platform’s registration status before investing to ensure proper oversight and investor protection.

4. How do investment platforms generate income for themselves?

Platforms typically charge flat fees, a small percentage of assets, or performance-based fees. Some may earn commissions on allocations to mutual funds or startup deals. Importantly, transparent platforms disclose fees upfront so you can assess whether the costs justify the investment opportunities.

5. Can I use more than one investment platform at the same time?

Yes, many investors use multiple platforms to access different asset classes or deal types. For example, you may use one app for public equities and another to invest in pre-IPO or startup rounds. Just track your portfolio carefully to avoid overlap or missing critical tax statements.