Key Takeaways:

- Master cash flow forecasting to avoid the liquidity traps that kill 40% of profitable SMEs

- Use margin analysis to identify your most profitable products and optimize your trading portfolio

- Implement liquidity monitoring to ensure you can weather payment delays and seasonal fluctuations

- Structure debt strategically to fuel growth without jeopardizing control of your business

- Track marketing efficiency to scale customer acquisition while maintaining profitability

Ravi thought his electronics trading business was thriving. Sales had grown 40% in six months, orders were pouring in, and his team was expanding. Then his biggest supplier demanded immediate payment while his largest customer delayed their invoice by 60 days. Suddenly, he couldn't meet payroll.

The problem wasn't his business model; it was his blind spot. Like many founders, Ravi focused on revenue growth while ignoring the financial metrics that actually determine survival.

India's 63 million MSMEs employ 111 million people and contribute nearly 29% to the country's GDP. In the trading sector, specifically, these businesses account for 40% of the country's exports. Yet studies show that over 60% of SME failures stem not from lack of customers or market demand, but from poor financial visibility and cash flow management.

Understanding the key financial metrics for SME trading is about building financial intelligence. This intelligence often distinguishes businesses that scale sustainably from those that fail despite early success.

#1 Cash Flow: The Oxygen of Your Trading Business

Cash flow is the most critical finance metric for trading SMEs because it measures the actual lifeblood of your business. The money is moving in and out of your accounts. While profit tells you if your business model works on paper, cash flow tells you if you can keep the doors open tomorrow.

Why Cash Flow Kills More SMEs Than Competition

The harsh reality is that 82% of businesses that fail had positive profit margins when they closed. The killer wasn't a lack of demand or poor products. It was cash flow mismanagement.

In trading businesses, especially, this risk amplifies because you're constantly managing the gap between buying inventory and collecting from customers.

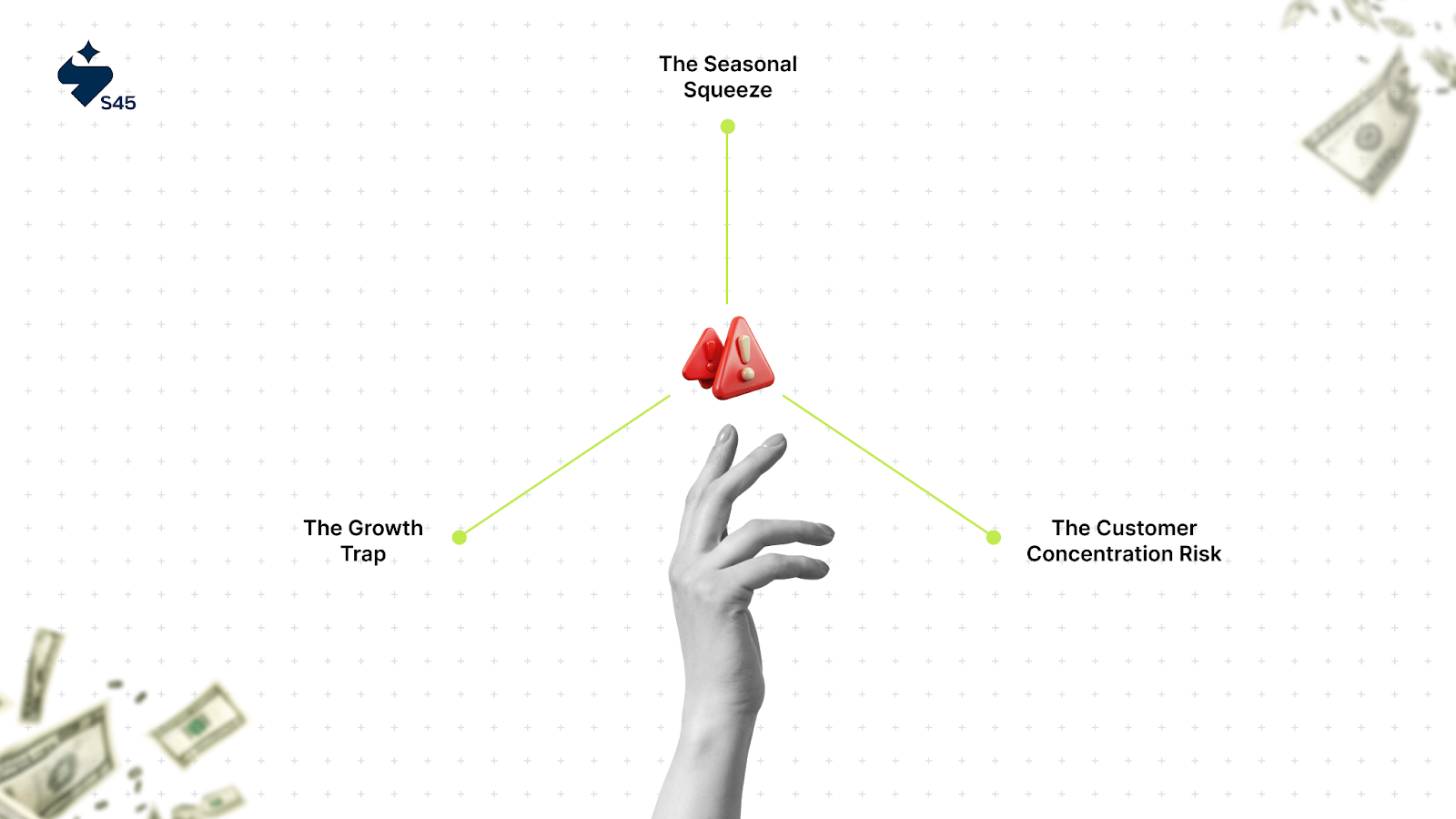

- The Growth Trap: You land a large order requiring upfront inventory investment, but payment terms extend 90 days

- The Seasonal Squeeze: Peak season demands heavy stock purchases, but sales don't convert to cash fast enough

- The Customer Concentration Risk: Your top customer pays slowly, creating a domino effect on your ability to pay suppliers

Advanced Cash Flow Management for Trading SMEs

Beyond basic tracking, sophisticated founders use cash flow forecasting to stay ahead of problems:

Rolling 13-Week Cash Flow Forecasts: Project cash inflows and outflows weekly for the next quarter. This gives you enough lead time to secure additional funding or adjust operations before hitting a crisis.

Scenario Planning: Model your cash flow under three scenarios—optimistic (120% of expected sales), realistic (100%), and pessimistic (70% of expected sales). This reveals how much buffer you need and when to trigger contingency plans.

Cash Conversion Cycle Optimization: Track the days it takes to convert inventory purchases into collected cash. Reducing this cycle from 90 to 60 days can dramatically improve your working capital position.

Tactical Steps to Bulletproof Your Cash Flow

Here are a few steps to consider for streamlining your cash flow.

Accelerate Receivables Collection:

- Implement 2/10 net 30 payment terms (2% discount for payment within 10 days)

- Use automated invoice reminders starting at day 15

- Offer multiple payment options, including digital wallets and bank transfers

- Consider factoring for large receivables to access immediate cash

Optimize Inventory Levels:

- Use ABC analysis to identify your top 20% of products that generate 80% of profits

- Implement just-in-time ordering for slow-moving items

- Negotiate consignment terms with suppliers for seasonal products

- Track inventory turnover by product category, not just overall

Strategic Payables Management:

- Negotiate extended payment terms with suppliers while maintaining early payment discounts

- Align supplier payment schedules with customer collection cycles

- Use trade credit effectively as a free source of short-term financing

Effective cash flow management is all about establishing predictable financial rhythms that support informed decision-making and sustainable growth.

#2 Understanding Your Margins: The Foundation of Profitable Scaling

In India's competitive trading landscape, where MSMEs operate on notoriously thin margins, understanding profitability at a granular level separates successful founders from those who simply stay busy.

Your margins reveal not just whether you're making money, but whether your business model can scale profitably.

The Hidden Truth About Trading Margins

Most trading SMEs track overall gross margin, but this misses critical insights. The founders who scale successfully track margins by product line, customer segment, and even individual transactions. This granular view reveals which parts of your business actually drive profits and which are draining resources.

Product-Level Margin Analysis:

- Track gross margin for each product category monthly

- Identify your "margin champions"—products with 40%+ gross margins that should get priority

- Flag "margin destroyers"—products below 15% gross margin that may not be worth the working capital

Customer Segment Profitability:

- Calculate total profitability per customer, including acquisition costs and service overhead

- Identify high-maintenance customers whose demands erode margins

- Focus growth efforts on customer segments with the best long-term economics

Strategic Pricing in Competitive Markets

Competing on price alone is a race to the bottom. The most successful trading SMEs use value-based pricing strategies that protect margins while building customer loyalty:

Market Positioning Strategy:

- Research your top 3 competitors' pricing and value propositions

- Identify the unique value you provide (faster delivery, better service, exclusive products)

- Price 10-15% above commodity competitors, but justify with clear value differentiators

Dynamic Pricing for Market Conditions:

- Adjust pricing based on inventory levels and higher prices when stock is low

- Implement seasonal pricing strategies for predictable demand cycles

- Use competitor pricing intelligence to optimize your position without starting price wars

Bundle and Tier Strategy:

- Create product bundles that increase average order value

- Offer premium service tiers (express delivery, extended warranties) at higher margins

- Structure volume discounts that encourage larger orders without destroying unit economics

Cost Control That Doesn't Stifle Growth

The best trading SMEs don't just cut costs—they optimize cost structure to support scaling:

Variable Cost Optimization:

- Negotiate volume discounts that kick in at achievable purchase levels

- Implement group purchasing with other SMEs to access better supplier terms

- Use data analytics to eliminate waste in your supply chain

Fixed Cost Leverage:

- Structure overhead costs to scale with revenue (commission-based sales instead of high fixed salaries)

- Invest in automation that reduces per-transaction costs as volume grows

- Choose flexible lease terms and equipment financing that adapt to business cycles

Understanding and actively managing your margins isn't just about today's profitability—it's about building a business model that gets stronger and more profitable as it grows.

#3 Liquidity Ratios: Your Early Warning System

Liquidity ratios serve as your business's financial immune system, detecting threats before they become terminal. For trading SMEs, where cash cycles can be unpredictable and seasonal demands intense, these metrics provide the early warning system that prevents catastrophic cash shortages.

Beyond Basic Current Ratio Analysis

While most founders know the current ratio (current assets ÷ current liabilities), sophisticated financial management requires deeper analysis:

Industry-Adjusted Benchmarks:

- Trading SMEs should maintain a current ratio between 1.5-2.5 (higher than service businesses due to inventory requirements)

- The quick ratio should stay above 1.0, ensuring you can meet obligations without liquidating inventory

- Working capital ratio trends matter more than absolute numbers—declining ratios signal trouble ahead

Liquidity Stress Testing: Run monthly scenarios asking: "What if our top customer delays payment by 30 days?" or "What if we need to purchase emergency inventory?" These stress tests reveal whether your liquidity buffers are adequate for real-world disruptions.

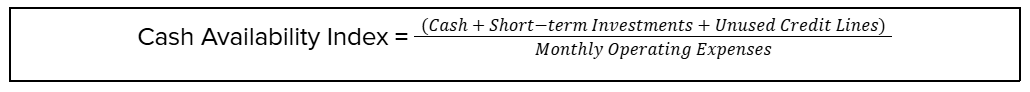

The Cash Availability Index

This index indicates the number of months you can operate without additional cash inflows. SMEs should maintain a CAI of at least 3-4 months to handle seasonal fluctuations and make informed growth investments confidently.

Strategic Liquidity Management

The most successful SMEs treat liquidity as a strategic asset, not just a safety net.

Your liquidity strategy should balance three key elements: immediate cash access, diversified funding sources, and optimal capital allocation. This means maintaining enough liquid assets to handle operational disruptions while avoiding the opportunity cost of holding excessive idle cash.

Credit Line Optimization:

- Establish multiple credit facilities before you need them (banks prefer lending to healthy businesses)

- Maintain relationships with 2-3 financial institutions to avoid over-dependence

- Use revolving credit facilities that adjust with your business cycles

Strategic Cash Reserves:

- Maintain 15-20% of annual revenue in accessible cash reserves

- Use high-yield savings accounts or short-term fixed deposits for emergency funds

- Consider money market instruments that provide liquidity with better returns than traditional savings

Strong liquidity management isn't about hoarding cash—it's about creating the financial flexibility that allows you to seize opportunities and weather storms without compromising your long-term vision.

#4 Managing Debt: Fuel for Growth, Not a Noose

Debt, when used strategically, accelerates growth and competitive positioning. When mismanaged, it becomes the constraint that limits every business decision. The most successful trading SMEs view debt as a tool for building competitive advantages, not just solving cash problems.

The Strategic Debt Framework

The key to understanding the strategic debt framework is that not all debt serves the same purpose or carries the same risk profile for your trading business.

Successful trading SMEs approach debt with a clear framework that categorizes borrowing by strategic purpose, matches debt terms to business needs, and ensures debt supports rather than constrains their growth vision. This strategic approach helps you avoid the common trap of taking on debt reactively during crises and instead positions debt as a tool for competitive advantage.

Growth Debt vs. Survival Debt:

- Growth debt funds, inventory expansion, new market entry, or technology upgrades that generate returns

- Survival debt covers operating shortfalls or unexpected expenses—this type should be minimized

- Track the percentage of your debt that's growth-oriented; successful SMEs keep this above 70%

- Working Capital Lines: 40-50% of total debt for inventory and receivables financing

- Term Loans: 30-40% for equipment, technology, and expansion investments

- Trade Credit: 10-20% from suppliers for inventory management

Advanced Debt Metrics Beyond Basic Ratios That You Must Consider

- Debt Service Coverage Ratio (DSCR) Trends: Don't just track current DSCR—analyze the 12-month trend. A declining DSCR (even if above 1.0) signals potential stress. Successful trading SMEs maintain DSCR above 1.5x to ensure comfortable debt service even during slower periods.

- Interest Coverage Evolution: Track how your interest coverage ratio changes with business growth. If coverage isn't improving as revenue grows, it suggests margin compression or inefficient use of debt capital.

- Debt-to-EBITDA Optimization: For trading SMEs planning significant growth, target debt-to-EBITDA ratios below 3x. This provides sufficient leverage for growth while maintaining financial flexibility for market volatility.

Strategic Debt Decisions That Are Necessary for SMEs

When to Leverage Up:

- Proven product-market fit with consistent gross margins above 25%

- Predictable cash conversion cycles under 90 days

- Clear path to 30%+ revenue growth that debt will enable

- Strong management systems that can handle increased complexity

When to Deleverage:

- Market uncertainty or increased competition is pressuring margins

- Customer concentration risk (top 3 customers represent >50% of revenue)

- Operational challenges that require management focus over growth

The goal isn't minimizing debt—it's optimizing debt structure to support your vision of sustainable, profitable growth while maintaining control of your business destiny.

#5 Working Capital Optimization: Turning Assets Into Growth Fuel

Working capital management separates amateur traders from professional operators. Your inventory and receivables aren't just assets on a balance sheet—they're either engines of growth or anchors dragging down your cash flow and profitability.

Inventory Intelligence for Trading SMEs

For trading SMEs, smart inventory management isn’t just about stock levels, it’s about turning inventory into working capital efficiency. Applying intelligence to high-value items, seasonal demand, and dead stock ensures profits aren’t locked up on the shelves.

The 80/20 Inventory Rule: Track which 20% of your products generate 80% of your profits. These "A-category" items deserve premium inventory management:

- Maintain higher stock levels to avoid stockouts

- Negotiate better payment terms with suppliers

- Consider exclusive distributor arrangements

- Price these items for margin, not just volume

Seasonal Inventory Modeling: Create predictive models for seasonal demand patterns. Successful trading SMEs plan inventory purchases 3-4 months ahead, securing better supplier terms and avoiding last-minute premium pricing during peak seasons.

Dead Stock Early Warning System: Implement automatic alerts when inventory items haven't moved in 60 days. Quick action on slow-moving stock (through bundling, discounting, or returning to suppliers) prevents cash from getting trapped in worthless inventory.

Receivables Management as Competitive Advantage

Receivables are a source of competitive advantage when managed strategically. By analyzing customer payment behavior, tightening collection processes, and using receivables data to guide growth decisions, trading SMEs can protect cash flow while scaling sustainably.

Customer Payment Behavior Analytics: Track payment patterns by customer to identify early warning signs:

- Customers paying 5-10 days later than usual may signal financial stress

- Changes in payment methods (switching from transfers to checks) often indicate cash flow problems

- Frequent payment rescheduling requests are red flags for potential bad debt

Proactive Collection Strategies:

- Segment customers by payment risk and adjust credit terms accordingly

- Implement automated payment reminders at day 15, 25, and 35

- Offer multiple payment options to reduce friction

- Consider trade credit insurance for customers representing >10% of revenue

Receivables as Growth Leverage: Use your receivables data to make smarter growth decisions:

- Prioritize customers who pay within terms for volume discounts

- Require upfront payments or deposits from consistently late payers

- Use payment history as a criterion for extending credit limits

Working Capital Cycle Optimization

Optimizing the working capital cycle is about accelerating cash flow without straining relationships. For trading SMEs, tighter control over payables, receivables, and inventory creates the liquidity needed for steady growth and market agility.

Measuring Your Cash Conversion Cycle: Track the days from when you pay suppliers to when you collect from customers. Industry-leading trading SMEs achieve cycles of 45-60 days, while struggling businesses often exceed 120 days.

Cycle Improvement Strategies:

- Negotiate 45-60 day payment terms with suppliers while offering 15-30 day terms to customers

- Use supply chain financing programs to extend payables without damaging supplier relationships

- Implement inventory financing facilities that align with your sales cycles

Optimizing working capital isn't about squeezing suppliers or customers—it's about creating financial rhythms that support predictable growth and give you the flexibility to seize market opportunities.

#6 Marketing ROI: Growing Smart, Not Just Fast

In today's competitive landscape, the trading SMEs that scale successfully are those that treat marketing as an investment requiring precise measurement and optimization. Understanding the financial returns of your customer acquisition efforts is crucial for sustainable growth.

Beyond Basic CAC: Customer Economics That Matter

Looking beyond basic CAC helps trading SMEs understand whether new customers truly create long-term value. By focusing on lifetime profitability, not just acquisition costs, businesses can ensure every rupee spent on growth compounds into sustainable returns.

Customer Lifetime Value (CLV) Modeling: Calculate the total profit you'll earn from a customer over their entire relationship with your business. For trading SMEs, this includes:

- Average order frequency and size over time

- Margin evolution as customers buy higher-value products

- Referral value (how many new customers each customer brings)

- Cross-selling and upselling potential

The LTV: CAC Ratio is essential. Target an LTV: CAC ratio of at least 3:1 for sustainable growth.

If you're acquiring customers for ₹5,000 but they only generate ₹10,000 in lifetime profit, you're in dangerous territory. The most successful trading SMEs achieve 5:1 or higher ratios.

Channel-Specific ROI Tracking

Not all marketing channels deliver the same quality of customers. For trading SMEs, tracking ROI at the channel and geographic level reveals where acquisition spend drives the highest lifetime value, helping prioritize efforts that maximize growth efficiency.

Digital vs. Traditional Channel Performance:

- Track CAC and conversion rates separately for digital marketing, trade shows, referrals, and direct sales

- Many trading SMEs discover their best customers come from relationship-based channels with higher CAC but much higher LTV

- Balance low-cost digital acquisition with high-value relationship building

Geographic ROI Analysis:

- Track customer acquisition costs and lifetime values by region or city

- Identify markets where your trading business has natural advantages

- Focus expansion efforts on geographies with the best customer economics

Marketing Investment Decision Framework

Deciding when to increase or optimize marketing investment is one of the toughest calls for growing businesses. Spend too early, and you burn cash without returns. Scale too late, and competitors capture market share. A clear framework based on financial metrics and channel performance ensures that every rupee invested compounds growth rather than drains resources.

The decision comes down to balancing customer lifetime value (LTV), acquisition costs (CAC), and payback timelines—while maintaining visibility into which channels truly deliver high-quality customers.

When to Scale Marketing Spend:

- LTV: CAC ratio consistently above 4:1 for 3+ months

- Payback period under 12 months for trading businesses (due to working capital requirements)

- Clear understanding of which channels drive the highest-quality customers

When to Optimize Before Scaling:

- Rising CAC without corresponding LTV improvement

- Payback periods extending beyond 18 months

- Difficulty tracking which marketing efforts drive actual sales (not just leads)

The goal isn't minimizing marketing costs—it's maximizing the return on every rupee invested in growth while building a sustainable customer acquisition engine.

#7 Revenue Intelligence: Reading the Signals That Predict Your Future

Revenue isn't just a number—it's a story about your business's health, market position, and growth potential. The most successful trading SME founders develop the ability to read revenue patterns like a doctor reads vital signs, detecting opportunities and threats long before they become obvious.

Revenue Quality Assessment

High revenue alone doesn’t guarantee business stability—what matters is its quality. For trading SMEs, assessing revenue concentration, predictability, and product evolution helps reduce risk, strengthen resilience, and guide smarter growth decisions.

Revenue Concentration Risk:

- Track the percentage of revenue from your top 3, 5, and 10 customers

- Trading SMEs with >40% revenue from any single customer face significant vulnerability

- Develop strategies to diversify your customer base while growing total revenue

Revenue Predictability Score: Create a monthly metric combining:

- Percentage of revenue from repeat customers (target: >60%)

- Average customer relationship duration (target: >18 months)

- Revenue variance month-over-month (lower variance = higher score)

Product Revenue Evolution:

- Track which products are gaining vs. losing revenue share

- Identify emerging products that could become major revenue drivers

- Plan inventory and marketing investments based on product trajectory

Growth Pattern Recognition

Not all growth is good growth. For trading SMEs, recognizing the difference between sustainable growth patterns and warning signs ensures that expansion strengthens profitability instead of masking underlying weaknesses.

Sustainable vs. Unsustainable Growth Indicators:

Knowing the difference helps trading SMEs double down on profitable growth while avoiding patterns that erode long-term stability.

Healthy Growth Signals:

- Revenue growth accompanied by margin improvement

- Increasing customer retention rates

- Growing average order values from existing customers

- Expansion into higher-margin product categories

Warning Signs in Revenue Trends:

- Revenue growth driven primarily by price cuts or heavy promotions

- Increasing customer churn requires constant new acquisition

- Growing revenue concentration in low-margin products

- Seasonal spikes followed by severe troughs

Revenue Forecasting for Strategic Planning

Accurate revenue forecasting is the foundation of strategic planning. For trading SMEs, combining internal performance data with external market intelligence enables realistic projections that guide smarter investments and reduce financial surprises.

Bottom-Up Revenue Modeling: Build revenue forecasts by combining:

- Existing customer growth trajectories

- New customer acquisition plans

- Product mix evolution

- Market expansion timeline

Market Intelligence Integration:

- Track competitor pricing and positioning changes

- Monitor supplier cost trends that might affect your margins

- Analyze economic indicators that influence your customers' buying power

Revenue intelligence helps you make proactive decisions about inventory, hiring, and growth investments rather than reacting to problems after they develop.

#8 When Financial Metrics Conflict: The Art of Financial Diagnosis

Every experienced founder encounters the frustrating scenario where their financial metrics tell different stories. Cash flow might be tight while profits look strong, or margins might be healthy while growth stalls. Learning to diagnose and resolve these conflicts is a critical skill for sustainable scaling.

Common Metric Conflicts and Their Root Causes

Financial metrics don’t always tell the same story. For trading SMEs, conflicts between profit, cash flow, and growth often reveal deeper structural issues, understanding these mismatches is key to fixing root causes before they become crises.

Profitable But Cash-Poor: This classic SME challenge usually stems from:

- Rapid growth requires increased working capital investment

- Extending payment terms to win customers without adjusting your supplier terms

- Inventory buildup ahead of anticipated demand that hasn't materialized

- Large one-time expenses that don't appear in profit calculations

Strong Cash Flow But Declining Margins: This often indicates:

- Liquidating inventory at below-cost prices to generate cash

- Delaying necessary investments in equipment or technology

- Reducing marketing spend that will hurt future revenue

- Potentially unsustainable operating practices

Financial Health Diagnostic Framework

A structured financial health checkup helps trading SMEs spot vulnerabilities early and course-correct before they escalate. By regularly reviewing cash, margins, growth sustainability, and risk concentration, businesses can ensure long-term stability while pursuing growth.

- Cash Position vs. Operating Needs: Is your cash balance growing faster or slower than your business?

- Margin Trends vs. Market Position: Are margin changes due to your strategy or market pressure?

- Growth Sustainability: Can your current cash generation support your growth rate?

- Risk Concentration: Are you dependent on any single customer, supplier, or product for >30% of key metrics?

Quarterly Strategic Review:

- Analyze the correlation between marketing spend and revenue growth with a 30-60 day lag

- Review whether your debt levels are supporting or constraining growth opportunities

- Assess if your working capital management is improving or deteriorating

- Evaluate whether your financial complexity is growing faster than your management capabilities

Resolution Strategies for Conflicting Metrics

When financial metrics conflict, the solution isn’t choosing one over the other. It’s resolving the imbalance. For trading SMEs, targeted strategies can align profit, cash flow, and growth so the business stays both stable and scalable.

When Cash Lags Profit:

- Implement aggressive receivables collection with early payment incentives

- Negotiate inventory financing facilities with banks

- Consider factoring for large receivables to improve cash conversion

- Temporarily reduce inventory levels to free up cash

When Margins Decline Despite Revenue Growth:

- Conduct a detailed product profitability analysis to identify margin leaks

- Review pricing strategy against value delivered to customers

- Analyze operational efficiency to identify cost reduction opportunities

- Consider whether growth is happening in lower-margin segments

The key is developing the pattern recognition to spot conflicts early and the operational discipline to address root causes rather than just symptoms.

#9 Technology Stack: Automating Financial Intelligence

The trading SMEs that scale most successfully are those that leverage technology to transform financial tracking from a manual burden into an automated competitive advantage. The right tech stack doesn't just save time—it provides insights that manual tracking can't match.

Essential Technology Infrastructure

The right technology backbone gives trading SMEs real-time financial visibility and tighter control over growth-critical metrics.

Integrated Financial Management Platforms: Modern cloud-based accounting systems like Zoho Books, Tally Prime, or QuickBooks India provide real-time visibility into all key metrics. Look for platforms that integrate with your inventory management and e-commerce systems to eliminate manual data entry and reduce errors.

Automated Dashboard Solutions:

- Connect your accounting software to dashboard tools like Microsoft Power BI or Google Data Studio

- Create automated weekly reports that track your five critical metrics

- Set up alert systems that notify you when metrics cross predefined thresholds

- Use mobile dashboards to monitor business health from anywhere

Custom Metric Tracking for Trading SMEs

Standard financial reports aren’t enough for trading SMEs. Custom metric tracking ensures leaders see the right data at the right time. A unified dashboard turns raw numbers into actionable insights for faster, smarter decisions.

Building Your Financial Command Center: Create a single dashboard that displays:

- Rolling 13-week cash flow forecast with actual vs. projected variance

- Gross margin trends by product category with inventory turnover rates

- Customer payment behavior analytics with aging receivables breakdown

- Working capital efficiency metrics with industry benchmarks

Automated Insights Generation:

- Set up systems that automatically flag when customer payment patterns change

- Create alerts when inventory levels deviate from optimal ranges

- Implement automated competitor pricing monitoring to inform margin decisions

- Use predictive analytics to forecast cash flow based on the sales pipeline and historical patterns

Implementation Strategy for Resource-Constrained SMEs

Phase 1: Foundation (Months 1-2):

- Implement cloud-based accounting with a proper chart of accounts structure

- Set up basic automated invoicing and payment reminders

- Create simple cash flow tracking spreadsheets with weekly update routines

Phase 2: Intelligence (Months 3-4):

- Add dashboard visualization for key metrics

- Implement automated bank feed integration

- Create customer payment behavior tracking systems

Phase 3: Optimization (Months 5-6):

- Add predictive analytics for inventory and cash flow forecasting

- Implement automated reporting for key stakeholders

- Create performance benchmarking against industry standards

The investment in financial technology typically pays for itself within 6-12 months through improved cash flow, reduced bad debt, and better inventory management.

Building Financial Intelligence That Scales with S45club

The founders who succeed in India's competitive trading landscape share one critical trait: they view financial management not as a compliance requirement but as a strategic advantage. They use metrics to spot opportunities others miss, avoid traps that destroy competitors, and make decisions based on data rather than intuition alone.

The most successful trading SME founders don't track these metrics in isolation. They understand that financial excellence comes from combining robust systems with strategic guidance and peer learning from others who've navigated similar challenges.

Join the S45 Club and connect with a community of founders who understand that great businesses are built on great financial foundations. Talk to the experts here!

Frequently Asked Questions

1. Why is cash flow more critical than profit for trading SMEs?

Cash flow measures actual money movement, while profit is accounting-based and includes unpaid sales. In trading, you need real cash to buy inventory and pay suppliers. Profitable businesses fail when they can't access the cash needed for operations.

2. What's the ideal current ratio for a trading SME in India?

Trading SMEs should maintain a current ratio between 1.5-2.5. Lower ratios indicate potential liquidity stress, while much higher ratios suggest inefficient use of capital. The exact target depends on your industry, seasonality, and growth stage.

3. How often should I review these financial metrics?

Cash flow should be monitored weekly, margins monthly, and strategic metrics like debt ratios quarterly. However, during rapid growth or market stress, increase the frequency of daily cash flow monitoring and weekly comprehensive reviews.

4. What's a healthy debt-to-equity ratio for growing trading SMEs?

Most successful trading SMEs maintain debt-to-equity ratios between 0.5-1.5. Ratios below 0.5 might indicate under-leveraging growth opportunities, while ratios above 2.0 suggest potential overleveraging. The key is ensuring debt supports growth rather than just covering operating shortfalls.

5. How do I know if my marketing spend is generating profitable growth?

Track Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV) with a target LTV: CAC ratio of at least 3:1. Also, monitor payback period—trading SMEs should typically recover customer acquisition costs within 12 months due to working capital requirements.