Key Takeaways:

- SME exchange platforms offer small and medium businesses easier, more affordable ways to raise capital without heavy debt or losing control.

- Since 2012, the BSE SME platform has helped companies raise over Rs 10,000 crore, with growing IPO sizes and increased market value.

- These platforms have relaxed listing requirements, lower compliance burdens, and connect businesses with growth-focused investors.

- Beyond funding, SME exchanges boost credibility, improve business practices, and provide access to networks of mentors and investors.

- Growing sustainably through SME exchanges allows companies to maintain control while expanding thoughtfully with market feedback.

Startups in India often struggle to find the proper funding to grow without losing control or incurring heavy debt. Small and medium-sized enterprises (SMEs) are changing the landscape by offering new, easier ways to raise money and attract investors.

Since it started, the BSE (Bombay Stock Exchange) SME platform has helped companies raise Rs 10,652 crore, and together their market value has grown to Rs 1.84 lakh crore. Since January 2023, the average size of an SME IPO has increased to Rs 32 crore, almost three times the earlier average of Rs 11 crore recorded between March 2012 and December 2022.

The growth in SME exchange platform opportunities is helping businesses expand with greater confidence. In this blog, we’ll explore how SME exchange platforms open up real growth opportunities, support business expansion, and help companies grow in a smart, sustainable way.

What You Need to Know About SME Exchange Platforms

As of 2023, SMEs make up about 30.2% of India’s Gross Domestic Product (GDP), contribute 50% to the country’s total manufacturing output, and are responsible for 45.5% of India’s exports. They directly employ more than 110 million people, as per the Ministry of MSMEs (Micro, Small, and Medium Enterprises).

Despite this, many face challenges in raising funds that support growth without sacrificing control or incurring burdensome debt.

SME exchange platforms were created to address this need. These are specialized stock exchanges designed to facilitate easier and more transparent access to capital for smaller businesses. They offer an environment tailored to their unique growth needs, focusing on sustainability, control, and building a lasting legacy.

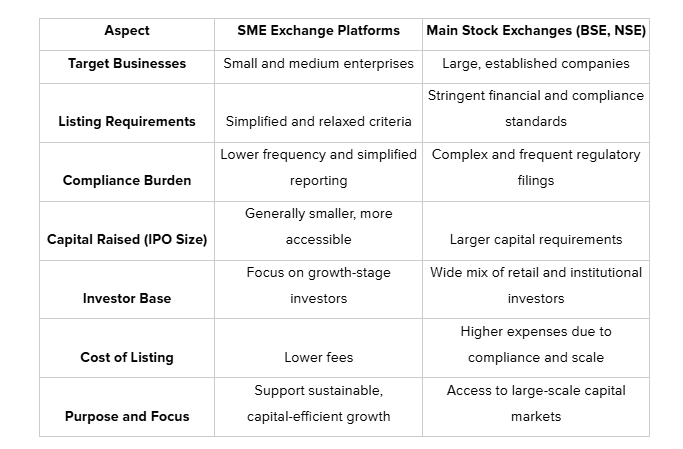

To understand how SME exchanges differ from the main stock exchanges like BSE and NSE, consider the following key differences:

This should clarify how SME exchanges are built to serve the growth needs of smaller businesses without overwhelming them with the complexities of larger markets.

Don’t navigate the SME exchange journey alone. Connect with platforms like S45club and tap into a network that’s been there before.

The Role of SME Exchanges in Driving Growth

Small and medium-sized enterprises in India face challenges in securing funding that supports expansion without sacrificing control or incurring excessive debt. SME exchange platforms were created as dedicated marketplaces where these businesses can raise equity capital more easily.

Backed by regulatory guidelines from the Securities and Exchange Board of India (SEBI), these platforms provide a streamlined and cost-effective path to public funding. Here are the main ways SME exchanges contribute to business growth:

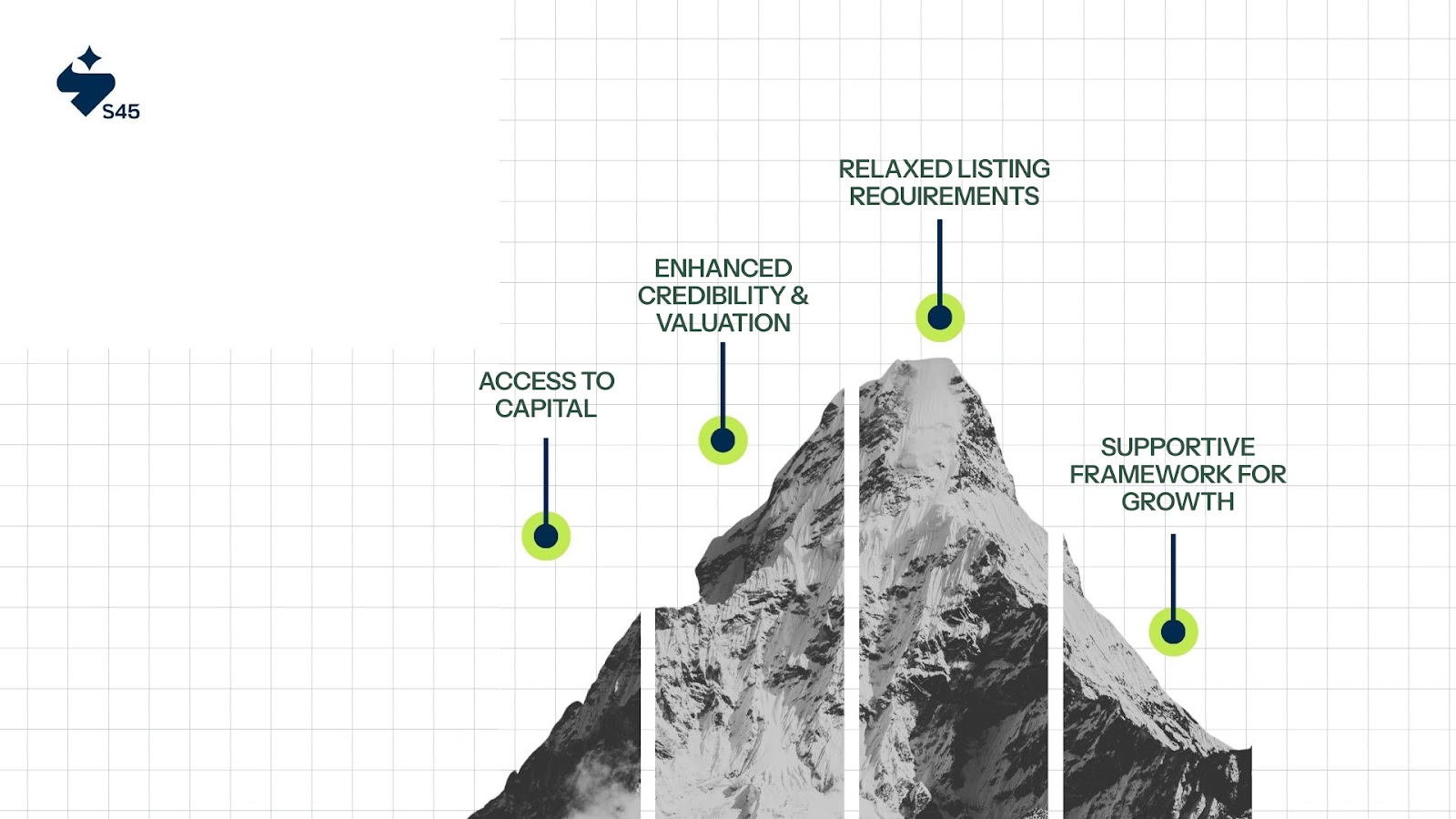

1. Access to Capital

SME exchanges connect companies with retail and institutional investors, enabling them to obtain funds needed for development, innovation, and scaling operations. This method reduces reliance on debt and limits ownership dilution.

2. Enhanced Credibility and Valuation

Listing on an SME platform improves transparency and compliance, which increases investor confidence. This boost in market reputation often results in higher company valuations and better future financing options.

3. Relaxed Listing Requirements

Since its launch by the Bombay Stock Exchange in 2012, the SME platform has allowed smaller companies to list under more flexible eligibility criteria compared to the main stock exchanges. Compliance obligations are also less stringent, making public listing feasible for emerging businesses.

4. Supportive Framework for Growth

The platforms offer a regulated environment that encourages prudent capital raising and strategic planning. This enables businesses to grow responsibly while maintaining necessary governance standards.

Here’s a Success Story That You Must Know

Sealmatic India Ltd., a manufacturer specializing in mechanical seals, made a successful debut on the BSE SME Exchange on March 1, 2023, aiming to raise funds for its growth plans. The company’s Initial Public Offering (IPO) was oversubscribed by an impressive 16.6 times, reflecting strong investor trust and demonstrating how the platform effectively draws significant attention to high-potential enterprises.

The growth in SME exchange platforms is broadening funding opportunities for smaller enterprises. These platforms offer transparent, affordable, and investor-friendly options, enabling companies to expand in a capital-efficient manner while maintaining control and building lasting value.

Ready to grow your SME the smart way? Join S45club and get the backing you need for your next move.

Growth Opportunities for SMEs on Exchange Platforms

The rise of SME exchange platforms is creating real opportunities for these businesses to grow stronger without losing control or incurring heavy debt. Here are some of the most important growth opportunities these platforms offer:

1. Raising Funds Without Burdening Debt

Many SMEs struggle with high-interest loans or borrowing that eats into profits. By listing on an SME exchange, companies can raise money by selling shares. This fresh capital can be invested in upgrading equipment, developing new products, or expanding production. For example, a manufacturing SME might use this funding to buy better machines, improving output and quality without monthly loan repayments.

2. Gaining Credibility to Attract More Customers and Partners

Being listed signals to the market that a company follows clear rules and shares accurate information. This builds trust with customers, suppliers, and investors. A tech startup that listed on an SME exchange found it easier to win big contracts because clients saw the company as reliable and transparent.

3. Improving Business Practices to Draw Investors

Listing means meeting certain governance and reporting standards. This discipline makes investors feel safer and more willing to invest. It also opens doors to partnerships and better business deals. For instance, a fast-moving consumer goods company noticed improved supplier terms and investor interest after going public on an SME platform.

4. Connecting With Skilled People and Support Networks

SME exchanges create communities where companies can meet experienced mentors, potential investors, and other entrepreneurs. This network helps in hiring talented staff who want to work for credible and growing companies. It also provides learning opportunities that help businesses grow smarter.

5. Growing Sustainably While Keeping Control

Unlike other funding routes that might require giving up large shares or control, SME exchanges offer a way to grow steadily. Companies can balance expansion with careful planning, building a lasting business that reflects their vision and values.

6. Using Market Feedback to Make Better Decisions

The exchange environment provides constant signals from investors and the market. Businesses can track the performance of their shares and adjust their strategies accordingly. This feedback helps them focus resources where they matter most, making growth more efficient and effective.

The growth in SME exchange platform options is transforming the way small and medium-sized businesses secure funding and build their futures.

Final Thoughts

The rise of SME exchange platforms is transforming how small and medium businesses fund their growth. Beyond just capital, these platforms provide a transparent and supportive space for companies to expand steadily while maintaining control and focusing on lasting impact.

Supporting growth while protecting what you’ve built is central to our mission. If you want to approach your investments with purpose and care, join Club S45 today. Together, we can create lasting value that honors your vision and legacy.

Frequently Asked Questions

1. What exactly are SME exchange platforms?

SME exchange platforms are specialized stock markets designed for small and medium enterprises. They provide a simpler, more affordable way for these businesses to raise funds by listing their shares, without the heavy compliance burden of bigger exchanges.

2. How do SME exchanges help businesses grow without losing control?

Listing on SME exchanges allows companies to raise equity capital rather than taking on debt. This means they can get funds for growth without giving up large ownership stakes or borrowing high-interest loans that weigh them down.

3. Are SME exchange platforms suitable for all types of small businesses?

These platforms are ideal for growth-oriented small and medium businesses that want to expand sustainably. While they have relaxed listing rules, companies still need to meet certain governance and reporting standards to qualify.

4. What benefits do businesses get beyond funding when they list on an SME exchange?

Listing improves credibility and builds trust with customers, suppliers, and investors. It also connects companies with a community of mentors, investors, and peers, offering valuable support and networking opportunities.

5. Is listing on an SME exchange expensive or complicated?

Compared to main stock exchanges, SME platforms have lower listing costs and simpler compliance requirements. This makes it easier and more affordable for smaller businesses to access public funding and grow confidently.