Key Takeaways

- Financing a long-term asset with short-term debt creates repayment and refinancing risks.

- Quick funds and lower initial costs drive businesses to use short-term debt.

- Mismatched financing impacts cash flow, credit rating, and supplier confidence.

- Alternatives include term loans, equipment leasing, equity infusion, and government schemes.

- Best practice is matching debt tenure with asset life for financial stability.

Many Indian businesses buy heavy machinery or property using short-term loans. But is this approach safe for your company’s cash flow?

In April 2025, Indian banks saw a 10% rise in working capital loans as businesses faced repayment stress on short-term debt funding long-term assets. It creates a risk of cash crunch, operational delays, and refinancing pressure. Mid-market manufacturing and trading firms often overlook the impact of debt terms on their growth and stability.

In this guide, founders will learn the risks of financing a long-term asset with short-term debt, practical examples of its impact, how to align asset life with funding, and alternatives available. You will also learn how to plan smarter debt strategies to keep your businesses stable and scalable without unwanted repayment burdens.

What Does Financing a Long-Term Asset with Short-Term Debt Mean?

Financing a long-term asset with short-term debt means using loans due within a year to buy multi-year assets. For example, using a 6-month working capital loan to buy machinery lasting 10 years. It causes a mismatch between repayment and asset returns.

In manufacturing, firms might buy CNC machines using overdraft facilities. In trading, businesses often use short-term bank loans to build new warehouses. Asset-heavy businesses like logistics buy vehicles with short-term loans due in months, while the vehicle’s life is 5-8 years.

This approach may seem quick and easy, but it creates repayment stress and cash flow gaps later.

Using short-term debt for long-term assets hurts stability. But why do businesses still choose this risky path? Let’s find out.

Why Do Businesses Use Short-Term Debt for Long-Term Assets?

Many businesses prefer short-term debt even for long-term assets. This choice often seems practical but carries risks. To understand why, it’s important to look at the underlying reasons that drive these decisions.

- First, quick access to funds motivates this choice. Short-term loans like overdrafts or working capital limits are easier to secure than long-term loans. For example, a trader may use a cash credit line to buy warehouse racks quickly.

- Alongside speed, lower immediate interest costs also attract businesses. Short-term interest rates are often lower, saving money in the short run.

- Additionally, the flexibility of short-term instruments is another factor. You can repay early without heavy penalties, unlike fixed-term loans.

- Moreover, many businesses face limitations in long-term financing access. Small businesses may not qualify for long-term loans due to poor financials or limited collateral.

But how do growth-ready SMEs cover this gap without losing momentum? Platforms like S45 step in by offering structured capital access beyond traditional lending barriers.

- Urgency is yet another reason. When asset purchases must happen quickly, such as seizing machinery discounts, short-term debt lets businesses act without waiting for long-term loan approvals.

While using short-term debt for long-term needs can seem straightforward, these choices introduce risks that can affect cash flow and stability. Now, let’s discuss these potential risks in more detail.

Risks of Using Short-Term Debt for Long-Term Financing

Using short-term debt for long-term assets feels easy, but often creates hidden risks. Many Indian SMEs face issues later when repayments strain their daily operations. Knowing these risks helps you plan better funding.

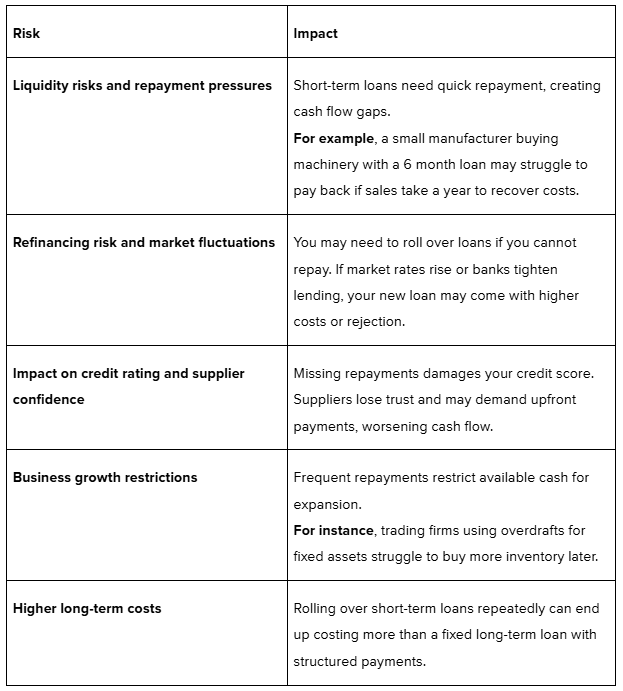

Here are the 5 key risks and their impacts:

Short-term debt for long-term assets exposes businesses to risks that outweigh initial benefits. Next, let’s have a look at some of the best practices to fund assets without these challenges.

Alternative Ways to Finance Long-Term Assets

Funding long-term assets with proper tools keeps growth steady and safe. Relying only on short-term debt increases interest rate and refinancing risks, which can strain cash flows. Knowing alternative options lets you plan asset purchases with reduced financial risk.

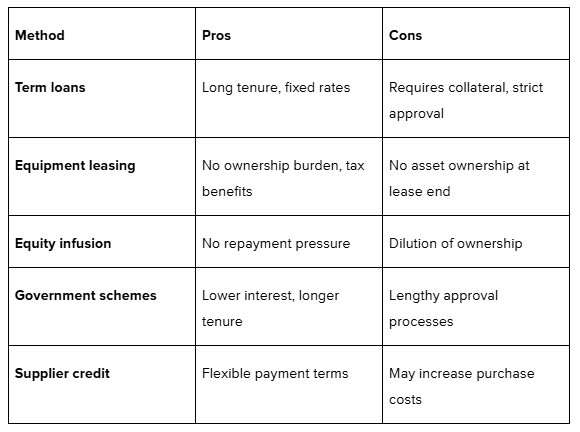

Here are better ways to finance long-term assets:

- Term loans from banks: Banks offer term loans with repayment periods matching asset life. For example, a 5-year machinery loan reduces yearly repayment pressure and aligns with expected returns.

- Equipment financing and leasing: Instead of buying, go for lease or finance machinery. Monthly payments are treated as expenses, saving upfront costs. Useful for technology-heavy sectors needing frequent upgrades.

- External equity infusion: Raise equity from investors to remove debt stress. Though your ownership dilutes, you get capital for expansion without hitting cash flow.

- Government schemes for asset-heavy sectors: Schemes like SIDBI’s MSME support provide low-interest, long-term loans. Manufacturing units can upgrade equipment with easier repayment terms.

- Vendor or supplier credit for equipment purchase: Ask suppliers for long credit periods or EMI options. Many machinery sellers offer staged payments to ease your upfront capital burden.

Here is a table summarising the pros and cons:

Choosing the right funding mix ensures assets support your growth instead of blocking it. Now, let’s understand how S45 could assist you with asset financing.

How S45 Guides You in Structuring Asset Financing?

At S45, founders get advisors who understand their growth plans and financing needs. Our role goes beyond arranging funds. We work with you to build capital structures that keep your business stable and future-ready.

You get guidance on aligning debt with asset life so repayments do not strain cash flows. We help you assess when equity, bank loans, or leasing suits your asset purchases. For manufacturing and trading founders, planning asset investments well means staying competitive while protecting liquidity.

Our team ensures your decisions support long-term goals without hidden risks. You also connect with sector-focused lenders and equity partners within our community. It expands your funding options beyond traditional routes.

Do you want clarity on the best way to fund your upcoming asset purchase? Connect with S45 to structure it with confidence and purpose.

Conclusion

Using short-term debt to fund long-term assets can seem attractive for quick access and lower costs. But it often creates repayment pressure, refinancing risks, and liquidity issues if not planned well. Businesses must weigh these risks against the benefits while exploring other options like term loans, leasing, or equity infusion.

Think of financing as more than arranging funds. It shapes your business stability and growth potential. Align debt duration with asset life, keep repayment terms manageable, and avoid funding decisions that strain cash flows in the future.

S45 guides founders to build strong capital structures aligned with their goals. From funding strategies to equity planning, you get realistic, actionable guidance. Do you want your next asset financing decision to build lasting strength? Connect with S45 for founder-focused capital advice that supports every step of your growth.

Frequently Asked Questions

1. What is the risk of using short-term debt for long-term assets?

Using short-term debt for long-term assets risks repayment pressure due to shorter tenures. Businesses may face refinancing risks if market rates rise or lenders change terms. This mismatch can strain cash flow, reduce credit ratings, and impact supplier or investor confidence in the business’s financial stability.

2. Why do companies finance long-term assets with short-term debt?

Companies sometimes use short-term debt for long-term assets to access quick funds at lower initial costs. They may expect cash inflows soon to repay or refinance. However, this is risky if inflows are delayed, interest rates rise, or refinancing options are reduced, creating repayment and liquidity stress.

3. What is an example of short-term debt used for long-term assets?

For example, a manufacturing unit buys heavy machinery worth ₹2 crore using a working capital overdraft. The overdraft is repayable within a year, but the machine will generate returns over ten years. This mismatch creates repayment risk if operating cash flows do not cover the short-term liability.

4. Is it good to finance fixed assets with short-term debt?

It is not a good practice. Financing fixed or long-term assets with short-term debt creates asset-liability mismatches. It increases repayment risks and refinancing dependence. Best practice recommends matching asset life with debt tenure to keep business cash flows stable and avoid liquidity stress or asset distress sales.

5. How can businesses avoid the risks of short-term debt for long-term use?

Businesses can avoid such risks by choosing term loans or leasing options with repayment periods matching the asset's life. Building cash reserves, maintaining good banking relationships, and planning debt structures with advisors also help. These ensure repayments remain manageable and avoid liquidity or refinancing risks in the future.