Key Takeaways

- Fair value represents the true, intrinsic worth of an asset, factoring in expected earnings and market conditions.

- The formula for calculating fair value incorporates cash value, interest rates, time, and dividends.

- Factors influencing fair value include recent transactions, expected earnings, replacement costs, market conditions, and risk profiles.

- S45 offers curated investment opportunities based on fair value analysis to help investors make informed decisions.

- Understanding fair value ensures that investments are based on the long-term potential of assets, not market fluctuations.

Understanding the true value of an asset is crucial when making investment decisions. The fair value of a share is equal to its intrinsic worth, determined by factors like expected earnings, market conditions, and replacement costs. This concept helps investors assess whether a stock is fairly priced or undervalued.

Fair value has been a critical concept in financial reporting since the issuance of IFRS 13® in May 2011. This standard established a framework for measuring fair value and has since become essential in financial reporting.

In this article, you'll learn what fair value is, how it's calculated, and see practical examples to help you understand its importance in finance.

What is Fair Value?

Fair value represents the true, intrinsic worth of an asset, reflecting its expected future earnings, market conditions, and replacement costs. It is an estimate of what a buyer would pay and a seller would accept in an open market.

Unlike market value, which short-term fluctuations can influence, fair value focuses on the long-term economic worth of an asset.

Understanding an asset's true value involves considering the key factors that determine its worth over time, offering a clearer picture of its potential.

Factors Influencing the Fair Value of an Asset

The fair value of an asset is not determined by a single factor but is influenced by a combination of market conditions, expected earnings, and other key considerations. Understanding these factors allows investors to more accurately assess the intrinsic value of an asset, helping guide informed investment decisions.

Platforms like S45 offer curated investment opportunities, using fair value analysis to guide smart, data-driven investment strategies.

Here are the key factors that influence the fair value of an asset:

- Recent Market Transactions: The prices at which similar assets have recently been bought or sold in the market. This provides a benchmark for determining fair value, especially in markets with frequent transactions.

- Expected Earnings and Future Income: The anticipated future earnings or cash flows that an asset, particularly stocks, is projected to generate. Higher expected earnings can lead to a higher fair value.

- Replacement Cost: The cost to replace the asset with one of similar functionality and quality. If replacement costs rise due to scarcity or demand, the fair value of an asset typically increases.

- Market Conditions and Economic Factors: Broader market trends, economic health, and supply-demand dynamics play a major role. For instance, economic downturns or growth periods can impact asset values.

- Risk and Return Profile: The risk associated with an asset and the expected return also impact fair value. Higher-risk assets typically require a higher return, affecting their fair value.

Understanding these factors helps provide a clearer view of an asset's value. To determine its true worth, the next step is to calculate its fair value using a specific formula.

The Formula for Calculating Fair Value

Calculating the fair value of an asset involves a formula that takes into account cash value, time, interest rates, and dividends. This formula helps investors adjust the current value of an asset to reflect its true worth based on these key components.

It provides a structured way to assess an asset's value, considering both time and market conditions.

Formula:

Fair Value = Cash * {1 + r (X / 360)} - Dividends

- Cash: This is the initial value of the asset or the amount currently held.

- r (Interest Rate): The annual rate of return or growth expected from the asset. This rate can reflect market conditions or the asset's inherent return potential.

- X (Days to Expiry): The number of days remaining until the asset or contract expires. This variable accounts for time decay and the asset's timeline.

- Dividends: Any expected dividends or income generated by the asset, which reduces the fair value by the amount of the dividends paid.

Applying this formula provides a more accurate estimate of an asset’s fair value. Here are some real-world examples to illustrate its application.

Examples of Fair Value in Action

Understanding fair value through practical scenarios can help clarify its real-world application.

Below are two examples showing how to calculate fair value in different situations.

1. Stock Sale Example

You are considering purchasing shares of a company priced at $100 per share. After evaluating expected earnings, the fair value calculation suggests that the intrinsic value of the stock is $110.

Fair Value Formula:

Fair Value = Cash * {1 + r (X / 360)} - Dividends

- Cash = $100

- Interest rate (r) = 5%

- Days to expiry (X) = 180

- Dividends = $2

Calculation:

Fair Value = 100 * {1 + (0.05 * 180 / 360)} - 2

Fair Value = 100 * {1 + 0.025} - 2 = 100 * 1.025 - 2 = 102.5 - 2 = 100.5

The fair value of the stock is $100.5, suggesting that at $100, it is fairly priced but not undervalued.

2. Real Estate Example

You’re evaluating a commercial property for investment. The property’s current market value is $500,000, but using the fair value formula, the expected future rental income and market conditions suggest a fair value of $530,000.

Fair Value Formula:

Fair Value = Cash * {1 + r (X / 360)} - Dividends

- Cash = $500,000

- Interest rate (r) = 4%

- Days to expiry (X) = 365

- Dividends (or expected rent payments) = $20,000

Calculation:

Fair Value = 500,000 * {1 + (0.04 * 365 / 360)} - 20,000

Fair Value = 500,000 * {1 + 0.0411} - 20,000 = 500,000 * 1.0411 - 20,000 = 520,550 - 20,000 = 500,550

The fair value of the property is $500,550, indicating it is priced very close to its intrinsic value.

These examples show how fair value can be applied to both stocks and real estate. Fair value also plays a crucial role in accounting and financial reporting, ensuring accurate asset valuation.

Fair Value in Accounting and Financial Reporting

Fair value is essential for accurate financial reporting, ensuring assets and liabilities are valued in a way that reflects current market conditions. This method helps provide a realistic, up-to-date financial picture of a company's position, enabling better decision-making for investors and stakeholders.

Here's how fair value is applied in accounting and reporting:

- IFRS 9 Financial Instruments: Under IFRS 9, financial instruments like equity securities and derivatives must be measured at fair value. These assets are valued using observable market prices or pricing models, with detailed disclosure required for valuation techniques.

- IAS 16® Property, Plant, and Equipment: IAS 16® allows companies to revalue tangible assets, like buildings and machinery, using fair value during periodic revaluations. This helps ensure that the assets reflect current market conditions and are not understated.

- Hedge Accounting: In hedge accounting, companies must use fair value to measure the hedging instrument. For example, interest rate swaps or foreign currency options are recorded at fair value, ensuring proper alignment with underlying transactions like loans or sales contracts.

- Investment Reporting: Investment funds and securities are reported at fair value on the balance sheet. For example, mutual funds are valued based on the market price of the underlying securities, reflecting the fund's true worth at any given time.

- Asset Sale Valuations: When assets, like real estate or intangible assets, are sold, fair value determines the transaction price. This ensures that both buyer and seller agree on a price that reflects the asset's true worth based on current market data.

These applications of fair value ensure transparency in financial reporting. This leads to a clear comparison between fair value, market value, and carrying value in asset valuation.

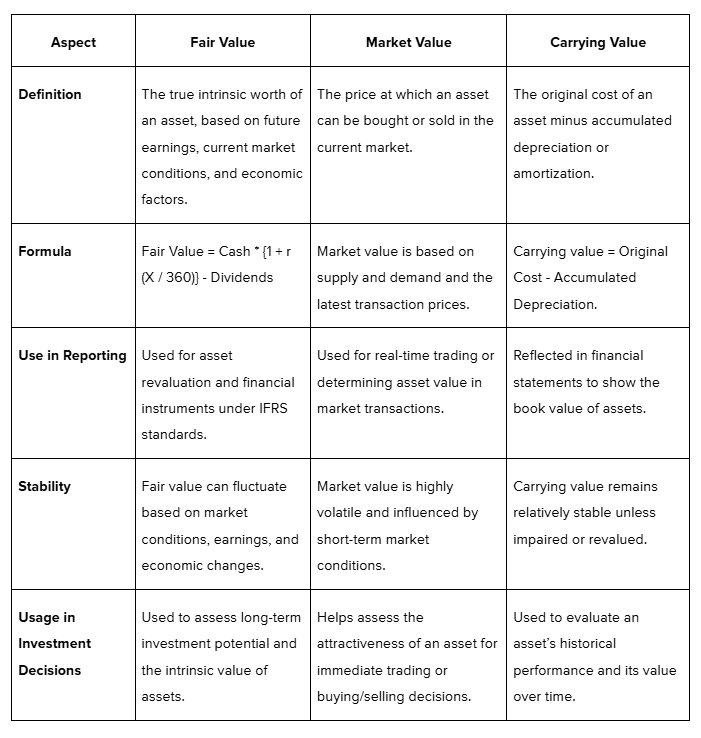

Fair Value vs. Market Value vs. Carrying Value

Understanding the differences between fair value, market value, and carrying value is essential for accurate asset valuation. While all three terms refer to how assets are valued, they each have distinct meanings and uses.

Here's a breakdown of how these values compare:

Understanding these distinctions provides clarity in asset valuation. These differences play a critical role in applying fair value effectively in investment decisions.

Practical Implications of Fair Value in Investment Decisions

Fair value plays a critical role in making informed investment decisions by providing a more accurate assessment of an asset's true worth. It helps investors identify undervalued or overvalued assets, ensuring they make sound choices for long-term growth.

Here are some practical implications of fair value in investment decisions:

- Identifying Undervalued Stocks: Using fair value helps investors spot stocks that are trading below their true worth. Valuing assets accurately using fair value metrics ensures that investors make informed decisions based on the real intrinsic value of the asset.

- Reducing Risk in Volatile Markets: In uncertain or volatile markets, fair value helps mitigate risks by offering a clearer picture of an asset's actual value. The Reserve Bank of India (RBI) has emphasized the importance of fair value in assessing the risk of financial instruments in changing economic environments.

- Aligning Long-Term Investment Strategies: Fair value allows investors to focus on long-term potential rather than short-term fluctuations. By using fair value, you can avoid market noise and make decisions that align with your long-term financial goals.

- Ensuring Transparency: Fair value provides transparency in financial reporting, making it easier for investors to assess the true worth of assets. This transparency is essential for building trust in the financial markets and ensuring that investors have access to accurate information.

By applying fair value, investors can make more informed, long-term decisions while managing risks effectively. S45 integrates these principles to help you make smarter investment choices.

Why Choose S45 for Your Investments?

Fair value plays a crucial role in making informed investment decisions, helping you assess assets accurately based on their true worth. By understanding fair value, you can avoid the pitfalls of market fluctuations and focus on long-term value. This approach ensures that you're investing with a deeper understanding of each asset's intrinsic value.

S45 offers a platform that empowers investors by providing curated, high-quality investment opportunities, designed to help you make data-driven, informed decisions. Here's what it offers:

- Curated Equity Opportunities: Access to exclusive IPOs, pre-IPOs, and high-growth opportunities, carefully vetted to ensure maximum potential for returns.

- In-Depth Insights: Detailed financial reports, market trend analysis, and company projections that help you evaluate the true value of your investments.

- Personalized Advisory: Expert guidance based on your investment goals, risk tolerance, and market conditions, personalized to your specific strategy.

- Investment Tracking: Real-time tracking of your investments, milestone updates, and transparent reporting for better decision-making and portfolio management.

Get in touch today to discover how S45 can support your investment goals!

FAQs

Q. How is fair value different from market value?

A. Fair value represents the true intrinsic worth of an asset based on expected earnings and economic factors, while market value is determined by supply and demand in the market at any given time.

Q. How can S45 help in applying fair value analysis to investment decisions?

A. S45 uses fair value analysis to provide curated investment opportunities, helping investors make informed decisions based on accurate asset valuations and long-term potential.

Q. How do interest rates impact the fair value of an asset?

A. Interest rates affect the fair value by influencing the discount rate used in calculating the present value of future earnings or cash flows. Higher rates typically lower the fair value, and vice versa.

Q. How does S45 select its investment opportunities?

A. S45 selects investment opportunities based on a thorough analysis of fair value, company financials, and market conditions, ensuring that each opportunity aligns with long-term growth strategies.

Q. How often should fair value be reassessed for assets?

A. Fair value should be reassessed regularly, particularly for assets that are affected by changing market conditions, such as stocks or real estate, to ensure that valuations reflect their current true worth.