Key Takeaways

- Assess risk and reward: Understand potential returns and risks for each investment type.

- Do your due diligence: Vet the investment's credibility, management, and financial health.

- Diversify investments: Spread your capital across multiple assets to reduce risk and increase stability.

- Think long-term: Choose investments that align with your business’s sustainable growth goals.

- S45’s support: We guide MSME founders in making well-informed investment decisions by offering both capital and expert advice.

If you’re building an MSME in India today, chances are you’re grappling with a familiar question: How do I fund growth without losing control or compromising my long-term vision?

Banks are tightening lending, NBFCs come with high interest, and grants remain limited. Meanwhile, new options like private equity, angel funding, debt funds, and even asset-backed investments are opening up. But the real hurdle is evaluating which alternative investment is right for your business.

This guide will walk you through the critical factors for evaluating alternative investments and offer insights tailored to the unique challenges Indian entrepreneurs face.

What Are Alternative Investments?

Alternative investments refer to asset classes outside traditional investments such as stocks, bonds, or cash. These can include private equity, venture capital, real estate, hedge funds, commodities, and more. While these investments can provide higher returns, they often carry higher risks and may require longer time horizons for success.

For MSMEs, alternative investments could be an essential component of a diversified portfolio, offering opportunities for scaling operations, expanding market presence, or even funding innovation projects.

As a founder, you may be asking yourself, “Why should I even bother with alternative investments when I can stretch existing credit lines or bootstrap a little longer?”

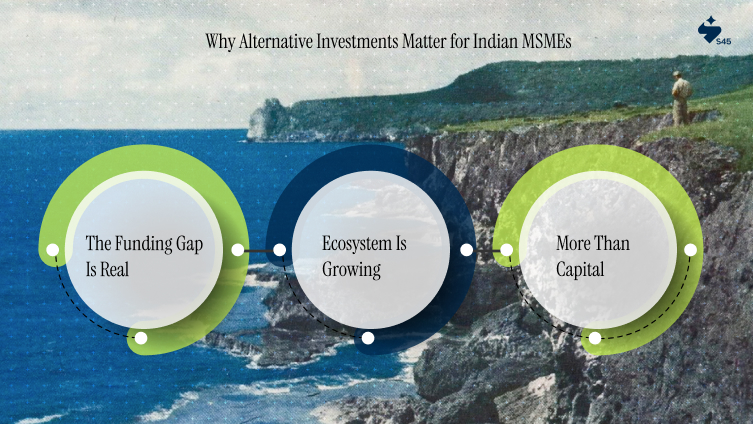

Why Alternative Investments Matter for Indian MSMEs

For Indian founders, evaluating the opportunities of alternative investments effectively can be the game-changer between stagnation and exponential growth for startups.

Here’s why:

- The Funding Gap Is Real: Traditional banks often shy away from MSMEs, citing “risk.” Alternative investors see potential in your growth story.

- Ecosystem Is Growing: India’s alternative investments are expanding rapidly, with venture debt, private equity, and impact capital targeting MSMEs.

- More Than Capital: The right partner doesn’t just bring money, they bring strategy, market access, and networks.

The right deal should allow you to retain control of your company’s vision while giving you enough resources to grow. At S45, we’re committed to helping founders make decisions that keep their long-term goals in sight.

As a founder, you may consider various investment types depending on your business’s needs and goals.

Common Types of Alternative Investments

Alternative investments include various types offering diversification beyond traditional stocks and bonds, each serving a unique role in a portfolio. Here are a few to keep in mind:

- Private Equity: Investments in private companies, typically made through venture capital or buyouts.

- Real Estate: Commercial or residential property investments that generate rental income or appreciate in value.

- Commodities: Investment in raw materials like gold, oil, or agricultural products.

- Hedge Funds: Pooled funds that employ various strategies to earn active returns for investors.

- Cryptocurrency: Digital assets offering high-risk but potentially high-return opportunities.

Each of these options has its pros and cons, so it’s vital to evaluate them based on your specific business goals and financial position.

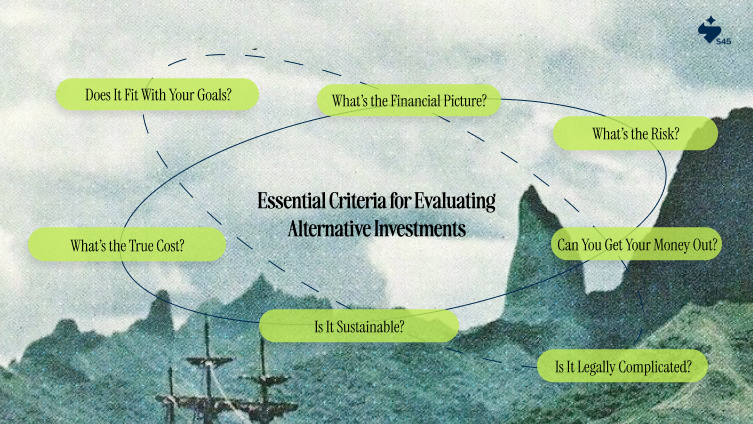

Essential Criteria for Evaluating Alternative Investments

If you have two investment offers in front of you and both look promising, how do you know which one you should take? Or, is it better to walk away altogether?

Here’s a simple, founder-friendly lens:

1. Does It Fit With Your Goals?

The first thing you need to ask yourself is: Does this investment align with where I want my business to go?

You’ve already got a plan, and an alternative investment should either help diversify your risk or support growth in new areas, not add unnecessary complexity. Think about it like adding another ingredient to a recipe, does it enhance the flavor or throw everything off balance?

Using tools that model your portfolio can help you understand whether this new investment will strengthen or weaken your financial position.

2. What’s the Financial Picture?

Here’s where it gets down to brass tacks: Will this investment make money for you? You’ll want to look at things like growth rate and dividend yield to get an idea of what kind of returns you’re realistically looking at.

And remember, it’s not just about the potential return, it’s about comparing that return to the risk you're taking. If the return doesn’t justify the risk, it might not be worth it.

3. What’s the Risk?

You know that every investment has some level of risk. But when it comes to alternative investments, those risks can sometimes be harder to spot. That’s why it’s crucial to look at things like market volatility, credit risk, and even how the investment is regulated.

There’s a lot of talk online (and in communities like Reddit) about the complexities of alternative investments. The last thing you want is to get into something that feels too risky or too complicated to navigate.

A good risk assessment helps you see the full picture and understand whether you’re prepared for what might come down the road.

4. Can You Get Your Money Out?

Liquidity is often overlooked, but it’s crucial. Some alternative investments are like a locked vault; they’re harder to convert into cash. If something unexpected comes up and you need access to your capital quickly, you’ll want to know how long it will take to liquidate the investment. Make sure you’re comfortable with the timeline before committing.

5. Is It Legally Complicated?

Some alternative investments come with legal and regulatory challenges. For example, private equity often requires you to be an accredited investor, meaning you need to have the experience or financial standing to handle these kinds of deals.

If you're not already familiar with these areas, it might be worth seeking advice from someone who can guide you through the process.

6. Is It Sustainable?

Increasingly, investors are prioritizing sustainability in their investments, seeking not only financial returns but also a positive impact on society. If you're looking at alternatives that support social causes or environmental issues, these could be a great fit, especially if they align with your company's values.

Plus, there’s growing interest in ESG (Environmental, Social, and Governance) investing, which might open up new opportunities.

7. What’s the True Cost?

Alternative investments are usually more expensive than traditional ones. High management fees, transaction costs, and other hidden fees can eat into your returns if you’re not careful.

Take the time to really break down these costs. Are they justified by the potential returns, or are you paying for an exclusive opportunity that doesn’t live up to the hype?

At S45, we partner with MSME founders to guide you through complex financial decisions, to ensure your business can thrive in a competitive environment.

What Founders Often Overlook (and Regret Later)

When speaking with fellow entrepreneurs, we’ve noticed a pattern. Many of the regrets founders share are less about the investment itself and more about the details they ignored upfront. Here’s what founders often overlook:

- Taxes and Regulations: A deal may look lucrative until tax structures eat away your returns. Always check compliance.

- The Quick-Win Trap: A short-term boost often distracts from long-term legacy goals.

- Stress Testing: Few founders ask, “How would this investment perform if market demand drops by 30%?” But the smartest founders always do.

Often, what you overlook at the start impacts your freedom and peace of mind later.

This is where many MSME founders feel alone when deals look complex, advisors are expensive, and investors may talk over your head. At S45, we partner with founders to evaluate opportunities, simplify the complex, and back your journey with both capital and expertise.

How S45 Helps MSME Founders Make Informed Investment Decisions

At S45, we believe in more than just funding. We aim to guide you through the entire investment process.

Our approach is different:

- We bring capital AND expertise so you’re not just funded, but guided.

- We live by the principle “Walk Beside, Never Above.” That means partnership, not ownership.

- We help you evaluate not just spreadsheets, but the strategic and sustainable value of each opportunity.

Think of us less like investors and more like your growth partner, one that understands the balance between innovation, sustainability, and legacy. Your business is more than numbers; it’s your story, sweat, and legacy. That’s why choosing the right investment partner matters.

If you’re ready to scale with investments that align with your vision—not just your balance sheet- let’s walk together!

FAQs

Q1: How do I know which alternative investment is best for my business?

A: It depends on your business's current financial health and long-term goals. Start by evaluating the risk and how each investment aligns with your growth strategy.

Q2: Should I invest a large portion of my capital in alternative investments?

A: No. Start small, and ensure you have enough cash flow to run your business. Consider alternative investments as part of a balanced portfolio.

Q3: How can I reduce risk when investing in alternative assets?

A: Diversify your investments across different sectors. Also, conduct thorough due diligence to ensure credibility before committing capital.

Q4: How long should I hold onto alternative investments?

A: These investments often require a long-term outlook. Be prepared to commit your capital for several years to maximize returns.