Key Takeaways

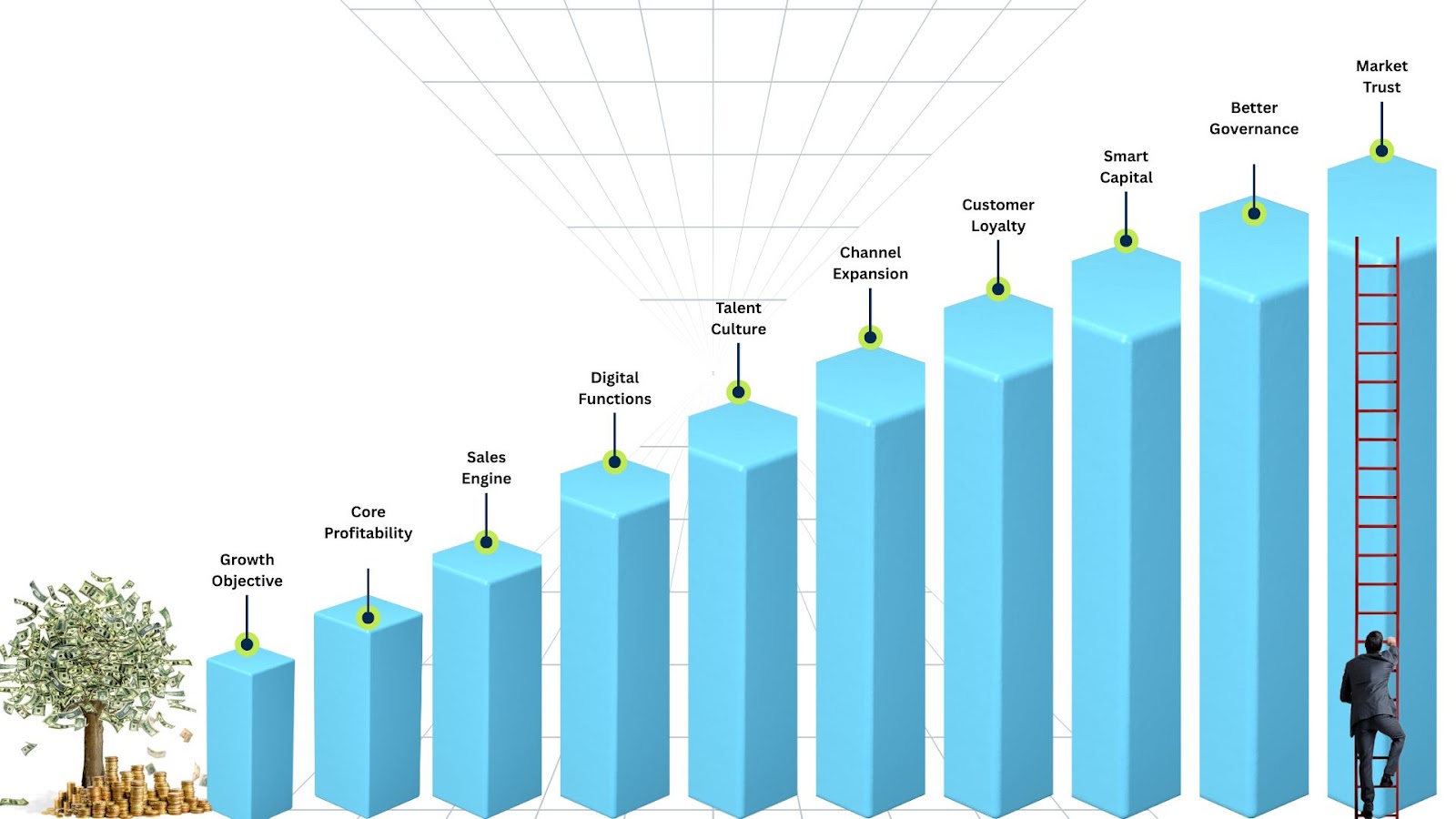

- Clear growth objectives help SMEs prioritize efforts and align teams effectively.

- Improving core profitability creates a stable foundation for sustainable expansion.

- Scalable sales, strengthening talent, and raising smart capital, are essential for consistent business growth in India.

- Strong governance and reporting boost investor confidence and operational control.

- Avoiding common scaling mistakes, like ignoring customer feedback and underestimating financial planning ensures long-term success and strategic clarity.

Are you ready to grow your SME in 2025 or risk falling behind?

Growth is no longer optional for Indian Small and Medium Enterprizes (SMEs); it’s the mainstream to stay relevant in a fast-evolving market. The MSME sector now contributes nearly one-third to India’s GDP and has seen bank credit to SMEs grow 16.9% to over ₹5 lakh crore in FY25. This growth reflects confidence in the sector, but also raises the bar for performance.

Tested and scalable strategies customized for growth-ready Indian businesses are the need of the hour. Each strategy helps you strengthen margins, build repeatable sales, improve governance, and secure smart capital. Meanwhile, you must also avoid common scaling mistakes and align execution with purpose.

In this guide, you will learn 10 effective SME growth strategies, plus what to avoid and how to execute them smartly for 2025 and beyond.

Why Are SME Growth Strategies Important in 2025?

The SME landscape is changing, competition, compliance, and customer expectations are all rising. A strong product or good market timing is no longer enough. You need direction. SME growth strategies give your business structure, pace, and purpose. They reduce guesswork and improve your ability to scale with fewer risks.

Here’s why they matter now more than ever:

- Rising Competition Across Sectors

More startups and digital-first companies are entering every market. Without clear SME growth strategies, your business risks losing its edge. A strong strategy helps define your niche, improve operations, and sharpen your brand. It lets you move faster while protecting what already works.

- Investors Expect Scalable Models

If you're looking to raise capital, you must show more than profits. Investors now expect systems, governance, and predictable growth. SME growth strategies make your model fund-ready by aligning metrics, reporting, and growth priorities from day one.

- Operational Costs Are Growing

Margins are tighter due to rising input and talent costs. A focused SME growth strategy helps reduce waste, automate low-value tasks, and improve profit per employee. Without that, costs can grow faster than revenue.

- Customers Are Smarter, Faster, and Harder to Retain

Indian customers now expect better service, faster delivery, and clearer communication. If your business doesn’t grow with them, it risks churn. A smart growth strategy builds processes that improve customer experience without adding complexity.

- Government Policy Now Rewards Scale

Schemes like PLI, Fund of Funds, and MSME tax benefits now favour growth-focused businesses. But to qualify, your SME needs a stable, fast-growing base. A clear SME growth strategy aligns your structure with what regulators look for.

SME business growth in India is no longer about effort alone; it’s about structure, execution, and timing. Clear strategies help you stay future-ready, fundable, and competitive, no matter your size. Growth now needs more than hustle; it needs a system.

Best SME Growth Strategies for 2025

Growth doesn’t happen by accident. In 2025, it demands a clear SME growth strategy that covers every part of your business: sales, costs, systems, and people. These strategies are not just ideas; they are actions tested by Indian SMEs across sectors.

Here are ten ways to build and scale your SME with purpose:

1. Define a Focused Growth Objective

Every SME needs a clear growth goal, more revenue, better margins, or entering new markets. Without it, your efforts are spread too thin. Strategic planning for SMEs starts with one simple question: “What does success look like in 12–18 months?”

For example, if your SME wants to grow margins, cut low-margin products and improve pricing. If you're aiming for new customers, launch in one city, not ten. Avoid chasing every idea. Focus helps align teams and budgets. A defined SME growth plan helps track progress, adjust faster, and avoid distractions.

2. Strengthen Core Profitability

You can’t grow on weak finances. Start with a cost audit, look for non-essential spends, supplier renegotiations, or underused tools. Then revisit your pricing. Are you selling at the right value, or just matching competitors?

You can increase net margins just by shifting to prepaid plans and optimising raw material usage. Use simple accounting tools to track profitability per product or customer. Platforms like S45 help SMEs benchmark profitability and identify cost levers across industries, giving founders deeper visibility into what drives margins.

SME profit improvement depends on smarter pricing, tighter cost control, and lower burn, not higher revenue alone.

3. Build a Sales Engine That Scales

Founder-led selling works in the early stage, but it can’t scale. Build a process that others can run. Use a CRM to track leads, set up follow-up workflows, and hire inside sales reps to handle inbound and outbound leads.

For example, a Delhi-based B2B firm can move from 10 deals/month to 30 by hiring a two-member sales team and setting monthly targets. A scalable sales strategy means building a team, setting clear roles, and using repeatable steps to drive deals. Without that, growth depends on the founder's time, which is always limited.

4. Go Digital Across Functions

Manual operations eat time and cause errors. Start automating key areas, like billing, payroll, inventory, and leave tracking. Tools like Zoho, Tally, or RazorpayX are built for SMEs and are easy to set up.

You can reduce payroll errors by switching to a basic HR tool. Digital tools for SMEs improve accuracy, speed, and decision-making. Automation means fewer mistakes, faster service, and more time to focus on growth. You don’t need to go all-in; start with one function, see results, then scale.

5. Strengthen Talent and Internal Culture

Growth comes from people, not just plans. Top talent is hard to attract unless your SME shows a growth story. Use ESOPs, flexible work, and career plans to hire better.

You can improve retention after giving teams more ownership and clarity. Build a second line of leadership so you’re not involved in every decision. SME talent retention isn’t about big perks; it’s about culture, growth visibility, and fair roles. Build a team that grows with the business.

6. Expand Distribution Channels

One channel is never enough. Add new ones: distributors, online platforms, or even exports. It spreads risk and opens new demand.

For example, an FMCG SME can grow 2x in just 3-4 months after listing on Flipkart and opening a small export line to the UAE. Don’t depend on just dealers or foot traffic. A strong SME distribution strategy increases reach and protects your revenue. Test channels one at a time. Scale the ones that work best for your product and margin.

7. Double Down on Existing Customers

It’s easier to sell to current customers than find new ones. Focus on increasing order value, repeat purchases, and referrals.

Start with a loyalty programme or scheduled follow-ups. A SME can add 25% more repeat revenue just by sending monthly reordering reminders. Customer retention strategy for SMEs can include WhatsApp updates, birthday discounts, or early access to offers. Your best sales team is your existing customer base, treat them well.

8. Raise Smart Capital

Not all money is good money. Choose the right mix of funding, debt for short-term needs, equity for scaling, or grants for innovation.

One SME can use a ₹50L working capital loan to build inventory and support seasonal demand. Another one can raise ₹1.5Cr equity to build tech. SME funding in India is more available now, but misusing funds can hurt more than help. Match your funding with your growth stage, not your ambition.

9. Improve Governance and Reporting

Growth without governance leads to chaos. Set monthly board reviews, financial reports, and compliance checks. Even if it’s just a 3-person team, create basic SOPs.

Your SME can land on a large B2B deal after sharing clean MIS reports and audit readiness. Good governance isn’t for big companies alone. SME governance practices build trust with banks, partners, and your own team. When reporting improves, so does internal discipline.

10. Invest in Brand and Market Trust

A strong brand builds trust before the first call. Use testimonials, case studies, awards, or press features. Keep your digital presence clean and updated.

For example, an SME can use LinkedIn to post customer success stories and get inbound leads from three cities. SME branding isn’t about expensive ads; it’s about telling real stories in simple words. Trust improves hiring, sales, and investor interest. It adds long-term value without high spending.

A good SME growth strategy is specific, simple, and actionable. You don’t need to do everything; start where your business needs help the most. Each of these strategies supports better cash flow, stronger teams, and wider reach. The right moves now prepare you for stronger growth in the months ahead.

Common Mistakes to Avoid While Scaling Your SME

Even with strong SME growth strategies, execution can fall short if avoidable mistakes go unchecked. Many Indian SMEs rush into growth without planning, which leads to missed goals and wasted capital. Avoiding these mistakes is just as important as choosing the right strategies.

Here are five common errors and how to fix them:

- Growing Without Process Discipline: Some SMEs scale operations without setting processes. It leads to confusion, inconsistency, and low accountability. Always build basic SOPs before expanding. Clear documentation of tasks and responsibilities ensures teams stay aligned as you grow.

- Underestimating Financial Planning: Ignoring cash flow and break-even analysis, or mixing personal and business expenses, creates long-term issues. Use proper accounting tools, like Zoho and work with financial experts. Keep a monthly review cycle to stay ahead of cash burn and profit targets.

- Hiring Too Fast or Too Slow: Growing teams too quickly strains budgets, while slow hiring leads to burnout. Define your hiring needs based on growth forecasts, not gut instinct. Start with flexible roles and invest in cross-training to balance cost and skill.

- Ignoring Customer Feedback: Many SMEs fail to listen once they start scaling. It leads to poor product-market fit and churn. Set up regular check-ins, NPS surveys, and customer interviews. Use feedback to adjust pricing, offerings, or service workflows.

- Delaying Tech Adoption: Some SMEs stick with manual tools even as operations grow. It limits visibility and slows decisions. Adopt digital tools early, start small with accounting, CRM, or HR. Automation helps save time, improve accuracy, and scale better.

Smart growth is about clarity, discipline, and timely action. Avoiding these mistakes ensures your SME growth strategies translate into real business outcomes. Let’s look at how platforms like S45 can support your journey.

How S45 Helps Growth-Stage SMEs?

S45 is a growth partner for Indian SMEs earning over ₹100 crore in annual revenue and ₹10 crore in profit. It works with founders who are ready to move beyond survival and build companies that last. S45 helps them scale with structure, financial strength, and leadership clarity.

Unlike generic SME support platforms, S45 is built for performance-stage businesses. If you're growing over 30% year-on-year and want to scale smarter, not harder, S45 provides the right mix of expert support and proven systems. It connects you with mentors, investors, and a high-quality peer network.

Here’s how S45 supports your SME growth strategies:

- Capital Access: S45 connects you with strategic investors who understand the needs of mid-sized Indian businesses. You don’t waste time chasing the wrong funding sources. Instead, you raise growth capital aligned with your stage and ambition, whether equity or structured debt.

- Governance Playbooks: Most growing SMEs lack strong reporting systems. S45 helps set up MIS dashboards, audit readiness, board reviews, and clear performance metrics. These steps build internal discipline and external trust, making it easier to attract funding and grow responsibly.

- Strategic Guidance: You get access to mentors who have scaled similar Indian businesses. Their advice isn’t abstract; it’s based on experience. From resolving internal issues to entering new markets, this guidance turns trial-and-error into a clear direction.

- Founder Community: Scaling can be isolating. S45’s founder network gives you a space to exchange ideas, challenges, and solutions with peers facing similar growth hurdles. It’s not just networking; it’s problem-solving with people who get it.

- Execution Focus: Great plans fail without follow-through. S45 helps you build quarterly plans and track progress with a hands-on approach. It’s not just about what to do, but how to get it done in your context.

Still confused about taking your step? Book a free demo now and scale faster, smarter, and more confidently with S45’s expert-led approach.

Conclusion

In 2025, a strategic approach to business growth is no longer optional; it’s a necessity. Indian SMEs face tighter margins, rising costs, and more competition than ever before. Clear SME growth strategies help you move with purpose and avoid guesswork.

Specific strategies work across sectors, whether it's strengthening core profitability, building a scalable sales engine, or improving governance and reporting; each contributes to sustained growth. But even the best strategies need strong execution and expert insight to succeed.

Platforms like S45 provide capital access, proven governance models, and a founder-driven community to help you scale faster and smarter.

Is your SME ready to break out of its current state and grow with clarity? Invest in growth that lasts. Connect with S45 today and start planning with the right strategies today.

Frequently Asked Questions

1. Can SMEs secure working capital without collateral?

Yes, many Indian SMEs access collateral-free loans through the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). These loans cover up to ₹5 crore and help businesses access credit even without fixed assets. Banks approve fast, and eligibility requires registered MSME Udyam credentials.

2. How does digital adoption impact SME growth in India?

Over 73% of MSMEs in semi-urban and rural India saw revenue increases and better efficiency after adopting tools like UPI and smartphone-based systems. Digital adoption boosts customer reach, improves process speed, and compiles real-time data, crucial for scaling smartly.

3. What are the common infrastructure hurdles for SMEs in India?

Many SMEs face challenges such as unreliable power, poor transport, and limited digital connectivity. These gaps cause delays, higher costs, and inefficiencies. Addressing infrastructure challenges or outsourcing key services can make growth smoother.

4. Are there SME-specific funding schemes available?

Yes, India offers schemes like the Credit Guarantee Scheme and PLI incentives specifically for manufacturing SMEs. These schemes provide collateral-free credit access or subsidized loans. To qualify, SMEs must register under Udyam and meet revenue/turnover thresholds.

5. What role does governance play in SME business growth?

Strong governance brings structure, accountability, and better decision-making. It helps SMEs attract funding, manage risks, and scale sustainably. Formal boards, clear reporting, and external advisors build investor trust and reduce internal chaos, making governance a key part of SME growth strategies in India.