Key Takeaways:

- The Debt-to-Equity Ratio helps assess how a company finances its operations through debt vs. equity, which is crucial for managing financial risk.

- A ratio higher than 2.0 suggests high financial risk and potential for default during downturns, while lower ratios indicate stability.

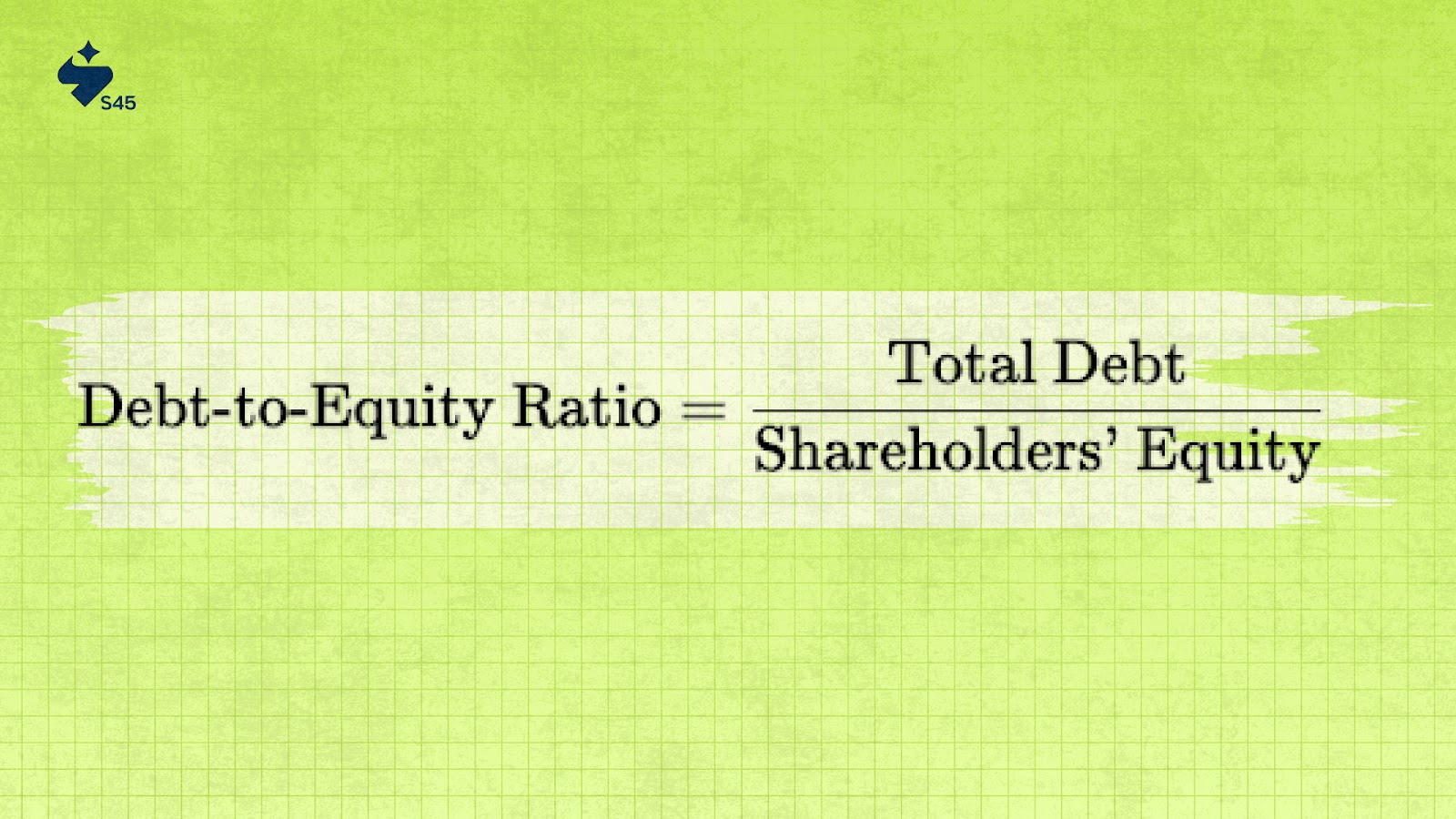

- The formula for the ratio is Total Debt / Shareholders' Equity, providing insights into leverage and financial health.

- Interpreting the ratio involves understanding industry benchmarks, growth stage, and economic conditions.

- The ratio impacts business decisions, such as expansion, investor risk assessment, and creditworthiness.

The Debt-to-Equity (D/E) Ratio is a crucial metric that shows how a company funds its operations, whether through debt or equity. For startups, it’s key for assessing financial risk and finding the right balance between borrowing and owner investment.

Did you know that startups with a D/E ratio above 2.0 are viewed as riskier by investors, with a 25% higher chance of default during downturns? Therefore, understanding this ratio is essential for managing risk and making strategic funding decisions.

In this blog, we’ll break down how to calculate the D/E ratio, interpret its significance, and explore its practical applications in assessing a startup’s financial strategy and stability.

How the Debt-to-Equity Ratio Reflects Financial Health

The Debt-to-Equity (D/E) ratio measures a company's financial leverage by comparing its total debt to shareholders' equity. This ratio indicates the extent to which a company uses debt to finance its operations compared to its equity.

A higher D/E ratio suggests increased reliance on debt, which can elevate financial risk, while a lower ratio indicates a more conservative approach with greater equity funding.

Industry Benchmarks:

- General Motors (GM): As of June 30, 2025, GM reported a D/E ratio of 2.05, indicating a significant reliance on debt financing.

- Ford Motor Company (F): For the same period, Ford's D/E ratio stood at 3.50, reflecting an even higher dependence on debt.

- Stellantis N.V. (STLA): In contrast, Stellantis maintained a lower D/E ratio of 0.56, suggesting a more balanced approach between debt and equity financing.

Interpretation:

- Higher D/E Ratio: Companies like Ford with a D/E ratio above 3.0 may face increased scrutiny from investors and lenders due to higher financial risk.

- Lower D/E Ratio: Stellantis' lower D/E ratio may be viewed favorably, indicating a more stable financial structure.

At S45, we guide founders in making key financial decisions, such as managing the Debt-to-Equity ratio. By understanding and optimizing this ratio, startups can maintain the right balance between growth and financial stability.

Calculating the Debt-to-Equity Ratio: Formula and Methods

The debt-to-equity (D/E) ratio compares the total debt a company has to its shareholders' equity, providing insight into the balance between borrowed funds and owner investment.

This ratio helps investors and analysts evaluate a company's reliance on debt and its ability to meet financial obligations.

The formula for calculating the D/E ratio is:

- Total Debt includes both short-term and long-term liabilities like loans, bonds, and accounts payable.

- Shareholders’ Equity represents the residual value of assets after deducting liabilities. It can be found on the company’s balance sheet.

Example:

- Total Debt: ₹50 million

- Shareholders’ Equity: ₹120 million

- Debt-to-Equity Ratio = 50/120=0.42

This means the company has ₹0.42 of debt for every ₹1 of equity. If the ratio were higher, such as 3.0, the company would be highly leveraged, indicating a greater reliance on debt financing and higher financial risk.

After a clear understanding of the calculation, it is also necessary to know how to interpret the Debt-to-Equity ratio for deeper insights.

What the Debt-to-Equity Ratio Reveals: Key Insights

The D/E ratio reveals how a company finances its operations, balancing debt and equity. It indicates the level of financial risk and growth potential. Here’s how to interpret it:

- Less than 1.0: The company relies more on equity, suggesting stability but potentially slower growth. Low D/E ratios are less risky during economic downturns but may limit scaling.

- Between 1.0 and 2.0: A balanced approach, signaling effective financial management. Companies in this range are stable, with manageable risk for investors and lenders.

- Above 2.0: Heavy reliance on debt, which can boost returns during growth but raises financial risk. High D/E ratios may lead to difficulties in meeting debt obligations during downturns when cash flow is tight.

Example: Group 1 Automotive’s debt-to-equity ratio peaked at 4.19 in Q2 2016 and then dropped to 2.26 by 2025, illustrating fluctuating financial leverage. A higher ratio often suggests greater risk, especially during economic downturns when cash flows might be tighter.

Key Factors that Influence the Debt-to-Equity Metrics

The debt-to-equity ratio is shaped by several factors that vary across industries and business strategies. Understanding these influences helps in interpreting the ratio accurately:

1. Industry Sector Norms

The debt-to-equity (D/E) ratio varies across different industries based on their capital needs and investment structures:

- Capital-Intensive Industries: Sectors like manufacturing and automotive often have higher D/E ratios due to significant capital investments. For example, Ford and GM rely on debt to fund heavy infrastructure needs.

- Tech and Service Industries: These sectors typically have lower D/E ratios, as they require less capital investment and rely more on equity.

2. Company’s Growth Stage

Startups usually have higher D/E ratios due to limited equity and reliance on debt or venture capital. As companies mature, their equity base grows, lowering the ratio and reducing financial risk.

3. Economic Conditions

The overall economic environment plays a significant role in shaping a company's debt-to-equity (D/E) ratio:

- Low-interest rates: Encourage companies to take on more debt, increasing the D/E ratio.

- Economic Downturns: Companies may reduce debt to lower financial risk, leading to a lower D/E ratio.

4. Management Strategy

Management's approach to growth and risk influences a company's capital structure and D/E ratio:

- Companies with aggressive growth strategies may increase debt, raising their D/E ratio.

- In contrast, risk-averse management might focus on equity financing to keep the ratio lower and maintain stability.

5. Capital Structure Decisions

Decisions about debt and equity issuance directly affect a company's D/E ratio:

- Issuing more debt or equity directly impacts the D/E ratio. Debt issuance raises the ratio, while equity financing reduces it.

- Companies may adjust their ratios based on capital needs or market conditions.

6. Regulatory and Market Conditions

Changes in regulations and market trends can influence a company's capital structure decisions and D/E ratio:

- Changes in lending standards or tax incentives can influence the balance between debt and equity, impacting the D/E ratio.

- Regulatory shifts may encourage companies to either increase debt or seek more equity capital.

How the Debt-to-Equity Ratio Applies in the Real World

The Debt-to-Equity (D/E) Ratio plays a crucial role in various financial decisions, from business expansion to risk assessment for investors and lenders.

Here’s how this ratio impacts real-world business decisions:

1. Business Growth and Expansion

A higher D/E ratio, like Ford’s 3.464, signals greater reliance on debt to drive growth, which increases risk during downturns. Stellantis, with a D/E ratio of 0.3643, takes a more conservative approach, relying on equity to mitigate risk.

2. Risk Assessment for Investors

Investors use the D/E ratio to gauge financial risk. Higher ratios offer the potential for higher returns but increase insolvency risk in tough times, guiding investment choices.

3. Creditworthiness and Borrowing Terms

A lower D/E ratio improves access to capital at better terms, while a higher ratio often results in higher borrowing costs due to perceived risk, affecting borrowing decisions.

While useful, the Debt-to-Equity ratio has its limitations. Let’s explore these challenges in more detail.

Challenges with the Debt-to-Equity Ratio

The debt-to-equity ratio is useful for assessing financial leverage, but it has limitations. It doesn't account for industry differences or company-specific risks and can be distorted by accounting choices or non-operational factors.

Some more challenges include:

1. Industry Variations

Capital-intensive industries like automotive manufacturing may naturally have higher ratios due to large, ongoing capital expenditures. This doesn’t necessarily indicate poor financial health

2. Economic Cycles

During periods of low-interest rates, companies might take on more debt, which could inflate the ratio. Conversely, in times of economic downturns, firms may reduce debt levels to minimize risk.

3. Debt Composition

The ratio doesn’t differentiate between short-term and long-term debt, which can have different implications for financial stability.

To help businesses manage financial leverage, let’s see how S45 Club can support startups in this area.

How s45club Helps Manage Financial Leverage

At S45, we empower founders to make informed decisions about their company’s financial strategy. Whether it’s managing the Debt-to-Equity ratio for sustainable growth or going through complex funding rounds, we provide the tools and expertise to balance debt and equity effectively.

Here’s how S45 Club supports businesses in managing financial leverage:

- Optimizing Capital Structure: We help startups structure their debt and equity mix to ensure they have the right balance for growth and stability.

- Access to Strategic Funding: Our platform connects startups with investors who align with their financial goals, ensuring access to the right capital at the right time.

- Risk Management: We provide insights into managing debt, ensuring founders understand the risks and rewards of different financing options.

- Guided Decision-Making: Our advisory services help founders navigate complex financial decisions, from raising capital to planning for future growth.

- Long-Term Financial Health: With S45 Club, startups gain the confidence to manage debt wisely, reducing financial strain while pursuing ambitious growth goals.

Conclusion

The debt-to-equity ratio is a key indicator of a company's financial health and future potential. It reveals the balance between debt and equity, showing the level of risk the company is taking on.

A high ratio suggests greater leverage and higher risk, while a low ratio indicates financial stability. By tracking this ratio over time, you can gain insights into how the company might handle economic shifts and growth opportunities.

To get a full picture of the company’s prospects, it should be considered alongside other financial metrics.

At S45, we help startups navigate financial decisions and growth strategies. Connect with us to get expert insights and ensure your company is on the right track for sustainable success.

Frequently Asked Questions:

Q: How does a high debt-to-equity ratio affect investor perception?

A: Investors may view a high debt-to-equity ratio as a red flag, signaling greater financial risk. While it could imply higher returns, it also increases the likelihood of insolvency, especially during downturns. Investors prefer a balanced ratio to ensure stability.

Q: Can a company with a low debt-to-equity ratio still face financial instability?

A: Yes, even with a low debt-to-equity ratio, a company can face instability if it has poor cash flow, high fixed costs, or operational inefficiencies. The ratio alone doesn’t fully capture all financial risks.

Q: How does the debt-to-equity ratio impact a company's ability to raise future capital?

A: A high debt-to-equity ratio might limit a company’s ability to raise more capital, as lenders and investors may see the company as over-leveraged. Conversely, a low ratio might suggest a lack of growth potential, potentially deterring investors looking for higher returns.

Q: Does the debt-to-equity ratio apply differently across global markets?

A: Yes, the debt-to-equity ratio can vary across global markets due to different economic conditions, regulatory environments, and cultural attitudes towards debt. What’s considered a safe ratio in one country might be viewed as risky in another.

Q: How does a company manage its debt-to-equity ratio during economic downturns?

A: During downturns, companies may reduce their debt levels to lower financial risk, often by paying off liabilities or securing additional equity funding. This helps maintain a healthier ratio and improves financial stability in tough market conditions.