Key Takeaways

- Compulsory Convertible Debentures (CCDs) start as debt and convert into equity after a set period or event.

- They help startups and SMEs raise capital without immediate dilution.

- Conversion terms, interest, and tenure must be clearly defined in the agreement.

- CCDs require legal and compliance checks under Companies Act and RBI rules.

- They are best suited for high-growth firms not ready to fix valuation early.

Looking to raise capital without giving away equity right away?

Many Indian startups and SMEs are using Compulsory Convertible Debentures (CCDs) to fund early growth while delaying valuation decisions. CCDs offer structured funding without immediate dilution, making them an attractive option for founders and investors.

In 2022, the Indian government extended the conversion timeline for CCDs from 5 to 10 years, but this applies specifically to DPIIT-recognized startups, giving qualifying businesses more room to grow before equity conversion. This shift adds flexibility for founders to strengthen operations before bringing in shareholders.

At the same time, investors gain better visibility into a company’s performance before converting their debt into equity. When used thoughtfully, CCDs strike a balance between growth capital and long-term ownership planning.

In this guide, you’ll learn how CCDs work in practice, how they compare to other options, the key legal and tax aspects, and when they fit best into your funding strategy.

What Are Compulsory Convertible Debentures?

Compulsory Convertible Debentures (CCDs) are debt instruments that must convert into equity after a fixed period or on a specific event. The terms of conversion, including timing and share ratio, are pre-agreed between the investor and the company. Unlike regular debt, CCDs are not repaid in cash; they turn into shares.

CCDs sit between debt and equity. They offer capital today while postponing dilution until later. Many early-stage and growth-stage companies in India prefer CCDs for this reason. The investor earns interest during the holding period, and the company benefits from delayed equity dilution.

CCDs mean raising money with a clear equity outcome later. Understanding their features helps you know if they fit your funding plan.

Key Features of Compulsory Convertible Debentures

CCDs come with a fixed structure, making them different from traditional debt or equity. They’re not open-ended or negotiable over time. Both the investor and the company know how and when the CCDs will convert into shares. This clarity makes CCDs useful for structured funding.

Let’s look at the main features that define CCDs.

- Mandatory Conversion: Conversion into equity is not optional. The investor cannot demand repayment in cash. CCDs must turn into shares after a set time or condition, such as a future funding round. This fixed outcome helps in planning equity dilution in advance.

- Pre-Defined Terms: The valuation, number of shares, and timeline are fixed in the CCD agreement. It protects both sides from disputes later. For companies, this also means they can close funding without renegotiating key terms each time.

- Interest Payable Until Conversion: CCDs usually carry an interest rate. The company pays this interest during the holding period until conversion. While this adds a cost, it helps attract investors who want regular returns before equity kicks in.

- Treated as Debt Until Conversion: Until conversion, CCDs appear as debt on the balance sheet. It matters for accounting and compliance. However, companies don’t need to repay the principal, which makes it different from traditional loans.

- Regulatory Compliance Needed: CDDs are governed by the Companies Act, 2013, and in the case of foreign investors, FEMA rules. It includes pricing, reporting, and share allotment timelines. Non-compliance can cause delays or penalties.

Each feature plays a clear role in how CCDs function as a funding tool. Understanding how they work in practice gives you better clarity on when to use them.

How Do CCDs Work in India?

CCDs follow a fixed structure. A company issues them to investors with clear terms for interest, tenure, and conversion. They’re registered as debt instruments first, and later convert into equity when the agreed conditions are met. This allows founders to raise money without giving up shares immediately.

Here’s how CCDs typically work in Indian startups and SMEs:

- Eligibility and Tenure: Any private limited or public company can issue CCDs, subject to sectoral caps (especially relevant in regulated industries or with FDI). The maximum conversion period is generally 10 years to avoid classification as a deposit under RBI rules.

- Valuation: If foreign investment is involved, the pricing formula or fixed price for conversion must be specified upfront; the conversion price cannot be lower than fair market value at issuance (per FEMA).

- Issuance: The company issues CCDs with a defined interest rate (often 8–12% annually), tenure (usually 1–3 years), and a fixed conversion ratio.

- Company Process: The issuance of CCDs typically requires shareholder special resolution, compliance with private placement rules (Forms PAS-4, PAS-5), and relevant regulatory filings.

- No Debenture Redemption Reserve (DRR): Fully and compulsorily convertible debentures are exempt from creating a DRR under the Companies Act.

- NCLAT and IBC Rulings: CCDs’ treatment under insolvency may depend on their contract and financial statement presentation, as some case law has addressed their dual nature as debt and future equity, but for most startup use, they are not seen as redeemable debt.

- Holding Period: Investors receive interest until the CCDs convert. This interest may be paid regularly or accrued till conversion.

- Tax Implications: Interest paid up to conversion is generally deductible; conversion to equity itself is not usually a taxable event for the company, but care must be taken about FMV and Section 56(2)(viib) implications at conversion if shares are issued over fair value.

- Voting Rights & Cap Table: CCD holders are creditors, not shareholders, until conversion—they do not have voting rights or appear on the equity cap table until converted.

- Hybrid Instrument Dynamics: CCDs are classified as debt until conversion but are treated as 'capital instruments' under FEMA for foreign investment from the outset.

- Conversion Triggers: These are either time-based (after X months) or linked to events (like the next funding round or crossing a revenue mark). Once the trigger is hit, CCDs convert into equity shares at the pre-agreed valuation or formula.

- Investor Role: Investors get early exposure with downside protection through interest, while founders avoid immediate dilution.

This system works best when both sides agree on the long-term vision. Knowing why startups and SMEs choose CCDs helps you understand where they fit into a growth plan.

Why Startups and SMEs Use CCDs?

Raising capital is always a balancing act, especially in the early stages of a business. Founders often want to delay dilution, while investors seek security and upside. Compulsory Convertible Debentures (CCDs) offer a middle ground. They work well when the business needs capital but isn't ready to price its equity yet.

Here’s why CCDs are popular among startups and SMEs:

- No immediate dilution, but capital flows in: With CCDs, founders don’t have to give up equity right away. It allows them to raise funds without changing their ownership structure at the start. CCDs also give them time to prove performance before any shareholding changes happen.

- Delays tough valuation talks: Startups often face uncertain or low valuations in the early stage. CCDs help delay this conversation. The company and investors can agree on a formula to decide valuation later, usually after the next round or once growth metrics are hit.

- Provides downside protection to investors: Unlike pure equity, CCDs offer interest payments until conversion. It makes them safer for early-stage investors. If things don’t go as planned, they still earn returns on their investment, which builds trust.

- Avoids pressure of immediate repayments: Pure debt puts pressure on cash flow due to EMI-style repayments. CCDs remove that stress. Since they convert to equity later, the business can use funds to grow instead of worrying about repaying principal amounts.

- Builds structured entry for future investors: CCDs make the cap table predictable. Because the conversion terms are fixed, new investors know what to expect. It also helps the business stay compliant and transparent during future rounds.

In addition to that, platforms like S45 further simplify the process by standardizing deal structures, making it easier for SMEs to stay investor-ready.

CCDs are often seen as startup-friendly convertible instruments in India. Before using them, it’s important to understand the rules that govern them.

Legal and Compliance Aspects of CCDs in India

Compulsory Convertible Debentures (CCDs) are hybrid instruments that occupy a unique space in Indian corporate funding. Their classification as debt, equity, or a mix is shaped by several laws and regulatory bodies.

Understanding the legal and compliance landscape of CCDs is important for companies, founders, and investors to avoid regulatory pitfalls, enable smooth issuance and conversion, and optimize tax treatment.

Each of these legal regimes views CCDs differently, requiring synchronized compliance at every stage, from structuring, issuance, and accounting to conversion and exit. Let’s have a look at various aspects:

1. CCD under the Company Law

Section 2(30) & Section 71, Companies Act, 2013

CCDs are classified as debentures, meaning instruments of company indebtedness. Issuing CCDs requires:

- Authorization in the Articles of Association.

- Shareholder approval by special resolution.

- Compliance with private placement procedures (including statutory offer letters and filings like PAS-4 and PAS-5).

- Filing special resolutions (Form MGT-14) and reporting to the Registrar of Companies.

Fully and compulsorily convertible debentures are exempt from maintaining a Debenture Redemption Reserve. Conversion terms (tenure, interest, conversion ratio) must be specified upfront and cannot be varied easily.

Section 129 & Schedule III

CCDs are shown as liabilities (“borrowings”) in the balance sheet until they convert. After conversion, they move to equity, reflecting the shift from creditor to shareholder.

2. CCD under the Security Law

Judicial Interpretation

The Supreme Court in Narendra Kumar Maheshwari v. Union of India clarified that compulsory conversion distinguishes CCDs from classic debt; they are treated as equity instruments for capital market regulations, since there's no repayment of principal.

Regulatory agencies like SEBI consider CCDs as equity from the outset when their conversion is mandatory and predetermined.

3. CCD under the Insolvency and Bankruptcy Code (IBC)

Nature as ‘Financial Debt’

Under Section 5(8)(c) of IBC, debentures are prima facie ‘financial debt’ since they are money raised for time value. However, if a CCD’s terms specify only conversion (with no principal repayment), recent judicial and NCLAT pronouncements have argued they function more like equity, denying creditor rights at the insolvency stage.

The Supreme Court's ruling in IFCI Ltd. v. Sutanu Sinha and ensuing NCLAT judgments underscore that final classification in insolvency depends on the instrument’s precise contractual terms and how it is reflected in the financial statements.

4. CCD under the Foreign Exchange Management Act (FEMA)

Foreign Investment Regulation

FEMA and its 2017 regulations treat CCDs held by non-residents as 'capital instruments,' making them similar to equity from a cross-border FDI perspective.

Key requirements include:

- The conversion ratio or pricing formula must be fixed at issuance and cannot result in shares issued below Fair Market Value.

- Filing and disclosure requirements (including with RBI) must be met for each allotment and eventual conversion.

- All sectoral caps, pricing guidelines, and end-use restrictions applicable to FDI in equity also apply to CCDs from the beginning.

5. CCD under Income Tax Law

Interest Deductibility

Interest paid on CCDs before conversion qualifies as a tax-deductible business expense under Section 36(1)(iii) of the Income Tax Act, provided the CCDs are issued for business purposes.

Multiple judicial decisions (such as the Bangalore Tribunal in CAE Flight Training (India) (P) Ltd.) confirm that interest continues to be treated as debt expense until the date of conversion.

Issue Expense Deductibility

Costs incurred for issuing CCDs, such as legal or placement fees, can generally be amortized or allowed as a deduction, per precedents set by courts, including in Ashima Syntex v. Asstt. CIT and CIT v. Secure Meters Ltd.

Taxation on Conversion

The act of conversion is not usually treated as a taxable transfer event. However, Section 56(2)(viib) scrutiny applies if shares are issued at a premium, so robust valuation is critical during both issuance and conversion.

From a compliance perspective, CCDs demand rigorous attention to their hybrid character, balancing debt-like protections and equity, like obligations across regulatory regimes. This multi-dimensional legal profile is vital when comparing CCDs to pure equity instruments, classic debt, or alternatives like SAFE notes or convertible notes.

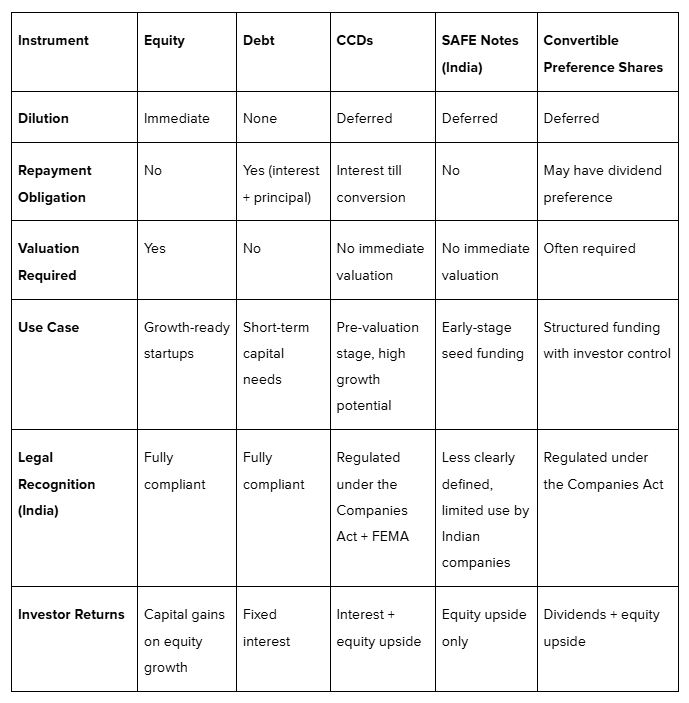

CCDs vs Other Instruments: Equity, Debt, SAFE Notes

Startups have several options to raise money; each comes with its own pros, risks, and use cases. While CCDs offer a flexible way to raise funds, they’re not the only option. Understanding how CCDs compare with equity, debt, and other instruments like SAFE notes helps you pick the right tool at the right stage.

Here’s a quick comparison to make that decision easier:

CCDs balance the flexibility of equity with the safety of debt, making them ideal for early growth phases. But they’re not always the best fit; choosing the right tool depends on the stage, needs, and clarity of your business plan.

Challenges and Risks of Using CCDs in India

CCDs can help raise funds without giving up control right away. However, they also come with trade-offs that founders must be aware of. The structure is hybrid; it initially behaves like debt and later converts into equity. If you’re not prepared, CCDs can create confusion, legal risk, and long-term dilution.

Let’s examine common risks and learn how to manage them effectively.

- Dilution after conversion: When CCDs convert to equity, founders often lose a chunk of their ownership. It can be higher than expected if the valuation wasn't set earlier. To avoid surprises, use caps or valuation-linked conversion terms in the agreement. Transparency with investors on potential dilution helps avoid friction down the line.

- Investor control and expectations: Investors using CCDs might expect rights typically reserved for equity holders, like board seats or exit preferences. These demands often grow once the CCDs convert. To manage this, clearly outline rights during the investment stage and keep roles aligned with actual equity conversion.

- Structuring and legal complexity: CCD agreements involve layered terms: interest, conversion triggers, timelines, and compliance. If not done right, they may face challenges in court or with regulators. Use experienced legal and financial advisors to ensure documentation meets all SEBI, RBI, and Companies Act requirements.

- Regulatory scrutiny on foreign investments: Foreign funds through CCDs must follow RBI and FEMA rules strictly. Delays or incorrect filings can halt funding or cause penalties. Founders must stay updated on sectoral caps, pricing norms, and conversion timelines. Work with advisors who specialize in cross-border compliance for smooth execution.

- Interest liability before conversion: CCDs usually carry interest, adding pressure to the startup's cash flow. For early-stage companies with limited revenue, it can create short-term strain. To avoid this, negotiate a moratorium or cumulative interest structure that doesn’t need regular payouts.

Though CCDs are flexible, they demand a strong understanding of terms, ownership, and investor relations. Used wisely, these risks can be managed and turned into growth opportunities.

How to Issue CCDs: A Step-by-Step Overview

Issuing Compulsorily Convertible Debentures (CCDs) involves a structured approach to ensure regulatory compliance and smooth processing. The process balances legal formalities, shareholder approvals, and operational steps, each essential to successful issuance and future conversion.

Understanding and following these steps minimizes delays and legal risks, helping companies raise capital efficiently.

The procedure can be broken down into clear sequential steps:

1. Board Meeting Approval

The company convenes a board meeting to approve the issuance of CCDs, including deciding the investors, issue size, interest rate, conversion terms, and tenure. This formal approval ensures that the company’s key decision-makers agree to the deal’s framework and terms. To avoid ambiguities, keep detailed records of resolutions and terms decided at this stage.

2. Preparation of CCD Agreement and Term Sheet

The company drafts a detailed agreement outlining key terms such as conversion ratio, triggering events, interest rate, and rights of the investors. The term sheet summarizes these key points. Clarity here prevents future disputes and aligns expectations. Seeking legal counsel for precise drafting helps mitigate risks of ambiguous or incomplete terms.

3. Obtain Valuation Report

A valuation by a registered valuer (for domestic investors) or a chartered accountant (for foreign investors) is necessary to fix the conversion price or formula, complying with tax and FEMA regulations. Getting this report early ensures compliance and smooth pricing negotiations. Delays can be minimized by selecting experienced valuers familiar with startup valuations.

4. Open a Dedicated Bank Account

A separate bank account must be opened specifically for receiving subscription money from CCD investors. It ensures transparency and regulatory compliance concerning fund flows. Maintaining this account until conversion avoids commingling and audit issues.

5. Shareholders’ Approval through EGM

An Extraordinary General Meeting (EGM) is called to obtain shareholder approval via a special resolution for CCD issuance. Proper advance notice and adherence to quorum requirements prevent procedural irregularities. This step is crucial, as failing to secure shareholders’ consent can invalidate the issuance.

6. Filing with Registrar of Companies (RoC)

After shareholder approval, the company files Form MGT-14 (for special resolution), PAS-4 (offer letter), PAS-3 (allotment details), and PAS-5 (annual return of allotments) with the RoC. Timely and accurate filings avoid penalties and regulatory scrutiny. Employing company secretarial professionals ensures this compliance is met seamlessly.

7. Issue Offer Letters and Allotment of CCDs

The company sends formal offer letters to investors with details and collects subscription money. Upon receipt, CCD allotment certificates are issued. Proper documentation and stamping of certificates are essential to establish investor rights and validate investments.

8. Additional Filings for Foreign Investment

If CCDs are issued to foreign investors, obtain KYC and Foreign Inward Remittance Certificates (FIRC), and file the FC-GPR form with the Reserve Bank of India (RBI) to comply with FEMA rules. Missing or delayed filings here can lead to penalties or restrictions on future repatriation.

Adhering to these steps, companies can ensure regulatory approval and operational readiness for CCD issuance. Proper legal and procedural discipline at each stage prevents delays that could risk the capital raise or conversion process.

Understanding these steps with care is important to using CCDs effectively as a funding tool and preparing for future conversion into equity. Now, let’s see how S45 can help SMEs eyeing CCDs.

How S45 Supports CCD-Ready SMEs?

S45 is a growth partner for Indian SMEs with ₹100 Cr+ in revenue and ₹10 Cr+ in annual profit. It helps founder-led businesses scale with better capital access, governance systems, and strategic clarity. If you're considering CCDs or hybrid instruments, S45 brings the right expertise and network to the table.

Here’s how S45 supports CCD-ready founders:

- Capital-smart guidance: Helps you assess if CCDs are the right fit based on your funding goals, valuation readiness, and growth plan.

- Expert-led structuring: Gives you access to experienced legal and financial advisors who can frame CCD terms clearly and compliantly.

- Governance support: Prepares your internal processes, cap table, and documentation to meet investor and regulatory expectations.

- Founder-to-founder learning: A strong peer network that shares insights on what worked and what didn’t, while raising capital via CCDs.

- Deep sectoral proficiency: A strong understanding of manufacturing and trading businesses makes CCD structuring more relevant and grounded.

S45 makes CCD planning easier, safer, and more founder-friendly. It’s not just support; it’s shared experience. Plan your next raise confidently with S45’s expert team and founder-first approach.

Conclusion

Compulsory Convertible Debentures (CCDs) are a smart funding option for high-growth firms that need capital now but want to delay equity dilution. They combine the safety of debt with the upside of equity, making them ideal for early-stage companies or profitable SMEs planning structured expansion.

But CCDs aren't plug-and-play; they require sound legal drafting, compliance with Indian laws, and clarity on terms like conversion timelines, interest rates, and investor rights.

When used without guidance, they can cause dilution shocks or control issues. But with the right usage, they help build a financial map and delay valuation talks until the business is stronger. CCDs work best for firms confident in growth but not ready for traditional equity.

Is your next fundraising structured for long-term success or just a short-term patch? Book a free demo to speak with the experts at S45 to use CCDs wisely and plan legally and financially for long-term growth.

Frequently Asked Questions

1. Are CCDs treated as equity or debt in India?

CCDs are treated as debt at the time of issuance. They convert into equity after a fixed period or event. Until conversion, they follow debt rules, including interest payment and compliance under the Companies Act and RBI regulations.

2. Can foreign investors invest in CCDs in India?

Yes, foreign investors can invest in CCDs under the automatic route if pricing, valuation, and conversion terms follow RBI guidelines and FEMA rules. Legal vetting and regulatory compliance are essential in such cases.

3. Are CCDs taxable in India?

Interest earned on CCDs before conversion is taxable as income. After conversion, capital gains tax may apply based on the holding period of the resulting equity shares. Firms must consult tax experts to plan better.

4. Is a valuation report required for issuing CCDs?

Yes, a valuation report from a registered valuer is usually required to fix the conversion price of CCDs. It helps in meeting regulatory requirements and avoiding future disputes with investors or tax authorities.

5. What is the minimum tenure for CCDs in India?

There’s no fixed minimum tenure under the Companies Act, but for foreign investors, RBI guidelines mandate a minimum maturity of one year. Most CCDs convert within 3–5 years, depending on growth plans and deal terms.