As an MSME founder, growing your business isn’t just about increasing sales or expanding operations. It’s also about making smarter, forward-thinking financial decisions.

While traditional investments like stocks and bonds have their place, they don’t always align with the unique needs of your business. That’s where alternative investments come in.

Alternative investments, such as private equity, venture capital, or real estate, can help diversify your portfolio and potentially offer higher returns. In India, the alternative investment market is growing at an impressive 27% annually, opening up new opportunities for business owners like you.

This guide of alternative investments for dummies will walk you through what alternative investments are, their benefits, and how they could be the right fit for your business.

What are Alternative Investments?

Alternative investments include assets that fall outside the traditional categories like stocks, bonds, or cash. They can range from private equity and venture capital to real estate, commodities, and cryptocurrencies.

In India, the alternative investment market manages around $400 billion in assets, with a large portion managed by SEBI-registered funds. While traditional AIFs often require large minimum investments, alternatives provide more flexible options, sometimes with much lower capital requirements.

What makes alternative investments stand out is their ability to perform differently from stocks and bonds. In times when markets fluctuate, these assets often remain stable or even increase in value, helping businesses protect their growth.

Now that you understand what alternative investments are, let’s look at the different types and how each can benefit your business.

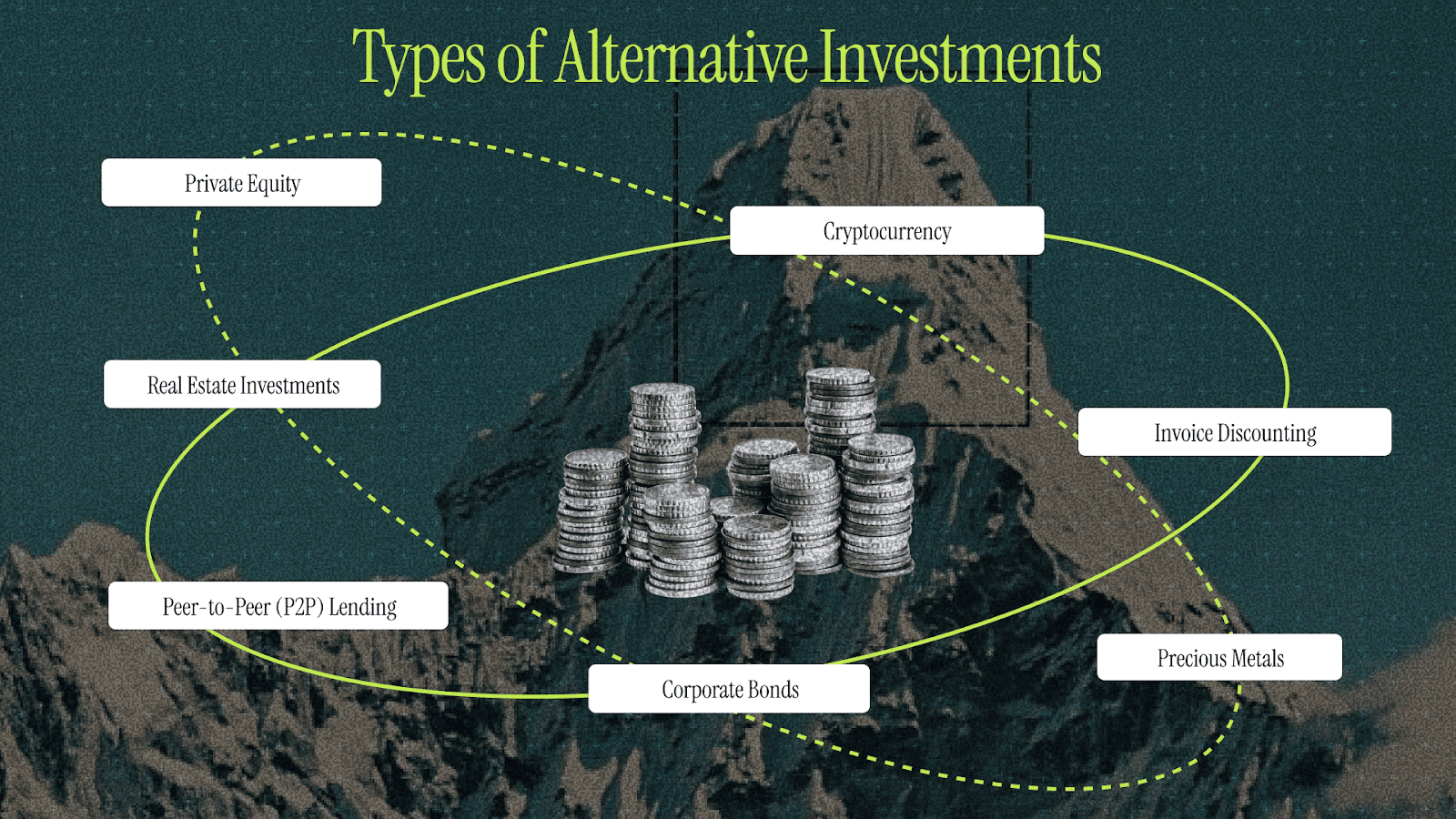

Types of Alternative Investments: Which One Works for You?

As a business owner, you want to know which types of investments can help fuel your growth. Here are some options to consider:

- Private Equity and Venture Capital: Private equity involves investing in established private companies, while venture capital focuses on high-growth startups. In India, you can now start investing in private equity with as little as ₹25 lakh, making it more accessible than ever before.

- Real Estate Investments: Real estate allows you to invest in properties without needing large amounts of capital or managing the property yourself. Platforms like Alt DrX and RealX allow you to start investing with as little as ₹5,000. Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) also provide exposure to commercial real estate and infrastructure through the stock market.

- Peer-to-Peer (P2P) Lending: Platforms like Faircent allow investors to lend directly to borrowers, cutting out traditional banks. P2P lending offers returns of 12-18% annually, backed by thorough borrower vetting, reducing risk and providing steady returns.

- Corporate Bonds and Debt Securities: With platforms like Grip Invest, you can start investing in corporate bonds from as low as ₹1,000. These fixed-income investments provide stable returns and are a great way to diversify your portfolio.

- Commodities and Precious Metals: Investing in commodities like gold or silver helps hedge against inflation. Gold ETFs, for example, allow you to invest in gold without the need for storage or physical ownership.

- Invoice Discounting: Invoice discounting lets you convert unpaid invoices into immediate cash. With returns typically around 12-15%, this low-risk option helps businesses access capital quickly while offering attractive returns for investors.

- Cryptocurrency and Digital Assets: While cryptocurrencies like Bitcoin and Ethereum have high growth potential, they also come with volatility. Platforms like WazirX provide access to digital assets, but you should be mindful of the regulatory uncertainties surrounding them.

Once you understand the different types of alternative investments, it’s important to explore how they can benefit your business.

Why Should You Consider Alternative Investments?

Investing in alternatives can offer more growth and diversification for your business. Here's how:

- Portfolio Diversification and Risk Mitigation: As a founder, you understand how unpredictable the market can be. Alternative investments help balance your portfolio and reduce risk. For example, during the 2008 financial crisis, while stock markets tumbled, commodities and real estate often saw stable or even growing returns. Diversifying into alternatives can offer a safeguard during uncertain times.

- Enhanced Return Potential: Traditional savings often don’t offer the growth your business needs. Peer-to-peer lending platforms, for example, can provide returns as high as 18%, far surpassing what you’d get from fixed deposits. Higher returns mean more capital for your business to reinvest.

- Access to Unique Investment Opportunities: Alternative investments give you access to opportunities that were once reserved for large institutions. You can now invest in premium real estate with just ₹5,000 or earn from corporate receivables through invoice discounting.

- Inflation Protection: Inflation can erode your assets, but investments in real estate and commodities like gold act as natural hedges. They typically perform well during inflationary periods, helping you protect your purchasing power and financial stability.

- Regular Income Generation: As a busy entrepreneur, managing cash flow is crucial. Many alternative investments, such as real estate or corporate bonds, offer regular income streams. These steady returns can help fuel your business growth without relying solely on your core operations.

However, before you opt for alternative investments, you must know weather alternative investments are a good fit for your startup. At S45 , we know that the most successful MSME founders are those who take a measured approach, carefully assessing their readiness before opting alternative investments.

Are Alternative Investments Right for You?

Deciding whether to explore alternative investments requires careful thought. Here are a few questions to ask yourself:

- Do you have the capital to make long-term investments? Ensure you have enough emergency funds (ideally 6-12 months of expenses) and manageable debt before making any major investments. Experts recommend keeping alternative investments to around 10-20% of your total assets.

- Are you prepared for potential risks? Alternative investments can carry more risk, especially if they have low liquidity. For instance, cryptocurrencies can fluctuate wildly. Consider your business’s stability and your ability to withstand market volatility.

- Do you need to diversify your portfolio? If you’re heavily invested in Indian equities, alternative investments like real estate or commodities can help spread risk and provide more balance.

- Does this align with your growth strategy? If your business is focused on long-term growth, alternatives might provide the stability and additional capital you need to scale.

Exploring alternatives isn’t a one-size-fits-all approach. It’s about finding what works for your specific goals, risk tolerance, and financial situation. Also, understanding where to invest is just as important as knowing what to invest in.

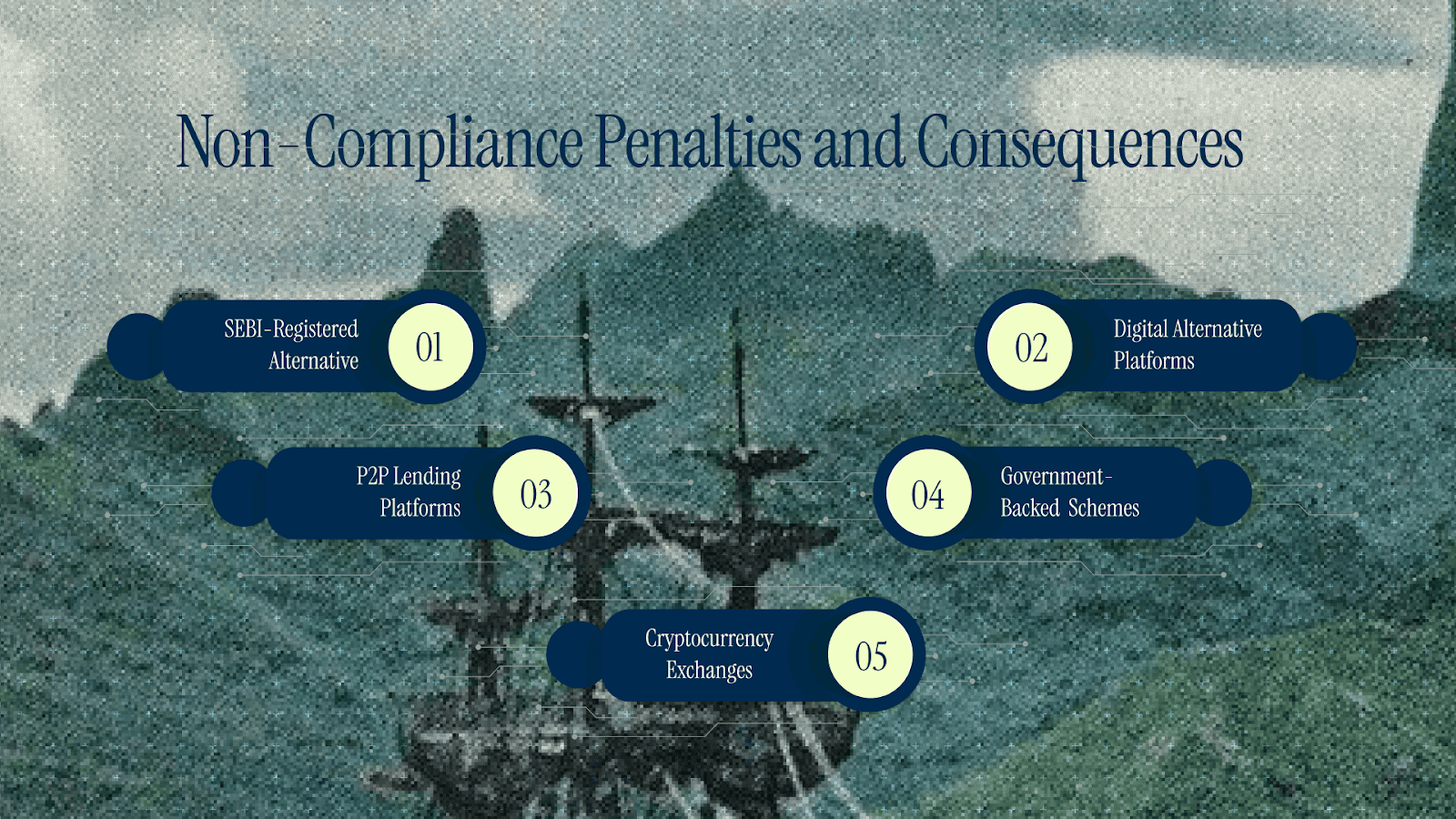

Platforms and Options for Alternative Investments in India

Fortunately, there are numerous platforms in India that make alternative investments more accessible. Here are some of the options for you:

1. SEBI-Registered Alternative Investment Fund Platforms

These platforms ensure transparency and professional management. While they typically require larger investments, SEBI-registered funds offer strong governance and risk management. Notable platforms include Edelweiss Alternative Assets, ICICI Venture, and SBI Ventures.

2. Digital Alternative Investment Platforms

Technology has made alternative investments more accessible to everyday investors. Digital platforms reduce the minimum investment while maintaining high standards of professional curation and risk management. Notable flatforms include Grip Invest, TradeCred, Alt DrX and RealX.

3. Peer-to-Peer (P2P) Lending Platforms

RBI-regulated P2P platforms connect investors directly to borrowers, offering high returns with manageable risks. For example, Faircent offers returns of 12-18% annually, with a 99% on-time repayment rate due to rigorous borrower evaluation. but higher returns come with higher risk. Investors can choose diversified portfolios to manage risk.

4. Government-Backed Investment Schemes

The Self Reliant India (SRI) Fund offers ₹50,000 crore in equity support to MSMEs. It aims to help businesses that contribute to India’s self-reliance goals. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) provides collateral-free loans up to ₹5 crore, with an 85% guarantee on coverage. This scheme has already supported 67 lakh MSME beneficiaries.

5. Cryptocurrency Exchanges

Cryptocurrencies are volatile but can offer significant returns. Be mindful of regulatory risks when investing in assets like Bitcoin and Ethereum through platforms like WazirX. However, due to regulatory uncertainty, carefully consider the legal and tax implications before investing in cryptocurrencies.

These platforms offer access to alternative investments, but navigating this space takes more than knowing where to invest. It requires strategic guidance and support tailored to your business.

How S45 Can Empower Your Alternative Investments Strategies

At S45, we understand the challenges you face as an MSME founder. That’s why we offer more than just capital, we provide the mentorship and guidance you need to make smart, informed investment decisions. Whether you’re exploring real estate, venture capital, or any other alternative asset, we’re here to support you every step of the way.

- Access to Capital: Financial backing to explore alternative investments.

- Expert Guidance: Years of experience to help you make informed decisions.

- Focus on Sustainable Growth: We prioritize long-term value over short-term gains.

With our support, you can confidently navigate the complexities of alternative investments and build a legacy of growth. Reach out to us today to take the next step toward scaling your business.

FAQs

1. How do alternative investments compare to traditional MSME funding options?

Alternative investments offer greater flexibility and better returns compared to traditional loans. Options like invoice discounting and P2P lending let you maintain equity ownership and avoid long approval processes.

2. Are alternative investments regulated in India?

Yes, RBI regulates P2P lending, and SEBI oversees AIFs, REITs, and InvITs, ensuring investor protection and transparency.

3. What risks should MSME founders consider with alternative investments?

Key risks include liquidity concerns, higher fees, and market volatility. Emerging assets like cryptocurrency come with regulatory uncertainties, so always ensure due diligence before investing.