Key Insights:

- VC Firms in India Are Key Growth Drivers: Venture capital firms play a crucial role in helping startups scale by providing funding, mentorship, and strategic guidance for rapid growth.

- Top Sectors for VC Investment: In 2025, venture capital in India is heavily focused on fintech, edtech, SaaS, and technology-driven businesses with high growth potential.

- Stage of Investment Matters: Different VC firms specialize in various stages of investment, from seed funding to growth-stage investments, offering tailored support based on business needs.

- Look for VC Firms with Proven Track Records: Choose firms with a strong history of successful exits and investments in high-growth companies to ensure valuable guidance and expertise.

- Cultural Fit and Mentorship Are Just as Important as Finances: A good VC firm offers more than capital. It provides mentorship, guidance, and a strong partnership to help founders navigate challenges and scale effectively.

Are you curious about how India’s venture capital scene is evolving? The country’s startup ecosystem has demonstrated remarkable resilience, particularly following a challenging few years.

In 2024, venture capital funding in India rebounded strongly, reaching a total of $13.7 billion, more than 1.4 times the amount invested in 2023.

According to the Bain & Company report, this resurgence reflects growing investor confidence and the continued potential of India’s dynamic market.

Opportunities in 2025-26, for both investors and entrepreneurs, is making it the ideal time to explore the booming world of venture capital in India.

What Are Venture Capital Firms?

So, what exactly are venture capital (VC) firms? Simply put, they’re investors who provide funding to early-stage companies that have high growth potential. In return, they get an ownership stake in the business.

VC firms typically focus on startups that are too risky for traditional banks but show promise in disruptive industries like tech, healthcare, and fintech.

Venture capital helps startups grow quickly by providing the funds needed for research, development, marketing, and scaling operations.

These firms usually invest in various stages, from seed funding (helping a startup get off the ground) to growth-stage funding (helping businesses expand rapidly). In return, they look for high returns, often hoping to cash out when the company goes public or gets acquired.

VC firms also bring expertise, mentorship, and connections, helping founders turn their ideas into thriving businesses. For India, this type of investment is vital as it continues to build a vibrant entrepreneurial ecosystem.

If you're a founder aiming to scale your business with sustainable growth, organizations like S45 Club can provide not only the capital but also the expert guidance to help you navigate the journey of building a legacy.

We focus on collaboration, innovation, and long-term success, making us a perfect partner for entrepreneurs looking to make an impact.

As venture capital continues to fuel India’s startup growth, several firms stand out for their impactful investments and strategic guidance. Let’s take a closer look at some of the top VC firms in India that are shaping the future of entrepreneurship in the country.

Top Venture Capital Firms in India

India’s venture capital ecosystem is home to some of the most influential players in the global startup scene. These firms are helping shape the future of technology, innovation, and entrepreneurship in the country.

Let’s take a look at the top seven VC firms in India that are making significant strides in supporting high-potential startups.

1. Sequoia India

Overview of the Firm

Sequoia India is a powerhouse in the Indian venture capital scene, having invested in some of the country’s biggest success stories. The firm was established in 2000 and has since become one of the most trusted names in venture capital.

With a long track record of helping businesses scale, Sequoia continues to focus on high-impact startups across multiple sectors.

Key Investments

Sequoia has been behind the rise of companies like Ola, Byju’s, Zomato, and Freshworks. These investments have helped the firm maintain its leadership position in India’s growing startup ecosystem.

Investment Focus

Sequoia primarily focuses on early-stage investments, with a keen interest in sectors like technology, healthcare, and consumer services. The firm aims to empower entrepreneurs through guidance and capital, helping them scale rapidly.

Noteworthy Achievements

Sequoia’s portfolio includes several unicorns and successful exits, making it a key player in scaling tech companies in India. The firm has been instrumental in helping startups grow into market leaders.

The firm has been instrumental in helping startups grow into market leaders, with its investments yielding over $10 billion in exits.

2. Accel India

Overview of the Firm

Accel India is known for its global presence and its role in transforming the Indian tech landscape.

Founded in 2005, Accel India has built a reputation for identifying high-potential startups and guiding them through their growth stages. The firm has been involved in some of the most significant tech success stories in India.

Key Investments

Accel India’s portfolio includes investments in Flipkart, Swiggy, and Freshworks, all of which have become household names in the Indian tech ecosystem.

Investment Focus

Accel focuses on technology-driven companies, particularly in the e-commerce, SaaS, and fintech spaces. The firm typically invests at the early and growth stages of startups.

Noteworthy Achievements

The firm recently launched its eighth India and Southeast Asia fund, a $650 million initiative aimed at partnering with early-stage founders, with a particular focus on AI and fintech startups. This move reinforces Accel’s commitment to backing the next wave of high-growth businesses.

3. Blume Ventures

Overview of the Firm

Blume Ventures is a prominent early-stage VC firm in India, founded in 2010. The firm is known for its hands-on approach to helping startups grow. Blume focuses on supporting entrepreneurs in their formative years, providing not just funding but also mentorship and strategic advice.

Key Investments

Blume Ventures has been an early investor in companies like Unacademy, Turtlemint, and Finbox. These startups have made a significant impact in the education, insurance, and fintech sectors.

Investment Focus

Blume Ventures focuses on seed and early-stage funding, primarily in the areas of edtech, fintech, and enterprise SaaS. The firm is passionate about building strong foundations for businesses to grow.

Noteworthy Achievements

Blume’s portfolio companies, such as Unacademy, have achieved rapid growth, raising multiple rounds of funding and making a significant impact on their respective industries.

Unacademy recently posted a revenue of Rs 1,044 crore in FY23, with losses shrinking by 39%. This milestone highlights Blume's success in nurturing high-potential companies and guiding them toward sustainable growth.

4. Matrix Partners India

Overview of the Firm

Matrix Partners India, established in 2006, is one of the leading VC firms in India. The firm is known for its deep focus on technology-driven businesses and its ability to nurture companies into becoming industry leaders.

Key Investments

Matrix Partners India has backed several high-profile startups, including Practo, Quikr, and Razorpay, which have made notable strides in healthtech, classifieds, and fintech.

Investment Focus

The firm’s investment focus is primarily on consumer tech, SaaS, and fintech, making it one of the key players in India’s growing tech startup ecosystem. Matrix Partners India tends to invest at the seed and early stages.

Noteworthy Achievements

Matrix has helped scale tech startups like Razorpay, which has become one of India’s leading fintech platforms. Its hands-on approach has helped many companies navigate the challenges of rapid growth.

5. Chiratae Ventures (formerly IDG Ventures India)

Overview of the Firm

Chiratae Ventures, formerly known as IDG Ventures India, has been a significant player in the Indian venture capital space since 2006. The firm’s focus has always been on backing high-potential, early-stage startups and helping them scale rapidly.

Key Investments

Chiratae Ventures has backed several successful startups, including FirstCry, Manthan Systems, and Stellars. These companies have seen tremendous growth, particularly in the retail and enterprise tech sectors.

Investment Focus

Chiratae focuses on early-stage investments, with a particular interest in consumer tech, enterprise solutions, and healthcare. The firm aims to back businesses that have the potential for long-term success.

Noteworthy Achievements

Chiratae Ventures has been instrumental in the growth of FirstCry, which saw an 18% increase in revenue, reaching Rs 7,659 crore in FY25. This growth underscores Chiratae’s ability to support startups in scaling up and achieving significant milestones in the competitive e-commerce space.

Also read: Growth Capital vs Venture Capital: Key Differences Explained

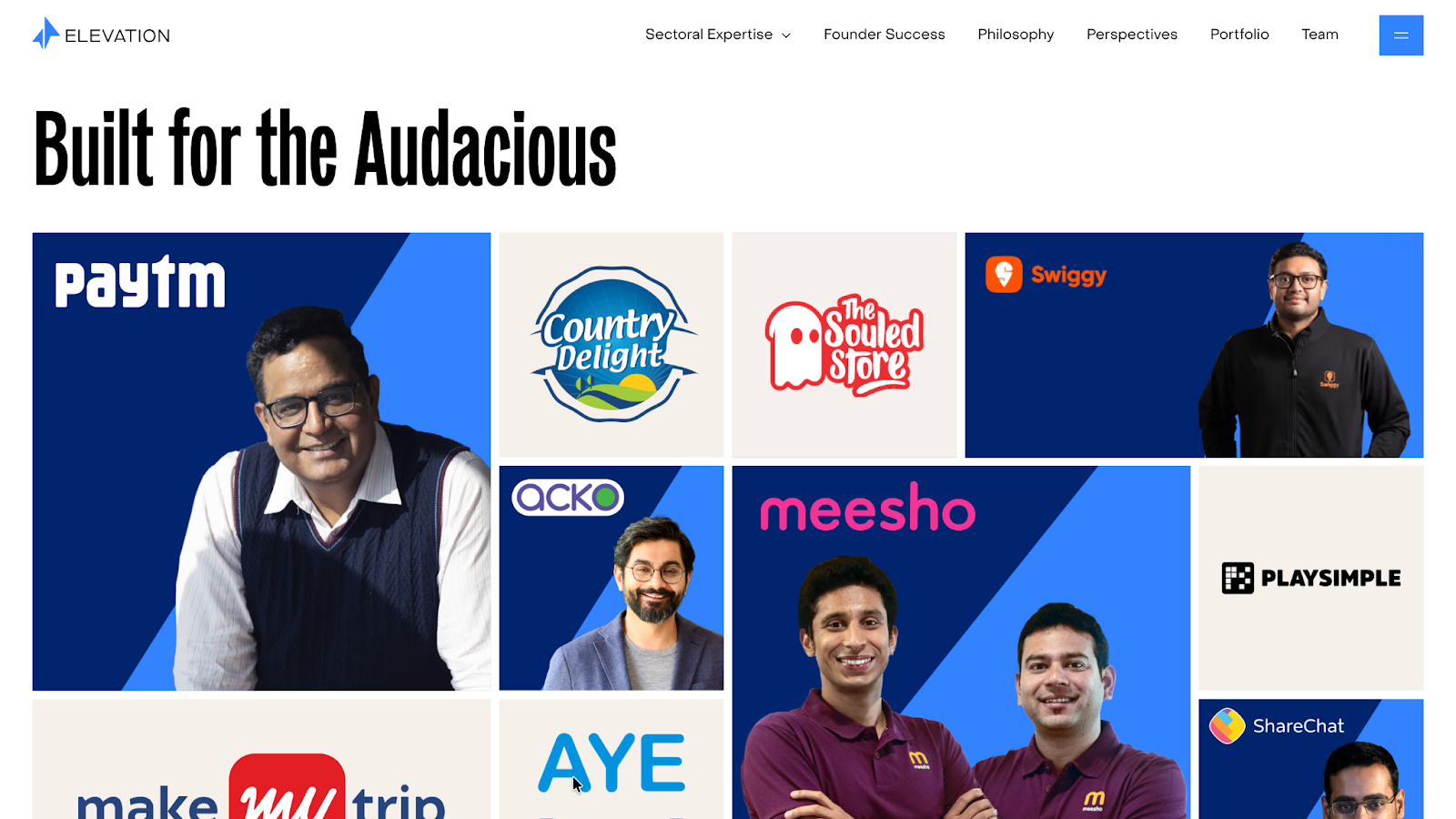

6. Elevation Capital (formerly SAIF Partners)

Overview of the Firm

Elevation Capital, formerly known as SAIF Partners, has been a prominent VC firm in India for over two decades. The firm has built a strong reputation for backing innovative startups and helping them scale to global heights.

Key Investments

Elevation Capital’s portfolio includes major investments in Paytm, MakeMyTrip, and Lenskart, all of which have become leaders in their respective sectors.

Investment Focus

Elevation Capital focuses on early-stage funding, particularly in consumer tech, fintech, and e-commerce. The firm has a hands-on approach, providing both capital and strategic advice.

Noteworthy Achievements

Elevation Capital recently raised $400 million for its new initiative, Elevation Holdings, which will focus on late-stage investments.

The firm plans to write checks ranging from $20 million to $50 million, targeting new-age companies nearing a public market listing. Elevation Holdings will also continue supporting these companies post-IPO, ensuring sustained growth and success.

7. Tiger Global Management

Overview of the Firm

Tiger Global Management is a US-based firm with a strong presence in India. Since entering the Indian market, it has been one of the most active investors in the country, with a focus on tech-driven startups and e-commerce companies.

Key Investments

Tiger Global has invested in several high-growth companies, including Flipkart, Ola, and Postman. These investments have solidified the firm’s reputation as a major player in India’s startup ecosystem.

Investment Focus

Tiger Global focuses on growth-stage investments, particularly in technology, e-commerce, and fintech. The firm aims to back businesses with the potential to dominate their markets.

Noteworthy Achievements

Tiger Global has made significant investments in India’s e-commerce sector, committing $1.25 billion across 101 firms. Notably, the firm invested $333 million in Flipkart and over $100 million in Ola, playing a key role in the growth of these industry giants.

As India’s MSME ecosystem continues to grow, communities like S45 Club are helping entrepreneurs scale their businesses with capital and expertise. If you’re an MSME founder looking to expand, contact us today to find out how we can support your journey toward innovation and long-term success.

Also read: Growth Capital vs Venture Capital: Key Differences Explained

Now that we've explored some of the top venture capital firms in India, it's important to understand how to choose the right VC firm for your company.

Finding the right partner can make all the difference in scaling your business successfully. Here’s a quick guide on what to look for when selecting a venture capital firm:

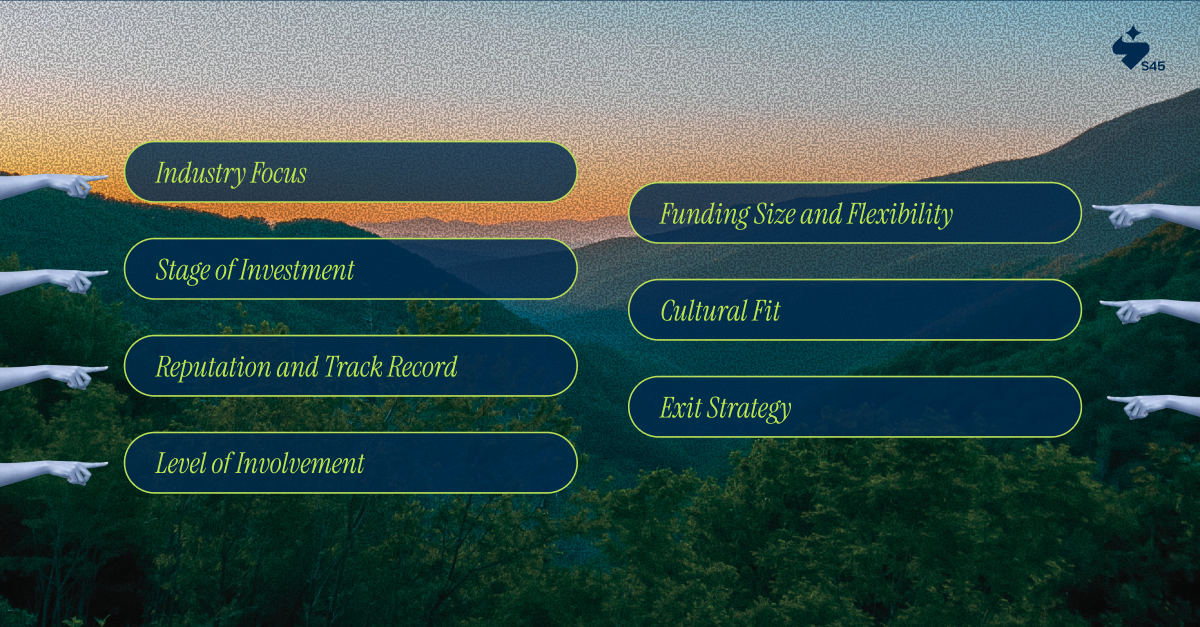

How to Choose the Right Venture Capital Firm for Your Company

Choosing the right VC firm is a critical decision that can impact the growth trajectory of your business. Here are some factors to consider when making this choice:

- Industry Focus: Ensure the VC firm has experience and a strong portfolio in your industry (e.g., fintech, edtech, SaaS). A firm with sector expertise can offer valuable insights and connections.

- Stage of Investment: Different firms specialize in various investment stages. Some focus on seed funding, while others invest in growth or late-stage companies. Match your company’s needs with their investment stage.

- Reputation and Track Record: Look for firms with a proven history of successful exits and a portfolio of companies that have grown and scaled. Their experience can provide the necessary guidance.

- Level of Involvement: Some VC firms take a hands-on approach, offering mentorship and strategic support. If you value guidance beyond just funding, look for firms that align with this approach.

- Funding Size and Flexibility: Make sure the firm’s funding range matches your needs. Some VC firms write large checks, while others prefer smaller, incremental investments.

- Cultural Fit: The relationship with your VC firm should feel like a partnership. Consider their values, investment philosophy, and the way they interact with entrepreneurs to ensure a good cultural fit.

- Exit Strategy: Discuss potential exit strategies upfront. Understanding their approach to IPOs, mergers, or acquisitions can help set expectations for both parties.

How S45 Club Can Help You Steer in the Right Direction

At S45 Club, we’re committed to supporting MSME founders with both capital and expertise. Our aim is to help you scale your business sustainably while encouraging innovation and building a lasting legacy. Here’s how we can assist you:

- Provide Capital for Growth: We offer financial support at every stage of your business journey, ensuring you have the resources to expand and reach your goals.

- Offer Strategic Guidance: Along with funding, we provide valuable mentorship and advice, helping you navigate challenges and refine your business strategies.

- Foster Innovation and Legacy Building: We help you create a forward-thinking business, focused on innovation and long-term success, ensuring that your company stands the test of time.

- Support with Long-Term Growth Strategies: Our approach emphasizes sustainable growth, offering guidance on scaling effectively while adapting to new market opportunities.

Wrapping Up

In conclusion, the venture capital ecosystem in India is experiencing rapid growth, with a wide range of firms actively investing in promising startups.

These VC firms are not only providing essential funding but also offering valuable expertise, mentorship, and networks to help businesses navigate challenges and scale effectively.

As the startup ecosystem becomes more dynamic, selecting the right venture capital partner is crucial for entrepreneurs looking to grow their businesses sustainably and create long-term value.

With the right support, companies can turn potential into performance and achieve remarkable success.

At S45 Club, we understand the unique challenges faced by MSME founders. With our capital support, strategic guidance, and focus on sustainable growth, we help businesses build a legacy that lasts.

Join our community today to connect with like-minded entrepreneurs, investors, and mentors to scale your business to new heights.

Frequently Asked Questions

1. What are the best venture capital firms in India for early-stage startups?

Some of the best venture capital firms in India for early-stage startups include Sequoia India, Accel, and Blume Ventures. These firms specialize in seed and early-stage investments, providing both capital and strategic guidance to help startups scale and succeed.

2. How do venture capital firms in India help startups grow?

Venture capital firms in India help startups grow by providing necessary funding, strategic advice, and mentorship. They also offer valuable industry connections and assist in scaling operations, helping businesses overcome challenges and navigate growth effectively.

3. What sectors do venture capital firms in India focus on in 2025?

In 2025, venture capital firms in India are focusing heavily on sectors such as fintech, edtech, healthtech, SaaS, and e-commerce. These industries are experiencing rapid growth, and VCs are keen on backing innovative companies with scalable solutions in these fields.

4. How can MSME founders in India benefit from venture capital?

MSME founders in India can benefit from venture capital by gaining access to the financial resources needed for expansion, as well as mentorship and expertise to scale their businesses effectively. VC funding can also provide startups with the market credibility and networks to attract new customers and partners.

5. What should startups look for when choosing a venture capital firm in India?

When choosing a venture capital firm in India, startups should consider the firm’s industry expertise, investment focus, reputation, level of involvement, and cultural fit. It’s important to select a firm that aligns with the company’s growth stage and long-term vision for success.