Before We Dive In

- Growth capital = for established, revenue-generating companies that want to expand.

- Venture capital = for startups and early-stage companies with high growth potential but also higher risks.

- Growth capital involves larger investments, lower risks, and longer horizons.

- Venture capital focuses on smaller ticket sizes initially, higher risks, and faster exits.

- Choosing between them depends on company maturity, control preferences, and investor objectives.

When businesses need money to grow, there are plenty of funding options available. But not all capital is created equal. Some funding works best for startups still trying to prove themselves, while other types are designed for established businesses ready to scale faster.

This is where the debate of growth capital vs venture capital comes in. Both play a vital role in the investment world, yet they’re built for very different stages and goals. For founders, knowing the difference can be the deciding factor between scaling smoothly or losing control too early. For investors, it’s about aligning risks and returns.

Let’s break down the differences in detail, without the jargon, so you can clearly see which path makes sense for your business or portfolio.

What is Growth Capital and Venture Capital, and Why Are They Important?

When it comes to business funding, two terms you’ll hear often are growth capital and venture capital. Although they may sound similar, they serve very different purposes in a company’s journey.

- Growth Capital (or Growth Equity): This is money invested in companies that are already doing well. Consider profitable businesses that have a proven product and now aim to scale faster, expand into new markets, or acquire competitors. Growth capital acts as a fuel booster for companies that are beyond the “survival stage” and ready for bigger moves.

- Venture Capital (VC): This funding type is aimed at startups and early-stage businesses that may not yet be profitable but show strong potential. Venture capital helps them test their ideas, build products, and grow quickly in the early years.

Why Do They Matter?

- For founders: Both funding types provide not just money but also strategic guidance, industry expertise, and credibility. The right capital at the right time can be the difference between stagnation and breakthrough success.

- For investors: They offer two distinct ways to grow wealth: steady and relatively safer returns with growth capital, or high-risk, high-reward opportunities with venture capital.

- For the economy: Together, they drive innovation, create jobs, and push industries forward by supporting businesses at all stages.

Think of it this way: venture capital plants the seed, growth capital adds fertilizer to a plant that’s already rooted.

With S45 Club’s network of investors, you don’t just get funding; you get the right guidance to match your company’s journey.

Which Businesses Attract Growth Capital vs Venture Capital?

The type of funding a company attracts depends heavily on where it stands in its growth journey. Growth capital and venture capital are designed for two very different audiences.

Growth Capital Targets

Growth capital is best suited for companies that have already proven themselves in the market. These businesses don’t just have an idea; they have products that sell, a loyal customer base, and reliable revenue streams.

- Stage of maturity: Typically, mid-sized companies that have moved past the early hustle and survival stage.

- Valuation range: Usually between $10 million and $100 million.

- Purpose of funding: To expand into new geographies, acquire competitors, diversify offerings, or upgrade infrastructure. In many cases, growth capital is also used to professionalize management and prepare for larger milestones like IPOs.

- Risk profile: Lower risk for investors since the company already has a sustainable business model.

- Example: Imagine a profitable e-commerce platform that has dominated its home market. It now wants to expand globally and compete with international players—that’s when growth capital comes in.

Venture Capital Targets

Venture capital is aimed at businesses that are just starting out or are in the early stages of growth. These companies may not have steady revenue yet, but they carry big potential for disruption.

- Stage of maturity: Startups at seed, early, or Series A stages. Sometimes, these companies are still fine-tuning their business model.

- Valuation range: Can vary widely, but usually much lower than growth-stage firms.

- Purpose of funding: To build prototypes, launch products, test markets, or scale initial traction. Venture capital often supports hiring key talent and investing in research and development.

- Risk profile: Higher risk because the company’s success isn’t guaranteed. Investors are essentially betting on the future promise, not the present performance.

- Example: A fintech app that’s still in testing but already gaining thousands of new users each month. It may not yet generate profits, but investors see the potential for it to reshape the digital payments space.

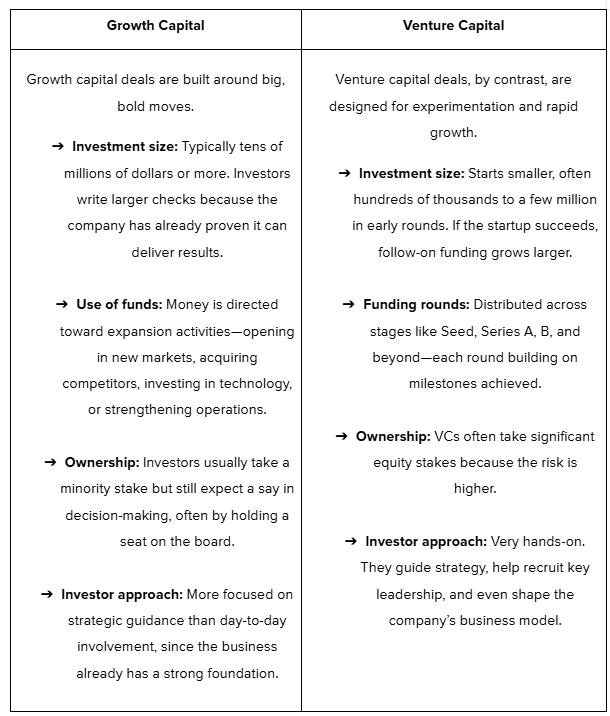

Investment Characteristics

The way money flows in—and what it’s used for—sets growth capital and venture capital apart. Both come with unique structures and expectations.

S45 Club simplifies this overall process by bridging startups and mature businesses with investors who align with their goals and growth needs.

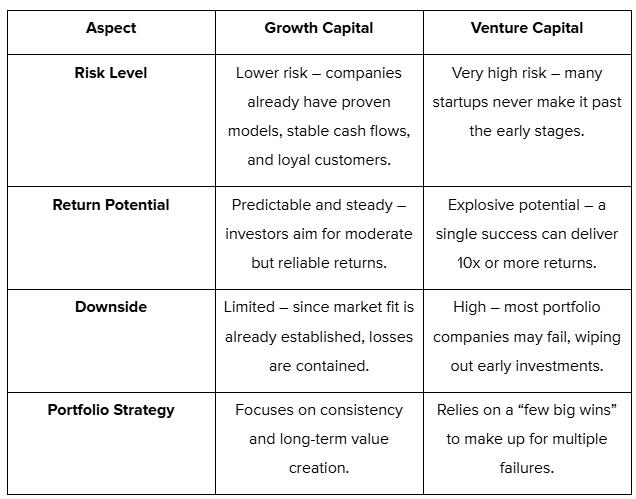

Risk Profiles and Return Expectations Compared

Every investment comes with a balance of risk and reward—but the scales tilt very differently for growth capital and venture capital.

What Is the Impact of Such Capitals on Business Ownership and Control?

When a business takes on external funding, it isn’t just money that changes hands—ownership stakes and decision-making power are also affected. The degree of this impact varies significantly between growth capital and venture capital.

Growth Capital:

- Investors usually take minority stakes, meaning founders retain significant control over their business.

- However, investors often negotiate for influence through board seats or veto rights on major decisions.

- While dilution occurs, it is generally less severe than with venture capital since funding can also involve debt structures alongside equity.

- Example: A manufacturing firm raising $30 million in growth capital might give up 15% equity but still maintain operational control.

Venture Capital:

- Venture capital often comes with deeper involvement and greater influence from investors.

- Founders may lose considerable control, especially across multiple funding rounds where equity gets diluted further.

- VCs usually demand active participation in strategy, governance, and hiring to protect their high-risk investment.

- Example: A startup founder who raises Seed, Series A, and Series B rounds may find themselves owning less than 40% of the company while investors control board decisions.

In short, growth capital is more about financial partnership with advisory oversight, while venture capital often reshapes ownership structures and centralizes significant decision-making power with investors.

Choosing the wrong kind of funding can cost founders their voice. S45 Club helps entrepreneurs find investors who add value without compromising their vision.

When and How Investors Cash Out?

No matter how much investors believe in a company, they don’t stay invested forever. At some point, they want to “cash out” and get returns on the money they put in. The way and the time it takes for them to exit depend on whether the funding is growth capital or venture capital.

Growth Capital:

1. Growth capital investors usually think long-term. They’re okay with waiting 5 to 10 years before exiting because they invest in stable, proven companies.

2. Since these businesses already make steady profits, investors look for structured exits—meaning planned ways to get their money back with profit.

3. Common methods include:

- Mergers or acquisitions: The company may be bought by a larger competitor.

- Buybacks: The company itself buys back the investor’s shares once it’s financially stronger.

- Secondary sales: Investors sell their stake to another private equity firm.

4. The goal here isn’t “quick wins” but rather steady, predictable growth that pays off over time.

Venture Capital:

1. Venture capital investors usually want faster and bigger returns. Their timelines are shorter, often around 3 to 7 years.

2. Since they invest in high-risk startups, they rely on big events to exit, such as:

- IPOs (Initial Public Offerings): When the startup goes public and lists on the stock market, VCs sell their shares at higher valuations.

- Acquisitions: Larger companies (like Google or Amazon) buy the startup to add it to their ecosystem.

- Secondary sales: Selling their shares to other investors or funds.

The goal is to identify jackpot exits that can yield 5x, 10x, or even higher returns, thereby offsetting losses from other failed startups in their portfolio.

Factors to Weigh Before Choosing the Right Capital

As a founder, picking between growth capital and venture capital isn’t just about who’s writing the check—it’s about alignment with your company’s stage, needs, and future vision. Here are some key questions to guide the decision:

- Stage of the company: Are you still proving your idea and building traction (better suited for VC), or do you already have stable revenues and want to scale aggressively (ideal for growth capital)?

- Control and decision-making: How comfortable are you with investors having a say in your business? Venture capital investors often demand significant control and board influence, while growth capital investors typically take minority stakes but still want influence on key decisions.

- Funding requirements: Do you need smaller rounds to test, hire, and experiment (VC), or a larger lump sum to expand into new markets, acquire competitors, or scale operations (growth capital)?

- Risk appetite: Are you ready for the uncertainty of a high-risk, high-reward path (venture capital), or would you prefer a more stable route with lower risks and steadier returns (growth capital)?

- Exit flexibility: Think about your long-term vision. Venture capital pushes for quicker exits (IPOs, acquisitions), while growth capital investors are often more patient, aligning with a slower, structured growth journey.

Global Trends in Growth and Venture Capital

The investment world doesn’t stand still; both growth capital and venture capital are constantly evolving to match the pace of innovation, global markets, and shifting investor priorities. Over the past few years, we’ve seen deal sizes swell, new regions emerge as funding hotspots, and sustainability take center stage. At the same time, founders are demanding more than just money; they want strategic partners who can help them scale responsibly and competitively.

Below, we’ll break down the biggest global trends shaping how growth capital and venture capital operate today and what they mean for both businesses and investors.

1. Tech Takes the Lead

- Fintech, AI, healthtech, and clean energy dominate VC funding.

- Growth capital increasingly backs established firms adopting digital tools and green practices.

2. Deal Sizes Keep Growing

- Startups are raising larger VC rounds to compete globally.

- Growth capital investors are writing bigger checks for cross-border expansion.

3. Emerging Markets on the Rise

- India, Southeast Asia, and Latin America are hotspots.

- Young, digital-first populations are fueling this surge.

4. Hybrid Funding Models

- More deals now mix equity and debt.

- This reduces dilution for founders while giving investors flexibility.

5. Patience Is Growing

- Growth investors often stay in for 5–10 years.

- Even VCs are extending timelines as startups take longer to mature.

6. Focus on ESG and Impact

- Funding is shifting toward companies with sustainability and social impact goals.

- Both VCs and growth funds want businesses aligned with ESG values.

7. Rising Competition

- More funds are chasing fewer high-quality startups.

- Founders now prefer “smart money” that brings mentorship, not just capital.

Whether it’s bigger deals, ESG priorities, or emerging markets, the funding world is shifting fast. S45 Club keeps founders ahead of the curve, connecting them with investors aligned with global trends.

Conclusion

Choosing between growth capital and venture capital comes down to your company’s stage and vision. Venture capital helps you launch, while growth capital helps you scale higher. The key is finding the right partner who understands your journey.

At S45 Club, we connect ambitious founders with the right investors and guidance to fuel their next big leap. Ready to explore what suits your business best? Let’s make it happen together.

FAQs

Q1. How do I know if my startup needs venture capital or growth capital?

If your company is still proving its product and scaling users, venture capital is usually the right fit. If you already have strong revenues and want to expand aggressively, growth capital works better.

Q2. Which type of funding is riskier for founders?

Venture capital typically involves higher risk because it’s invested in unproven business models. Growth capital carries less risk since it goes into established businesses, but it may still affect ownership and decision-making.

Q3. Can a startup transition from venture capital to growth capital?

Yes! Many companies start with VC in early stages and later raise growth capital once they’ve achieved stability. Through S45 Club’s investor ecosystem, founders can make this transition more smoothly by building long-term relationships with investors.

Q4. How does each type of funding affect founder control?

VC investors often take a larger share of equity and may demand significant board influence. Growth capital investors usually take minority stakes but still expect input on key decisions. Knowing your comfort level with control is important before choosing.

Q5. How long do investors usually stay before exiting?

Venture capitalists usually look for quicker exits (3–7 years), while growth capital investors prefer longer timelines (5–10 years). S45 Club helps founders align with investors whose timelines match their vision.