Choosing the right funding partner can shape your business journey. But, do you know when to choose private equity over venture capital? Both play strong roles in India’s growth-stage funding. Private equity firms invest in mature businesses needing scale, operational improvements, or restructuring. Venture capitalists back early to mid-stage startups aiming for rapid growth.

In fact, India’s PE-VC investments reached $43 billion across 1,600 deals in 2024, marking a strong recovery from pandemic lows. Technology, financial services, and healthcare led the deal count. For Indian founders, understanding private equity vs venture capital can help plan long-term capital and control. Each investor type comes with unique expectations, involvement, and outcomes.

In this guide, you will learn what private equity and venture capital mean, their core differences, when to choose each, and how funding impacts business control, growth, and legacy planning.

Key Takeaways

- Private equity invests in mature businesses while venture capital funds early-stage startups

- PE takes larger controlling stakes whereas VC takes smaller minority stakes

- PE focuses on stable cash flows while VC seeks high-growth potential

- PE suits expansion and restructuring needs while VC suits product development and scaling

- Choosing between private equity vs venture capital depends on business stage funding needs and growth plans

What is Private Equity?

Private equity refers to investments made directly into private companies or public companies taken private. PE firms pool funds from institutional and individual investors to acquire significant stakes in mature businesses. They aim to improve operations, restructure finances, or drive expansion before exiting for returns.

In India, PE firms invest in mid to large businesses across sectors like healthcare, manufacturing, retail, and technology. Investment sizes range from ₹100 crore to over ₹1,000 crore, depending on company scale and growth potential. PE deals often involve majority ownership, board participation, and strategic decision influence to improve profitability and scale.

Some examples of Indian businesses funded by private equity include Manipal Hospitals (TPG Capital), Mankind Pharma (ChrysCapital), and Flipkart (Tiger Global as PE in later rounds).

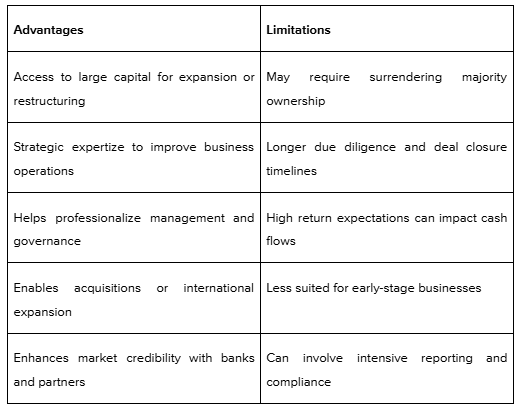

Private equity investments bring growth capital and expertize but come with expectations of control and structured exits. It creates opportunities for scale if aligned with founder vision. Now, let’s understand how venture capital differs in approach and stage focus.

What is Venture Capital?

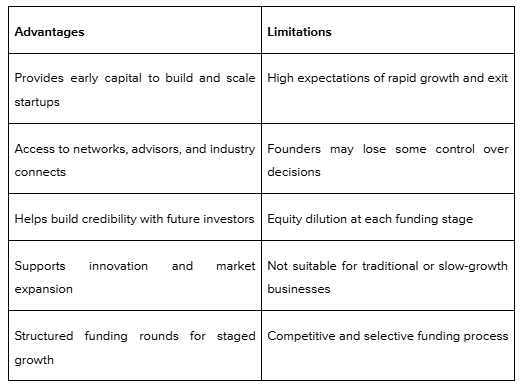

Venture capital refers to funding provided to early and growth-stage startups with strong potential. VC firms raise money from institutional and high-net-worth investors to invest in young businesses aiming for high growth and returns. They take minority stakes and support founders in scaling operations.

In India, VC firms invest mainly in technology, fintech, healthcare, and consumer startups. Typical investments range from ₹2 crore in seed rounds to ₹100 crore or more in Series B and beyond. VC funding involves equity stakes, board participation, and active involvement in growth decisions, branding, and team building.

Some examples of Indian businesses funded by venture capital include Ola (Tiger Global, Matrix Partners), Byju’s (Sequoia Capital, Lightspeed), and Razorpay (Tiger Global, Sequoia Capital).

Venture capital fuels startup growth with structured support and funding but expects quick scalability. Now, let’s understand the key differences between private equity and venture capital to help you choose wisely.

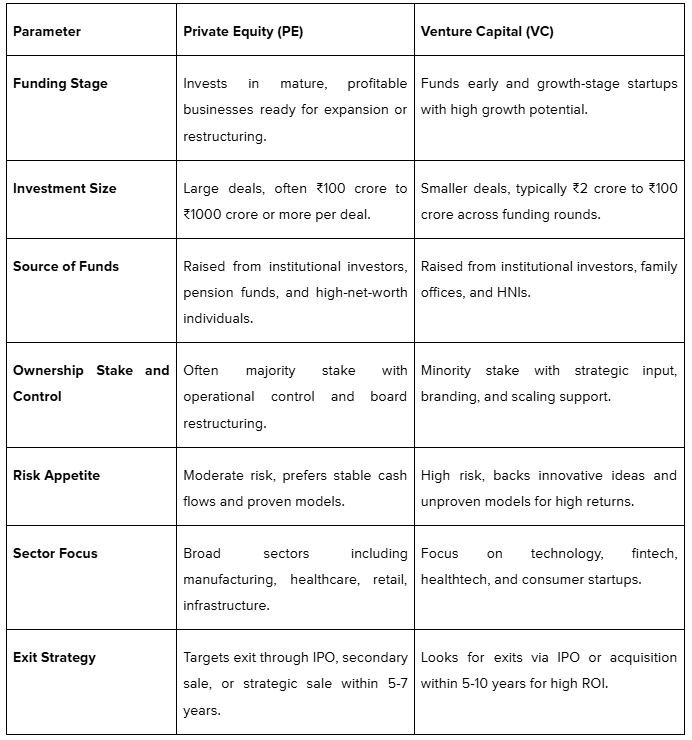

Key Differences Between Private Equity and Venture Capital

Choosing between private equity and venture capital depends on your business stage and funding needs. Both offer growth capital but differ in approach, risk, and involvement.

Here is a simple comparison to guide your decision:

PE and VC have distinct purposes based on growth stage and strategy. Next, let’s discuss when founders should choose private equity for their business growth plans.

When Should Businesses Choose Private Equity?

Private equity suits businesses ready for structured growth or operational changes. It is ideal when you need large capital infusions and experienced partners for scaling. PE firms help in building governance, driving expansion, and planning profitable exits with strategic buyers or public markets.

Here are five situations where private equity works well:

- Stable Cash Flows: Your business generates steady profits, making it attractive for PE firms seeking reliable returns.

- Expansion or Diversification Plans: You plan acquisitions, new units, or entering new markets that require large capital.

- Management Buyouts: When existing promoters want to exit or reduce stake while ensuring business continuity.

- Operational Restructuring: PE brings experience to simplify processes, cut inefficiencies, and improve profitability.

- Preparing for IPO or Strategic Sale: PE firms invest to strengthen governance and build a growth story before market listing.

Choosing private equity requires understanding its control expectations and exit timelines. But when is venture capital a better funding choice? Let's find out.

When Should Businesses Choose Venture Capital?

Venture capital suits startups building new solutions or disrupting markets. It funds early to mid-stage growth when revenues are low but potential is high. VC firms support rapid scaling with their capital, networks, and expertise.

Here are five situations where venture capital works best:

- Early-Stage Innovative Ideas: Your product is new or tech-driven and needs funds to build and launch.

- Rapid Growth Plans: You have traction and need fast expansion before competitors catch up.

- High Cash Burn Models: Businesses like e-commerce or deep tech with long gestation periods need VC funding.

- Building Brand and Market Position: VC funds marketing, hiring, and product development to establish leadership.

- Access to Mentor Networks: VCs connect you with experienced founders, industry experts, and future investors.

While venture capital fuels fast growth, it requires sharing equity and aligning with aggressive targets. Now, let’s discuss how S45 guides founders in choosing between PE and VC.

How S45 Supports You in Funding Decisions?

Choosing between Private Equity (PE) and Venture Capital (VC) is a big decision for any founder. At S45, we help you navigate this by understanding your business, goals, and growth stage. Our team works closely with you to choose the right funding path and ensure your vision stays on track.

Clear Guidance for Every Growth Stage

Whether you're a fast-growing startup or an established business, we offer tailored advice. We take the time to understand your needs and guide you to the funding option, PE or VC, that fits best.

Making Complex Decisions Simple

We explain the differences between PE and VC, break down the terms, and negotiate the best deal structure for you. Our goal is to ensure you feel confident and in control of your decisions.

Helping You Build the Right Capital Structure

We’ll help you blend equity, debt, or internal funds to create a capital structure that allows you to grow while keeping control of your business.

Our Impact: Trusted by Founders

At S45, we’ve helped many founders raise the right capital for growth:

- Our work has contributed to businesses that drive 30% of India’s GDP.

- We’ve assisted founders in securing strategic funding, scaling successfully, and improving governance.

If you’re unsure about your next funding step, let’s talk. S45 is here to help you make the right decision and grow your business with confidence.

Conclusion

Private equity and venture capital differ in funding stages, investment sizes, sector focus, and ownership approach. PE suits mature businesses seeking expansion or restructuring, while VC supports startups aiming for fast growth and market entry.

Founders must assess their business stage, risk comfort, and control preferences before choosing. PE works well for stable cash flows and scalability, whereas VC aligns with disruptive ideas needing early backing and guidance.

Making funding decisions alone can be challenging. S45 supports founders by guiding them through equity options, protecting their vision, and building capital structures that suit growth goals. Are you ready to choose the right funding partner? Connect with S45 for clarity and confidence in your funding journey.

Frequently Asked Questions

1. What is the main difference between private equity and venture capital?

Private equity invests in mature businesses for expansion, restructuring, or buyouts. Venture capital invests in early-stage startups with high growth potential. PE takes larger stakes with active control, while VC takes minority stakes, offering mentorship and support for scaling innovations in competitive markets.

2. Is private equity riskier than venture capital?

Private equity is generally less risky than venture capital. PE invests in established companies with stable cash flows, reducing risk. VC invests in startups that may fail, making it riskier. However, VC offers higher potential returns if startups succeed and grow fast.

3. Which is better for startups, PE or VC?

Venture capital is better for startups. VC firms invest in early-stage companies needing funds to develop products, build teams, and enter markets. Private equity prefers mature businesses with proven models, making VC the primary choice for startups seeking growth and guidance.

4. Can a company get both private equity and venture capital funding?

Yes, but at different stages. Startups usually raise venture capital in early stages for growth. Once they mature, expand, or restructure, they may attract private equity funding. PE investors focus on established companies with revenue, while VC backs companies from idea to market.

5. How do private equity firms make money?

Private equity firms make money by improving company performance and selling stakes at higher valuations. They charge management fees and earn a share of profits called carried interest. PE firms often restructure businesses, improve operations, or merge companies to create higher exit values.