Overview

- Understanding the different types of funding for startups in India is essential to finding the right fit for your business stage, growth goals, and capital needs.

- Each funding option comes with trade-offs between control, risk, speed, and investor involvement, so careful alignment with your vision and growth plans is critical.

- Early-stage funding sources like FFF (Friends, Family, and Fools), bootstrapping, and seed funding help validate your product while minimizing dilution.

- Growth-stage funding, such as Series A to E rounds, venture capital, and private equity, supports rapid scaling, market expansion, and operational maturity.

- Non-traditional options like leasing, factoring, and accelerators provide alternative ways to manage cash flow and access mentorship without immediate equity dilution.

Startup funding in India continues to evolve, with Indian tech startups raising $4.8 billion in the first half of 2025, making India the third-highest funded country globally, even as funding volumes softened by 25% compared to last year.

This resilience demonstrates investor confidence in India’s ability to create impactful and enduring ventures, even in shifting market cycles. As a founder, understanding the different types of funding for startups in India helps you find the right fit for your journey.

Each funding source brings distinct advantages, obligations, and strategies for growth. Whether you’re seeking capital for rapid expansion or building for sustainable, long-term value, knowing your options gives clarity and confidence as you scale.

This blog contains everything you need to know about startup funding in India: why funding is crucial for growth and innovation, a breakdown of the different types of funding for startups in India, and clear guidance on how to choose the right funding option for your venture.

Why Startup Funding Is Important?

s45club understands that funding is the fuel that powers business expansion and product development. With the right capital, you can hire skilled talent, invest in technology, market your solution, and move from concept to scale much faster.

Along the way, funding cushions your venture against unexpected challenges, provides flexibility to refine your approach, and opens the door to strategic partnerships that can further your mission. Ultimately, funding is about giving your business the edge needed for sustainable growth, stronger execution, and building something that lasts.

Understanding why funding matters sets the stage, but knowing the different types available in India is what will help you choose the right path.

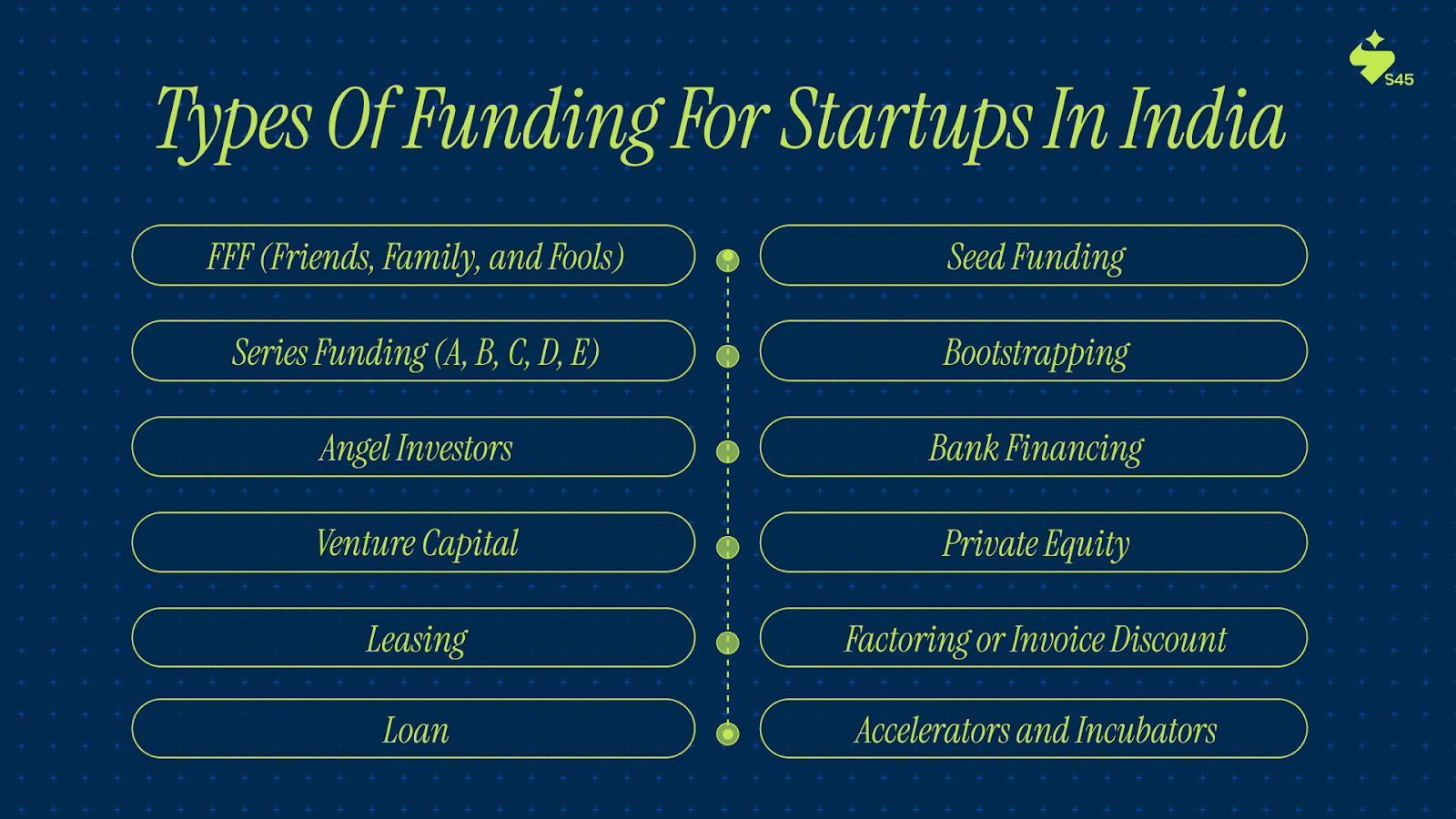

Different Types Of Funding For Startups In India

Each funding option comes with its own set of terms, expectations, and impacts on control and scalability. Below is a clear breakdown of the most common types of startup funding in India, along with practical tips to help you make an informed choice:

1. FFF (Friends, Family, and Fools)

Funding from your personal network, friends, family, and enthusiastic supporters, often called “fools.” This early capital is usually more flexible and quicker to access, but carries the risk of straining personal relationships if not handled professionally.

It’s typically used to build prototypes or cover initial startup costs. Treat these funds like any formal investment, set clear terms and document agreements to keep relationships intact.

2. Seed Funding

Seed funding helps move from idea to prototype and early customer validation. Investors at this stage provide smaller capital sums but significant mentorship and network support.

This round sets the foundation for scaling by proving your business concept. Choose seed investors who believe in your vision and bring strategic value, not just money.

3. Series Funding (A, B, C, D, E)

These rounds come after proving your business model and early traction. As you progress, the funding amounts and investor expectations grow, focusing on scaling and market expansion.

- Series A: The first significant round of funding, focused on scaling product development and building a solid business model; typical raise ranges from $2 million to $15 million, with investors looking for clear traction and growth potential.

- Series B: Aimed at expanding market reach and scaling operations; rounds usually range from $10 million to $30 million, with a focus on stronger revenue growth and building out teams to support growth.

- Series C: Designed for rapid expansion, entering new markets, or product diversification; funding can exceed $30 million, attracting late-stage VCs, private equity, and institutional investors.

- Series D: Less common, used for further expansion, acquisitions, or preparing for IPO; may indicate a need for additional capital to meet growth targets or extend private company status.

- Series E: The final funding rounds, often to sustain growth, reposition business models, or delay IPO; this round is typically raised by companies refining long-term strategy or seeking turnaround capital.

Each round should align with clear business milestones. Avoid raising premature capital that dilutes ownership without delivering growth.

4. Bootstrapping

Self-funding your startup using personal savings or operational revenue. This keeps full control with no equity dilution, but may limit growth speed. Use bootstrapping to validate your product early and retain control before seeking outside capital.

5. Angel Investors

Wealthy individuals investing at early stages often provide mentorship and access to their networks alongside capital. Angels back businesses with potential and help bridge the gap to institutional funding. Align with angels who have industry experience relevant to your business for maximum benefit.

6. Bank Financing

Loans or credit lines from banks with fixed repayment schedules. This is suitable for startups with steady cash flow but requires good credit and collateral. Use bank financing for working capital or equipment purchase, ensuring repayments fit your cash flow projections.

7. Venture Capital

Professional firms investing large capital in high-growth startups, usually in exchange for significant equity and governance rights. VCs bring strategic support but expect clear growth trajectories. Opt for VCs who share your long-term vision and can bring operational support beyond funding.

8. Private Equity

Typically invests in more mature startups or businesses, aiming for market expansion, restructuring, or preparing for exit opportunities. Private equity suits businesses ready for major growth or transformation requiring substantial capital and governance updates.

9. Leasing

Instead of buying equipment or assets outright, you lease them to reduce upfront costs and preserve cash. Leasing is not traditional funding but helps with capital efficiency. Leasing frees capital, but evaluate total costs over time to ensure it fits your budget.

10. Factoring or Invoice Discount

Sell your receivables to a third party to improve cash flow. This is helpful if you have long credit terms and need working capital. Use factoring selectively as it reduces overall revenue; ensure discount costs don’t outweigh benefits.

11. Loan

Beyond bank loans, startups can use government-backed schemes, microfinance, or peer-to-peer lending. Loans require repayment but preserve equity. Match loan terms with your business cycle to avoid liquidity crunches.

12. Accelerators and Incubators

Programs that offer seed capital, mentorship, workspace, and business support, often in exchange for equity. They help you prepare for larger-scale investments. Choose programs with strong networks and relevant expertise to accelerate learning and investor access.

Understanding these different types of funding for startups in India will help you make choices that support your business’s sustainable growth and long-term legacy. Choose the funding path that aligns not only with your current needs but also with your vision for the future.

Need help understanding your funding choices? Join the s45club to explore which options fit your business and growth plans.

With a wide range of funding choices available, the next question is how to determine which one fits your specific business needs and vision.

How To Choose The Right Type Of Funding For Your Startup?

Choosing the right type of funding is about matching your business needs with the right financial and strategic support. Every funding source comes with trade-offs in control, risk, timing, and expectations.

The decision should not be reactive but a considered step aligned with your business goals, growth stage, and future vision. Here’s how to approach selecting the right funding option:

- Assess your current business stage and the amount of capital needed to reach the next milestone.

- Understand how much control you are willing to share and what kind of involvement or oversight you expect from investors or lenders.

- Evaluate your repayment ability if considering debt or loans, and ensure the terms align with your cash flow.

- Consider the value beyond capital, such as expertise, networks, and guidance that investors or partners may bring.

- Factor in timing, some funds take longer to secure but can provide more significant benefits, while others are faster but may come with higher costs.

- Align funding choices with your long-term vision for business legacy and sustainable growth.

Choosing the right type of funding for startups in India means balancing immediate needs with future aspirations, ensuring you build a resilient and thriving enterprise.

Conclusion

Funding is a crucial tool in building a strong, scalable business, but it is just one part of a broader growth journey. Thoughtful decisions about funding enable steady transformation, empower strategic advancements, and help maintain control over the long-term direction of your business.

Selecting the best funding path means being clear on your current needs and future goals. When the financial foundation is strong and aligned with your vision, every step you take builds on lasting value.

S24 Club supports businesses by providing expert guidance. Whether you're considering debt or equity financing, we help align your strategy with your growth objectives. Contact S24 Club today to discover how we can help you choose the right startup funding in India.

FAQs

Q. What are the most common types of startup funding available in India?

Common options include bootstrapping, friends and family (FFF), angel investors, seed funding, venture capital, bank loans, private equity, leasing, and accelerators/incubators. Each serves different business stages and capital needs, with varying impacts on control and growth speed.

Q. How do I decide between equity funding and debt funding for my startup?

Equity funding involves sharing ownership with investors, which can bring strategic support but dilutes control. Debt funding requires repayment but keeps full ownership. Match your repayment capacity, control preferences, and growth plans before deciding.

Q. When should a startup consider venture capital funding in India?

Venture capital is ideal once the business has proven traction and needs significant capital for scaling. VCs expect strong growth potential and strategic partnership, usually in Series A or later rounds.

Q. What is the role of accelerators and incubators in startup funding?

These provide early-stage startups with capital, mentorship, workspace, and connections in exchange for equity or fees. They prepare startups for larger funding rounds and accelerate growth through structured support.

Q. Can bootstrapping be a sustainable funding method for Indian startups?

Bootstrapping keeps control and limits dilution, but may restrict rapid scaling. It’s best for validating the business model early and managing costs before seeking external funding for expansion.

Q. How has the startup funding environment in India changed in 2025?

While funding volumes dipped slightly compared to previous years, India remains the third-largest startup funding destination globally. Sectors like fintech, e-commerce, healthtech, and AI continue to attract significant investments, signaling strong investor confidence in sustainable and scalable startups.