Key Takeaways:

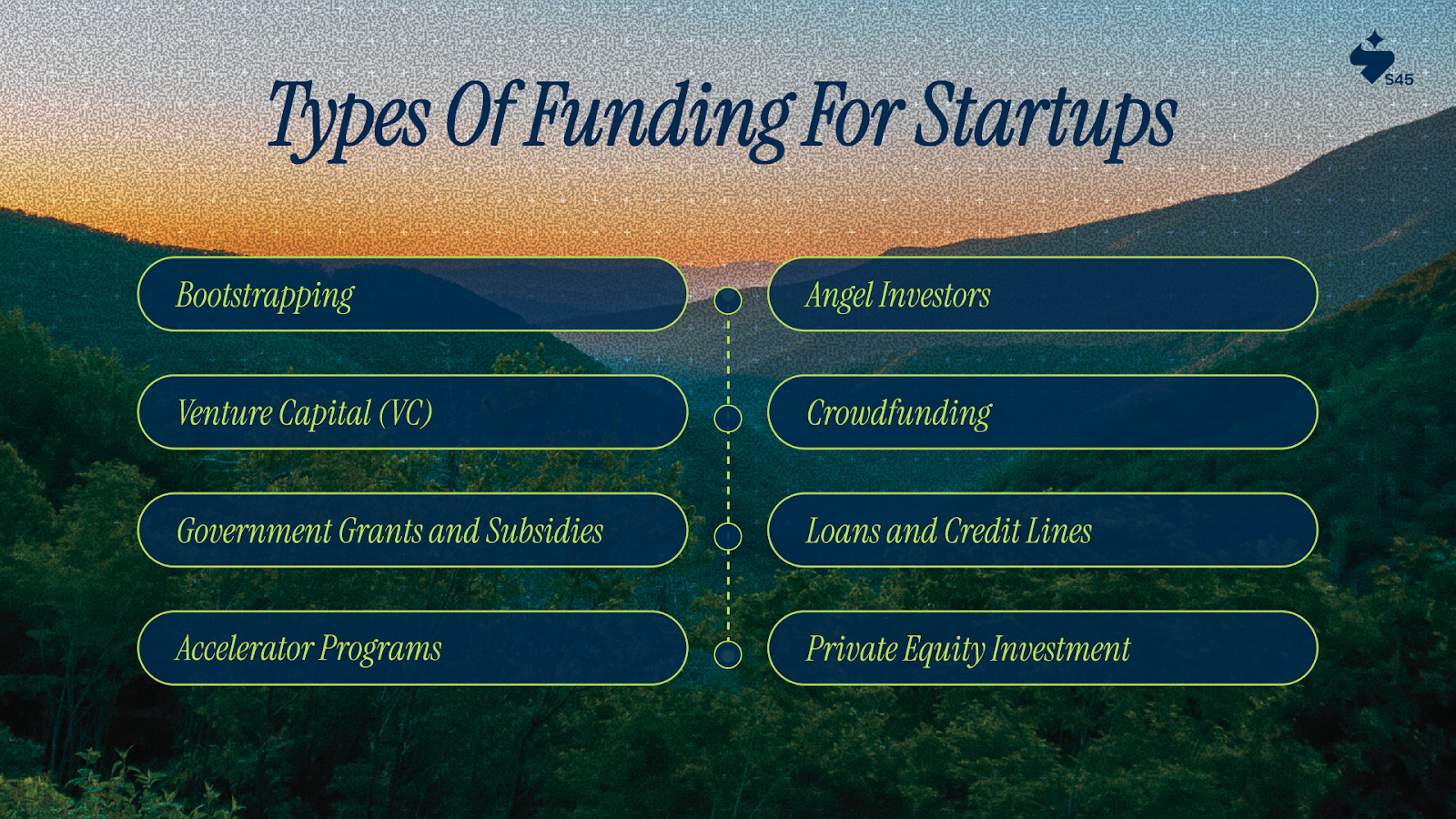

- Types of funding for startups: Bootstrapping, angel investors, venture capital, crowdfunding, government grants, bank loans, and more.

- Choosing the right funding: Consider your business stage, funding needs, and long-term goals.

- S45’s role: Offering capital and expertise to support your startup’s growth and scaling.

Starting a business is an exciting venture, but the road to success often requires more than just a great idea. It takes capital, strategy, and expertise to turn that idea into a thriving business.

For entrepreneurs, one of the biggest challenges is figuring out how to fund their startup. In India, nearly 90% of startups fail due lack of sufficient funds, alongside other factors

In this blog, we will explore the various types of funding for startups and how to determine which option is right for you to help fuel your startup's growth.

What is Startup Funding?

Startup funding is capital raised by entrepreneurs to launch, sustain, or scale their businesses.

Why Startup Funding is Valuable?

The value of startup funding lies in its ability to provide a financial cushion to any business.

- Funding is crucial to turning a business idea into a profitable venture.

- It is crucial for companies to hire employees, purchase equipment, develop products, and expand their reach.

- It gives entrepreneurs the freedom to focus on growth while tackling day-to-day operational costs.

Without proper funding, startups risk stagnating or failing, so understanding your funding options is critical to ensure long-term success.

Now, let’s explore the types of funding for startups that every entrepreneur should be aware of.

Types of Funding for Startups You Should Know

When considering types of funding for startups, it's essential to understand what stage your business is in and how much capital you need. Each funding option has its own benefits and challenges, which can affect your control, equity, and business growth trajectory.

1. Bootstrapping

Bootstrapping means funding your startup using your own money, whether it’s a loan from a friend or family, or by reinvesting profits back into the business. This is often the most cost-effective way to get started, as you won’t have to give up any equity or take on debt.

Pros:

- Complete control and decision-making power

- No equity dilution or investor pressure

- Forces discipline and lean operations

- Keeps you close to customer needs

Cons:

- Limited growth potential due to capital constraints

- Personal financial risk

- Slower scaling compared to funded competitors

- Can limit market opportunities

Best for: Service-based businesses, low-capital startups, and founders who want to maintain full ownership.

2. Angel Investors

Angel investors provide capital for early-stage startups in exchange for equity or debt. They typically invest in businesses at the seed stage and offer both funding and expertise.

Pros:

- Faster decision-making than institutional investors

- Industry expertise and mentorship

- Valuable network connections

- More flexible terms than VCs

Cons:

- Limited funding amounts

- May lack follow-on investment capacity

- Variable involvement levels

- Due diligence can be inconsistent

Best for: Early-stage startups with proven concepts and initial traction.

3. Venture Capital (VC)

Venture capital firms pool money from institutional investors to fund high-growth startups. In exchange for capital, VCs typically take a stake in the business and may take an active role in your company's strategy.

Pros:

- Substantial funding amounts

- Professional expertise and governance

- Strong networks and partnerships

- Follow-on investment capability

Cons:

- Rigorous due diligence process

- Significant equity dilution

- Pressure for rapid growth and exits

- Board involvement and oversight

Best for: Scalable tech businesses, proven business models, and companies targeting large markets.

At S45, we understand that venture capital often pushes founders toward aggressive growth. Our partnership model balances ambition with sustainability, ensuring scaling doesn’t compromise long-term legacy.

4. Crowdfunding

Crowdfunding refers to raising funds from a large group of people, typically through online platforms like Kickstarter, Indiegogo, or GoFundMe. This is an excellent option for startups with a compelling product or service that can generate interest among consumers.

Pros:

- Market validation before launch

- Marketing and brand-building opportunity

- Retain control (reward-based crowdfunding)

- Access to customer feedback

Cons:

- Time-intensive campaign management

- Public visibility of funding struggles

- Platform fees and requirements

- Fulfillment obligations for rewards

Best for: Consumer products, innovative concepts, and businesses with strong storytelling potential.

5. Government Grants and Subsidies

The Indian government supports MSMEs and startups through schemes like Startup India Seed Fund, SIDBI, PMEGP loans, and Atal Innovation Mission.

Pros:

- No repayment or equity requirements

- Credibility boost from government backing

- Access to additional support programs

- Networking with other grant recipients

Cons:

- Competitive application process

- Strict compliance and reporting requirements

- Limited funding amounts

- Lengthy approval processes

Best for: Founders aligned with national priority areas like manufacturing, green tech, digital transformation, research-intensive businesses, and companies addressing social challenges.

6. Loans and Credit Lines

Loans and credit lines are traditional ways of obtaining funding for your business. Banks or financial institutions typically offer these, and they require repayment with interest.

Government schemes like MUDRA loans and CGTMSE can make bank financing more accessible for MSMEs. Building strong financial records and relationships with bankers is crucial for securing favorable terms.

Pros:

- Retain full ownership and control

- Interest payments are tax-deductible

- Predictable repayment terms

- Build business credit history

Cons:

- Personal guarantees are often required

- Strict qualification criteria

- Fixed repayment obligations regardless of performance

- Collateral requirements

Best for: Established businesses with steady cash flows, asset-heavy industries, and founders preferring debt over equity.

7. Accelerator Programs: Funding Plus Mentorship

Accelerator programs provide seed funding, mentorship, and resources in exchange for equity. Programs typically last 3-6 months, and startups need to pitch to investors.

Notable Indian accelerators include T-Hub, NASSCOM 10000 Startups, and sector-specific programs.

Pros:

- Comprehensive support beyond funding

- Access to mentor and investor networks

- Structured learning and development

- Credibility and validation

Cons:

- Highly competitive selection process

- Equity requirements despite small funding amounts

- Time-intensive program commitment

- May not align with all business models

Best for: Early-stage startups seeking mentorship, network access, and structured growth programs.

8. Private Equity Investment

Private equity firms invest in more mature companies, typically providing larger funding rounds for expansion, acquisitions, or buyouts. They focus on operational improvements and strategic growth.

Pros:

- Substantial funding amounts

- Operational expertise and resources

- Strategic guidance and networks

- Professional governance

Cons:

- Significant equity stakes required

- Focus on financial returns and exits

- Intensive due diligence process

- Potential operational changes

Best for: Established businesses with strong fundamentals seeking expansion capital or strategic transformation.

Choosing the right funding option can make or break your startup’s future. Let’s discuss some tips to guide your decision.

Tips to Choose the Right Funding Option for Your Startup

Deciding on the best funding option requires evaluating several factors:

Tip 1: Assess Your Business Stage

Are you in the early, middle, or scaling phase? Different funding options suit different stages of business development. For instance, bootstrapping may work in the early stages, while venture capital is more suitable for scaling businesses.

Tip 2: Understand the Level of Control You Want

Some funding options require giving up equity or control, while others, like bank loans, let you retain full ownership. Consider how much control you're willing to lose.

Tip 3: Consider the Funding Amount

The amount of funding you need will determine which options are viable. Angel investors and venture capital may be better suited for high-growth startups, while bank loans may work for businesses with steady cash flow.

Tip 4: Evaluate Risk and Repayment Terms

Understand the risks involved in each funding option. Some options, like loans or revenue-based financing, can have fixed repayment terms, while others, like equity investments, might bring in external opinions and pressure.

Tip 5: Factor in the Relationship

Funding isn’t just about money; it’s about building relationships. Consider whether you want partners who can add value beyond capital, like mentors or industry experts.

S45 empowers Indian entrepreneurs and MSME founders by combining capital with expert guidance, helping businesses scale without compromising their vision. Partnering with us means finding the right balance for sustainable growth and taking your business to the next level.

How S45 Can Support Your Startup’s Growth

At S45, we believe in partnering with you, walking beside you every step of the way. We don’t just write cheques. We:

- Provide capital + expertise, ensuring funds are used strategically.

- Focus on sustainable and purposeful growth, not just aggressive scaling.

- Honor legacy while driving innovation, aligning with Indian MSME realities.

- Walk beside founders, as true partners in growth.

Whether you're looking to start small with bootstrapping or scale rapidly with venture capital, S45 is here to help guide you through the process.

Ready to scale? Let’s discuss how we can assist you in achieving your growth objectives. Contact us today to get started!

Frequently Asked Questions (FAQs)

1. How do I know which type of funding is right for my startup?

Consider the stage of your business, your funding needs, and your long-term goals. If you’re just starting out and need a small amount, bootstrapping or angel investors may be the best options. If you're looking for substantial growth, venture capital might be a better fit.

2. Can I mix different types of funding for my startup?

Yes, many startups combine various types of funding, such as taking on angel investments while also applying for government grants or using crowdfunding to gauge interest in a product.

3. What's the best type of funding for early-stage manufacturing startups?

Early-stage manufacturing startups often benefit from a combination of bootstrapping, government grants, and angel investors who understand the sector. Manufacturing requires patient capital due to longer product development cycles and inventory requirements. Consider grants first for non-dilutive funding, then seek angels with manufacturing experience.

4. When should I transition from bootstrapping to external funding?

Consider external funding when you've validated product-market fit but need capital to scale faster than organic growth allows. Key indicators include strong customer traction, clear growth opportunities that require investment, and competitive pressure that demands faster expansion.