Key Takeaways:

- Startup funding isn’t a one-time event. It’s a journey across stages, each with its own purpose.

- Pre-seed and seed are about proving the idea and building the first product.

- Series A–C are where you scale customers, revenue, and team.

- Beyond that, late-stage and IPO funding are about market dominance and liquidity.

- Knowing which stage you’re in helps you target the right investors and ask for the right amount.

If you’re building a startup, you already know fundraising isn’t as simple as “going out to raise.”

Every stage of funding has its own rules.

Pre-seed investors back conviction and scrappy MVPs. Seed requires proof of traction. By Series A, you’re expected to show you can scale, and later stages demand operational excellence.

The numbers back it up.

In just the first half of 2025, Indian startups raised $5.7B+ across 450+ deals. The money is there, but so is the competition. Median ticket sizes now exceed $3M, which means expectations have risen.

If you’re raising, you need to know exactly what milestone signals investors are looking for, and how to stand out in a crowded ecosystem.

This guide breaks down each funding stage, stage by stage. You’ll learn what investors expect, how much to raise, and how communities like s45club help you cut through the noise.

Funding Stages Every Founder Should Know

India’s funding environment in 2025 can feel like an obstacle course. You’re racing forward, the path isn’t always clear, and every step counts.

Big growth rounds grab headlines, but for most founders, the real bottleneck happens much earlier.

Whether you’re pitching at pre-seed or gearing up for Series B, the bar has risen across the board. Investors aren’t just writing checks; they’re looking for sharper proof at every stage.

Here’s a stage-by-stage breakdown of funding in India, what investors look for, and how to avoid the mistakes that stall many founders.

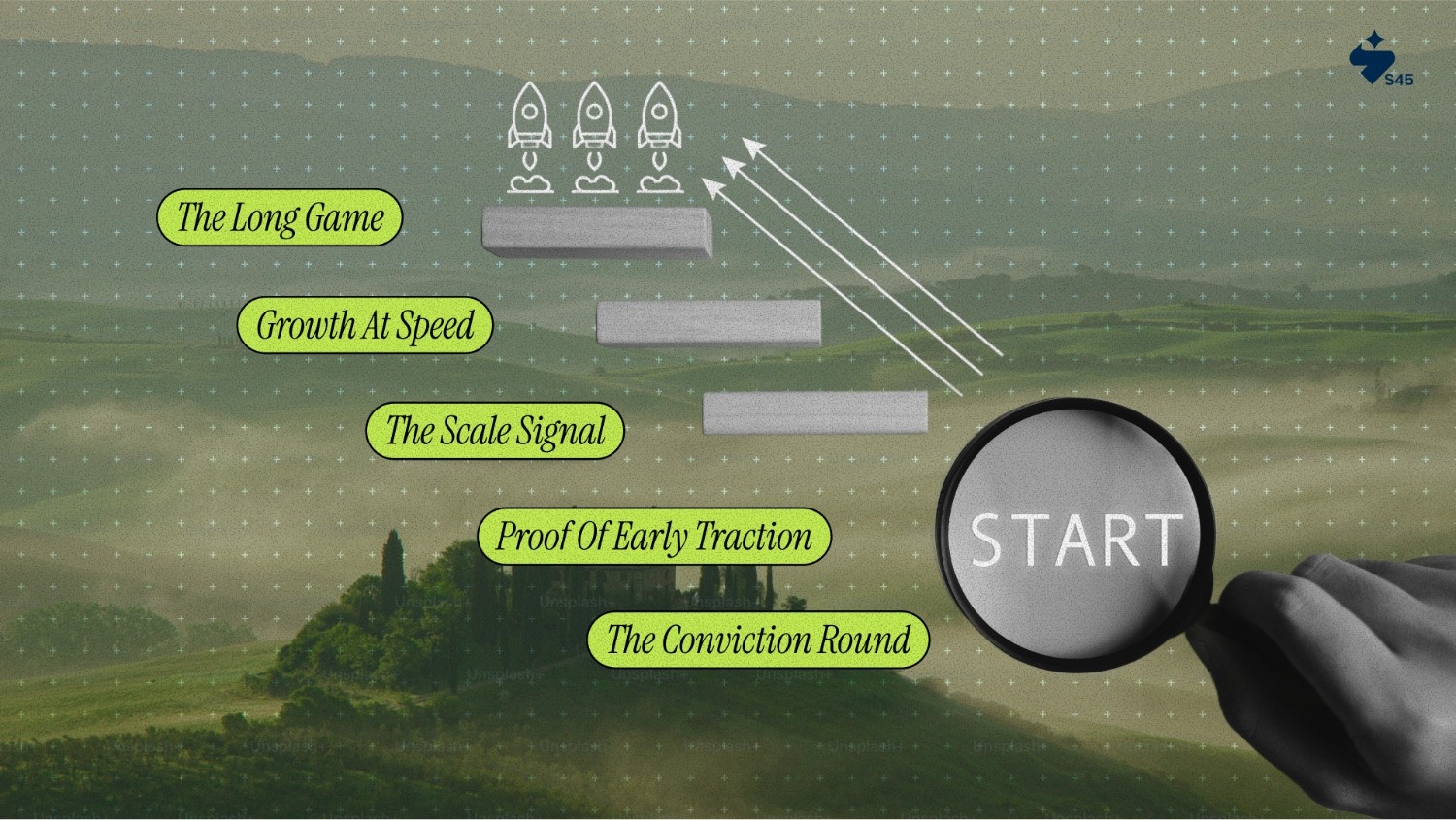

1. Pre-Seed Stage: The Conviction Round

Pre-seed is the first external capital a startup raises, usually from angels, micro-VCs, or even friends and family. Typical ticket sizes range from ₹20 lakh to ₹1 crore.

At this stage, investors are not backing numbers; they are backing conviction. What matters most is the strength of the founding team, the clarity of the vision, and whether there is an early prototype that shows promise.

Investors typically look for:

- A scrappy MVP or working prototype

- Early signs that the problem is real and the market is large enough

- A team that is deeply committed to solving it

The biggest mistake founders make here is treating pre-seed like “easy money.” Investors have grown far more discerning, and vague ambition does not cut it anymore.

Pro tip: Anchor your pitch in clarity. Tell the story as, “Here is the problem, here is how we validated it, and here is why we are the team to solve it.”

That structure alone can make you stand out in an overcrowded deck pile.

2. Seed Stage: Proof of Early Traction

The seed round is where you move beyond conviction and start showing real traction. At this stage, startups typically raise between ₹40 lakh and ₹15 crore, depending on the sector and investor appetite.

The goal is to demonstrate that your product has a market and that customers are willing to pay for it.

What investors expect to see:

- Paying customers or strong early user growth

- Revenue signals with CAC benchmarks that make sense

- Evidence that acquisition channels actually work

The common founder mistake here is pitching with vague revenue plans. Saying “we will charge subscriptions” is too shallow. Investors want hard proof that customers are already paying, and that your channels can scale.

Pro tip: Ground your story in real data. For example, “Early customers are paying ₹8,000 a month” lands much stronger than “We will charge subscriptions.” Even better, “We ran an ₹80,000 LinkedIn campaign and acquired 200 sign-ups at ₹400 each.”

Data like this builds instant credibility.

How s45club Supports You in the Early Rounds

Raising your first real capital can feel overwhelming. Platforms like s45club work alongside founders to make sense of these early stages.

Whether it’s refining your story, showing traction in the right way, or knowing what investors are really looking for, S45 helps you cut through the noise. Think of us as your guide and sparring partner as you move from conviction to proof.

3. Series A: The Scale Signal

Series A is the inflection point where investors back you to scale a validated model. Typical funding at this stage ranges from ₹15 crore to ₹120 crore, reflecting the higher bar for growth capital.

It is all about building a repeatable and sustainable growth engine.

What investors expect to see:

- Consistent and growing revenue

- A repeatable sales process that can scale

- Early signs of strong unit economics

The mistake many founders make is trying to raise Series A with only early traction. A few logos or initial sales may open doors, but what closes the round is proof that your model can be repeated and scaled without breaking.

Pro tip: Frame your raise around efficiency and momentum. For example: “We are raising ₹50 crore to expand sales and engineering.

This gives us 24 months of runway to reach ₹400 crore ARR.” Numbers like this show investors not just ambition but a clear capital-to-milestone path.

4. Series B and Beyond: Growth at Speed

Series B and later rounds are about accelerating growth and capturing market share quickly. By this stage, you need to show that your company can scale efficiently at speed.

What investors expect to see:

- A strong and experienced leadership team

- Operational processes that can handle rapid growth

- Aggressive yet efficient market expansion strategies

The trap many founders fall into is underestimating the importance of governance and maturity. At this stage, investors are not just backing a product; they are backing a full-fledged company. Weak compliance, poor financial reporting, or leadership gaps can derail a raise, no matter how strong the topline growth is.

Pro tip: Let investors know you’ve got this. Show clean books, a sharp leadership team, and solid compliance practices alongside your growth metrics. It reassures them you can scale without breaking a sweat.

5. IPO or Exit: The Long Game

The final stage for many startups is either going public or being acquired. By this point, the focus shifts from growth alone to building a business that is durable, well-governed, and capable of delivering liquidity to investors.

What investors expect to see:

- Sustainable profitability and predictable cash flows

- Strong governance, transparency, and board oversight

- A brand with market trust and staying power

The challenge for founders is recognizing that not every company is built for an IPO. For many, a strategic acquisition is a smarter and more realistic outcome than chasing the public markets.

Pro tip: Align your exit strategy with your strengths. If you are building for IPO, emphasize your profitability, governance, and growth consistency. If an acquisition is more likely, highlight strategic partnerships and ecosystem fit.

Investors want clarity on how their returns will materialize.

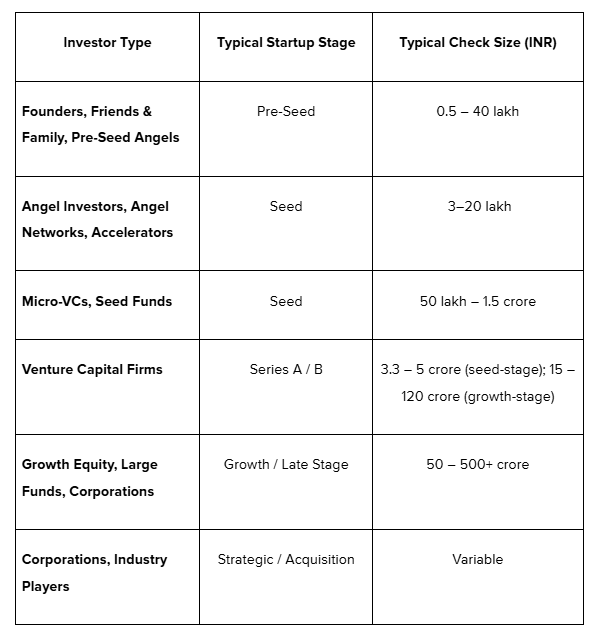

Types of Startup Investors You’ll Meet

Not all capital is created equal. Different investors bring different risk appetites, timelines, and expectations. Understanding these nuances helps you raise smarter, avoid mismatches, and stay in control of your journey.

At s45club, we help founders pick the right investors and show traction that matters. Our focus is simple: raise the right money at the right time, and scale with clarity and confidence.

1. Angel Investors

These are typically successful founders, CXOs, or professionals writing smaller personal cheques. Angels invest early and fast, often driven by conviction in the founder more than spreadsheets.

In India, average angel ticket sizes range from ₹3–20 lakhs. Syndicate platforms make it easier to pool money, so you might have 10–15 small backers instead of one large one.

Insider tip: The best angels bring warm intros, advice, and experience. But too many small cheques can clutter your cap table. So, manage carefully.

2. Micro-VCs and Seed Funds

Institutional funds with smaller pools usually write ₹50 lakh–1.5 crore cheques. They expect sharper proof than angels: paying customers, early traction, or strong usage metrics. Accelerators also sit here, bundling investment with mentorship, cohorts, and customer access.

Insider tip: Micro-VCs are often hands-on, but their reserves for follow-on rounds are limited. Choose carefully if you want long-term capital support.

3. Venture Capital Firms (Series A/B)

VCs step in once there’s evidence of product–market fit. They bring bigger cheques, governance, networks, and terms like board seats and pro-rata rights. In India, average seed-stage VC cheques are ₹3.3–5 crore. International VCs are increasingly scouting Indian startups early, especially in fintech, SaaS, and logistics.

Insider tip: VCs will dig deep. They look at customer contracts, churn rates, and even call your competitors. Surface-level traction won’t cut it.

4. Growth Equity and Late-Stage Investors

Large funds, sovereign wealth players, or corporate venture arms that back proven businesses ready to scale. They care about operational discipline, predictable growth, and margins. Beyond money, they can open doors to cross-border markets, acquisitions, and IPO prep.

Insider tip: Growth funds benchmark against global comparables. Thin margins show up in valuation conversations.

5. Strategic Investors and Acquirers

Corporates or incumbents investing for synergy, not just returns. They can provide distribution, technology, or regulatory cover, but alignment is critical. The wrong partner can lock you into a single path.

Insider tip: Strategic investors often move more slowly than financial VCs. If speed matters, weigh the trade-offs carefully.

Figuring out which investor to pitch can feel like playing a high-stakes soccer match. Each type of investor is a different opponent, some quick and aggressive, others patient and tactical. You need timing, strategy, and a bit of skill to score the winning goal.

At s45club, we help founders pick the right “plays” and show traction that matters, so you can score consistently and keep your startup moving toward the championship.

Choosing Investors That Fuel Real Growth

Raising capital is more than money. It’s about choosing partners who align with your vision, push you forward, and open doors you couldn’t open on your own. From angels to VCs to strategic investors, each brings different expertise, expectations, and ways of shaping your journey.

- Early investors, like angels and micro-VCs, are often your first believers. They back the founder more than the spreadsheets, offer mentorship, and can connect you with a network that’s hard to access alone.

- Series A and B VCs bring governance, discipline, and bigger cheques—but they dig deep.

- Growth-stage funds and corporates open markets, smooth operational challenges, and set the stage for scaling beyond borders.

The key isn’t just to raise money; it’s to raise the right money.

The right investor sharpens your strategy, fuels sustainable growth, and guides you through the challenges of scaling while keeping your vision intact.

At s45club, we partner with founders to scale businesses sustainably. From early-stage guidance to connecting you with the right capital, we focus on legacy, innovation, and purposeful growth.

Join the s45club today and take the next step in building a business that lasts.

FAQs

Q: How do I know which funding stage my startup is in?

A: Your stage is defined by traction, team, and business model maturity. Pre-seed is about validating your idea. Seed demonstrates early traction. Series A/B is focused on scaling. Growth and late-stage funding target operational excellence and market expansion.

Q: Can I skip funding stages and go straight to Series A or B?

A: It’s rare. Investors expect proof at each stage. Skipping early rounds can raise doubts about your product-market fit, traction, and team readiness.

Q: What’s the difference between angels, micro-VCs, and traditional VCs?

A: Angels invest early, often based on conviction in the founder. Micro-VCs write slightly larger cheques and expect proof of traction. VCs focus on scalability, revenue, and repeatable growth. Choosing the right type matters as much as the capital itself.

Q: How much equity should I give up at each stage?

A: Equity dilution depends on cheque size, valuation, and investor terms. Pre-seed and seed usually involve higher risk for smaller amounts, while later rounds bring larger checks but often less dilution. Always align decisions with long-term strategy, not just short-term capital.

Q: Should I take money from strategic investors or corporates early on?

A: Strategic investors can provide access and synergy, but may move more slowly or limit your options. Early-stage startups usually benefit more from investors focused on growth and mentorship.