Key Takeaways

- Clear Communication: Present your vision, market opportunity, and business model effectively to capture investor interest.

- Essential Pitch Structure: Include slides on the problem, solution, market size, traction, team, and financials.

- Tailor to Audience: Make the presentation concise, visually appealing, and backed by data to resonate with investors.

- Practice and Preparation: Anticipate questions and practice delivery for a confident, polished pitch.

- Avoid Pitfalls: Steer clear of overloaded slides, unclear messaging, and neglecting competitive analysis.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

Securing seed funding is frequently the crucial aspect that decides a venture's course in the dynamic and competitive world of startups. Early-stage startups face a common challenge: how to effectively communicate their potential and value proposition to attract the right investors. A compelling seed funding presentation can make this difference.

An effective pitch not only introduces your startup but also builds confidence, establishes credibility, and sets the stage for ongoing investor relationships. This guide will help founders develop an investor-ready seed funding presentation, equipping you with the tools to make a memorable impression and increase your funding success.

What Is a Seed Funding Presentation?

A seed funding presentation is a concise, visually engaging deck designed to summarize your startup’s potential and persuade early-stage investors to commit capital. Typically, this deck ranges from 10 to 15 slides, focusing on the core facets of your business strategy and growth potential.

The primary purpose is to communicate your value proposition clearly and convincingly. It's your opportunity to tell your startup’s story addressing the problem, your innovative solution, the market opportunity, traction, and financial projections all while demonstrating why your team is best suited to execute this vision.

Once you grasp the basics, you can focus on perfecting your pitch to win investor support and succeed.

Why Getting Your Seed Pitch Right Is Crucial

Approaching the seed pitch with professionalism and clarity sends strong signals to investors about preparedness and seriousness, two critical factors in early-stage funding.

- Trust Building: A well-crafted pitch builds investor confidence in your venture and team.

- Investor Excitement: It generates enthusiasm around your opportunity, increasing the likelihood of funding.

- Vision Clarity: Articulating your vision solidifies your own focus and strategic direction.

- Network Growth: Engaging investors can lead to valuable mentorship and partnerships.

Successful fundraising often hinges on how effectively you present your story, not just the idea itself.

With this in mind, let’s break down the key components that make up an effective seed funding presentation.

Is your business ready to accelerate growth with seed funding? S45 collaborates with entrepreneurs seeking to scale from local leaders to global players. Our founder-first approach provides more than just capital. It offers the strategic guidance, network access, and operational expertise essential for sustainable growth.

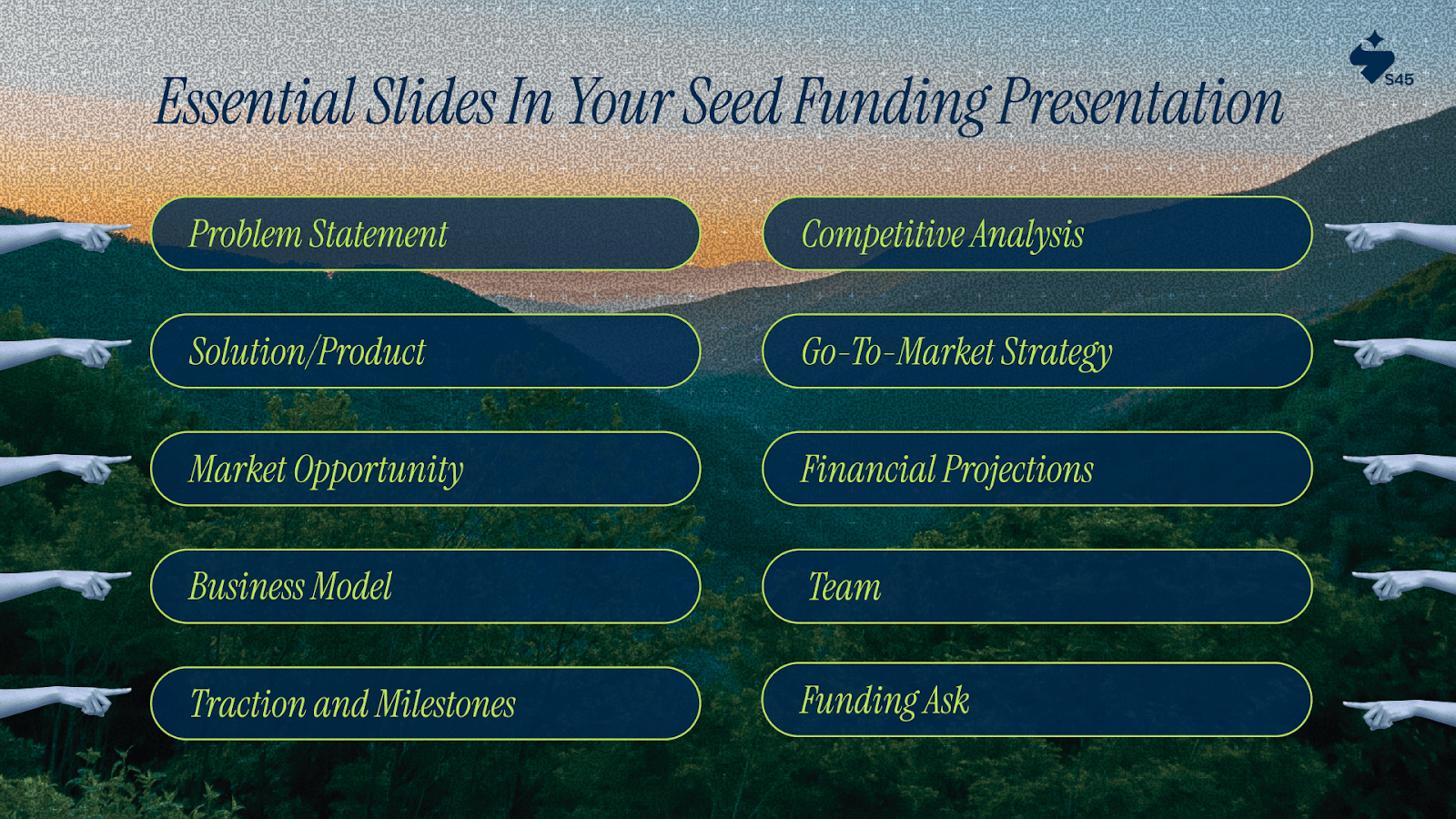

Essential Slides in Your Seed Funding Presentation

Every successful pitch deck includes several key components. Each slide plays a specific role in convincing investors you have a scalable, sustainable, and investable business.

1. Problem Statement: Defining the Core Challenge Your Startup Solves

Clearly articulating the problem gives investors a compelling reason to listen. Show the pain points your target customers face, supported by real data or anecdotes to demonstrate urgency and scope. This builds emotional and intellectual engagement.

Example: Imagine a startup addressing India's rising food delivery delays. The problem slide highlights that 60% of users experience delivery taking over 45 minutes, leading to customer dissatisfaction and lost revenue. This statistic anchors the startup’s relevance and market need.

2. Solution/Product: Presenting Your Unique Value Proposition

Showcase how your product or service directly solves the defined problem. Illustrate what makes your solution innovative, better, or faster, using visuals, user testimonials, or product demos. This convinces investors of your startup's potential impact.

Example: The food delivery startup introduces a streamlined logistics app using AI to optimize delivery routes, reducing delays. A demo video or customer feedback snippet can highlight improvements in user experience.

3. Market Opportunity: Quantifying Your Target Market

Define the size and growth potential of your target market. Use credible data sources to demonstrate scalability and the demand for your solution. Highlight specific customer segments that your startup will prioritize initially.

Example: The delivery startup cites reports estimating that India’s hyperlocal delivery market is expected to reach $20 billion by 2027, with a 25% CAGR. It targets urban millennials in metros initially, a segment representing $5 billion market.

4. Business Model: Explaining How Your Startup Makes Money

Outline the revenue streams and pricing strategy. Whether subscription, transaction fees, or advertising, make clear how your startup will generate sustainable income and profitability.

Example: The delivery startup describes generating revenue through a commission on each delivery and premium subscriptions for restaurant partners for enhanced visibility and faster logistics.

5. Traction and Milestones: Demonstrating Early Progress and Validation

Showcase key achievements such as user growth, revenue, partnerships, or product development milestones. This builds credibility and signals momentum, reducing investor risk perception.

Example: Within six months, the startup onboarded 50 restaurant partners, achieved 10,000 monthly active users, and recorded ₹10 lakh monthly revenue, indicating strong market validation.

6. Competitive Analysis: Showing Your Differentiation and Moat

Detail who your competitors are, how your startup stands apart, and your competitive advantages whether technology, partnerships, or business model innovations.

Example: The startup illustrates competitors with slower delivery times and lack of AI optimization, positioning its tech-driven logistics as a unique value differentiator creating customer loyalty.

7. Go-To-Market Strategy: Mapping Your Customer Acquisition and Scaling Plan

Explain your marketing, sales, and distribution plans to attract and retain customers. This demonstrates a clear route to capturing market share and growing rapidly.

Example: The startup plans a phased rollout—starting with social media and influencer campaigns in Bengaluru, followed by strategic partnerships with food bloggers and delivery aggregators to increase visibility.

8. Financial Projections: Laying Out Key Metrics and Forecasts

Present realistic revenue, costs, gross margin, burn rate, and cash runway for at least 12-18 months. Include different scenarios to show thoughtfulness in planning risks and opportunities.

Example: The startup projects ₹1 crore revenue by Year 2, with a planned monthly burn rate of ₹10 lakhs and break-even in 24 months. Conservative and optimistic scenarios reflect market uncertainties.

9. Team: Highlighting Founders’ Expertise and Complementary Skills

Showcase backgrounds that make your founders and key team members uniquely qualified to execute the business plan. Include relevant industry experience, technical knowledge, and prior successes.

Example: The founding team includes a logistics expert with 10 years at a top courier company, a former data scientist with AI startup experience, and a sales head with a robust network in the food industry.

10. Funding Ask: Clear Statement of Capital Request and Use of Funds

Specify how much you’re raising, the equity offered (if applicable), and the planned use of funds tied directly to milestones. This helps investors understand the deal and expected growth leverage.

Example: The startup requests ₹2 crores, allocating 40% to product development, 30% to marketing, 20% to hiring key staff, and 10% contingency aiming to achieve 1 lakh users and ₹5 crore in revenue within 18 months.

Want to create a seed funding presentation that wins investor confidence and drives your startup’s growth? S45 connects you with experienced founders and advisors who’ve mastered the art of pitching and raising capital successfully.

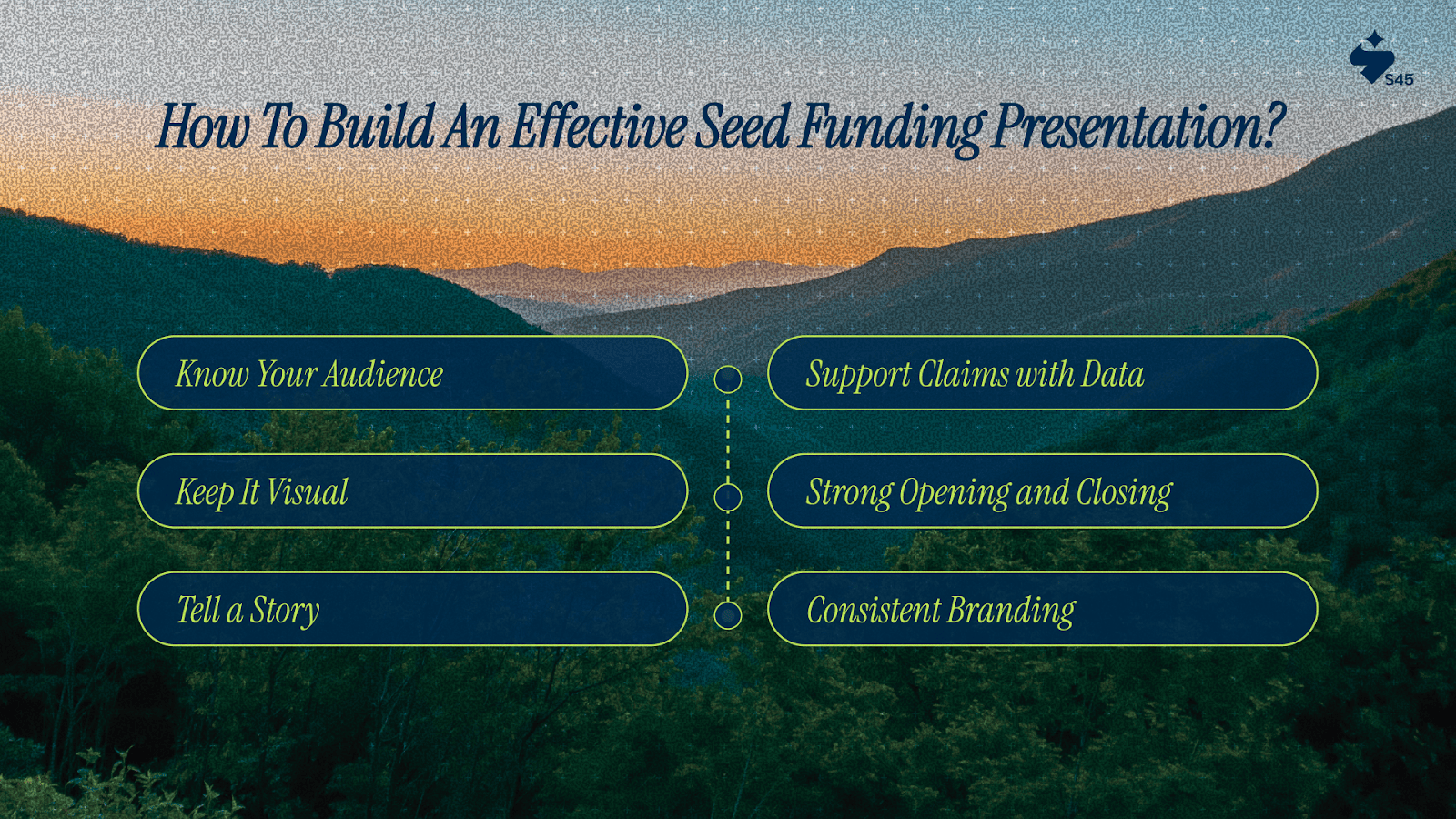

How to Build an Effective Seed Funding Presentation?

Crafting a seed funding presentation that truly resonates with investors takes both art and strategy. It involves weaving your vision and data into a compelling story while respecting investors’ time and intellect. Here how you can do it:

1. Know Your Audience

Understanding your investors' priorities and past investments helps you tailor your message to what matters most to them. Whether they prioritize market traction, technology differentiation, or founding team strength, align your content to speak their language.

Example: When pitching to impact investors, a startup highlighted its social good metrics alongside traditional business KPIs, creating a narrative that deeply resonated with their ethos.

2. Keep It Visual

Busy investors absorb information more quickly through visuals than text-heavy slides. Use intuitive charts, infographics, and imagery that clarify complex ideas at a glance. Maintain simplicity; a clean design reflects clear thinking and respects your audience’s attention span.

Example: Instead of listing all customer acquisition channels page by page, use a funnel graphic showing conversion rates, making the strategy immediately accessible and impactful.

3. Tell a Story

Your pitch deck is more than bullet points; it’s the story of your startup’s journey and purpose. Build a narrative arc that connects problem, solution, market opportunity, traction, and future vision seamlessly. Stories create emotional engagement and make your presentation memorable.

Example: A fintech startup started its presentation with a customer story depicting financial exclusion, followed by its innovative solution and quantified market opportunity capturing both hearts and minds.

4. Support Claims with Data

Substantiate every major claim with tangible data points, market research, user metrics, financial forecasts, or customer feedback. Data builds credibility and transforms aspirations into believable projections.

Example: A SaaS startup supported its growth claims by showcasing month-on-month churn reduction through customer testimonials and retention graphs, presenting a well-rounded proof of concept.

5. Strong Opening and Closing

Your opening slide should hook attention, a striking fact, bold claim, or mission-driven statement. Similarly, end with a clear and confident closing that reaffirms your funding request and invites engagement.

Example: Opening with “India’s 500 million smartphone users lack affordable digital banking” followed by a closing slide detailing how the funding will triple active users within 18 months creates a compelling frame.

6. Consistent Branding

Visual and tonal consistency across your deck signals professionalism and builds brand identity. Carefully choose fonts, colors, and imagery that reflect your startup’s personality and values. Coherence improves readability and leaves no room for distraction.

Example: A health tech startup embraced a calming color palette and clean fonts aligned with its mission of accessible, trustworthy care, boosting investor confidence through thoughtful design.

After the presentation is produced, the next step is delivery, when your vision becomes a reality.

Tips for Delivering a Winning Pitch

Delivering your seed funding presentation effectively can inspire confidence, build trust, and significantly increase your chances of success. Here are practical tips to help you deliver a memorable and impactful pitch:

- Practice Thoroughly

Rehearse your entire pitch multiple times until you can present smoothly and confidently without relying heavily on notes. Simulate investor Q&A sessions with mentors or peers to prepare for challenging questions. This preparation transforms nervousness into calm, purposeful delivery.

- Be Concise

Keep your presentation focused and to the point. Respect investors' limited time by highlighting core messages clearly and avoiding unnecessary details or tangents. A concise pitch holds attention and makes your key points more powerful.

- Engage Your Audience

Use confident eye contact, open body language, and vocal variation to connect authentically with investors, whether in person or virtually. Engagement keeps listeners interested and helps them remember your story beyond just the slides.

- Address Risks Honestly

Acknowledge your startup’s challenges openly along with your mitigation strategies. Transparency fosters credibility and shows investors you have realistic expectations and a solid plan for obstacles.

- Prepare for Q&A

Anticipate likely investor questions and prepare clear, thoughtful answers. Being ready for dialogue demonstrates confidence, expertise, and respect for investors’ concerns, encouraging deeper engagement.

Without avoiding typical pitfalls, even the best delivery can fail. First, we'll go over some of the pitfalls that founders should try to avoid.

Common Mistakes to Avoid in Your Seed Funding Presentation

Even minor missteps in your pitch deck can undermine your credibility and hurt your chances of securing investment. Founders who avoid these common pitfalls position themselves for greater success:

- Overloaded Slides: Cramming too much information or data onto one slide overwhelms investors and dilutes your key message. Stick to one clear idea per slide with concise visuals or bullet points for maximum impact.

- Unclear Problem or Solution: If investors don’t immediately understand what problem you’re solving or how your solution works, they lose interest. Be crystal clear and focus on making the problem relatable and the solution straightforward.

- Ignoring Competitors: Claiming “no competition” or glossing over competitors signals a lack of market understanding. Investors expect you to know your landscape and articulate how you differentiate meaningfully.

- Poor Preparation: An unpolished delivery, hesitations, inconsistent answers, or unclear messaging can erode confidence quickly. Thorough preparation shows you respect investors’ time and believe in your business.

- Unrealistic Financials: Overly optimistic or unsupported projections damage trust. Ground your financial forecasts in credible data and transparent assumptions to show business maturity and financial discipline.

Avoiding these errors sharpens your narrative, builds investor trust, and increases your chances of funding success by presenting you as a confident, credible, and thoughtful founder with a viable vision.

Final Thoughts

A seed funding presentation does more than just secure capital—it establishes the strategic foundation that sets successful startups apart from those that struggle with execution and growth. When crafted and delivered well, it becomes a living document that drives clear decision-making, aligns your team around common goals, and creates accountability for measurable outcomes.

Your ability to tell a coherent, data-backed story today influences your capacity to raise not only immediate funding but also future rounds that scale your impact sustainably. Execution against your commitments strengthens investor trust and builds lasting business legacies.

At S45, we partner with founders to build the frameworks and operational discipline necessary for scaling businesses from Indian startups to global powerhouses. Join a community of visionary entrepreneurs committed to meaningful growth and transformational success.

FAQs

Q. What is the concept of seed funding?

A. Seed funding is the essential first step that powers startups from idea to initial growth. It provides the early capital needed to develop your product, validate your market, and build a strong foundation, setting your journey toward lasting impact.

Q. What is the 10/20/30 rule for presentations?

A. The 10/20/30 rule is a simple guideline to keep presentations sharp: no more than 10 slides, delivered in 20 minutes, with font size no smaller than 30 points. It helps maintain clarity, focus, and engagement, respecting busy investors’ time.

Q. How to make a presentation for funding?

A. Craft your funding presentation as a clear, compelling story covering your problem, solution, market, business model, traction, team, and financials. Use visuals to simplify complex ideas, and tailor your pitch to what investors care about most.

Q. How to pitch for seed funding?

A. Pitching seed funding is about confidently sharing your vision, demonstrating real market need, showcasing early wins, and explaining how capital will accelerate growth. Preparation and authenticity create trust and open doors to collaborative success.

Q. How to make a PPT for startup?

A. Create a startup PPT that’s visually engaging and focused—each slide should tell part of your story: the need, your unique solution, market potential, progress, team strength, and how you’ll use investors’ funds to grow sustainably.

Q. Is seed funding risky?

A. Seed funding carries inherent risk since startups are early-stage ventures. But with the right strategy, transparency, and resilience, this risk becomes a catalyst for growth and transformation, turning vision into a meaningful, lasting business.