Key Takeaways

- Raising money for business needs a clear strategy choice matching the growth stage and goals.

- Self-funding, loans, investors, and crowdfunding are a few ways to raise capital.

- Choosing the wrong funding risks ownership dilution, financial stress, or blocked growth plans.

- Preparation needs strong financials, governance, valuation clarity, and a clear business narrative.

- Blending funding sources, be it from investors or government grants, helps balance control, repayment, and long-term business vision.

Raising money for your business often feels like the hardest step. Then, what are the right options, and when should you choose each?

Funding decisions shape how your business grows and how much control you keep. In the 2nd week of July 2025, 17 Indian startups raised around $95 million, with 10 early-stage deals making up $22.11 million. It shows how founders are finding ways to fund growth despite market shifts.

Knowing how to raise money for a business is no longer just about approaching banks or investors. Founders need to align strategies with goals, structure deals wisely, and prepare their business to attract the right funding partners.

In this guide, founders will learn practical ways to raise money for their business, from bootstrapping and bank loans to private equity and strategic partnerships, along with key preparation tips to build confidence before approaching any funding option.

Why Raising Money is a Strategic Business Decision?

Raising money is not just about filling cash gaps. Businesses often need funds to expand capacity, enter new markets, or invest in technology. Funding decisions shape growth speed and direction. Choosing the right type of funding aligns with your goals and timelines, whether you plan a quick market capture or steady long-term scaling.

Wrong funding choices can create debt burdens, dilute ownership unfairly, or restrict future strategic moves. For example, taking high-interest loans when equity funding was better suited can strain cash flows. Or giving away too much equity early can limit control later. Treating funding as a strategic decision protects your vision while ensuring the business has resources to grow confidently.

Each funding strategy has its own purpose and impact on your journey. Understanding these helps you choose options that match your ambitions and business stage.

Best Strategies to Raise Money for Your Business

Funding your business growth requires clear knowledge of available options. Each strategy suits different business models, goals, and founder preferences. Some bring faster capital with equity dilution, while others retain full ownership but add repayment obligations. Indian founders need to plan funding with a long-term view to avoid short-term mismatches.

Here are top 10 strategies to raise money for your business effectively:

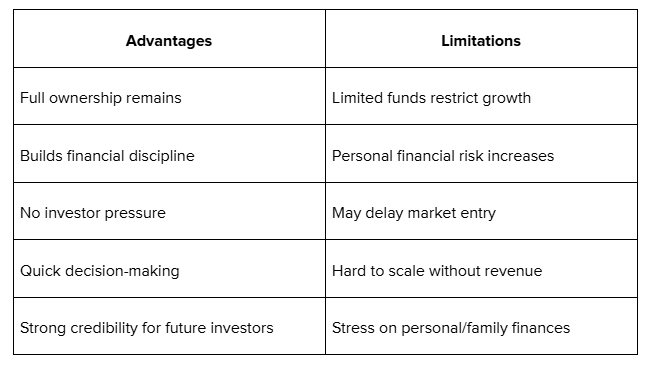

1. Self-Funding and Bootstrapping

Bootstrapping means using personal savings or business cash flows to fund growth. It keeps control in the founders' hands and builds financial discipline. However, it limits scaling speed and can stress personal finances. Ideal for early-stage founders testing models with limited capital requirements before external investment.

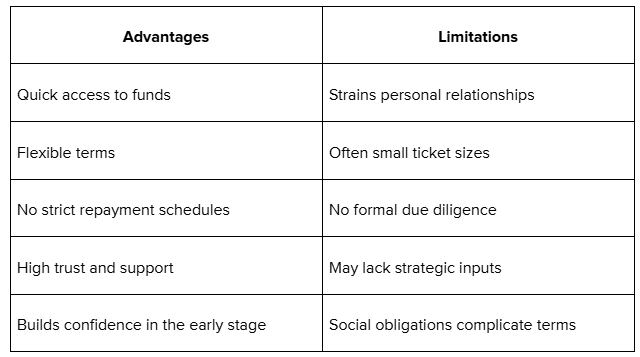

2. Friends and Family Funding

It involves raising funds from personal networks. The funding is fast and based on trust. However, mixing relationships and money can cause strain if business performance falls. In India, cultural obligations may influence repayment expectations, so clarity on terms is essential to maintain harmony.

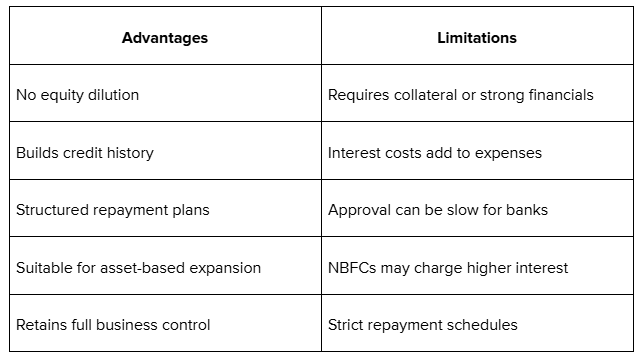

3. Bank Loans and NBFC Financing

Banks offer term loans, working capital loans, and overdraft facilities. NBFCs provide faster approvals and flexible terms for SMEs. These create fixed repayment obligations but retain equity control. For example, MSMEs use Mudra loans for equipment purchase or working capital without giving up ownership.

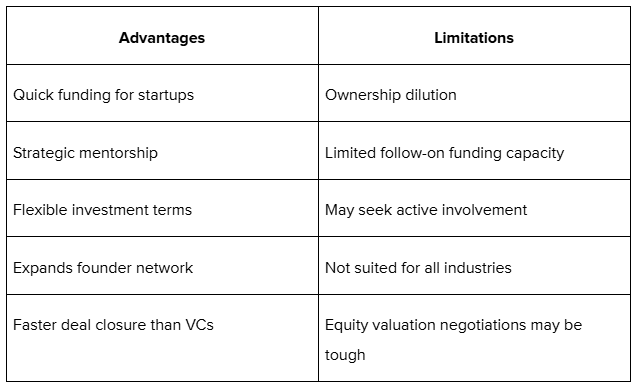

4. Angel Investors

Angel investors are high-net-worth individuals funding early-stage businesses with growth potential. They invest ₹25 lakh to ₹2 crore typically in return for equity. This funding brings strategic guidance but dilutes ownership.

For example, early funding by angels helped Ola scale before VC rounds.

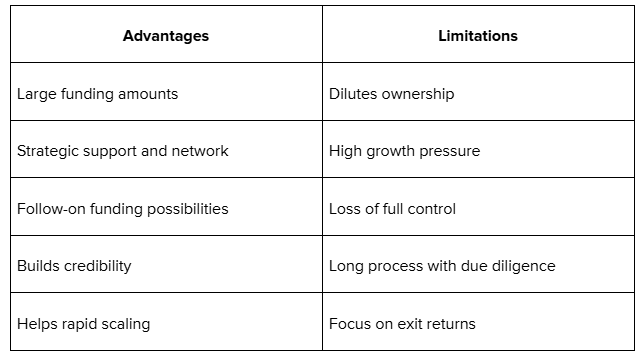

5. Venture Capital Funding

VC funding involves firms investing in startups with high growth potential for equity. They invest in stages like seed, Series A, or B. It brings large capital and strategic inputs but requires fast scaling and exit readiness. Many Indian SaaS and fintech startups use VC to accelerate growth.

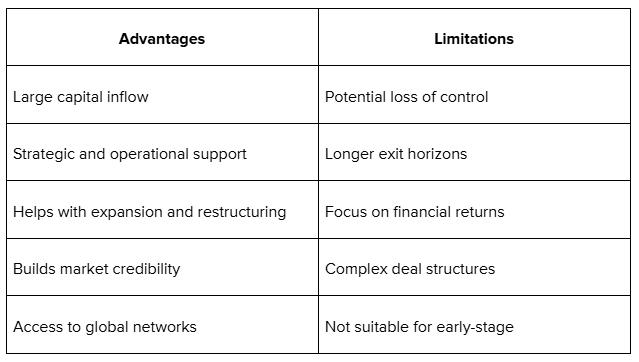

6. Private Equity Funding

Private equity firms invest in mature businesses needing expansion capital, buyouts, or restructuring. They bring strategic guidance and operational expertise. It suits mid-large businesses ready to scale or restructure but founders may cede board control or majority stakes.

Through platforms like S45, SMEs can better understand when they are truly private-equity ready by comparing performance benchmarks and identifying gaps before engaging investors.

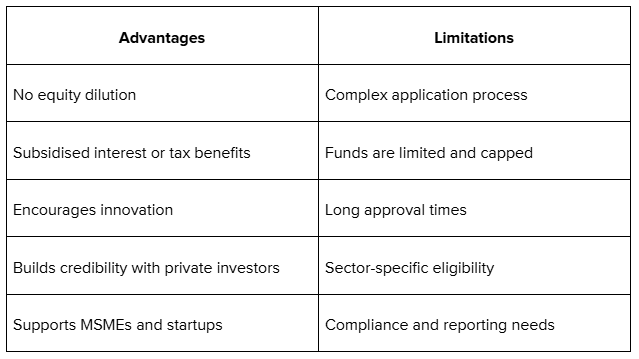

7. Government Schemes and Grants

India offers schemes like Startup India, Mudra, and SIDBI loans. These provide collateral-free loans, tax exemptions, or grants to support innovation and MSME growth. Eligibility and paperwork are strict, and funds are limited, but they help reduce financing costs for new businesses.

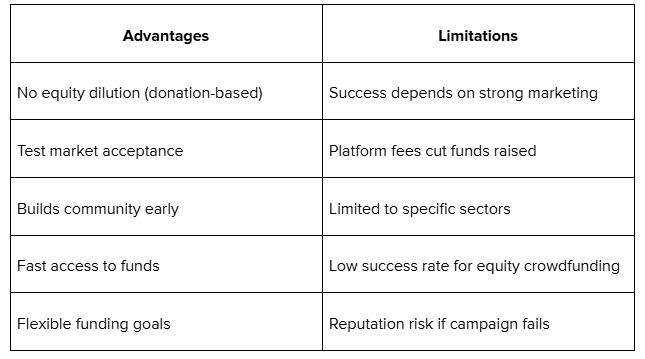

8. Crowdfunding

Crowdfunding pools small funds from many people via online platforms. It works well for consumer products, creative projects, or community-focused businesses. Examples include Ketto and Wishberry in India. Success depends on strong digital marketing and a clear pitch.

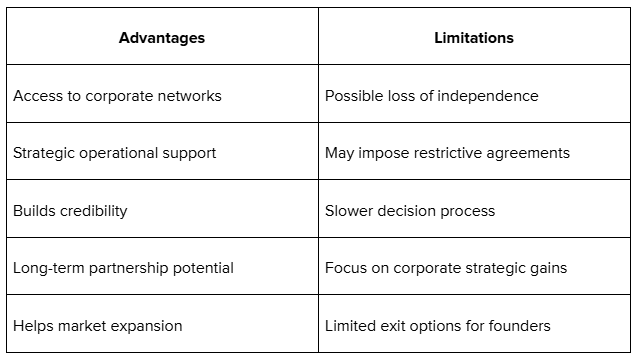

9. Strategic Corporate Investors

Corporations invest in startups to gain market access, technology, or supply chain integration. For manufacturing businesses, strategic investors can bring distribution networks and operational expertise. However, founders must align expectations to avoid future conflicts of interest.

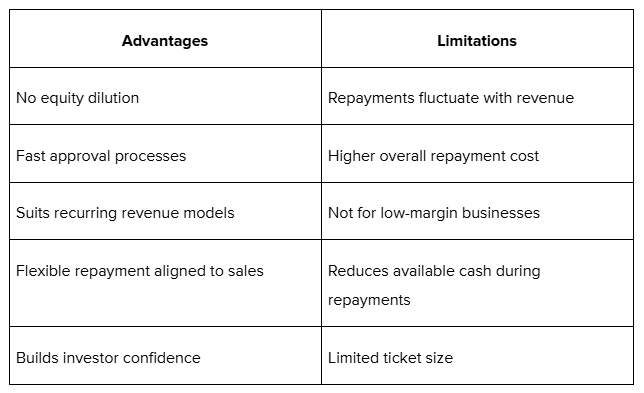

10. Revenue-Based Financing

It offers upfront capital in return for a fixed percentage of future revenues until repayment plus a fee. It suits asset-light or SaaS businesses with stable revenues. No equity dilution occurs, but repayments can strain cash flows during slow months.

Funding strategies shape your growth journey and control. Each has trade-offs based on business goals, industry, and risk appetite. Choosing the right approach ensures sustainable growth while keeping your vision protected.

How to Choose the Right Funding Strategy For Your Business?

Choosing the right funding strategy shapes your business growth and long-term success. Each funding option comes with its own demands, risks, and benefits. Founders must align these with their goals and capacities. The wrong funding choice can add pressure, while the right one builds stability.

Here are 5 key factors to consider:

1. Growth Stage

Your business stage defines suitable funding options. Early-stage founders may use bootstrapping or angel investments, while mature businesses can approach private equity or strategic investors. For example, a manufacturing SME expanding capacity may suit PE funding better than crowdfunding.

2. Ownership Dilution

Equity funding dilutes ownership. Founders must decide how much control they are willing to share. Bootstrapping retains full ownership but limits growth. VC funding accelerates scaling but requires giving up shares and board rights.

3. Repayment Capacity

Debt options like bank loans require fixed repayments. Evaluate cash flows to ensure timely payments without stressing operations. For seasonal businesses, revenue-based financing can match repayments with sales cycles.

4. Strategic Fit

Choose funding sources that align with your vision. Strategic investors bring networks, while government schemes offer low-cost support. Misaligned investors may restrict decision-making later.

5. Speed and Flexibility

Some funding takes months (VC, PE) while others are fast (NBFCs, revenue-based financing). Align timelines with business needs. For urgent working capital, bank overdrafts or NBFC loans work better than equity rounds.

Combining funding sources builds financial strength without relying heavily on one. This blended approach protects ownership while ensuring stable cash flow for growth.

How to Prepare Your Business Before Raising Money?

Raising money is not just about asking for funds. It shows how ready your business is for growth. Investors look for clear plans, strong finances, and founder commitment. Good preparation builds confidence and increases your chances of getting the right funding.

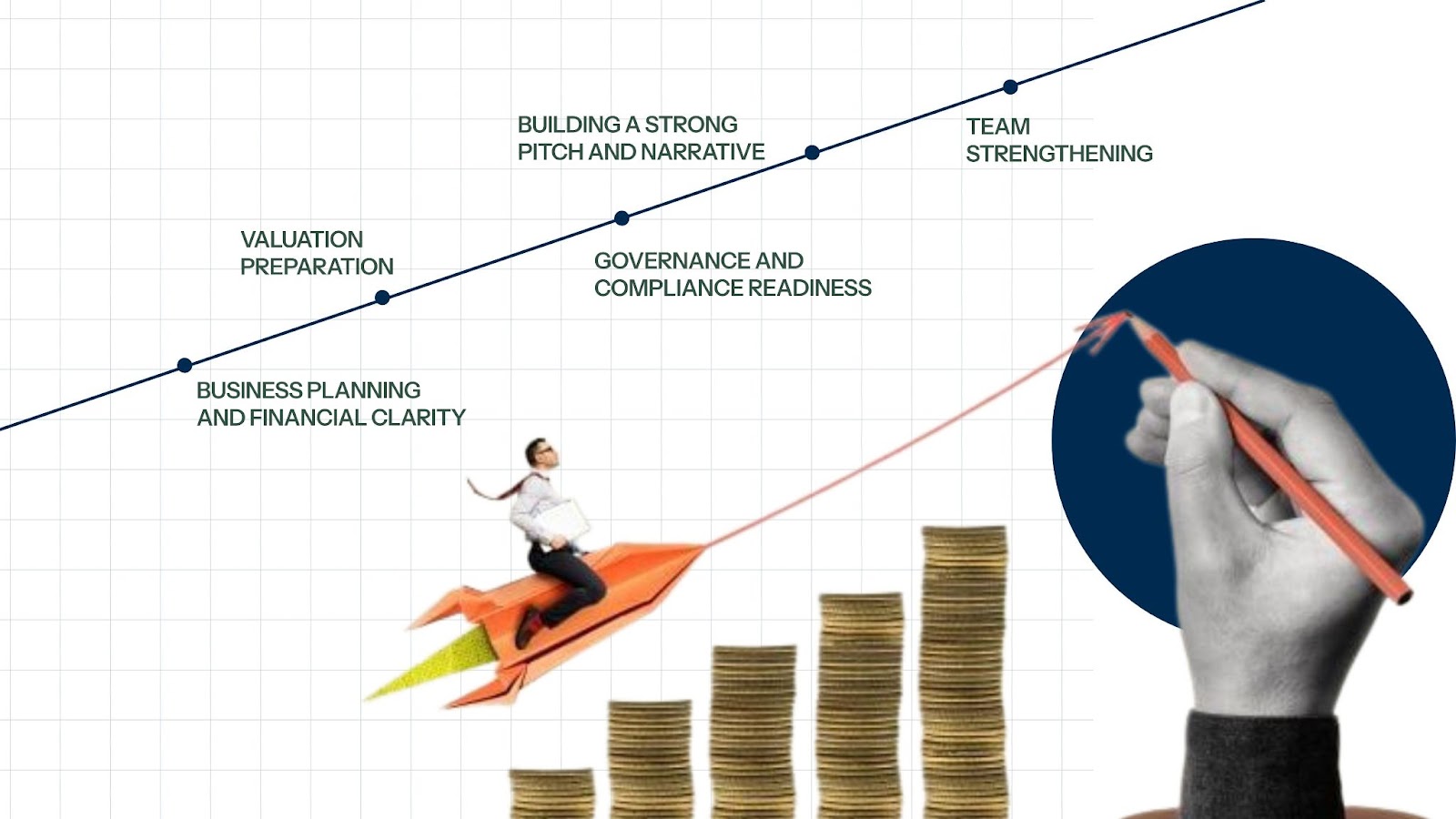

Here are the key steps to prepare:

1. Business Planning and Financial Clarity

Create a detailed business plan with goals, strategies, and financial forecasts. Investors assess your numbers to judge potential. For example, a trading business should project margins and working capital needs for the next 12-24 months.

2. Valuation Preparation

Know your business's worth before negotiations. Valuation considers revenue, assets, and market potential. Engage experts if needed to avoid under- or overvaluation, which can harm future rounds.

3. Governance and Compliance Readiness

Ensure clean company records, legal compliance, and structured governance. Missing filings or unclear shareholding patterns reduce investor trust. Fix these before you approach any funders.

4. Building a Strong Pitch and Narrative

Create a clear pitch that tells your growth story, market opportunity, and how funds will be used. Include data, visuals, and simple explanations to build confidence in your leadership.

5. Team Strengthening

Investors back teams, not just ideas. Review leadership gaps and plan for key hires or advisors to build trust in your execution capacity.

Preparing well positions your business for better negotiations and investor partnerships that truly support growth and stability.

How Does S45 Help Indian Founders Raise Capital Effectively?

S45 stands out as an equity advisor and growth partner for Indian founders. Unlike generic advisors, we specialize in personalized funding strategies for each business stage and goal. Our expert team goes deep into your financials, structure, and ambitions to recommend the most relevant funding paths.

We do not just advise on options; rather help you understand what each funding type demands and how it affects control, returns, and long-term growth. It ensures you raise money with clarity and confidence.

The S45 community also connects you with other founders, experts, and potential investors. It builds trusted networks and shared learning, especially for manufacturing, trading, and family-run businesses looking to grow with stability.

If you are planning your funding journey, connect with S45 to assess your options and prepare your business for the right capital partners.

Conclusion

Raising money for your business demands careful planning. Strategies include self-funding, friends and family support, bank loans, angel investors, venture capital, private equity, government schemes, crowdfunding, strategic investors, and revenue-based financing. Each comes with clear advantages and risks. Knowing them helps you plan funding without harming control or growth.

Choosing the right funding depends on your business stage, goals, and risk appetite. Fast-scaling startups may seek venture capital, while stable family businesses may prefer private equity or bank loans. Preparing with strong financials, clear valuation, and compliance readiness ensures smooth investor discussions.

S45 acts as an equity advisor and growth partner, helping you plan funding strategies with confidence. Their guidance simplifies decisions and connects you with reliable capital partners. Ready to advance your funding journey? Partner with S45 today for a complimentary funding readiness assessment and receive a tailored strategy to support your business growth.

Frequently Asked Questions

1. What is the best way to raise money for a business?

The best way depends on your business stage and goals. Early-stage startups often use self-funding, friends and family, or angel investors. Growing businesses may prefer venture capital or bank loans. Mature companies can consider private equity. Always match funding type with your growth and control needs.

2. How can I raise money for my business without a loan?

You can raise money without loans by using equity funding options like angel investors, venture capital, private equity, crowdfunding, or government grants. Each provides capital in exchange for equity, without repayment obligations. Ensure you understand ownership dilution and choose investors aligned with your long-term goals.

3. How do small businesses get funding in India?

Small businesses in India get funding through bank loans, NBFC financing, government schemes like Mudra or SIDBI, friends and family, and sometimes crowdfunding. Preparing clear financials, strong business plans, and compliance documents increases approval chances. Many also explore revenue-based financing for flexible repayment options.

4. Is crowdfunding a good option to raise money?

Crowdfunding is a good option for businesses with innovative products or strong community appeal. It helps raise small amounts from many people via online platforms. Crowdfunding works well for pre-launch products but needs strong marketing. Risks include failure to reach targets and platform fees.

5. Can I get investors without giving up equity?

Yes, you can raise funds without giving up equity through bank loans, NBFC loans, government schemes, or revenue-based financing. However, equity-free funding usually involves repayment with interest or revenue share. Weigh your repayment capacity before choosing debt-based funding options over equity dilution.