Key Takeaways:

- Understand your business stage and capital requirements to choose the right funding option, from government schemes to bootstrapping.

- Define funding needs, prepare strong pitch decks, and build a clear business plan to attract investors and stay investor-ready.

- From bootstrapping to government schemes, angel investors, VC, crowdfunding, and alternative financing, each option offers unique benefits and trade-offs.

- Take advantage of initiatives like Startup India and Mudra Yojana for grants, loans, and equity-free funding.

- Platforms like S45 Club connect startups with investors, provide equity advisory, and help align funding decisions with long-term growth strategies.

For founders in India, securing funding is often one of the toughest challenges. Even with a strong vision, finding the right financial support to bring your idea to life can be demanding.

The good news? As of 2024, the Indian government has allocated over $2.3 billion (INR 21,276 crore) through Startup India programs and other initiatives to help founders grow their businesses. With so many funding options available, choosing the right fund can still feel complex.

In this article, we’ll guide you on how to raise funds for startup business in India, covering government schemes, angel investors, and other effective strategies.

Before learning how to raise funds for a startup business in India, it’s important to know why funding is crucial for your startup’s growth.

Why Securing Funding Is Crucial for Startups in India?

India’s startup scene is growing fast, but many new businesses struggle to survive in the first few years. Getting the right funding can help you tackle early challenges, hire skilled people, reach more customers, and speed up product development.

It also shows that your business idea has potential and builds trust with investors, partners, and clients. With strong support from investors and companies, you now have more opportunities to grow your startup.

Next, let’s explore the main types of startup funding available in India.

Types of Startup Funding in India

The funding you choose should match your startup’s stage and goals:

- Bootstrapping: You can use your own savings or early revenue to run your startup. This works best in the early stages while keeping full control.

- Angel Investors: Wealthy individuals can invest in your business in exchange for a share of ownership. This is ideal if you’re in the pre-seed or seed stage.

- Venture Capital (VC): Professional firms can provide money along with guidance and resources to help you scale your startup quickly.

- Government Grants and Schemes: Programs like Startup India, PMMY, and CGTMSE can give you funds without taking any ownership, helping you grow efficiently.

- Debt Financing: Loans or credit lines let you get money without giving up control of your business. This works well if you already have revenue coming in.

- Crowdfunding: You can raise small contributions from a large audience through platforms like Kickstarter or Ketto. This is useful if your product appeals to many customers.

- Corporate Funding: Companies may invest in or partner with your startup to access new ideas, collaborate strategically, or explore acquisitions.

Every startup needs the right funding to grow, and platforms like S45 Club help connect with investors and secure capital while keeping control over the business.

Once you know what fits your business, you can focus on the steps on how to raise funds for startup business in India and turn your ideas into reality.

How to Raise Funds for Startup Business in India?

Before approaching investors or applying for funding programs, it’s important to identify which options match the startup’s stage and long-term goals. With a clear funding strategy in place, businesses can follow a structured process to secure the capital they need.

The following steps outline how startups in India can raise funds effectively.

Step 1: Understand Your Funding Needs

Prior to approaching investors, it’s crucial to clearly define how much funding your startup actually requires. Asking for too little risks running out of cash, while asking for too much may mean giving away unnecessary equity.

- Stage of Your Business:

1. Early Stage: Seed funding for product development and market validation.

2. Growth Stage: Funds for operations, hiring, and marketing.

3. Scaling: Larger capital for rapid expansion, new markets, or increased production.

- Amount of Capital Required: Allocate funds specifically for product development, operations, and marketing.

- Revenue Model & Market Readiness: Clarify how your startup makes money and whether it’s ready to scale.

- Equity vs. Debt: Decide whether to give up ownership (equity) or take loans (debt).

- Growth Plans & Urgency: Match your funding type with business growth, venture capital for aggressive expansion, angel investors or loans for gradual growth.

Challenge: Many founders either underestimate or overestimate capital requirements, leading to cash crunches or unnecessary equity dilution.

Tip:

- Break down funding needs by stage, early-stage (product development, market validation), growth (operations, hiring, marketing), and scaling (rapid expansion, new markets).

- Define revenue model, market readiness, and decide between equity vs. debt. Always align funding with growth trajectory and urgency.

Step 2: Prepare Your Pitch

A compelling pitch is the first step to engaging potential investors:

- Use investor-ready pitch decks to showcase your business potential, market opportunity, and founder vision.

- Include clear visuals and a strong narrative to capture attention.

- Highlight your unique value proposition, scalability, and expected returns.

Challenge: Investors get hundreds of pitches; weak storytelling or unclear value propositions get ignored.Tip:

- Use a concise, visually appealing pitch deck that clearly communicates your problem, solution, market opportunity, competitive edge, and expected returns.

- Include real data, milestones, and scalability potential. Customize the pitch for each investor.

Step 3: Build a Business Plan

A strong business plan communicates your strategy clearly:

- Outline the problem your startup solves, the solution, and market competition.

- Include revenue models, financial projections, and your execution strategy.

- Keep it comprehensive yet concise for easy understanding.

Challenge: Overly technical or disorganized plans make investors doubt execution capability.

Tip:

- Keep the plan clear and structured: explain the problem you solve, your solution, competition, revenue model, financial projections, and execution strategy.

- Highlight how funding will be used and projected outcomes.

Step 4: Find the Right Investor

Connecting with the right investor is more effective than approaching everyone:

- Target investors aligned with your industry, stage, and geography.

- Platforms like S45 Club can help you research portfolios and investor preferences.

- Example: Startups in Bengaluru could gain from early-stage VCs focusing on the Karnataka tech ecosystem.

Challenge: Approaching investors who don’t fit your industry, stage, or geography wastes time and reduces chances.

Tip:

- Research investors’ portfolios, sector focus, and previous investments.

- Use platforms like S45 Club to identify suitable VCs and angel investors.

Step 5: Network and Pitch

Getting noticed is essential to secure funding:

- Attend pitch days, demos, accelerators, and online forums.

- Adapt your pitch for each investor based on their interests and portfolio.

- Networking increases visibility and improves your chances of success.

Challenge: Limited visibility and weak connections prevent opportunities.

Tip: Build professional networks, join startup communities, and seek introductions through mentors or industry peers to increase credibility before pitching.

Step 6: Due Diligence and Term Sheet

Once an investor shows interest, they’ll validate your business:

- Due diligence covers financials, IP, compliance, and legal documentation.

- A term sheet is then signed, detailing investment terms, equity, and governance rights.

- Legal counsel is highly recommended at this stage to protect your interests.

Challenge: Investors can delay or reject funding if documents, compliance, or IP rights are incomplete.

Tip: Keep all essential documents updated and organized in a central repository, and conduct a preemptive internal audit to identify gaps before approaching investors.

Step 7: Organize Key Documents

Prepared documentation increases investor confidence:

- Pitch Deck (optimized for web and mobile)

- Business Plan & Executive Summary

- Cap Table & Shareholding Structure

- Financial Projections (3–5 years)

- Customer Testimonials or Product Demos

- Incorporation Certificate, GST, and legal registrations

- IP Ownership Documents

- Founder & Team Backgrounds

Challenge: Incomplete or scattered documents can reduce investor confidence.

Tip: Keep all key documents organized in a single, accessible format; regularly update financials, projections, and legal papers. Use cloud-based platforms to streamline sharing with investors.

Step 8: Bootstrapping and Self-Funding

Self-funding can be a strategic way to maintain control while growing:

- Maximise Assets: Leverage personal savings, home equity, or inventory.

- Harness Organic Marketing: Word-of-mouth, partnerships, and social media can reduce costs.

- Tightly Manage Finances: Separate personal and business finances; track expenses carefully.

- Consider Low-Interest Debt: Short-term loans or credit lines can provide liquidity without giving up equity.

- Prioritize Profitability Early: Focus on creating a sustainable revenue model from the start.

- Scale Smartly: Avoid rapid growth; refine your business model and build a strong foundation first.

Challenge: Limited resources can hinder product development, marketing, hiring, and overall growth, making it difficult to reach key milestones and scale the startup effectively.

Tip: Prioritize spending, optimize cash flow, reinvest earnings, and use cost-effective marketing; consider short-term loans or strategic partnerships to access additional funds without losing control.

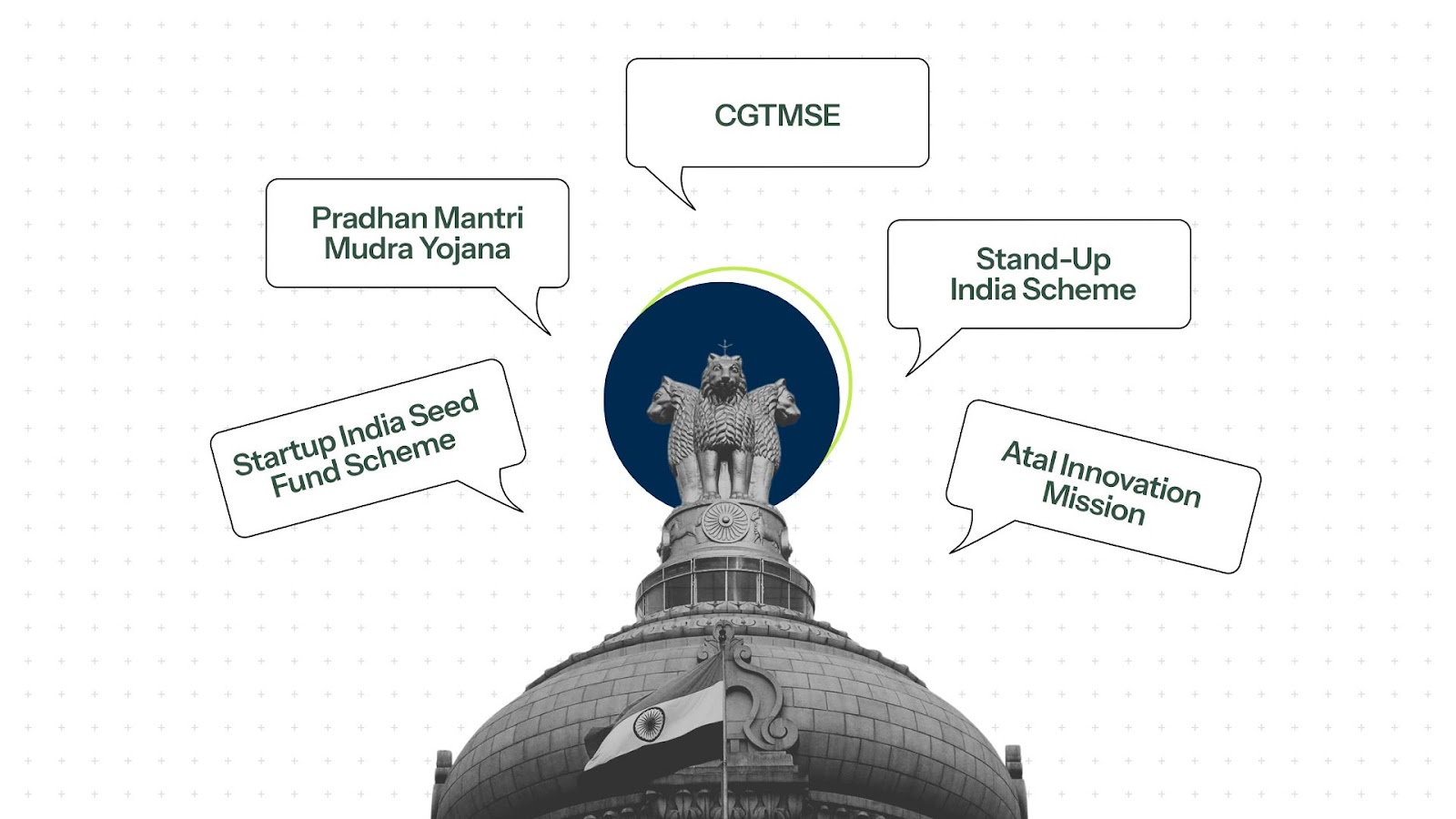

Step 9: Explore Government Schemes

Government initiatives can provide funding without equity dilution:

a. Startup India Seed Fund Scheme (SISFS)

- Funding for product development, market entry, and scaling.

- Eligibility: DPIIT-recognized startups with innovative solutions.

- Access: Apply through the Startup India portal with a business plan and proof of concept.

b. Pradhan Mantri Mudra Yojana (PMMY)

- Loans up to INR 10 lakh for micro and small businesses.

- Eligibility: Non-corporate, non-farm small/micro enterprises.

- Access: Apply via banks like SBI, HDFC, or ICICI.

c. CGTMSE

- Collateral-free credit for micro and small enterprises.

- Access: Apply via member banks; CGTMSE guarantees up to 75% of the loan.

d. Stand-Up India Scheme

- Loans for women and SC/ST entrepreneurs.

- Access: Scheduled commercial banks; loans INR 10 lakh to INR 1 crore.

e. Atal Innovation Mission (AIM)

- Funding and incubation for innovative, high-impact startups.

- Access: Apply via AIM portal; selection based on innovation and scalability.

Following these steps allows founders to approach funding strategically, stay investor-ready, and secure capital to grow their startups in India successfully.

Once you have prepared your startup and explored traditional funding routes, it’s worth considering alternative funding options that can provide flexibility and new opportunities.

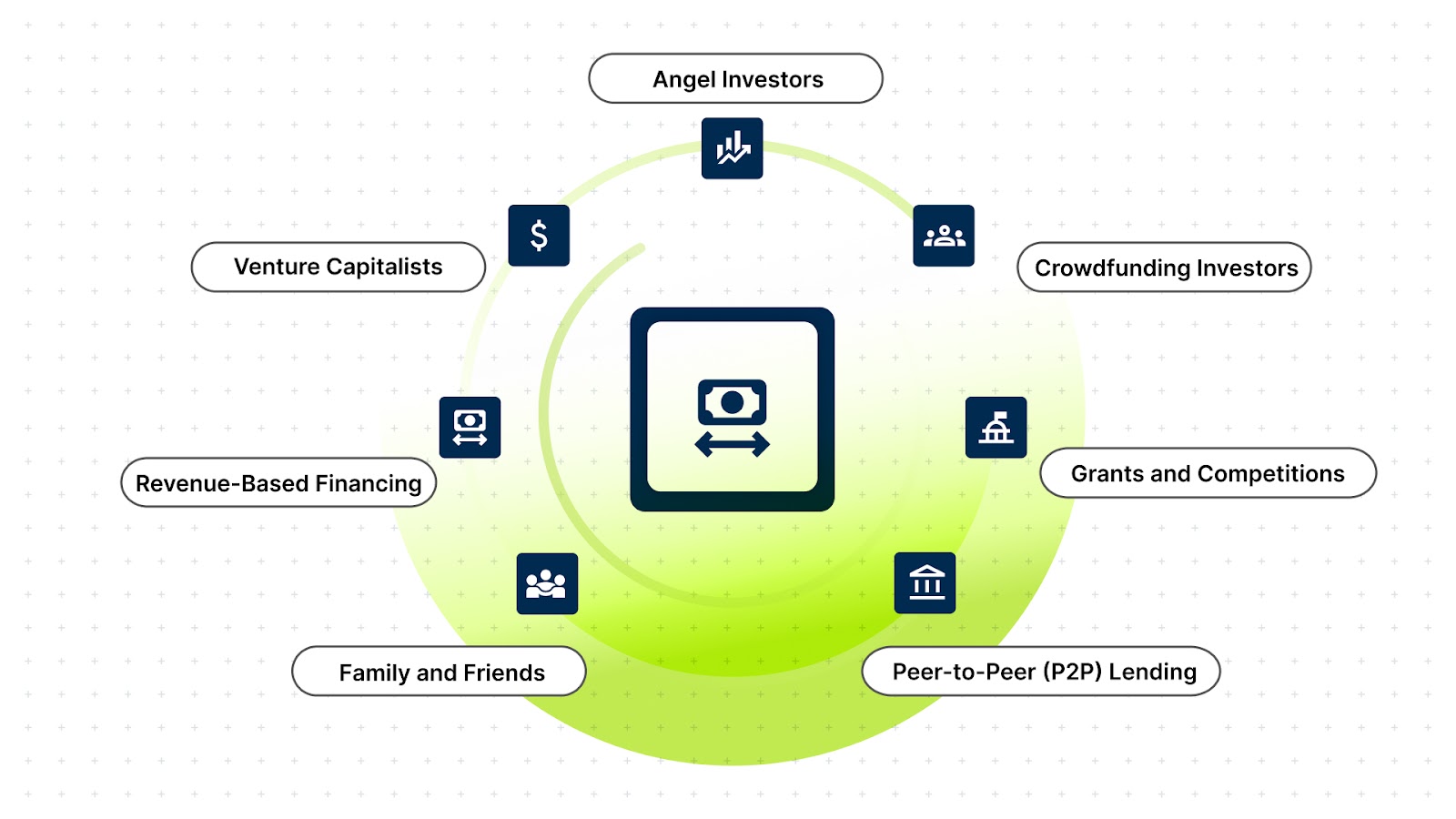

Alternative Funding Options for Startups in India in 2025

When traditional funding routes like bootstrapping or government schemes aren’t enough, alternative funding options can provide the flexibility and speed that startups need. These options allow you to tap into capital without the constraints of equity dilution or lengthy approval processes.

Here’s a breakdown of the most relevant alternatives:

- Angel Investors: Offer early-stage capital along with mentorship and industry connections, helping founders validate ideas and gain initial traction.

- Venture Capital (VC): Invest significant funds in high-growth startups in exchange for equity, supporting rapid scaling, market expansion, and strategic guidance.

- Crowdfunding: Collect small contributions from many supporters online, while testing product-market fit and building a loyal customer base.

- Revenue-Based Financing (RBF): Provide flexible funding tied to future revenue without giving up ownership, ideal for startups with steady cash flow.

- Family and Friends: Deliver seed capital based on trust; professional agreements ensure clarity and avoid personal conflicts.

- Peer-to-Peer (P2P) Lending: Connect with individual lenders online for short-term loans, bypassing traditional banks with faster access to capital.

- Grants and Competitions: Offer non-dilutive funding for innovative or socially impactful projects, often backed by government or private programs.

- Bootstrapping/Self-Funding: Use personal savings or revenue to grow deliberately, maintaining full control over business decisions.

- Government Schemes: Provide structured support, seed funding, and incentives through programs like Startup India, PMMY, CGTMSE, or Stand-Up India, helping startups scale without external equity pressure.

Now that you know the funding options available, the next step in how to raise funds for a startup business in India is using platforms like S45 Club, which help connect startups with the right investors and simplify the process.

How Can S45 Club Help You with Startup Funding in India?

S45 Club is a modern equity advisory platform built for founders, investors, and family offices who want to move beyond one-off raises and start thinking strategically about private market growth.

It brings together capital access, pre-IPO deal flow, and deep startup equity expertise, so your financing decisions align with long-term value, not just short-term runway.

Here’s how S45 Club supports founders building toward something bigger:

- Smart Entry Timing: S45 Club helps assess your company’s growth cycle and maps the right time to bring in external capital, whether through structured funding, secondary exits, or pre-IPO rounds.

- Deeper Due Diligence: You get a clear picture of your own company’s fundamentals from an investor’s lens, valuation drivers, cap table hygiene, governance gaps, so you’re always pitch-ready.

- Access to Late-Stage Deal Flow: For founders looking to reinvest or diversify, S45 Club connects you with high-quality pre-IPO opportunities typically reserved for insider networks.

- Risk Clarity, Not Just Return Projections: S45 Club helps founders evaluate trade-offs like dilution, liquidity timelines, and exit complexity before committing to any funding path.

- Equity Advisory That Looks Beyond the Round: Whether you’re considering ESOP liquidity, partial exits, or preparing for institutional capital, S45 Club supports you with strategy, not just paperwork.

Thinking beyond your next raise? Start your capital journey with S45 Club and see how strategic funding can support what you're really building toward.

Conclusion

Raising funds for your startup in India can feel challenging, but having a clear strategy and the right resources makes all the difference. Keep your vision at the center of every decision and align your funding with your growth goals. With S45 Club, you can structure your capital, stay in control, and make smarter choices as your business grows.

Want to learn from founders who’ve already walked the funding path? Join the S45 Club founder community to exchange insights, share playbooks, and stay sharp together.

Frequently Asked Questions

Q. How do I know if my startup is ready to approach investors for funding?

You’re ready if you have a validated product or service, clear market potential, paying customers, a scalable business model, organized financials, and a growth plan aligned with investor expectations.

Q. Can I raise funds without giving up equity in my startup?

Yes. Options like revenue-based financing, grants, or loans allow funding without equity, though they may involve repayments or interest. This helps maintain control while growing your business.

Q. What is the best way to approach venture capitalists in India?

Create a compelling pitch deck highlighting your product, market opportunity, business model, and financial projections. Tailor your approach to VCs’ focus areas and emphasize growth potential.

Q. How can government schemes like Startup India support my startup's growth?

Startup India and other schemes provide seed funding, tax benefits, legal support, and networking opportunities, helping founders raise funds for startup business in India without giving away ownership.

Q. What role does a strong business plan play in raising startup funds?

A well-structured business plan communicates your vision, market opportunity, financials, and growth strategy. It reduces perceived risk, boosts credibility, and increases investor confidence.