Ever felt the rush of launching a big idea, only to hit the wall of financial reality? Every founder knows that moment when ambition races ahead, but the limited funds act as a blocker. You’re pushing out product updates, interviewing potential hires, and pitching to customers, yet wondering if you’ll even be able to manage payroll next month.

Moreover, the impact of limited funding goes beyond numbers on a balance sheet. When marketing budgets dry up, customer acquisition slows, and growth stalls. A single missed vendor payment can disrupt supply chains, damaging credibility.

Lack of funding is also the top reason startups fail, with 38% of founders admitting they ran out of cash or couldn’t raise capital. That doesn’t always mean the idea was weak or the execution poor. Often, it’s simply about not having enough financial backing to survive early stages, invest in growth at the right time, or compete with better-funded peers.

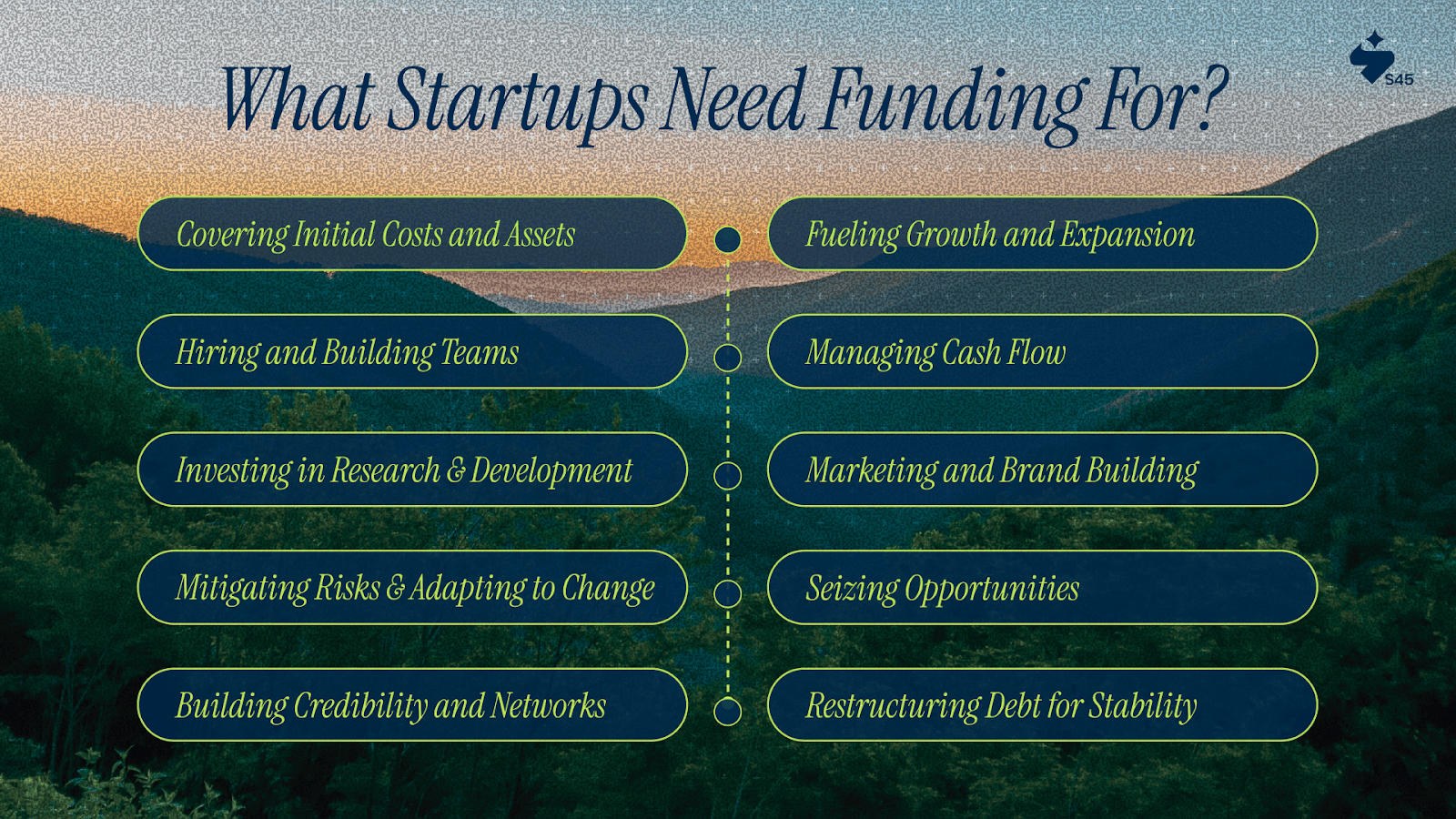

In this blog, we’ll explore the primary reasons why startups require funding. From fueling expansion and hiring critical talent to managing cash flow and mitigating risks, the right funding decisions often determine whether a startup builds momentum or burns out.

At a Glance

- Funding builds and scales startups: Covers early costs like licensing, assets, and hiring, while enabling expansion into new markets without overstretching.

- Cash flow matters as much as profit: Working capital funding keeps operations stable during receivable delays, seasonal dips, and rising costs.

- Capital drives growth levers: Enables consistent marketing, brand building, and R&D to attract customers, stay competitive, and improve offerings.

- Funds boost resilience and trust: Provide buffers to pivot in crises, seize opportunities, and enhance credibility with investors, partners, and customers.

- Smart funding creates stability: Debt restructuring, planned capital use, and community support free founders to focus on growth and legacy.

Disclaimer: The information shared here is for general understanding of why startups seek funding and the common areas where capital is applied. It does not constitute financial advice. Founders should consult banks, investors, or certified financial advisors before making funding decisions.

What Are the Primary Reasons That Startups Need Funding For?

Funding is not just cash in the bank. For founders, it is the oxygen that keeps ideas alive and the fuel that powers every growth milestone. Let’s break down the primary reasons why startups need funding, providing insights you can apply directly to your own journey.

1. Starting Strong: Covering Initial Costs and Assets

Every founder knows the first hurdle is survival; getting your business off the ground before the first rupee of revenue comes in. Funding here isn’t about luxury spend; it’s about covering non-negotiables, such as:

- Market research and feasibility studies

- Legal and licensing fees

- Branding, website, and digital setup

- Office or workspace setup (or remote infrastructure)

- Initial inventory or raw materials

- Hiring and training early employees

- Buying or leasing essential assets (equipment, machinery, IT systems, vehicles)

Founder’s Insight: Self-funding is effective only for a limited timeframe. A manufacturing startup in Coimbatore, for example, might need machines worth ₹30 lakh just to begin production. At this stage, S45 helps founders structure early funding so they don’t cut corners or exhaust personal reserves.

Pro Tip: Always build a 6–12 month runway for early expenses. The early stage should focus on finding product-market fit, rather than being distracted by constant fundraising.

2. Fueling Growth and Expansion

Once a startup survives the early phase, the next challenge is scaling up. Growth without funding is like running a marathon without water; you’ll collapse before the finish line. Founders who try to “bootstrap scale” often overstretch operations, leading to delayed payments for suppliers, missed orders, and decreased customer satisfaction.

To scale, founders often need capital to:

- Expand production capacity with upgraded technology.

- Enter new geographies (domestic and international). Cover compliance, logistics, and localization costs.

- Build distribution and logistics infrastructure, such as warehouses, vehicles, and supply chain partners.

- Add product lines or new service verticals.

Example: A Jaipur handicraft startup may dream of expanding from local bazaars to Amazon Global. But without funding for export compliance, upgraded packaging, and targeted marketing, the opportunity remains out of reach.

Investor Lens: Investors measure not just growth, but the ability to sustain growth without collapsing under demand.

3. Hiring and Building Teams

Many startups fail because the founder tries to do everything alone. For instance, a Bengaluru SaaS founder may be a strong coder but struggles with sales. Without funds to hire sales talent, customer acquisition slows down, no matter how good the product is.

Funding gives you the bandwidth to:

- Attract skilled employees: Competitive salaries and ESOPs bring in top talent. Without this, the best engineers or salespeople join larger, well-funded competitors instead.

- Build core teams: Establish dedicated functions in tech, sales, marketing, finance, and operations.

- Upskill and retain staff: Training and career growth reduce attrition.

- Prevent founder burnout: Founders who try to do it all often burn out, losing focus on strategy and investor confidence. Funding enables you to hire staff and assign tasks accordingly, hence freeing yourself from day-to-day firefighting.

Takeaway for Founders: Talent is often the single most significant multiplier of growth. Investors, too, back teams, not just solo founders.

4. Managing Cash Flow and Working Capital

Revenue on paper doesn’t keep the lights on. Instead, cash flow is the heartbeat of any startup. Even profitable businesses can sink if cash is tied up in long-pending receivables or seasonal cycles. Funding enables you to:

- Cover day-to-day expenses like salaries, rent, and utilities. Without this, staff morale drops and suppliers lose trust.

- Smooth out seasonal dips or cyclical slowdowns (festivals, off-peak months) in demand.

- Cushion 60–90 day delays between supplier payments and customer receivables.

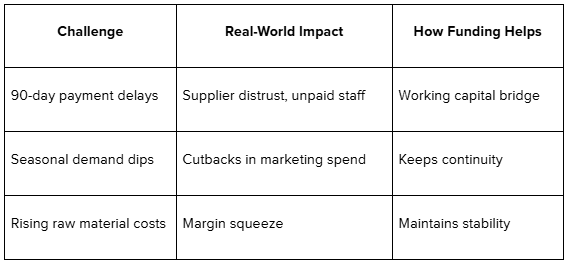

Common Founder Challenges in Cash Flow

Key Consideration: Founders often confuse profitability with liquidity. You may be “profitable on paper” but still struggle with daily expenses. External funding prevents liquidity crunches that force desperate measures like high-interest loans or unpaid salaries.

5. Investing in Research and Development (R&D)

For startups, innovation fuels relevance. Without consistent R&D, even great ideas risk becoming outdated. Funding enables you to:

- Prototype and test new features or designs. Without this, products stagnate and lose customer appeal.

- Integrate advanced technologies (AI, IoT, automation).

- Conduct customer surveys and usability trials to identify demand patterns.

- Iterate quickly before competitors catch up.

Example: A Pune-based EdTech startup may need R&D funds to build adaptive learning features before bigger players copy the idea.

Actionable Insight: Investors reward startups that continuously innovate. R&D shows you’re not just competing today but preparing for tomorrow.

6. Marketing and Brand Building

A great product won’t succeed if no one knows about it. Marketing funding ensures you can amplify visibility, attract customers, and build brand trust at scale.

- Run digital ad campaigns to acquire users at scale. Without campaigns, CAC (Customer Acquisition Cost) rises as organic reach dips after a certain point.

- PR and media features validate your startup. Without them, enterprise buyers hesitate to sign deals. Build PR stories and secure media presence.

- Participate in trade shows and industry events.

- Produce high-quality brand assets (videos, content, social media campaigns). These are critical factors defining public perception.

Practical Takeaway: Marketing is not an expense; it is traction. Investors view consistent marketing as proof of demand and scalability.

Pro Tip: Allocate at least 10–20% of your funding round to marketing.

7. Mitigating Risks and Adapting to Change

The business landscape is unpredictable. Funding acts as insurance. It gives you the flexibility to adapt to regulatory shifts, industry disruptions, or sudden downturns without losing momentum.

- Adapt to new regulations and compliance costs (GST, SEBI, labor laws, export rules).

- Survive industry disruptions (like AI reshaping traditional workflows). Without adaptability budgets, your startup risks losing relevance quickly.

- Handle downturns and black swan events like the 2008 Global Financial Crisis or the COVID-19 pandemic. Reserves enable you to shift models or launch new services, helping you stay ahead of the competition.

Why This Matters: A well-funded startup pivots quickly; a cash-strapped one collapses.

8. Seizing Opportunities

Opportunities often appear when least expected. Without reserves, you watch competitors move in while you hesitate. With funds, you grab momentum.

Funding lets you move quickly, whether by:

- Acquiring a smaller competitor: Consolidation can instantly increase market share, talent, and customer base.

- Launching a product in sync with consumer trends: Consumer trends shift rapidly, from D2C “clean beauty” to SaaS integrations with AI. Funding helps you capitalize on such opportunities through enhanced production and marketing.

- Invest in strategic partnerships: Joint ventures, co-branded launches, or tech integrations often need upfront funding. For instance, a fintech startup with funding partners quickly partners with a major NBFC, while underfunded peers miss out.

Strategic Note: Having “dry powder” (capital on hand) signals preparedness. Investors love founders who act fast when the market shifts.

9. Building Credibility and Networks

Funding is more than money. It builds legitimacy, signals belief in your idea, and opens doors to new relationships. Here’s how:

- Boosts customer trust (“If they’re backed, they’re credible.”) Without validation, customers hesitate to sign large contracts.

- Vendors trust funded startups with better payment terms. Without credibility, you face stricter payment terms and other conditions.

- Each round of funding compounds legitimacy. Without momentum, future funding dries up.

- Access to an investor’s professional network to scale beyond local markets.

Takeaway for Founders: Funding creates a ripple effect. With each milestone, credibility compounds, making it easier to attract talent, investors, and customers.

10. Restructuring Debt for Stability

Carrying multiple loans or high-interest borrowings can significantly hinder a startup’s growth. Funding can help restructure or consolidate debt, giving founders financial breathing room. Here’s how:

- Combine multiple loans into a single manageable repayment.

- Lower interest rates to reduce financial strain.

- Free up cash flow for working capital or expansion.

- Simplify monthly tracking and planning through predictable repayments.

Founder’s Perspective: Many founders get stuck servicing debt instead of building their business. By restructuring, you reduce pressure on operations, improve predictability in repayments, and redirect resources back into growth.

Nevertheless, funding alone isn’t enough; you also need reliable partners and a community that understands the journey. Having both capital and trusted guidance can turn out to be the difference between short-term survival and long-term success.

From Capital to Guidance: How S45 Helps Startups Raise Smart, Sustainable Funding

S45 is built to support Indian founders who want to scale with purpose, not pressure. Here’s how it helps address the primary reasons behind startup funding:

- Laying a strong foundation → From early licensing fees and equipment to branding and setup, S45 structures initial funding so you don’t burn personal savings or compromise on quality at the start.

- Scaling operations with discipline → Advisors guide founders on channeling capital into production, technology upgrades, supply chains, and market expansion, ensuring growth is sustainable, not overstretched.

- Building teams that deliver → Our platform benchmarks compensation and role priorities, helping founders allocate funds to attract and retain the right talent without inflating payrolls.

- Maintaining stability with cash flow planning → Tools and advisory support help founders allocate funds for working capital, bridge receivable delays, and create buffers for seasonal or cyclical fluctuations.

- Managing risks and seizing opportunities → Founders get frameworks to set aside reserves for regulatory changes or downturns while staying prepared to capture sudden opportunities like acquisitions or partnerships.

- Strengthening credibility through community → S45 connects founders with peers and investors, creating a trusted ecosystem where shared experiences, benchmarking, and networks make future fundraising easier.

The result is not just money in the bank, but a reliable, community-based support system that enables you to grow steadily and sustainably.

Tired of chasing growth while cash flow, hiring, and expansion always feel stuck? Explore S45 now to access capital, expertise, and a trusted founder community before missed opportunities turn into setbacks.

FAQs

1. What are the different stages of startup funding?

Startup funding usually begins with seed capital, followed by Series A, B, C, or D rounds. Some companies also raise bridge financing or venture debt before eventually moving toward an IPO.

2. What preparation do I need before seeking funding?

You need a clear problem statement, a strong team, validated market traction, product viability, financial forecasts, and a funding request with a defined use. Most investors expect solid pitch materials, external validation, and evidence of growth potential.

3. What are the three main types of funding?

The three primary funding types are retained earnings, debt capital, and equity capital. Retained earnings come from profits, debt involves borrowing from banks or markets, and equity means raising money by selling ownership stakes.

4. How long does fundraising usually take?

Fundraising typically takes 4-6 months, covering preparation, pitching, due diligence, and negotiations. You should begin early, as delays are common, and ensure enough runway to avoid cash flow stress during the process.

5. When is the right time to raise funds?

The best time is after validating your idea, proving customer traction, and showing clear growth potential. Raising too early risks heavy dilution, while waiting too long can stall momentum or cause cash flow strain.